Intel CEO Pat Gelsinger argued that its Gaudi 3 AI accelerator will be able to deliver strong total cost of ownership even as it falls short of the $500 million revenue target for 2024.

Gelsinger said on Intel's third quarter earnings call that the company is encouraged by Gaudi 3 interest despite the sales setback. Gaudi 3 AI accelerators are Intel's play to be in the mix for AI workloads. Nvidia is the clear leader in AI infrastructure with AMD playing No. 2 competitor.

Here's what Gelsinger had to say:

"While the Gaudi 3 benchmarks have been impressive and we are pleased by our recent collaboration with IBM to deploy Gaudi 3 as a service on IBM Cloud. The overall uptake of Gaudi has been slower than we anticipated as adoption rates were impacted by the product transition from Gaudi 2 to Gaudi 3 and software ease of use.

As a result, we will not achieve our target of $500 million in revenue for Gaudi in 2024. That said, taking a longer-term view, we remain encouraged by the market available to us. There is clear need for solutions with superior TCO based on open standards and we are continuing to enhance the Gaudi value proposition."

When pressed by analysts, Gelsinger said Gaudi 3 should be viewed as part of a CPU combination.

- Intel to give Intel Foundry more independence, expands AWS partnership

- Intel's Q2 wipeout: Guidance cut, 15% layoffs, dividend suspended

- Is AI data center buildout a case of irrational exuberance?

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

Gelsinger made the following points:

- CPU is playing an increasing role in data center AI compute due to inference. "As you go into enterprise AI, we expect to place a more prominent role, databases, embedding, refinement or much more attuned to CPU workloads. And our strategy there is CPU plus accelerator or CPU plus Gaudi," he said.

- Enterprise use cases will be more about inference and CPUs and Gaudi 3.

- Intel is seeing a good pipeline for Gaudi 3 and early interest.

- "Our strategy there is CPU plus accelerator or CPU plus Gaudi," said Gelsinger.

Intel's third quarter results and fourth quarter outlook left room for optimism, but the chipmaker still has a lot of work to do.

By the numbers:

- Intel said it expects fourth quarter revenue to be between $13.3 billion and $14.3 billion and the midpoint of $13.8 billion was above the $13.66 billion estimate. Adjusted earnings for the fourth quarter are expected to be 12 cents a share, above the 8 cents a share estimate.

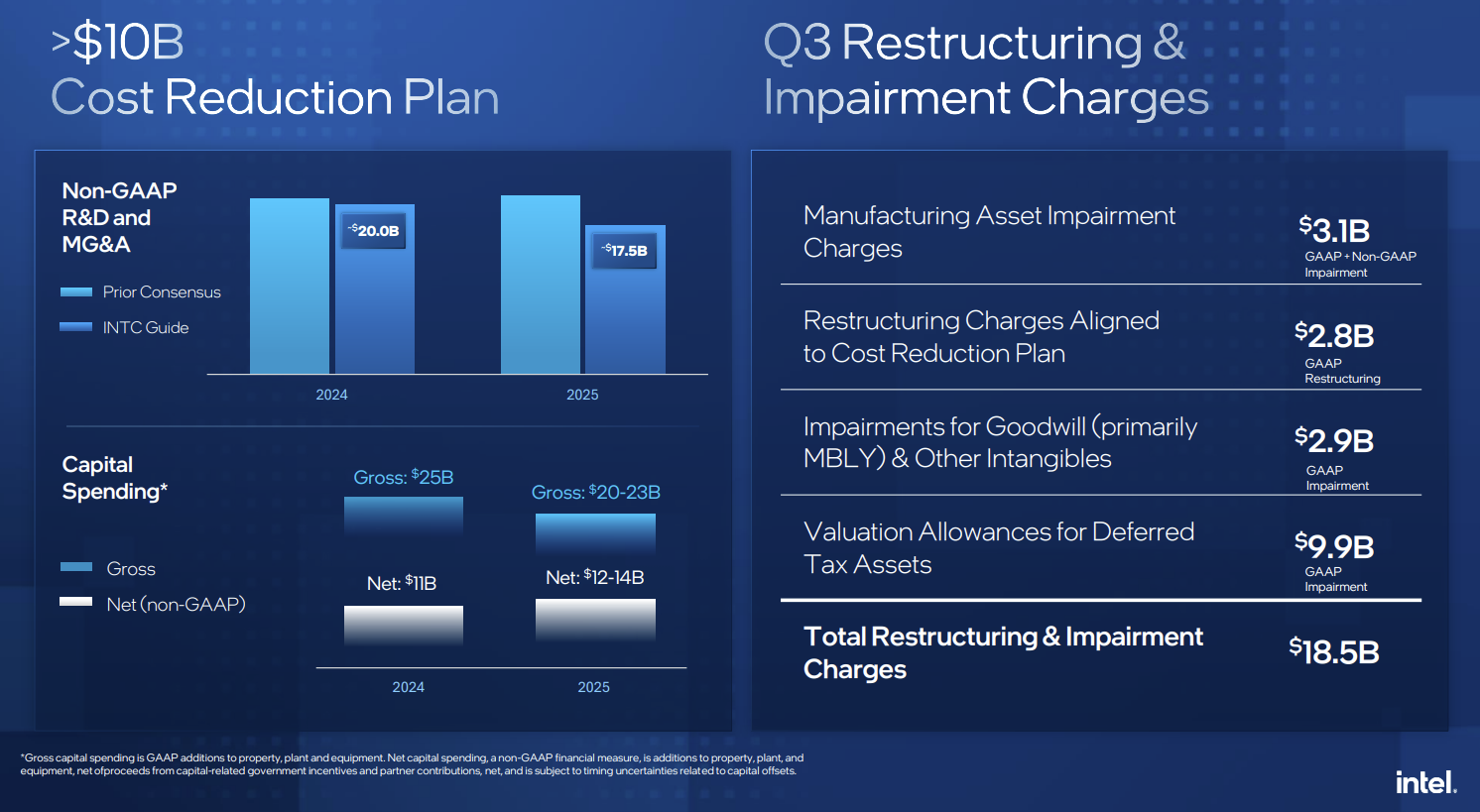

- Intel reported a third quarter net loss of $16.6 billion, which includes restructuring charges on revenue of $13.3 billion, down 6% from a year ago. On a non-GAAP basis, Intel lost $2 billion, or 46 cents a share.

- The company took a $2.8 billion restructuring charge in the third quarter.

- Intel said its client computing unit revenue was down 7% in the third quarter and the data center division was up 9%.