Fortinet appears to be setting itself up to be more of a rival to Palo Alto Networks with the acquisitions of Next DLP and Lacework as well as better-than-expected second quarter results.

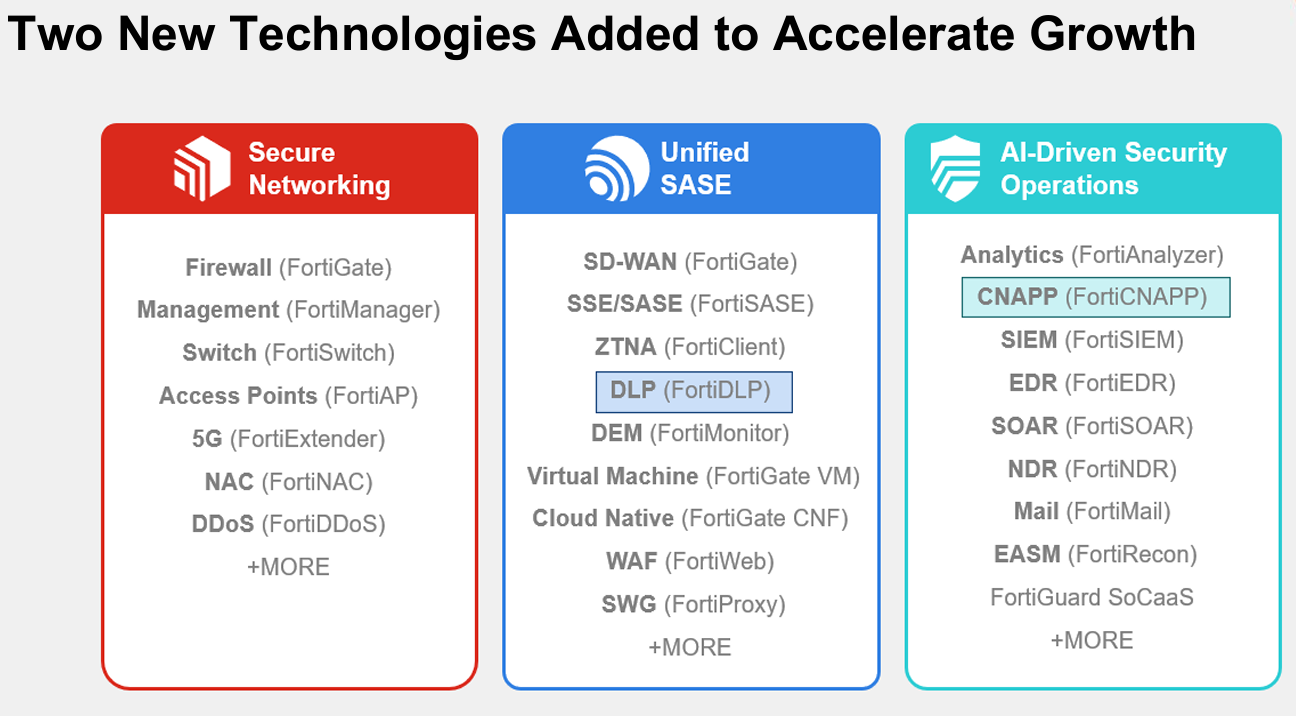

Ahead of its second quarter results, Fortinet announced the acquisition of Next DLP, which is focused on insider risk and data protection. Fortinet said the purchase of Next DLP will improve its position in the standalone enterprise data lost prevention (DLP) market and complement its endpoint and secure access service edge (SASE) businesses.

In addition, Fortinet completed its purchase of Lacework, a cloud-native application protection platform (CNAPP) provider. Fortinet plans to integrate Lacework with its Fortinet Security Fabric.

Here's how the technologies fit into the Fortinet stack.

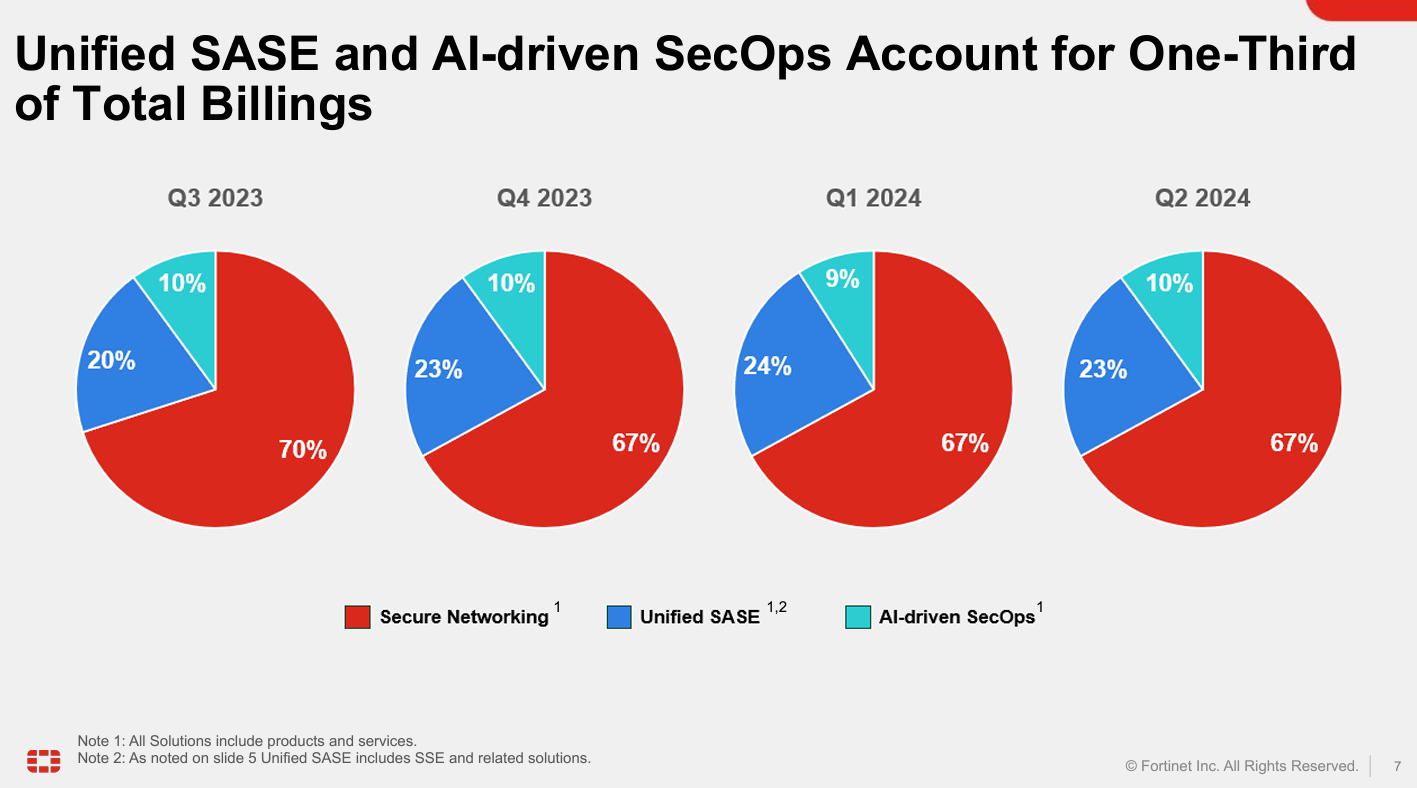

Ultimately, Fortinet is piecing together a broad cybersecurity platform that covers secure networking, unified SASE and AI-driven SecOps. In other words, Fortinet's billings trend highlight how it'll look more like Palo Alto Networks.

Speaking on Fortinet's second quarter earnings conference call, CEO Ken Xie said:

"We continue to build our own SASE delivery infrastructure, including leverage of FortiGate technologies, providing us with a competitive long-term cost advantage. We acquired Next DLP, a next-generation cloud-native SaaS data protection platform, extending from endpoint to cloud. This will allow us to enter the stand-alone enterprise DLP market as well as the market for the SASE solution."

Xie also said that the Lacework purchase will give it "one of the most comprehensive full-stack cloud security solutions available from a single vendor." The Lacework AI-driven platform will be combined with Fortinet's security platform to cover network, cloud and endpoint.

- CrowdStrike to Delta: Don't blame us for your IT outage response

- From Blue Screen to Blackout: Unpacking the CrowdStrike Catastrophe and Industry Implications

- CrowdStrike outage likely to hit cybersecurity's platformization pitch

- Cybersecurity platformization: What you need to know

Constellation Research's take

Constellation Research analyst Chirag Mehta outlined how Fortinet's approach can make it formidable.

"In today’s complex multicloud and hybrid world, where remote work is the norm, traditional perimeter security is becoming obsolete. As more organizations move to the cloud and seek to enhance their security posture, Secure Access Service Edge (SASE) solutions are increasingly in demand. Fortinet is addressing these needs by bolstering its portfolio to meet customer requirements for networking and cloud security.

Fortinet's recent acquisition of Lacework significantly strengthened its cloud security portfolio by incorporating Cloud Native Application Protection Platform (CNAPP) capabilities. This acquisition also provided Fortinet with access to Lacework's advancements in DevSecOps, enhancing its overall security offerings.

Now, with the acquisition of Next DLP, Fortinet has further fortified its SASE portfolio. AI-led Data Loss Prevention (DLP) solutions are crucial as data security remains a significant concern for customers adopting AI technologies. CxOs often struggle with visibility into “shadow AI” systems and the associated data movement, which expands their attack surface. Next DLP's capabilities address these critical issues, ensuring better data security and compliance.

With steady organic growth and strategic acquisitions, Fortinet is positioning itself as a formidable competitor to Palo Alto Networks, which has pursued a similar strategy of acquisitions and organic investments. However, while Palo Alto Networks' push for platformization has raised concerns about vendor lock-in, Fortinet's approach offers customers more flexibility and options, addressing their diverse needs in the evolving cybersecurity landscape."

- Constellation ShortList™ Security Access Service Edge (SASE)

- Constellation ShortList™ Network Firewall

- Constellation ShortList™ Endpoint Protection Platforms

- Constellation ShortList™ Extended Detection and Response Platforms (XDR)

- Constellation ShortList™ Security Information and Event Management (SIEM)

- Constellation ShortList™ Software Defined - Wide Area Network (SD-WAN)

Second quarter results

Fortinet is clearly looking to expand wallet share with large enterprises as well as mid-sized businesses. Fortinet touted a series of 7-figure deal wins due to its ability to use FortiOS to consolidate security functions into one platform.

The company reported second-quarter earnings that were well ahead of expectations. Fortinet reported second-quarter earnings of $379.8 million, or 49 cents a share, on revenue of $1.43 billion, up 11% from a year ago. Non-GAAP earnings were 57 cents a share.

Wall Street was expecting Fortinet to report earnings of 41 cents a share on revenue of $1.4 billion.

As for the outlook, Fortinet projected third quarter revenue between $1.445 billion and $1.505 billion with non-GAAP earnings of 56 cents a share to 58 cents a share. For fiscal 2024, Fortinet projected revenue between $5.8 billion to $5.9 billion with non-GAAP earnings of $2.13 a share to $2.19 a share.

Xie added that Fortinet can expand beyond IT security to operational technology. The general theme for Fortinet is that it has a cybersecurity stack and unified operating system that can make it a platformization player over time.