Freshworks is winning more mid-market and enterprise deals and plans to double down on its employee experience business as it builds out its IT service management, IT operations and service management products.

The company delivered strong third quarter results and raised its fourth quarter outlook. Freshworks also said it will cut 13% of its workforce.

Freshworks reported a third quarter net loss of 10 cents a share on revenue of $186.6 million, up 22% from a year ago. Non-GAAP earnings of 11 cents a share were ahead of expectations. For the fourth quarter, Freshworks projected $187.8 million to $190.8 million, up 17% to 19% from a year ago, with non-GAAP earnings of 9 cents a share to 10 cents a share.

For the year, Freshworks is projecting non-GAAP earnings of 38 cents a share to 39 cents a share with revenue growth of 20% to $713.6 million to $716.6 million.

Speaking on Freshworks earnings conference call, CEO Dennis Woodside said the company is expanding in its employee experience (EX) business, which is less known than the customer experience offerings. Woodside said:

"Our EX business is strong with over $390 million in ARR and a year-over-year growth rate of over 40% in Q3. Today, more than 17,800 customers are using our EX solutions to deliver IT and employee service management. By prioritizing investments in EX, we are moving up-market and winning more mid-market and enterprise deals. We won 16 new and expansion deals over 100,000 in ARR in EX, including several against our largest competitor in Q3."

The bet for Freshworks is that it can provide enterprise grade EX software to midmarket companies that are "tired of being forced into oversized solutions that are hard to implement and operate," said Woodside.

- Constellation ShortList™ Incident Management

- Constellation ShortList™ Digital Customer Service and Support

- Constellation ShortList™ Sales Force Automation

- Connecting Experiences From Employees to Customers

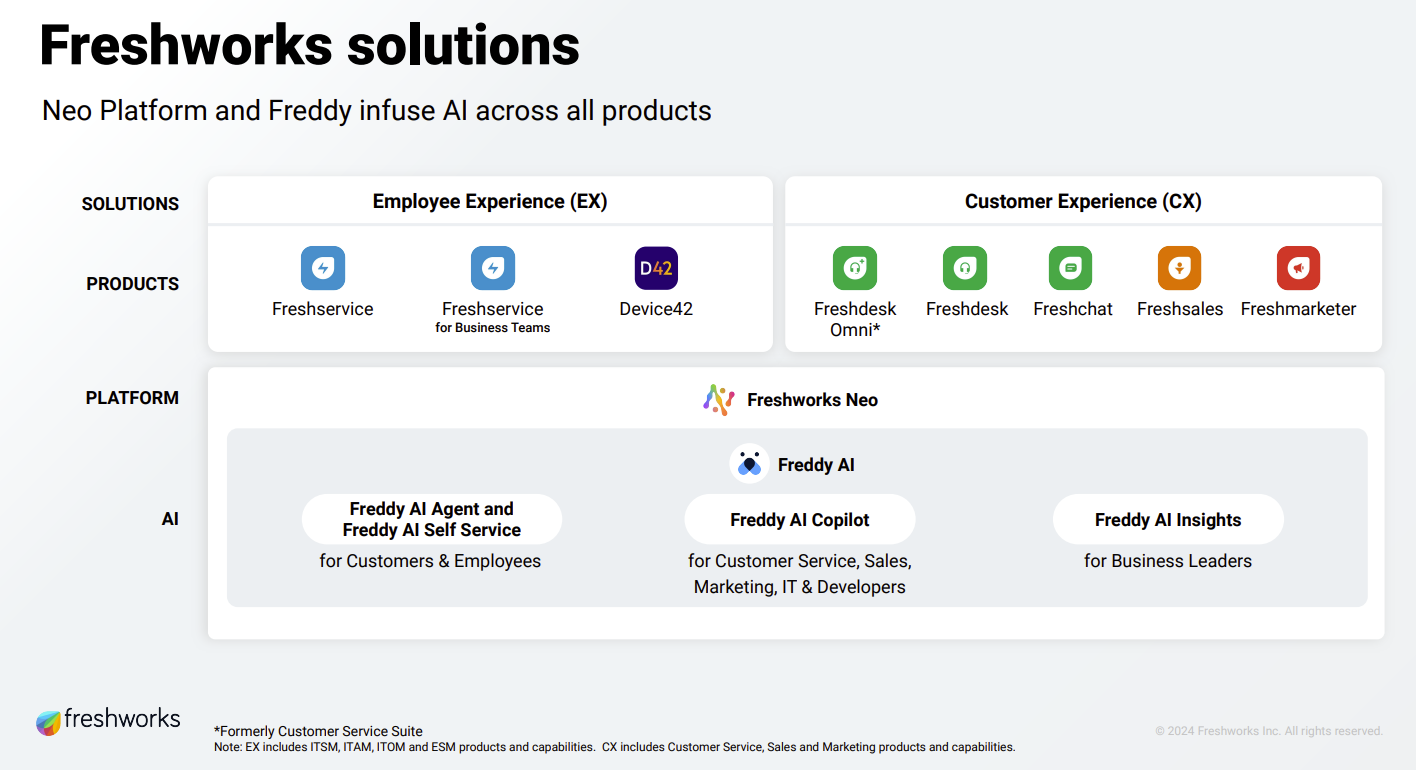

By leveraging its AI assistant, called Freddy, it can provide an employee and customer experience stack that's effective for midmarket firms. With the acquisition of Device42, closed in June, Freshworks has been able to sell IT asset management to Freshservice customers.

Freshworks also said that it is prioritizing R&D to focus on EX and accelerate features for change management, access and controls. While EX has a solid footprint, it's smaller than Freshworks' CX business, which has 56,100 customers.

"By adding these resources to EX, we have significantly pulled forward our product road map, in some cases, up to four quarters," said Woodside.

With its EX moves, Freshworks is looking to sell to larger enterprises without running into ServiceNow. Woodside said:

"EX is a fantastic market. The market is growing at double-digit rates. The competitive landscape is very clear. You got ServiceNow, who cares about the biggest companies in the world. We do run into Atlassian. There’s a number of small players and some incumbents, but nobody is really focused on that mid-market and lower end of enterprise where sophisticated IT departments that need a solution. They want to automate their IT operations, ITAM, ESM, and they need an enterprise-grade platform. That’s what we provide. There’s a lot of growth in that market."

Fortunately, Freshworks won't have to bump into much larger EX players. It'll do fine by adding EX plans to its existing CX customers as it upsells its AI capabilities.