A pair of CFO surveys highlight how finance chiefs remain optimistic about the economy, but are cautious about investment plans due to uncertainty.

Duke University's Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta released its third quarter The CFO Survey, which has 450 respondents.

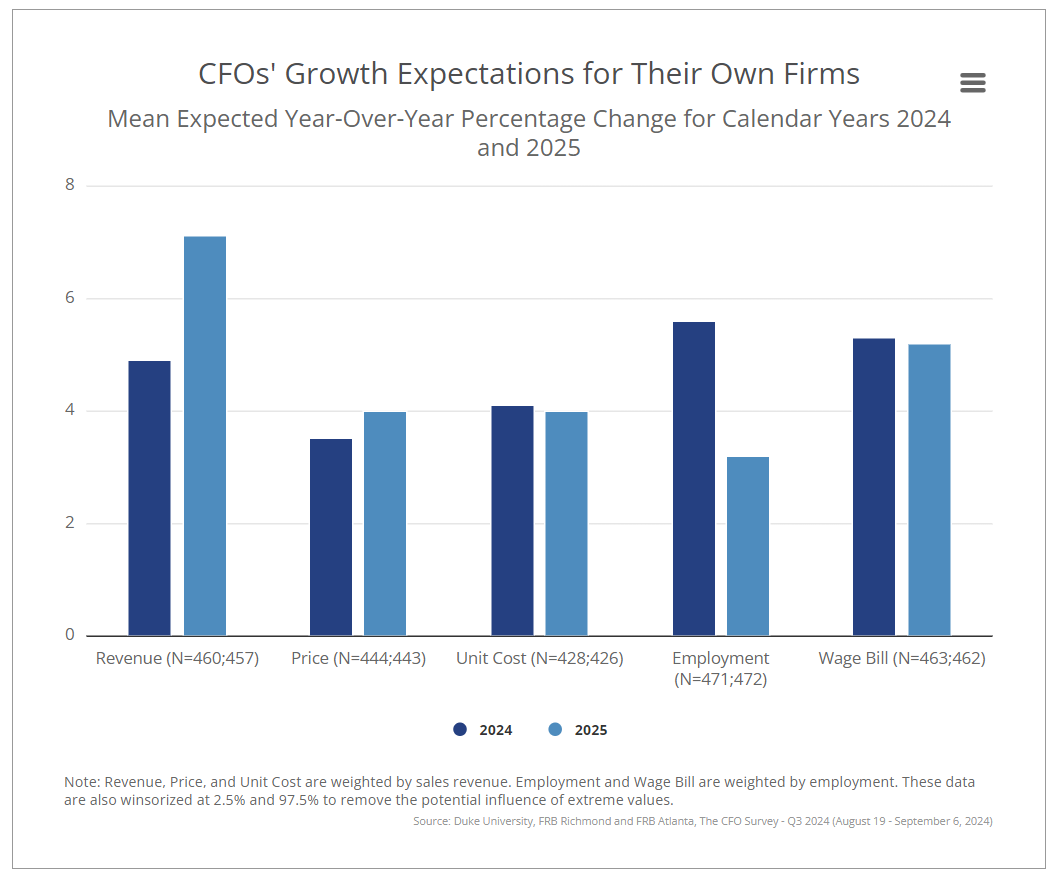

According to The CFO Survey, companies are still expecting a soft landing in the economy and plan to invest in infrastructure. However, 30% of firms are postponing, scaling down or canceling investment plans due to uncertainty about the US elections.

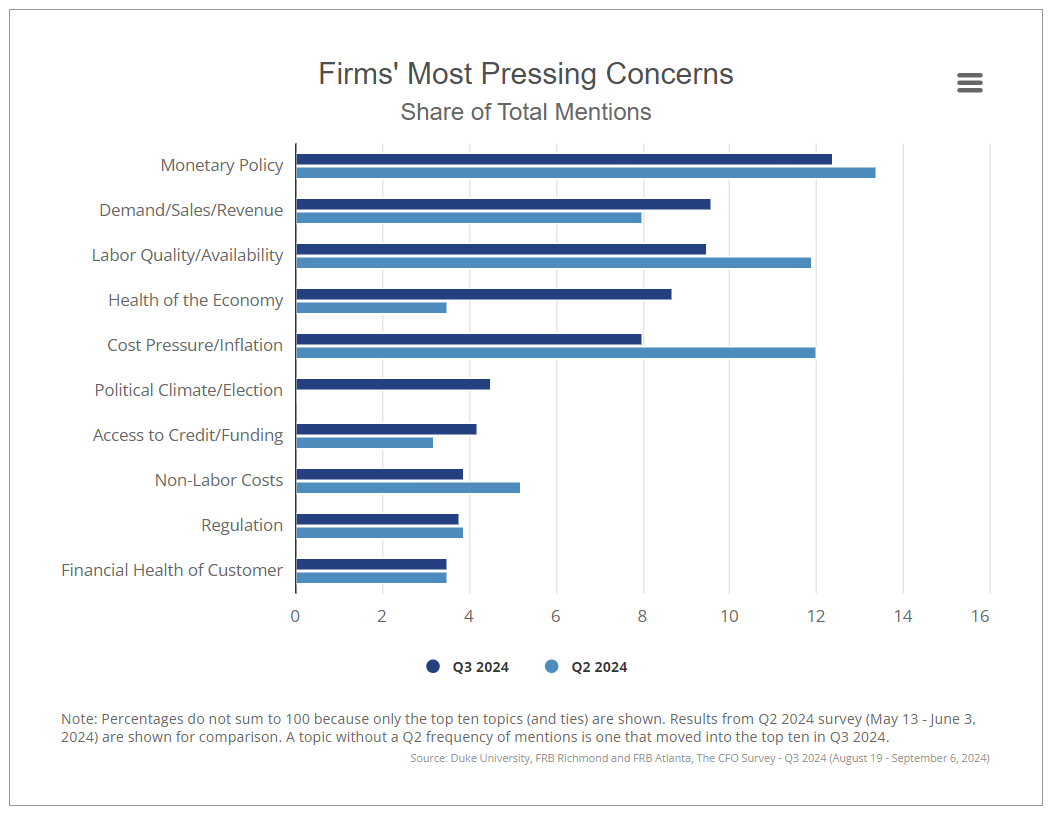

CFOs were more concerned about demand, sales and revenue in the third quarter than the second quarter. Concerns about inflation, labor and monetary policy receded in the third quarter compared to the second quarter.

The CFO Survey landed a week after Deloitte released its third quarter CFO Signals survey, which had 200 respondents from companies with at least $1 billion in revenue.

- AI projects remain work in progress, pilots, say CxOs

- Enterprises leading with AI plan next genAI, agentic AI phases

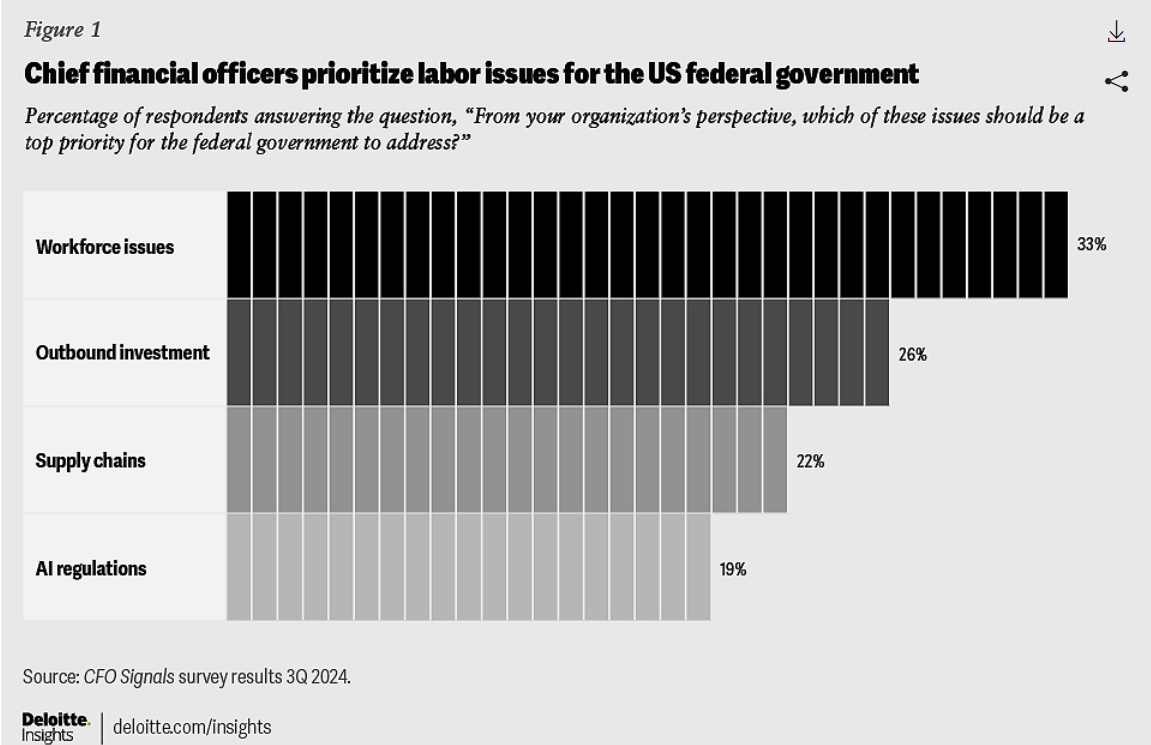

Deloitte said, "finance chiefs expressed concern about how talent shortages, wage inflation, and recent regulatory changes and proposals could impact their ability to manage and retain a skilled workforce."

The CFO Signals survey found that CFOs were also more cautious about spending. Deloitte found that CFOs were expecting 2024 earnings growth of 2.1%, less than the two-year survey average of 4.7%. CFOs also expected a slowdown in capital spending with growth of 3.4% in the third quarter, down from 6.2% a year ago.

Just 14% of CFOs rate the current North American economy as good, and only 19% see it improving in a year, according to Deloitte's CFO Signals survey.