Palantir delivered strong third quarter results and upped its outlook for the fourth quarter. CEO Alex Karp said the quarter "was driven by unrelenting AI demand that won't slow down."

The company reported third quarter earnings of $144 million, or 6 cents a share, on revenue of $726 million, up 30% from a year ago. Non-GAAP earnings were 10 cents a share in the quarter.

Wall Street was expecting Palantir to report non-GAAP third quarter earnings of 9 cents a share on revenue of $703.7 million.

Palantir is delivering strong growth as its US commercial revenue accelerates along with its US government sales. Palantir has landed enterprise customers with its AI Platform Boot Camps.

As for the outlook, Palantir projected revenue of $767 million to $771 million. For 2024, Palantir projected $2.805 billion to $2.809 billion. The company expects a US commercial revenue of $687 million, up 50% from a year ago, and GAAP operating and net income in each quarter of the year.

- Palantir to deploy platforms on Microsoft Azure

- Palantir will move workloads to Oracle Cloud as both court governments and enterprises

-

Palantir Q2 shines as US enterprise growth accelerates, eyes manufacturing, ERP with Warp Speed

Palantir closed 104 deals above $1 million in the third quarter as customer accounts surged 39% from a year ago. Lowe's bets on AI, technology to navigate slowing demand

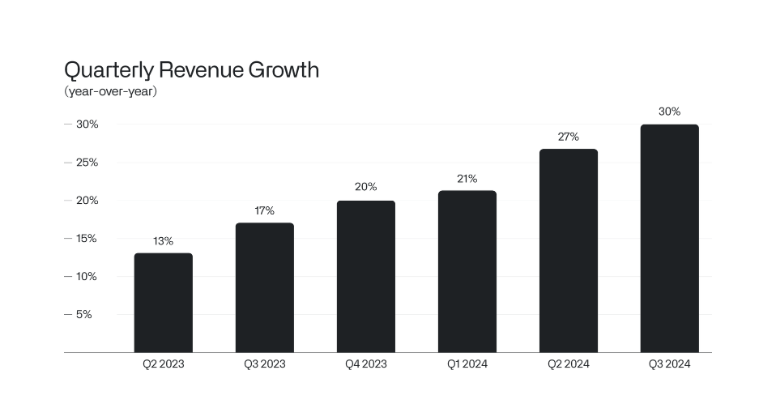

The company's growth rate has accelerated in the last six quarters.

In a shareholder letter, Karp said the following:

- "The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand for the most advanced artificial intelligence technologies from our U.S. government and commercial customers."

- "A juggernaut is emerging. This is the software century, and we intend to take the entire market."

- "The unrelenting march of our business has been driven by an early and decades-long investment in the technical infrastructure that is now making the large language models that have reshaped our world useful and valuable to large enterprises."

- "It is the speed with which institutions in the United States, in particular, have adopted our platforms and artificial intelligence capabilities more broadly that has been, and we believe will continue to be, the driver of our growth. As America once again forges ahead, our allies and partners in Europe are being left behind. Their private and state institutions stand on the sidelines during this pivotal moment in economic history, while the relentless innovation of U.S. companies disrupts and reshapes global industries. Europe must adapt to the opportunities and challenges of AI, or risk ruin."

On a conference call, Palantir executives made the following points:

- "We're witnessing the commoditization of cognition with the rapid advancement of AI models," said Ryan Taylor, Chief Revenue Officer. "Almost all investment in the AI space has been focused on supplying and improving these models. What would differentiate the AI haves from the have needs is the ability to maximally leverage these models by capitalizing upon the rich context within the enterprise."

- Taylor said Department of Defense drove seqentual revenue growth.

- Shyam Sankar, CTO, said: "Models continue to improve, but more importantly, the models across both open and closed source are becoming more similar. They are converging, all while pricing for inference is dropping like a rock. This only strengthens our conviction the value is in the application and workflow layer, which is where we excel."

- The big LLM companies will have to build applications around their models to extract value, said Sankar. The differentiation for Palantir is ontology across AIP.