HubSpot reported better-than-expected second quarter results as customers of the CRM vendor decided to consolidate on its unified platform.

The company reported a second quarter net loss of $14.4 million, or 28 cents a share, on revenue of $637.2 million, up 20% from a year ago. Non-GAAP second quarter earnings were $1.94 a share. The company improved non-GAAP operating margins in the quarter to 17.2% from 14.5% a year ago.

Wall Street was expecting HubSpot to report second quarter earnings of $1.64 a share on revenue of $619 million. HubSpot was reportedly a buyout target for Google Cloud, but talks broke down.

- Constellation ShortList™ Social Engagement Platforms

- Constellation ShortList™ Sales Engagement Platforms

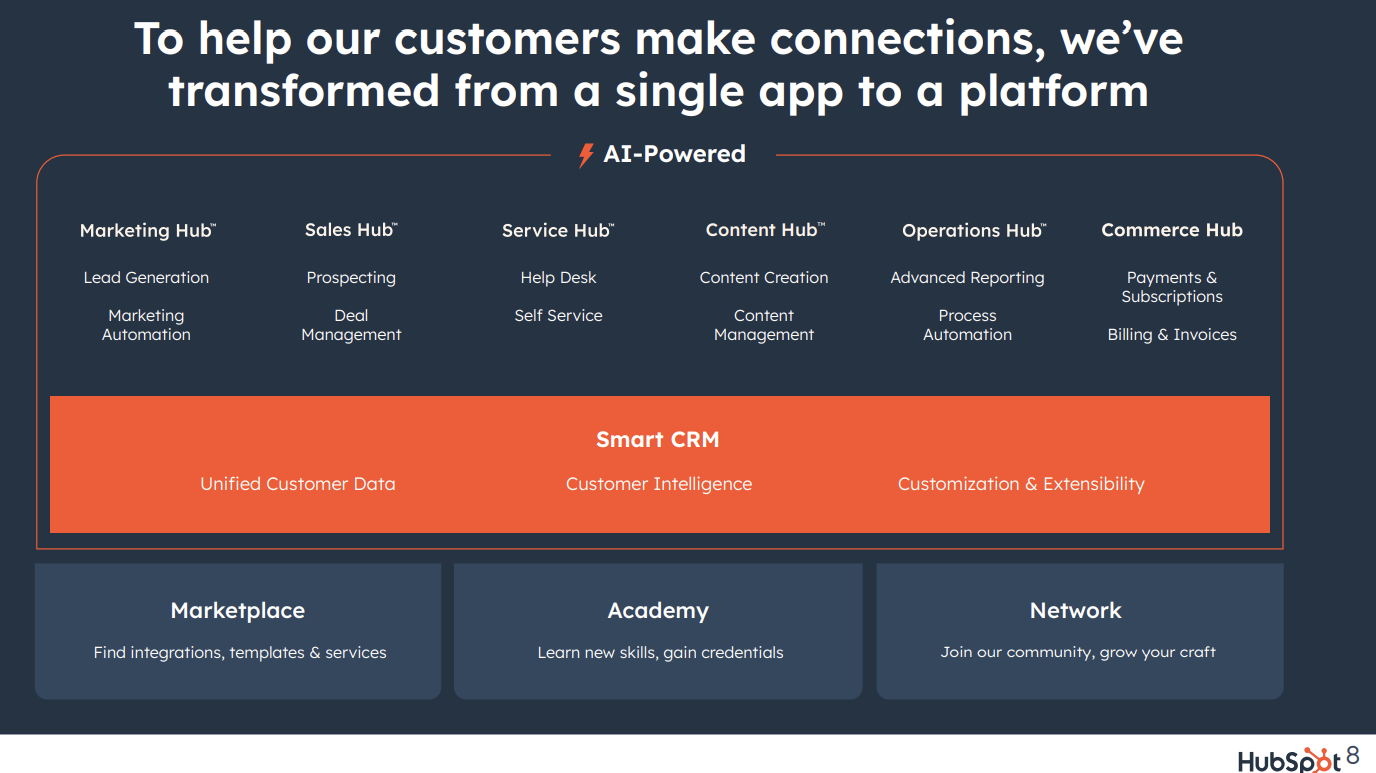

Speaking on an earnings conference call, HubSpot CEO Yamini Rangan said customers are buying multiple hubs and leveraging the common data platform for insights. "We're going to build best-in-class engagement hubs, but most importantly, we're going to build a platform that unifies data insights across all of those hubs," she said. "If I were to point to one thing that we're seeing in the last few quarters, it is the multi hub momentum."

Rangan said HubSpot had multi-hub wins for marketing, sales and service as well as content. "Our customers acquired a bunch of point solutions, and they are struggling to integrate all of those data points into actionable insights and to control the cost, and they're looking for much better ways to be able to get all of that information into a single platform," said Rangan.

In addition, HubSpot layers commerce data, transaction data and payments data into its CRM platform.

HubSpot's earnings are notable given an uncertain macro environment. Rangan said customers are slowing to make decisions and using committees to approve purchases. Sales cycles are now longer.

However, HubSpot is winning wallet share. "When we talk to customers even when they are not ready to make a decision it's mostly not now for HubSpot and not a no," said Rangan.

Constellation Research analyst Liz Miller said:

“What Hubspot proves, time and again, is that easy wins the day. The reality is that establishing a hub for engagement across Sales, Service and Marketing functions can be exceedingly difficult…painful in fact. One minute you are deploying a point solution, the next you have given rise to a frankenstack. Hubspot is easy to navigate, easy to acquire, easy to adopt and easy to integrate and use. Hubspot no longer meet your needs? Hubspot makes it easy to transition while still leaving the door open to return and possibly expand. With a vibrant community of excited users, the Hubspot-vibe is one of success and positive growth. Customers are happy to consolidate around something that just works for their business and stage of growth.”

As for the outlook, HubSpot said its third quarter revenue will be between $646 million to $647 million with non-GAAP earnings between $1.89 a share to $1.91 a share.

For 2024, HubSpot is projecting revenue between $2.567 billion and $2.573 billion. Non-GAAP earnings will be between $7.64 a share to $7.70 a share.