Box is seeing customers upgrade to its enterprise content management suite to get access to Box AI and there's a big opportunity in mining unstructured data, workflows and vertical use cases. But the payoff to Box will take time.

To say Box CEO Aaron Levie is enthusiastic about what generative AI can do for unstructured data and content management is an understatement. The company launched Box AI recently, acquired Crooze and has an architecture that allows it to add new models--including OpenAI's GPT-4o. It doesn't hurt to have partnerships with the likes of Nvidia and ServiceNow either.

During Box's first quarter earnings call, Levie said the company is seeing an increasing number of customers upgrade to its Enterprise Plus plan for Box AI. Demand has been across multiple industries. For instance, a commercial real estate company is using Box AI to find trends across leases, analyze client dynamics and generate marketing content.

Levie said:

"All of the insights necessary to create better business decisions and smoother business processes are living inside of an enterprise's content. It's the key data points inside of contracts that help businesses close new deals. The assets that create a major new ad campaign, the manufacturing and R&D files that enables the next breakthrough product to ship on time and the financial documents that help close the books smoothly. Yet for as important as all of this unstructured data is, and it makes up 90% of our corporate information, we've never been able to fully extract all of the value from it."

Box's bets revolve around AI transformation bets on workflow and collaboration. Box AI for Hubs, which is rolling out to Enterprise Plus customers, users can ask questions across multiple documents and give enterprises retrieval augmented generation use cases from the content repository.

- Box integrates Microsoft Azure Open AI Service, Box AI goes to GA

- Box CEO Levie on generative AI, productivity and platform neutrality

- Analysis: Box's Acquisition of Crooze Stands To Accelerate Customer Innovation

- Constellation ShortList™ Enterprise File Sharing and Cloud Content Management

Levie is also bullish on content metadata.

"With Box AI, customers will soon be able to extract metadata from a large number of document and content types within their enterprise. Once you have metadata on content, you can automate almost any workflow in the enterprise, from invoice processing and contract management to digital asset management and clinical trial management. This is why we acquired Crooze back in December, and we are working aggressively to natively integrate Crooze's no code application building and metadata features into Box to support powering content centric workflows on Box."

Box, which has integrations with all of the primary players in the enterprise stack, is looking to be an abstraction layer connecting AI models to content. "We are at a major moment as an industry. With AI, the role of unstructured data in enterprises has exploded," said Levie. "We will look back on this as a defining period for how work was shaped for decades to come."

What’s the problem?

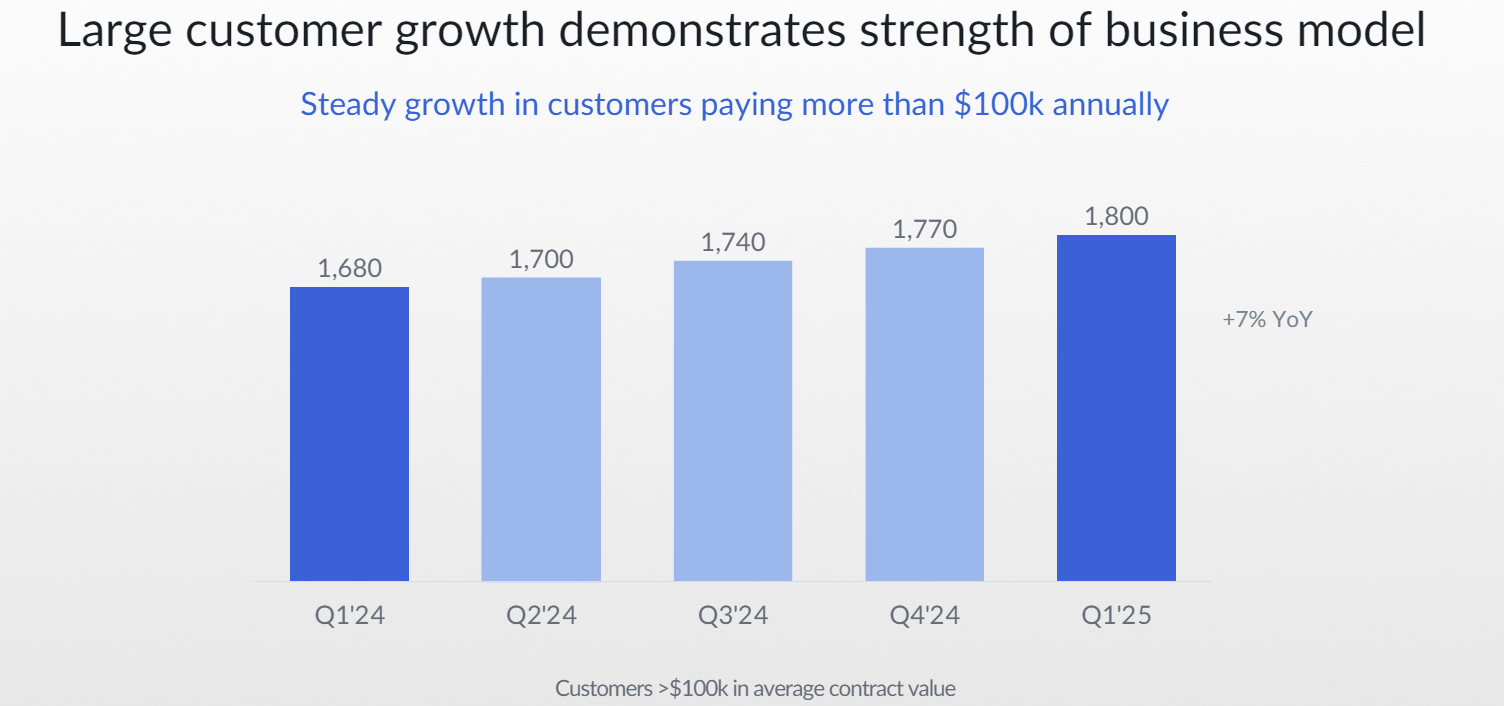

Box's vision is on target, but its growth isn't showing it. In the first quarter, Box had revenue of $265 million, up 5% from a year ago. The company has about 1,800 customers paying more than $100,000 annually. The attach rate for suites on those large deals was 85%. Box Suites is 56% of Box's revenue. Earnings per share were 39 cents a share, 3 cents a share better than estimates.

The company also raised its fiscal 2025 outlook with adjusted earnings of $1.54 a share and $1.58 a share on revenue of $1.075 billion and $1.08 billion, up 4%.

Constellation Research analyst Holger Mueller said:

"Box is doing all things on the R&D side from a growth perspective – and should grow well in the teens if not twenties. The question remains if it is customer loss or commoditization of basic capabilities that does not allow the whole industry to show growth that is in line with the growth of business relevant electronic information that is growing 30-40% every year. The reality is that the Future of Work for knowledge workers is filled with a lot of “blood sweat and tears” from manual labor around documents."

To drive growth Box will have to expand its market. Levie noted that customer spending on Box still largely comes from the IT budget. AI spending is moving beyond IT and into other business units, but that movement is still early. Levie said:

"If we maybe fast forward a year or two from now, I could see that the budget increases when you look at line of business that will be able to drive more efficiency because of AI, that we're only in the earliest days of what that looks like. But certainly, as AI really drives workflow automation and more business process transformation, I think you'll see even increased budget that opens up for AI use cases around content."

With Hubs just launching in beta, it's unclear how demand and interest will shape up into revenue growth.

Box's master plan for AI and its "scaffolding, abstraction layer and platform services" vision makes sense since every model needs content access. How long this vision takes to play out remains to be seen.