Cisco reported better-than-expected first quarter results and said it saw "acceleration in product orders reflecting normalizing demand."

But Cisco's first quarter networking revenue fell 23% from a year ago.

The company said it saw product orders jump 20% in the first quarter compared to a year ago and 9% excluding the Splunk acquisition.

Cisco reported first quarter earnings of 68 cents a share on revenue of $13.8 billion, down 6% from a year ago. Without Splunk, Cisco's first quarter revenue would have been down 14%. The first quarter earnings include a tax benefit of $720 million.

Non-GAAP first quarter earnings were 91 cents a share. Wall Street was expecting Cisco to report non-GAAP earnings of 87 cents a share on revenue of $13.77 billion.

- Cisco Q4 better-than-expected, will cut 7% of global workforce

- Splunk adds genAI tools, more Cisco touchpoints across observability and security

As for the outlook, Cisco projected second quarter revenue of $13.75 billion to $13.95 billion with non-GAAP earnings of 89 cents a share to 91 cents a share. For fiscal 2025, Cisco projected revenue of $55.3 billion to $56.3 billion with non-GAAP earnings of $3.60 a share to $3.66 a share.

Cisco CEO Chuck Robbins said "our customers are investing in critical infrastructure to prepare for AI."

By the numbers:

- Networking revenue in the first quarter was $6.75 billion, down 23% from a year ago.

- Security revenue was $2.017 billion, up 100% from a year ago.

- Collaboration revenue was $1.085 billion, down 3%.

- Observability revenue was $258 million, up 36%.

- Services revenue was $3.727 billion, up 6%.

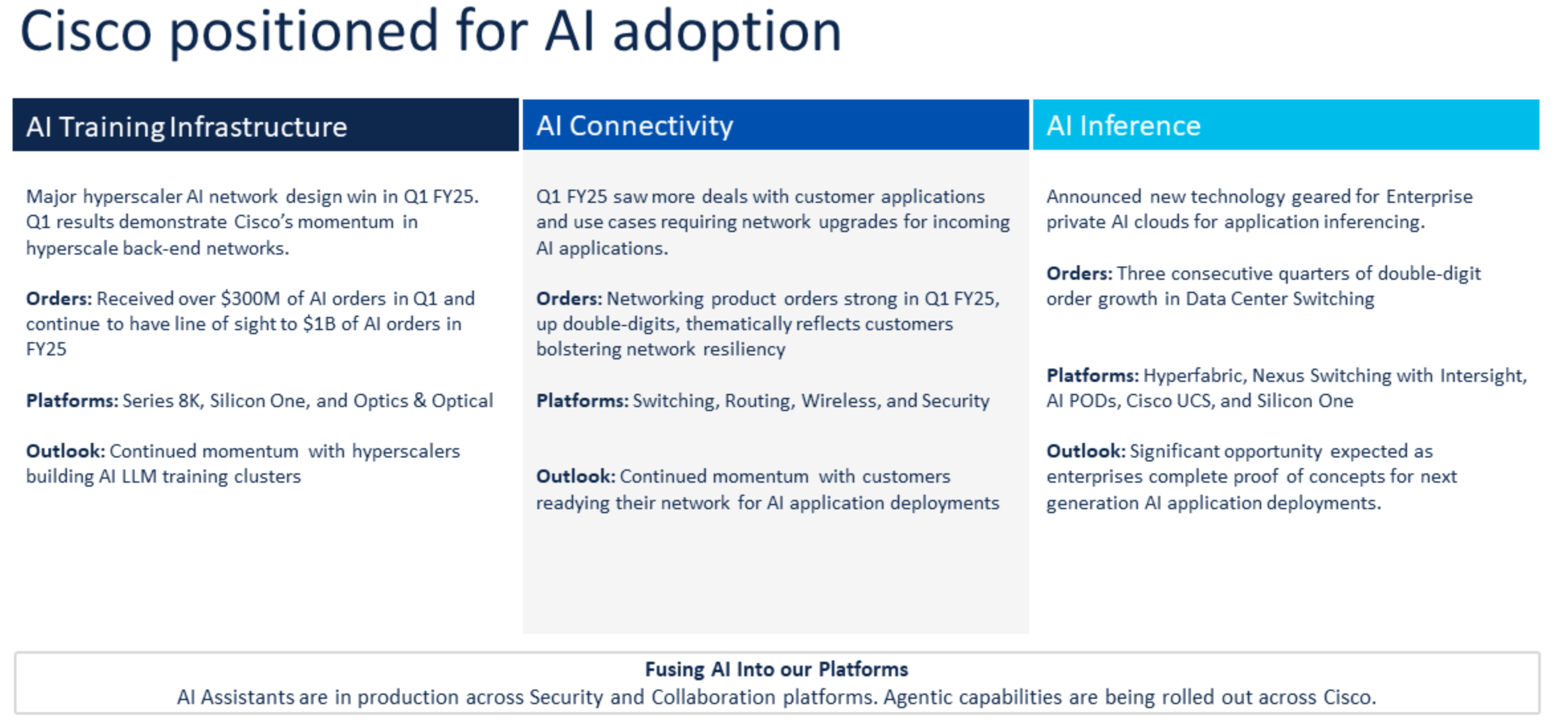

On a conference call with analysts, Robbins said Cisco's portfolio is set up to capture demand for AI training infrastructure, AI networks and connectivity and observability.

He added that Cisco's new AI survey with Nvidia will ship in December and AI pods are available. Robbins said:

"As we look at what's occurring with AI, there are three key things. First, there is significant investment in back end AI networks with hyperscalers focused on training. Second, as enterprises look to adopt and deploy AI, they need to modernize and secure their infrastructure to prepare for pervasive deployment of AI applications. Finally, the combination of mature back end models with enterprise AI application deployment will lead to increased capacity requirements on both private and public front end cloud networks. Cisco is already playing a major role across all three of these significant opportunities."

Constellation Research analyst Holger Mueller said:

"Cisco can't catch growth for it's offerings. It was a struggle to grow in the cloud era and it seems to be one in the AI era as well. While 20% growth on product seems to be encouraging (unless you have not forgotten the previous focus on services) but half of it comes from the Splunk acquisition. Adjust for Splunk and Cisco is in medium single digit growth. When and where will Cisco grow again? Referring to government contracts as CFO Scott Herren did is not sustainable growth."