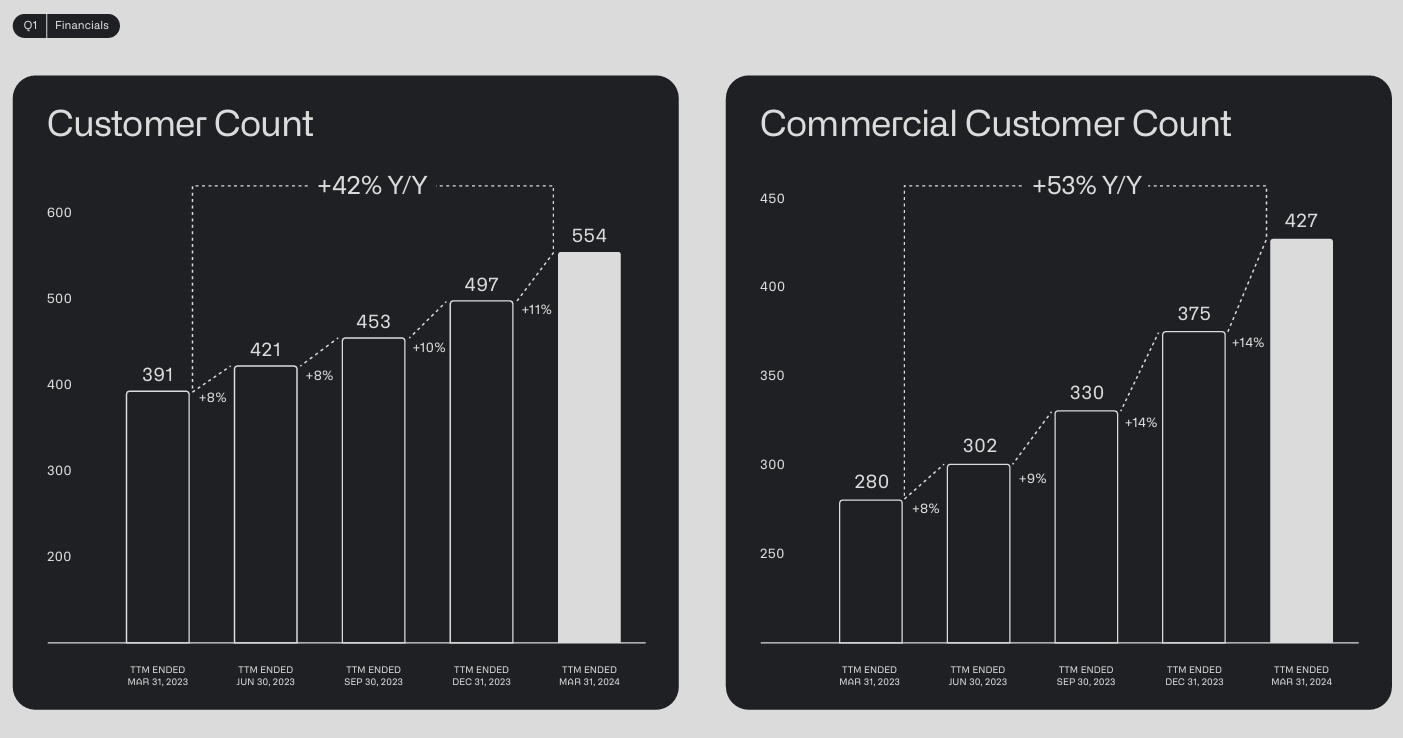

Palantir continued to gain enterprise customers in the first quarter as it delivered first quarter earnings in line with expectations. Commercial revenue was up 40% in the US from a year ago with global government revenue up 16%.

The company reported first quarter net income of $106 million, or 4 cents a share, on revenue of $634 million, up 21% from a year ago. Adjusted earnings were 8 cents a share in line with Wall Street estimates. Palantir's first quarter revenue was ahead of the $617.7 million expected by analysts.

By the numbers for the first quarter:

- US commercial revenue was up 40% in the first quarter to $150 million with 262 customers.

- Commercial first quarter revenue globally was up 27% from a year ago to $299 million.

- Government first quarter revenue was up 16% from a year ago to $335 million. US government revenue for the first quarter was up 12% from a year ago to $57 million.

- Palantir ended the first quarter with cash and equivalents of $3.9 billion.

As for the outlook, Palantir projected second quarter revenue between $649 million and $653 million with adjusted income from operations between $209 million and $213 million. For 2024, Palantir projected revenue of $2.677 billion and $2.69 billion. US commercial revenue for the year will grow at least 45% to $661 million. Adjusted income from operations for 2024 will be between $868 million and $880 million.

The company added that it expects to be GAAP profitable each quarter of 2024.

- Palantir will move workloads to Oracle Cloud as both court governments and enterprises

- Enterprise generative AI use cases, applications about to surge

- Generative AI spending will move beyond the IT budget

CEO Alex Karp in a shareholder letter emphasized that its Artificial Intelligence Platform (AIP) is seeing strong demand. AIP has been a focus area for both Palantir and Wall Street and the company has recently outlined a bevy of customer use cases.

He said:

"We have been investing in and refining our enterprise software platforms for years. And a growing portion of the American corporate sector is now coming to us, more aware than ever of how significant artificial intelligence and large language models will be in reshaping the industries within which they operate."

Karp also said that Palantir's 660 bootcamps across sectors have been paying off with customers. He added:

"Other companies engage in intricate and elaborate efforts to sell and market their offerings. Their resources are focused on marketing at the expense of actually constructing the software and building the systems that they hope to sell. We have taken a different approach and are now investing even more heavily in simply letting potential partners use our software in order to decide what works and what does not for themselves."

Palantir is working to make AIP available to more markets, governments and businesses.

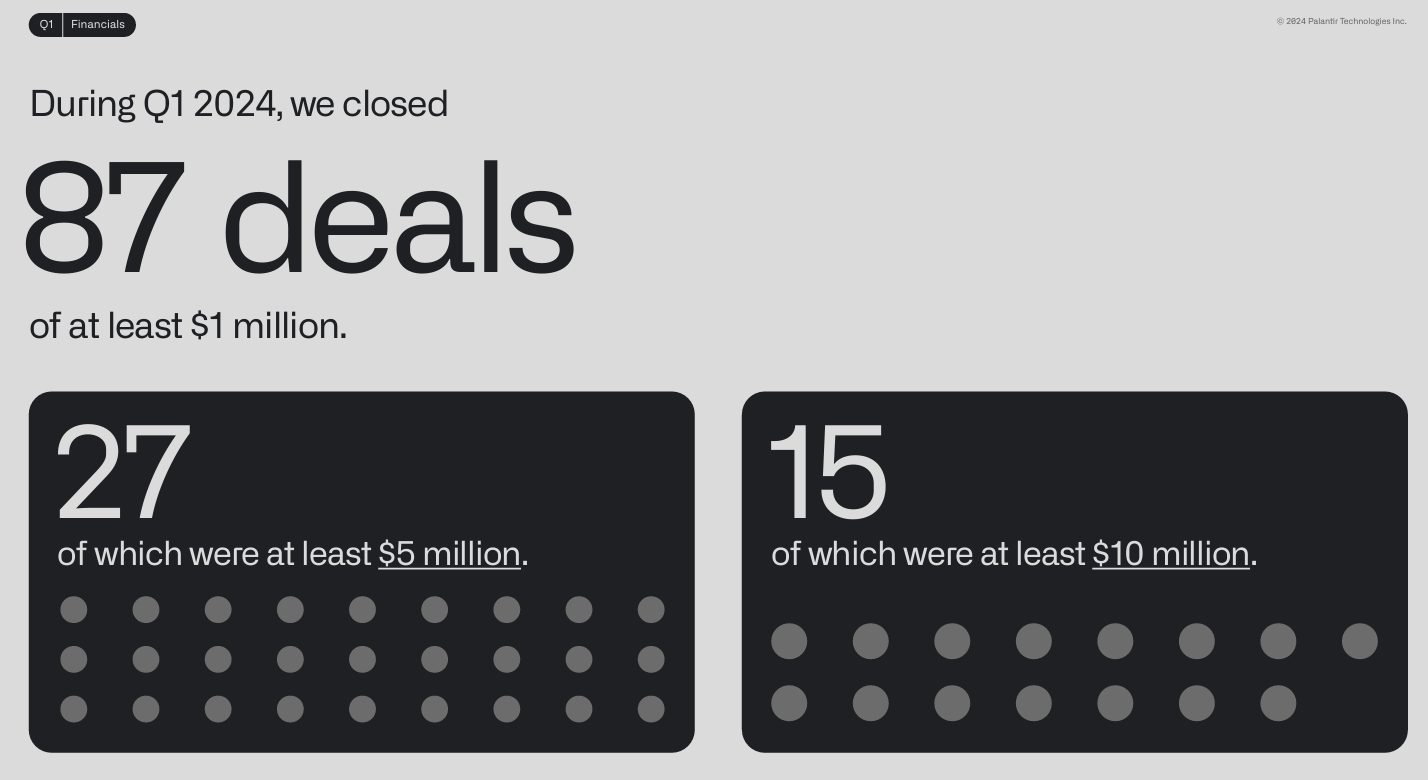

On a conference call, Palantir kicked off comments with Ryan Clark, Chief Revenue Officer. Clark went through a bevy of commercial customer references and noted that AIP is driving inbound demand and enterprises are rapidly signing larger deals.

"Lowe's accelerated its engagement from a starting point of no AI to utilizing production level AI for over 1,000 customer service agents, resulting in a 75% reduction in overdue tasks," said Clark. "As one of its directors noted, we achieved this in just four months and onboarded 1,000 users within three weeks."

The company's bet is that the momentum AIP has in the enterprise will translate to US government accounts, where Palantir has a series of contracts with the US Army. Palantir is rolling out AIP Boot Camps to US government agencies.