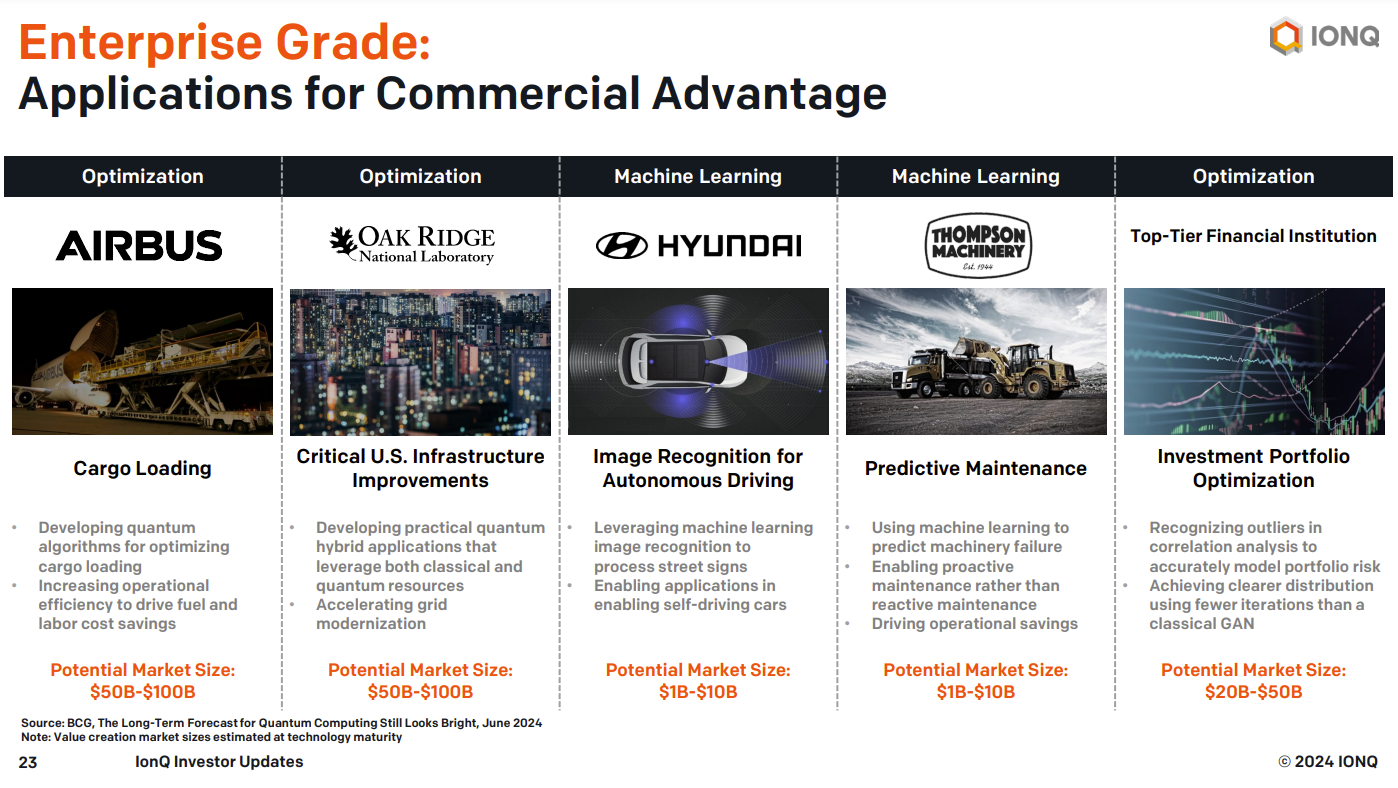

IonQ's bet to focus on making quantum computing applications relevant for enterprises today instead of waiting for quantum supremacy appears to be paying off nicely.

The company lifted its sales outlook for the 2024 to $38.5 million to $42.5 million. IonQ said fourth quarter revenue will be between $7.1 million to $11.1 million. In the third quarter, IonQ reported a net loss of $52.5 million, or 24 cents a share, on revenue of $12.4 million, up 102% from a year ago.

- IonQ's quantum computing bets: Quantum for LLM training, chemistry and enterprise use cases

- Quantum Computing Platforms

- Quantum Computing Software Platforms

- Quantum Full Stack Players

Although those revenue figures are small compared to a market cap currently at $3.52 billion, IonQ's approach is gaining commercial traction. Consider:

- IonQ said it will partner with AstraZeneca to develop quantum applications for drug discovery and development.

- The company announced a deal with Ansys to bring quantum applications to computer-aided engineering.

- Inked a $9 million partnership with the University of Maryland.

- Partnered with NKT Photonics to develop and deliver three prototype optical subsystems for IonQ systems in 2025.

- And acquired Quibitekk, a quantum networking company. Quantum networking is a potentially large market and IonQ expects it to be its first cash flow positive unit.

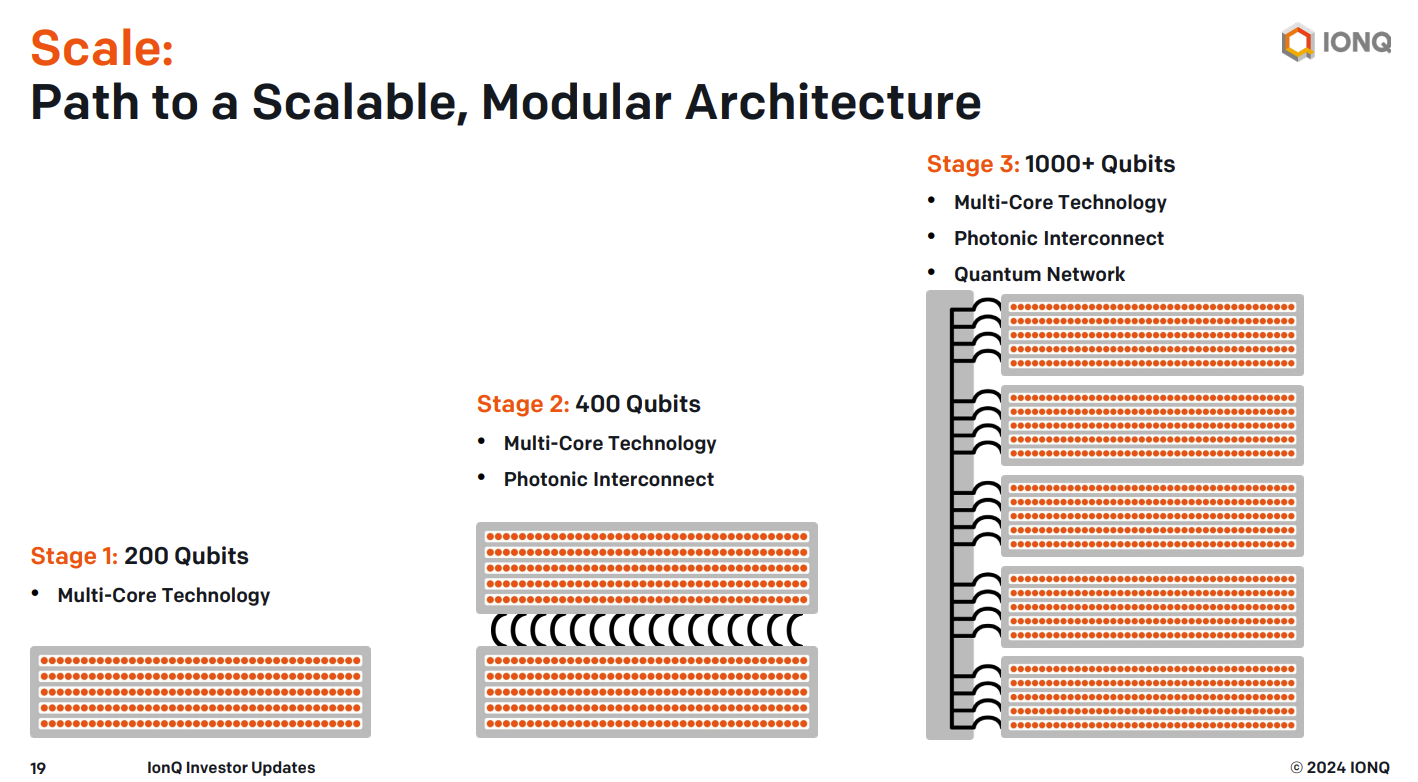

Chapman said to scale IonQ will leverage Quibitekk to network its systems together. IonQ paid $22 million in cash for Quibitekk, which has partnerships with telecommunications companies.

"Quantum networking, like classical networking hardware, is also expected to require several orders of magnitude more physical hardware than quantum computing to build the infrastructure for the quantum internet," said Chapman. "This is another element of the networking market, where IonQ is particularly well suited, given the investments we have made over the past years to scale up our production manufacturing capabilities."

IonQ also said that it landed $63.5 million in third quarter bookings including a $54.5 million award from the US Air Force Research Lab.

On IonQ's earnings conference call, CEO Peter Chapman said, "one can no longer ignore the scale of IonQ's commercial success." Chapman added that 18 months ago, the company bet that it could make its quantum systems enterprise ready.

- Will IonQ make quantum computing enterprise relevant in 2025?

- Why your quantum computing vendors are going to look familiar

"In the quantum world, there are two camps or schools of thought on this topic. One camp believes you need near perfection before value can be unlocked. If they are correct, sadly, Quantum is still a long way off. The naysayers belong to this camp, but their numbers are dwindling every day.

The other camp, which IonQ and others belong to, believe today's early noisy quantum computers can provide value even before they are perfected. If we are right, it gives us a significant advantage by generating early meaningful cash collection as we work towards perfection."

Chapman acknowledged that he wasn't concerned with academic arguments over quantum computing. The plan was to take IonQ's integrated quantum stack and apply the technology for commercial value.

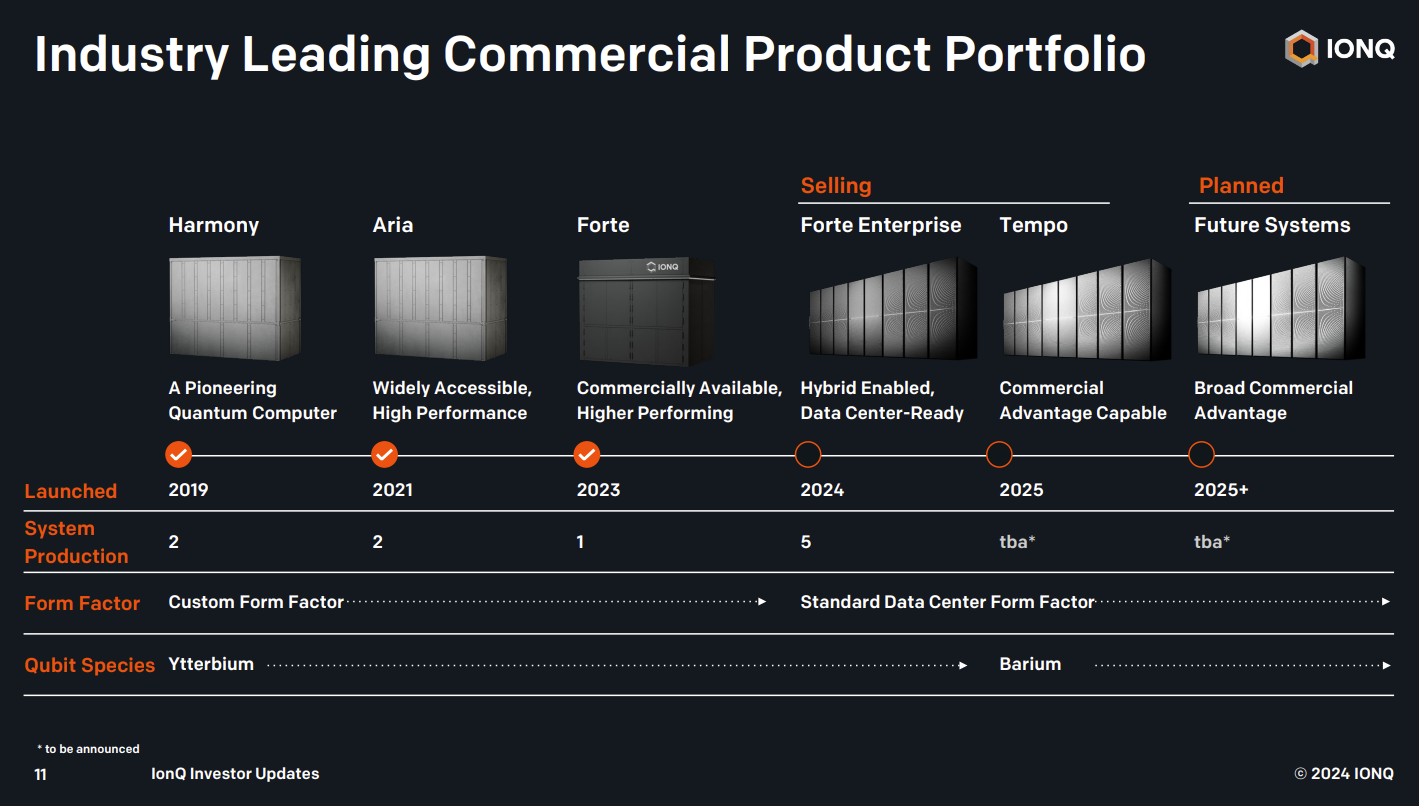

The focus for IonQ is to make sure it has software ready to go when its latest hardware systems are ready to roll.

"When we have the hardware done, we want the software to come along at exactly the same time as when the hardware is ready to run those applications," said Chapman. "We're timing those two things together. What the two announcements that are today with both Ansys and AstraZeneca are the beginnings of working on those applications."

While IonQ’s commercial traction is impressive, the company will still face tough competition from much larger companies.

- IBM upgrades IBM Quantum Data Center with Heron

- IBM Boosts the Software Side of Quantum

- Quantinuum, Microsoft claim quantum reliability breakthrough

- Microsoft claims hybrid quantum breakthrough with Quantinuum, partners with Atom Computing

- Quantinuum raises $300 million, valued at $5 billion

- Classiq CEO Minerbi on the intersection of quantum computing, HPC and use cases

- Quantum Brilliance, Oak Ridge National Laboratory aims to meld quantum computing, HPC

Constellation Research analyst Holger Mueller said:

"The race for software is heating up, as vendors want to see utlization as soon as the hardware is ready. So it is no suprise IonQ is focussing on software readiness as well, assuming its Forte Enterprise system is delivered and it's on track with its Tempo system. In the meantime, the revenue is in quantum scale encryption - so the acquisition of Quibitekk makes sense and deliver immediate, reliable revenue."