Walmart's second quarter shined partly due to technology investment in automation and AI as well as strong demand.

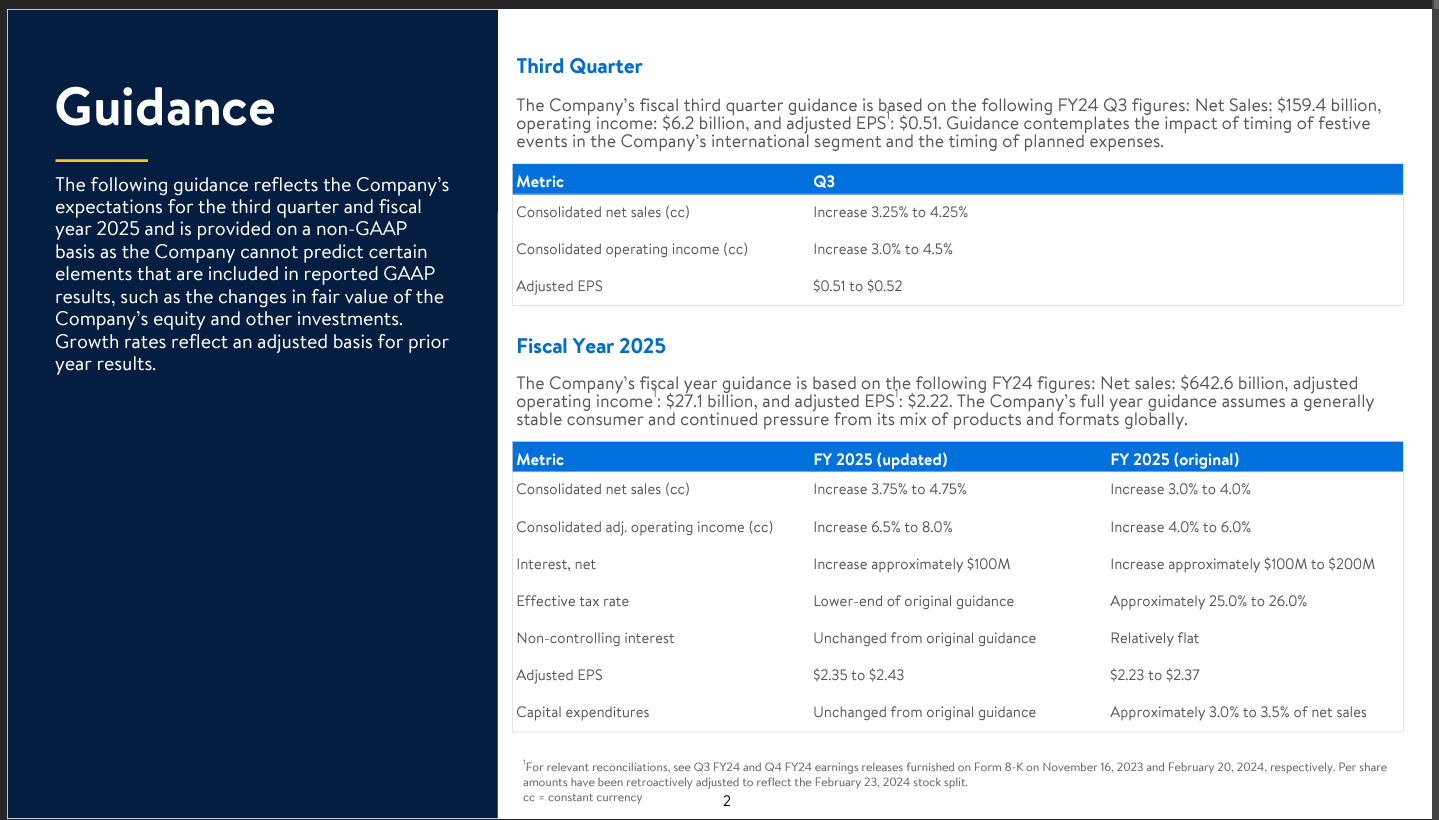

The retailing giant reported second quarter revenue of $169.3 billion, up 4.8%, with earnings of 56 cents a share. Adjusted earnings were 67 cents a share. Walmart also raised its outlook for fiscal 2025.

Walmart benefited from strong demand and efficiency that enabled it to lower prices across 7,200 categories. Perhaps the biggest news from Walmart is that consumers kept spending due to a focus on value.

Here's a look at the enterprise technology takeaways from Walmart's second quarter:

Generative AI. Walmart CEO Doug McMillon had a long riff on Walmart's earnings call. here are some of the bullet points.

- Walmart is building its own large language models (LLMs) and using third party sources too.

- GenAI has sped up the time it takes to improve the product catalog. McMillon said:

"One example is that we've used generative AI to improve our product catalog. The quality of the data in our catalog affects nearly everything we do from helping customers find and buy what they're looking for, to how we store inventory in the network, to delivering orders. We've used multiple large language models to accurately create or improve over 850 million pieces of data in a catalog. Without the use of generative AI, this work would have required nearly 100 times the current headcount to complete in the same amount of time."

- Associates are using an AI-driven shopping assistant that provides advice and ideas. The shopping assistant will get an upgrade to answer follow-up questions.

- Generative AI is driving cross-category sales and replicating what happens with impulse buys in a physical store. "One of the interesting things that's happening with generative AI is that cross-category search is more effective, which serves up more general merchandise items and it helps drive e-commerce profitability," said McMillion.

Enterprises start to harvest AI-driven exponential efficiency efforts | GenAI may be the new UI for enterprise software | 14 takeaways from genAI initiatives midway through 2024

E-commerce revenue was strong with 21% growth, and the store pickup and delivery outpaced in-store and club sales. "Pickup is growing faster than our in-store or club sales, and delivery is growing even faster than pickup. Delivery accuracy and speed continue to improve," said McMillon. "Our e-commerce progress creates more optionality for our customers and fuels the growth of our newer businesses."

Store fulfilled delivery was up about 50% in the second quarter, said Walmart CFO John David Rainey.

Scan and go is driving digital engagement at Sam's Club. "Digital engagement remains strong with Scan and Go penetration surpassing 30%. With our increased convenience of our Just Go technology now operational in 325 clubs, over 50% of our members can exit without a check, improving member NPS by more than 800 basis points, compared to the clubs without this technology," said Rainey.

- Walmart CEO McMillon highlights adaptive retail, applied AI at CES 2024

- Walmart Chief Sustainability Officer: ESG is integrated into operations, business

- Walmart, Target highlight intersection of supply chain, customer experience

- Amazon vs. Walmart: 8 innovation takeaways

Supply chain automation. Rainey said more than 45% of Walmart's e-commerce fulfillment center volume is now automated. Rainey said:

"We have about 1,800 stores receiving some level of freight from 15 of our regional distribution centers that are in varying stages of automation implementation. And as a result, our supply chain teams are processing more units through our DCs and FCs. And while we're spending more on CapEx than we have historically, we're pleased with the returns from these investments, particularly the automation of our supply chain. We expect these investments to yield returns that will allow us to increase our return on invested capital each year."

By the end of the year, Walmart said about 3,000 stores of the 4,600 will have deliveries from automated facilities some way.