Ford CFO Navin Kumar sounds like an enterprise software executive when he talks about Ford Pro, a unit focused on vehicles for businesses, and total cost of ownership, data and subscriptions.

Speaking at Goldman Sachs Communacopia + Technology Conference, Kumar noted the flywheel of data, vehicles, telematics, uptime and customer experience. Ford Pro includes commercial vehicles, all-electric trucks and vans and various services including telematics, telematics with dashcam, data services and fleet management.

The Ford Pro strategy is similar to Rivian's model: Build a fleet, create a data flywheel and deliver a great customer experience. See: How Rivian Data, AI, and a Software-Defined-Vehicle Strategy Is Paying Off

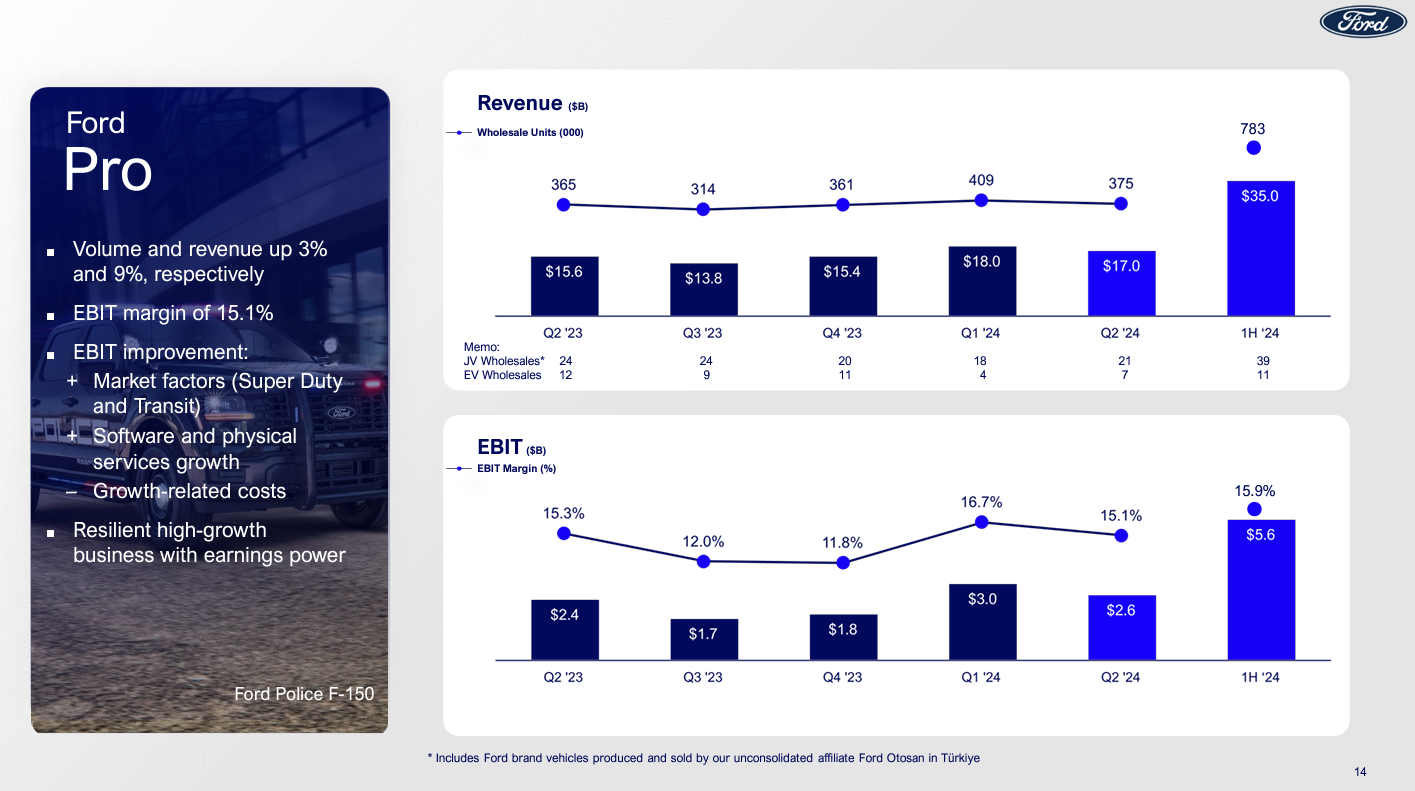

Kumar noted that Ford Pro has 600,000 paid software subscriptions and 32 dedicated elite service centers with 100 operational by 2026. Mobile repair orders grew 100% from a year ago in the second quarter. In the second quarter, Ford Pro delivered EBIT of $2.6 billion on revenue of $17 billion, up 9% from a year ago. Demand was driven by Super Duty trucks and Transit commercial vans. Demand for those vehicles outpaced production.

Kumar said:

"We're building out a fast, reliable, data driven service network that keeps vehicles on the road. And for Pro, this is a virtuous cycle. The more software subscriptions we have, the more data intelligence and analytics that flows into how our customers can operate their fleets more efficiently, how we can service these fleets more effectively and also make the software better and better.

So, for Pro, growing our software across all customer channels and use cases really builds out an intelligence mode that sustains our market leadership and helps our customers improve their bottom line."

Kumar said Ford Pro is looking to integrate hardware, software and cloud applications to improve customer productivity and uptime. "Our service is getting smarter and much more proactive to minimize vehicle downtime. For our customers, that's improving their bottom line. And for Pro, it is diversifying and growing our business into higher margin software and services which are more durable earnings streams," said Kumar.

Related: General Motors needs to fix its software issues quickly

Ford Pro is expanding into fleet management for small and medium sized businesses with a focus on driver management, inventory management, service scheduling and parts expense management.

Kumar said the telematics dashboard blended ARPU is about $20 per month and can vary based on size of fleet and use cases. Data services are priced lower. Rental companies want a full data pipe and the pricing starts at $5 a month and expands. On a blended basis, Ford Pro is seeing ARPU between $7 to $8 a month.

Kumar said:

"We run our software team like a software business. You have annual recurring targets, you have gross margin targets, you have churn targets. But from an enterprise standpoint, we want as many vehicles connected and need vehicles in our ecosystem that could drive differentiation and uptime and productivity. That has dividends when it comes to vehicle loyalty and market share leadership and growing our service parts business. From an enterprise holistic mix standpoint, it's about subscription growth."

Ford Motor is using Google Cloud's deep learning services to build simulations for virtual wind tunnels to replace computational fluid dynamics. Ford also leverages Google Cloud's database services.