CoreWeave, a hyperscale cloud provider focused on AI workloads, raised $7.5 billion in debt financing to build out data centers primarily with Nvidia GPUs to go with $1.1 billion in equity funding earlier this month.

In the last 12 months, CoreWeave has raised more than $12 billion in equity and debt financing. CoreWeave's funding highlights how the generative AI boom has fueled a new category of specialized cloud vendors.

The debt financing, led by Blackstone, Magnetar and Coatue, will be used to develop compute infrastructure for existing contracts. CoreWeave customers are using its infrastructure to train models.

CoreWeave is also building out its European footprint, which includes a headquarters in London and a commitment to invest $1.25 billion in the region.

By the end of 2024, CoreWeave expects to have 28 data centers double its 2023 footprint, which was up from 3 data centers in 2022.

Michael Intrator, CoreWeave CEO and co-founder, said the company is looking to provide specialized GPU cloud infrastructure that can "reshape the cloud landscape, accelerate the AI race, and power the next generation of AI innovation." CoreWeave's infrastructure is designed for AI and machine learning, graphics and rendering and life sciences and other intensive workloads.

Nvidia is a CoreWeave investor, and the cloud provider is adopting its latest technology in its data centers whether it's GPUs, networking systems, applications and architecture. For Nvidia, CoreWeave is a key cog in its plans to scale AI factories. Microsoft is reportedly among CoreWeave’s largest customers.

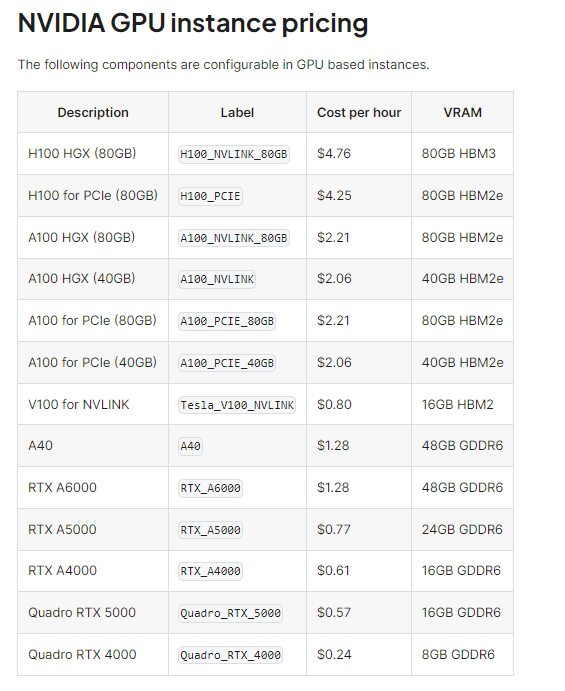

According to CoreWeave, its infrastructure is purpose built for intensive workloads and can deliver performance 35x times faster and 80% less expensive than general purpose clouds. Here's a look at CoreWeave's Nvidia GPU pricing.