The great generative AI boom for enterprise software isn't happening yet as sales cycle grow longer due to platform bets, macroeconomic conditions and cost of capital crimping budgets.

What's really happening: Enterprise technology buyers aren't buying into grand enterprise software copilots, picking sides in large language models (LLMs) and platform bets that could easily equate to technology debt if they're not careful. It's also clear that generative AI projects are stealing budget dollars from enterprise software purchases.

Simply put, we're in the pick and shovel phase of the AI buildout and that means Nvidia, server makers and that's about it. Rest assured we'll see the indigestion from the AI capacity buildout too, but that's months if not years away.

The recent earnings parade from enterprise software companies highlights the big hurry up and wait approach when it comes to AI. Here's a tour.

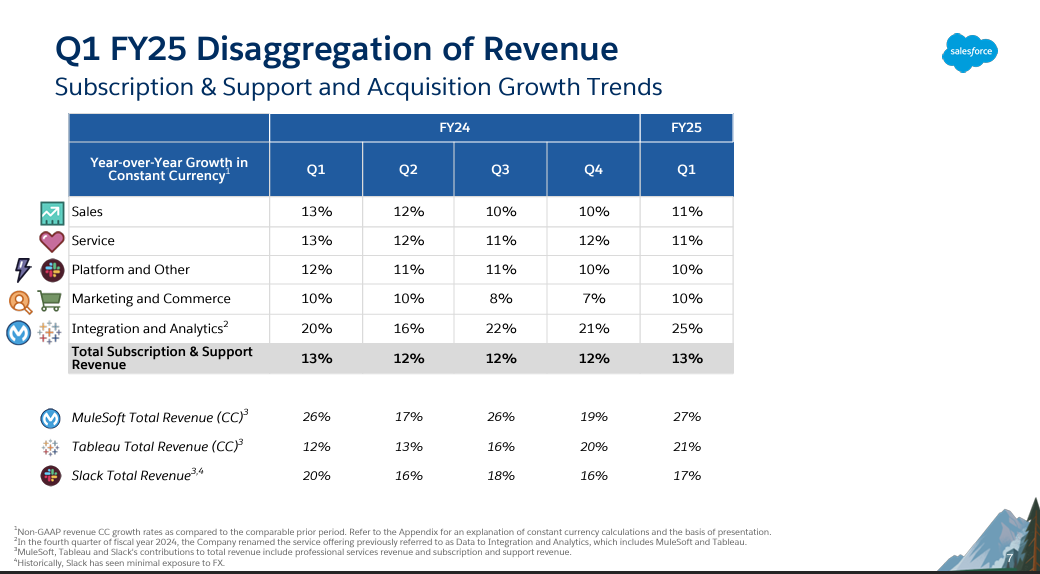

Salesforce predicted single digit revenue growth amid longer sales cycles. CEO Marc Benioff defended the company's first quarter disappointment and played up the long game. "When you look at the power of AI, you realize the models and the UI are not the critical success factors, it's not critical where the enterprise will transform. There are thousands of these models, some open source and some closed source models, some built with billions, some with just a few dollars, most of these will not survive," said Benioff. "They are just commodities now and it's not where intelligence lies. And they don't know anything about a company's customer relationships."

Benioff added that customers are flocking to Data Cloud, which has more than 1,000 customers. Operating chief Brian Millham, however, noted that "we continue to see the measured buying behavior similar to what we experienced over the past two years and with the exception of Q4 where we saw stronger bookings."

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

Millham added that "customers are getting their data estate in order as a precursor to leveraging AI capabilities, and we're seeing that with the growth of Data Cloud right now."

Nutanix said sales cycles are longer and more unpredictable. Nutanix is battling VMware, but CEO Rajiv Ramaswami noted that the company is seeing larger opportunities that "tend to have longer sales cycles can involve aggressive competitive responses and exhibit great variability with respect to timing and outcome." Nutanix isn’t a direct generative AI play, but has GPT-in-a-Box and is often lumped into a broader transformation plan.

Workday said the buying cycle is choppy. Workday CEO Carl Eschenbach reiterated comments made on the company's first quarter conference call at the Jefferies Software Conference. He said: "Last year was a pretty solid year for most software companies. I think this year, people do talk about a slightly different macro that they're dealing with. They use terms like it's choppy--it's uncertain, it's uneven. And I just think when people are going to invest in technology, they're really thinking hard and deeply about where they're going to make those investments. And I think for all of us in the software space, you have to have a strong value proposition to make sure you're a priority."

MongoDB cut its outlook for second quarter and fiscal year. CEO Dev Ittycheria said, "we had a slower than expected start to the year for both Atlas consumption growth and new workload wins, which will have a downstream impact for the remainder of fiscal 2025."

Ittycheria said MongoDB still had a large opportunity to gain share and become a standard and that it will be "a substantial beneficiary of this next wave of application development" revolving around AI. For now, MongoDB saw lower consumption due to a spotty macroeconomic environment and go-to-market changes.

UiPath's first quarter had a lot of issues, but longer sales cycles were one of them. Sure, UiPath's quarter was a disaster as CEO Rob Enslin resigned, but deliberation time for purchases was also extended. Incoming CEO Daniel Dines said: "While we had a healthy start to the quarter, we saw the pace slow as we progressed through the second half of March and into April. This was primarily due to the impact of a challenging macroeconomic environment that we see persisting with mid-market customers, as well as a change in customer behavior particularly with large multi-year deals."

These enterprise software executives aren't seeing the generative AI boom yet, because the technology hasn't really hit the application layer. And when genAI drives enterprise software deals it's unclear whether buyers are going to swallow copilot upcharges. Today, the genAI spending is on infrastructure moving into tools and data platforms and then hitting applications.

In the end, enterprise software valuations moved too far too fast without anything to back them up. Constellation Research CEO Ray Wang said, "valuations without cash flow are the key issues." Wang noted the buy and sell side of enterprise tech are dealing with three factors driving the market.

- Exponential efficiency is forced by 5% interest rates.

- AI arbitrage as we replace human work.

- Margin compression as new business models require a 10X improvement at 1/10 the cost.

Not every enterprise software play is struggling. C3 AI reported a better-than-expected first quarter but is showing growth on a much smaller base than the companies that were pummeled over recent quarters. C3 AI is also working a layer above the application providers seeing longer sales cycles. C3 AI CEO Tom Siebel said the genAI era will rhyme with previous technology cycles:

"The AI era will be no different and the same game is going to play out as we move forward. The bulk of the value is going to accrue to the applications that leverage the entire AI stack and deliver value to the business. Silicon will get commoditized. It always gets commoditized. Infrastructure will get commoditized. It always gets commoditized. What doesn't get commoditized in the long run are the applications and that's where C3 AI plays."

If Siebel is right--and there's no reason to think he's wrong--genAI will drive enterprise software for years to come. When this evolution plays out is anyone's guess.

More on genAI:

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Enterprises Must Now Cultivate a Capable and Diverse AI Model Garden

- Secrets to a Successful AI Strategy

- Return on Transformation Investments (RTI)

- Financial services firms see genAI use cases leading to efficiency boom

- Foundation model debate: Choices, small vs. large, commoditization