Blackstone and Vista Equity Partners are taking Smartsheet private in an all-cash deal valued at $8.4 billion, or $56.40 a share.

The price is a 41% premium to Smartsheet's 90 trading days ending July 17. In recent months, numerous reports noted that Smartsheet was in talks to go private.

Mark Mader, CEO of Smartsheet, said the deal will "accelerate our vision of modernizing work management for enterprises." Blackstone and Vista Equity Partners said Smartsheet will benefit from the combined firms scale and network of companies. For instance, Vista is focused on enterprise software, data and technology.

Constellation Research analyst Liz Miller said:

"Smartsheet going private is an interesting move as the very idea of what work and project management means today, especially in this age of AI where work is being forever changed by automation. The interesting differentiation with Smartsheet isn’t just their capacity to help manage, automate and optimize work and projects across the enterprise but also their past acquisitions like Brandfolder."

Smartsheet will have a 45-day go-shop period that expires Nov. 8 where the company will be able to solicit other acquisition offers.

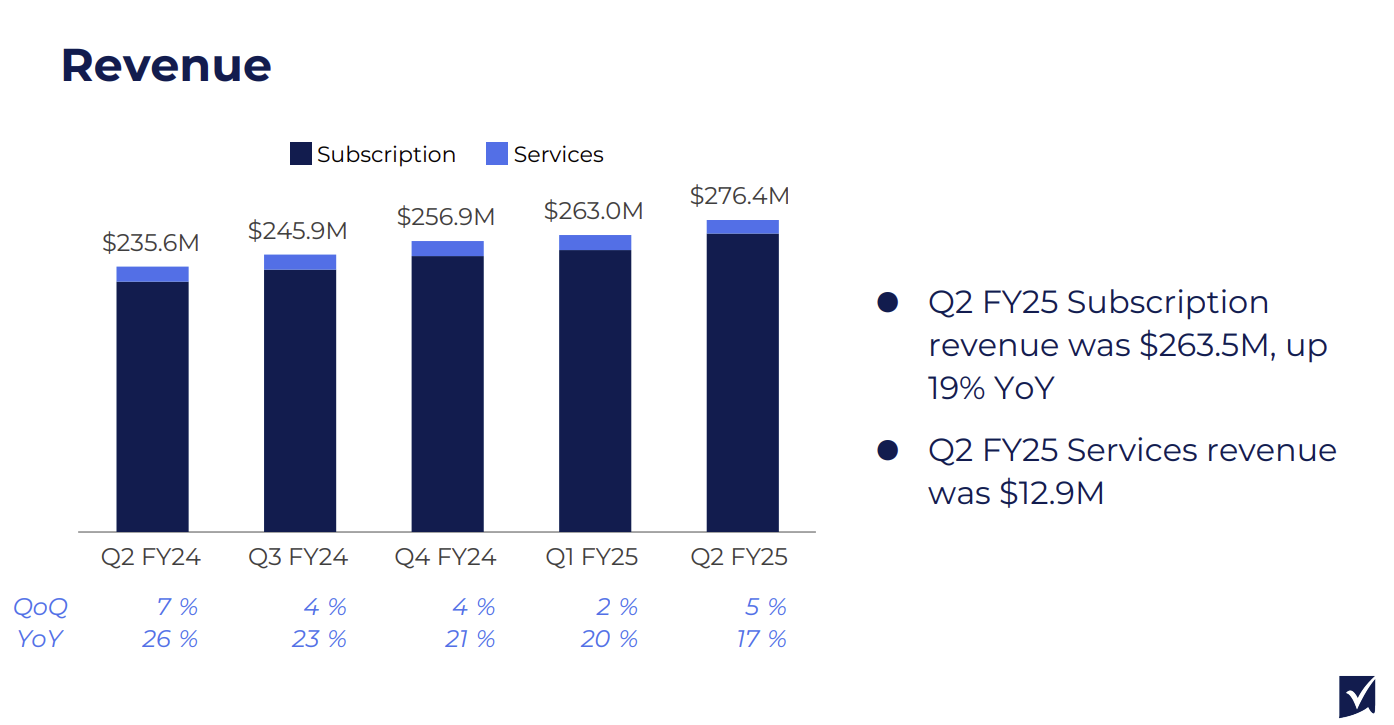

For the second quarter, Smartsheet reported revenue of $276.4 million, up 17% from a year ago. Annual recurring revenue was $1.09 billion. Smartsheet reported earnings of $7.9 million, or 6 cents a share.

Smartsheet, which competes with Asana and Monday, had 2,056 customers with ARR of more than $100,000. The company projected fiscal 2025 revenue of $1.116 billion to $1.121 billion.