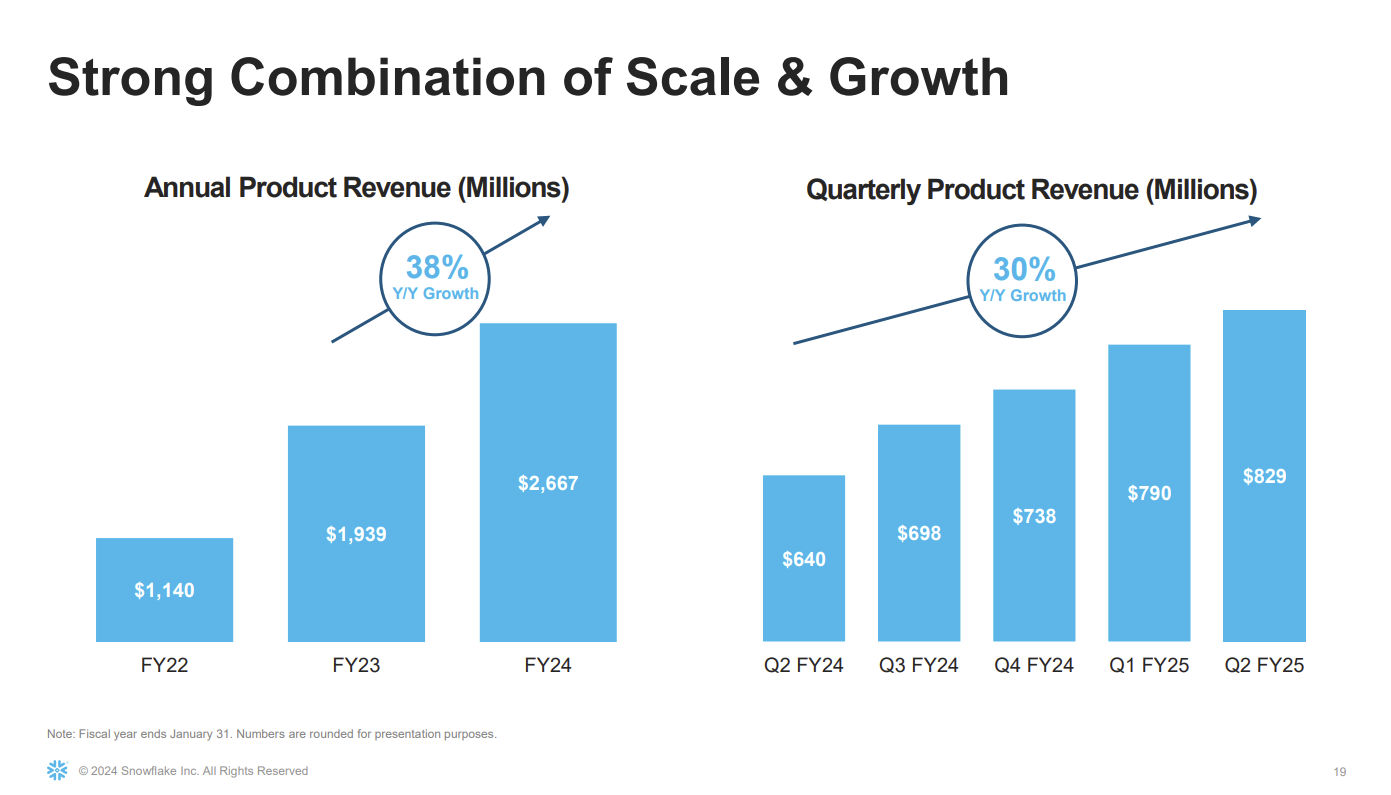

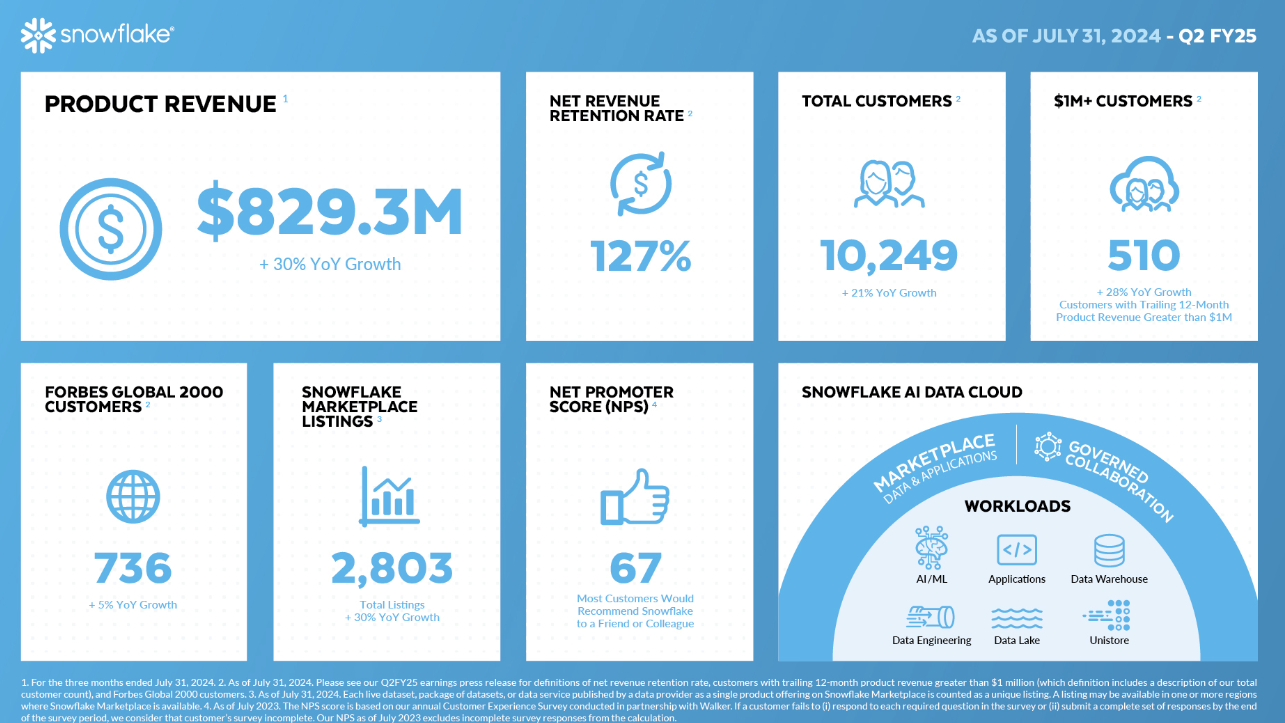

Snowflake reported strong product revenue growth 29% in the second quarter and raised its outlook.

As usual with Snowflake, it takes a long scroll to figure out what the company actually made or lost. Snowflake reported a second quarter net loss of $317 million, or 95 cents a share, on revenue of $868.82 million. Non-GAAP second quarter earnings for Snowflake were 18 cents a share.

Wall Street was expecting Snowflake to report second quarter non-GAAP earnings of 16 cents a share on revenue of $850.15 million.

- Snowflake bolsters Cortex, launches AI and ML Studio, Snowflake Trail

- Snowflake to support Polaris Catalog for Apache Iceberg

- Databricks acquires Tabular to bridge Iceberg formats with its lakehouse

- Snowflake CEO Ramaswamy on product cycles, AI, scaling

- Databricks launches Data Intelligence Platform, melds data, AI workflows

- Snowflake launches Arctic LLM, to release details under Apache 2.0 license

Sridhar Ramaswamy, CEO of Snowflake, said the company was seeing "great traction in the early stages of our new AI products." Snowflake needs its AI lineup to be a hit as it competes with Databricks.

As for the financial outlook, Snowflake projected third quarter product revenue of $850 million to $855 million, up 22%. For fiscal 2025, Snowflake sees product revenue of $3.356 billion, up 26%.

The company also said it authorized another $2.5 billion to buy common stock through March 2027.

- Constellation ShortList™ Automated Cloud Data Warehouse Services

- Constellation ShortList™ Customer Data Platform (CDP)

Constellation Research analyst Holger Mueller said Snowflake's reported strong growth but burned cash. He said:

"Snowflake blew through $1 billion in cash in 6 months. Snowflake had a very good quarter on the revenue side – growing 30% but its net loss is up more than 40%. And all that despite a rosy outlook thanks to AI. But something will have to give in the second half as somehow Sridhar Ramaswamy and team want to end the fiscal year with an operating income of 3% down from 5%. The question is – when will Snowflake turn profitable on a GAAP basis. Looks like not this fiscal year."

Speaking on a conference call, Ramaswamy said:

"In the first half of this year alone, we brought as much product to market as we did all of last year. We are making Snowflake the best cloud for computation, collaboration, and application on all data. And we are leveraging the power of AI to make all of these easier to create, maintain and use. This is what our team is aligned around. And I can tell you, that our customers are adopting the new capabilities at an incredible base."

Ramaswamy cover the following topics:

- Security: "We obviously had some rough headlines in the quarter as some of our customers dealt with cybersecurity threat. As extensively reported, the issue wasn't on the Snowflake site. However, we understand that when it comes to cybersecurity, we are all in it together," he said. "My one ask of all businesses around the world, whether they are a Snowflake customer or not, is to enable and enforce multi-factor authentication in your organization and ensure that you have network policies that are as strong as possible."

- Product availability. "In Q2, we made nine net -- nine net new product announcements and brought more than 15 and product capabilities to general availability to the market, that's what we call, progress," said Ramaswamy.

- AI. "As of the end of Q2, more than 2,500 accounts were using Snowflake AI on a weekly basis. We expect that option to continue to increase and revenue contribution to follow. Our Notebooks offering is also seeing great traction in public preview, with more than 1,600 accounts, using that feature. This is critical to engage with data sciences on will unlock new opportunities that we previously did not address," he said.