VMware added a bevy of features to its VMware Cloud Foundation (VCF) platform including import tools that make the migration from vSphere and vSAN to VCF easier.

The updates come as VMware is under fire from customers. When Broadcom completed the VMware acquisition it shifted to subscription-based pricing in a move that raised costs for enterprises.

BT150 zeitgeist: Dear SaaS vendors: Your customers are pissed

Nutanix has been able to add VMware customers, but acknowledged last quarter that Broadcom was responding with aggressive pricing. Hewlett Packard Enterprise also entered the virtualization space by building open-source kernel-based virtual machines into HPE Private Cloud, but that move will take time to play out.

On Broadcom's fiscal second quarter conference call, CEO Hock Tan said that VMware's transition to a new model is on track. VMware revenue in the second quarter was $2.7 billion, up from $2.1 billion in the first quarter. Tan said the company has signed up nearly 3,000 of its largest 10,000 customers to deals, mostly multi-year contracts.

Tan reiterated that VMware would deliver $4 billion a quarter in revenue, but declined to give a time frame.

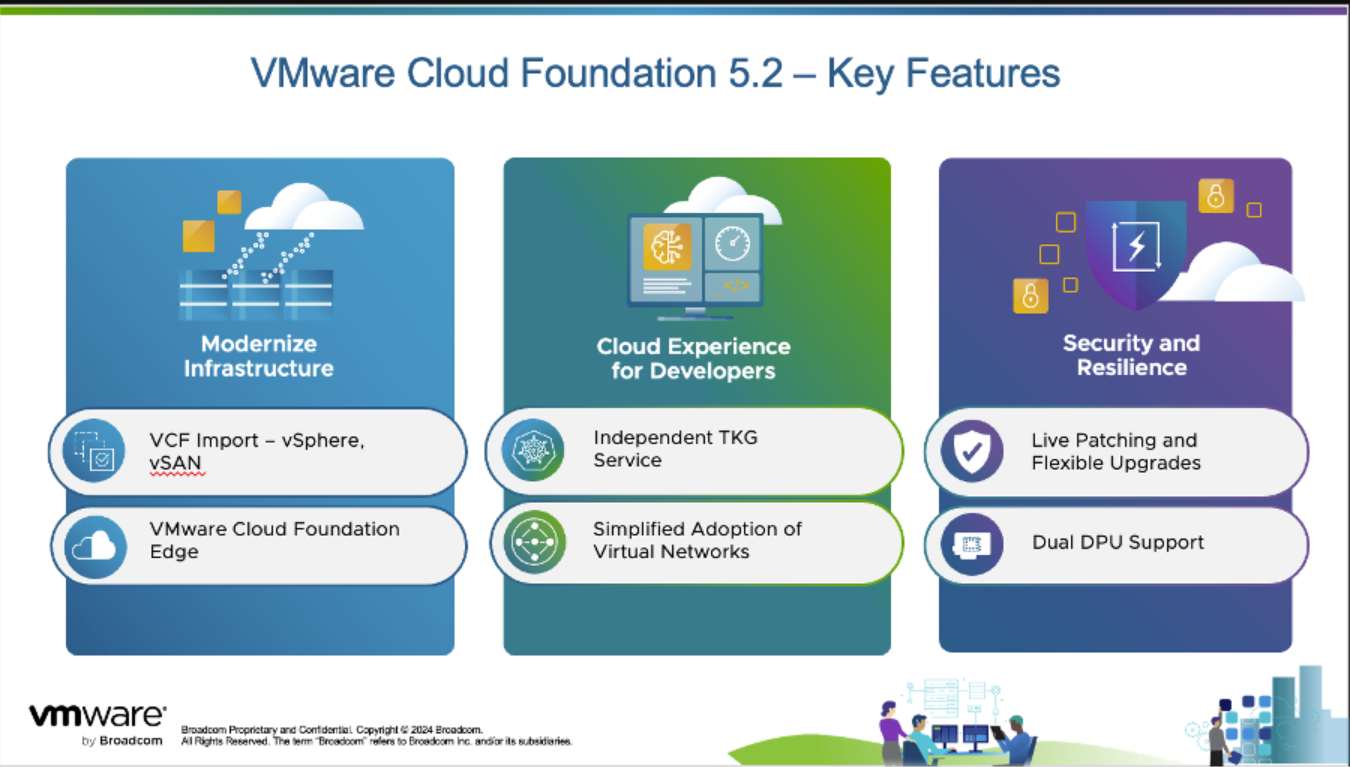

The VMware Cloud Foundation 5.2 release includes the following:

- VCF Import from vSphere, vSAN. The import tool enables the integration from vSphere and vSAN into VCF without downtime. With easier migration, VMware can simplify its selling cadence and move customers from point products.

- VCF Edge, which extends cloud capabilities to edge location and better manage distributed infrastructure.

- Cloud management enhancements including Tanzu Kubernetes Grid (TKG) as an independent service to manage container-based workloads, a streamlined process to adopt virtual networking and new interfaces for cloud administrators and DevOps.

- Security features for live VCF patching as well as flexible patch schedules.

- Broadcom also added new features to VMware vSphere Foundation including self-service tools, TKG and an improved user experience.

Holger Mueller, Constellation Research analyst, said VMware is motivated to move customers to VCF and it's possible that disgruntled enterprises will stick with the company despite competition from Nutanix and possibly HPE. "I expect the same story with VMware as with CA," said Meuller. "There's alarm, disgruntled customers and 85% of enterprises stay. That's a good outcome for tech."

Mueller added:

"So far, Broadcom leadership has shown its first commitment to R&D and innovation. And it is better than what neutral observers were expecting. This innovation now puts VMware customers in the pickle--trust innovation will keep flowing or bet that this update is a one time burst of capabilities. It's up to Broadcom to show a steady cadence of innovation."