Enterprise software could become disrupted as new AI and data driven entrants smell opportunity by either serving as an overlay to the acronym-laden soup of systems or replacing them.

The disgruntlement with enterprise software has been brewing throughout 2024. Forced migrations, multi-cloud cross-selling, copilot upcharges and lack of value are forcing the issue.

Here's a look at the themes bubbling up in 2024.

- Enterprise software customers are annoyed with their vendors.

- Customers need more value but they are mostly seeing cross-sells designed to raise annual contract value for vendors.

- Migrations and upgrades are challenging and a hard sell due to the lack of value. The enterprise software ecosystem is using the same integrator heavy playbook even as they allegedly simplify with AI.

- GenAI may be the new UI, but enterprises are trying to sell you copilot silos.

- Enterprise software vendors are mostly data stores with a UI and could be relegated to systems of record. Vendors will move to keep your data on their respective platforms.

- Workflows are the new battleground.

- There's a need for platforms that can bring automation, AI and process intelligence to legacy investments.

Add it up and I can only conclude that the table is set for disruption. If this were Game of Thrones, you could say winter is coming for enterprise software.

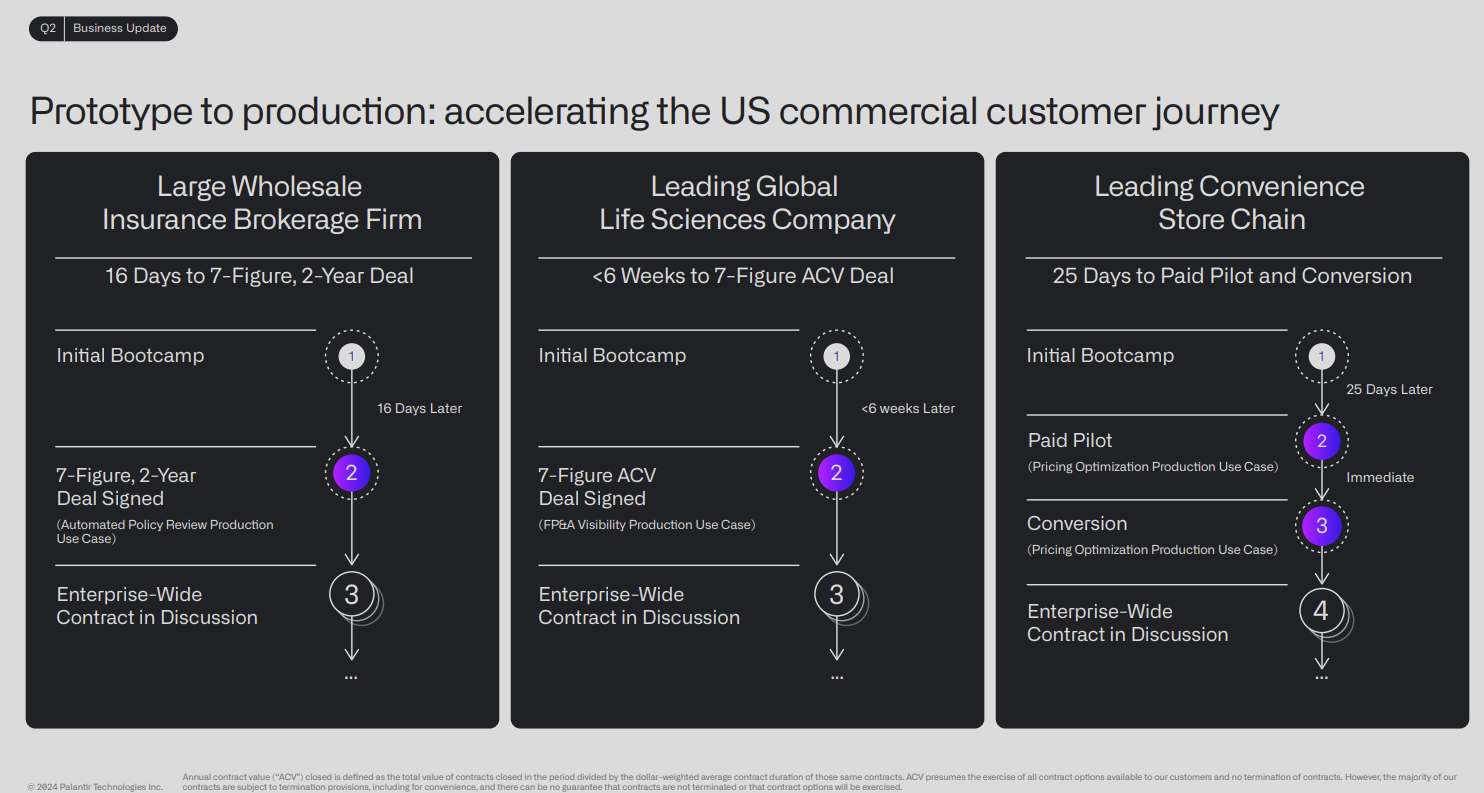

Palantir this week outlined Warp Speed, built on the company's Artificial Intelligence Platform (AIP), to target manufacturers. The Palantir argument is that traditional ERP systems were built for the CFO and don't support modern requirements.

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

Speaking on Palantir's second quarter earnings conference call, CTO Shyam Sankar said the US needs to reindustrialize, but is hampered by outdated enterprise systems. It's why SpaceX and Tesla have built their own ERP systems. The new reality also means companies like Rivian and Uber build more of their enterprise software than buy it.

"Warp Speed, built on AIP, on our industrial AI, and with ontology is the modern American manufacturing operating system that reimagines how to bend atoms better with bits," said Sankar. "Warp Speed is conceived as an operating system for the modern American manufacturer. It touches not just ERP, but MES (manufacturing execution system), PLM (product lifecycle management), PLCs (programmable logic controllers) and it's interacting with the factory floor. We think there's an opportunity to reimagine this."

Sankar said Warp Speed will appeal to next-gen manufacturers instead of large ones that have already bet on legacy systems. These next-generation enterprises are focused on leveraging data for competitive advantage. "It's not actually believable that the same ERP manufacturing system that you use to build rockets is what you'd use to build rackets," said Sankar.

Manufacturers need to be thinking about driving value instead of creating services revenue for systems integrators, said Sankar. "We live in a world today where it's $1 of license for $9 of implementation that never seems to quite work," he added.

Palantir appears to be focused on next-gen manufacturers so it's not quite taking SAP head on. However, SAP is hellbent on being more than a system of record and said Business AI is driving deals. The real battle in the future between companies like Palantir and SAP will revolve around data ontologies.

Speaking at C3 AI's annual Transform conference in March, CEO Thomas Siebel said AI can make enterprise systems more valuable, by riding on top of them. Siebel noted that the enterprise software stack needs to be reinvented, but it won't be by replacing systems. "No way no how is SAP going away. Sorry, the bad news is SAP isn't going away," said Siebel.

"Your accounting software and HR software isn't going away. It's not a replacement market for the entire enterprise application software stack. But generative AI certainly does change the entire enterprise application software stack."

Siebel said that if you fast forward to 2027 no CEO or CFO is going to survive without predictive insights from AI-driven systems. Siebel was more in the genAI as UI camp. He noted that the human-computer interface is going to be reshaped by genAI and replace the crappy user experience that hasn't changed in enterprise software for more than two decades.

My take

As with everything in life, your view of this issue will depend on timeline. It's clear to me that enterprise software is hitting a wall on multiple fronts and the tension between margin compression and margin preservation is palpable.

In the short term (3 years), it's highly likely enterprises are stuck with what they have. If you can't migrate off of VMware just remember how hard it is to migrate off your legacy systems. As a result, the plan for many enterprises is to box these systems out with an abstraction layer.

That abstraction layer--facilitated by generative AI as a front end--will give enterprises more control over the UI and leverage some of that internal data Palantir's Sankar was talking about. Some companies, especially the next-generation of enterprises that build over buy, will get to that genAI as UI moment quickly. Others will need to develop their data ground games and move more into generative AI.

One note about the abstraction layer with genAI as the new UI is that it may take a while.

Palantir and C3 AI are coming at the enterprise disruption from a big data and AI perspective. ServiceNow can also be an abstraction layer and has invested more in process intelligence.

"Our Gen AI strategy is focused on infusing intelligence into the flow of work, end-to-end across the enterprise, every department, every persona," said ServiceNow CEO Bill McDermott on the company's latest earnings call. "With our native integrations, we already help people orchestrate across different systems and data sources. Now we can train the machines to do the low value work so the people can up level to the knowledge work."

Beyond the next three years, Siebel's vision about enterprise software makes sense. Enterprise software has become stagnant and more about sales playbooks than value. What is missing from many potential disruptors is the process intelligence and automation that would go with the AI and data.

Here are a few developments to watch as this enterprise software disruption theme plays out:

- Data lock-in. Every cloud vendor and enterprise software provider wants your data on their platform. Your data has been in play for years. Yes, SAP wants to keep you on its data ontology. Salesforce wants you in Data Cloud. And guess what? Palantir and C3 will want your data on their ontologies too. A neutral vendor in your stack is great, but also a pipe dream

- How does this enterprise software disruption play out for data platforms? Enterprises are more likely to consider Databricks and Snowflake as their platforms to remain agile. Both have pushed open source and visions to ensure customers keep their data.

- Vendors without your data may become critical. ServiceNow automates your workflows, but doesn't have your data. That reality may become more critical to enterprise technology strategy.

- M&A. Look for a series of acquisitions revolving around orchestration, process automation and automation. Some vendors will have to buy their way into this abstraction layer concept.

Insights archive

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- The generative AI buildout, overcapacity and what history tells us

- Enterprises start to harvest AI-driven exponential efficiency efforts

- GenAI may be the new UI for enterprise software

- Education tech in turmoil amid genAI: Why consolidation is next

- 14 takeaways from genAI initiatives midway through 2024

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Financial services firms see genAI use cases leading to efficiency boom