Hewlett Packard Enterprise posted a mixed first quarter where sales fell short of expectations due to what CFO Marie Myers said were "challenges brought by the softening of the networking market and GPU deal timing."

The company reported first quarter non-GAAP earnings of 48 cents per share, GAAP earnings of 29 cents a share and revenue of $6.8 billion, down 14% from a year ago. Wall Street was expecting HPE to report adjusted earnings of 45 cents per share on revenue of $7.1 billion. HPE is planning to buy Juniper Networks in a deal valued at $14 billion.

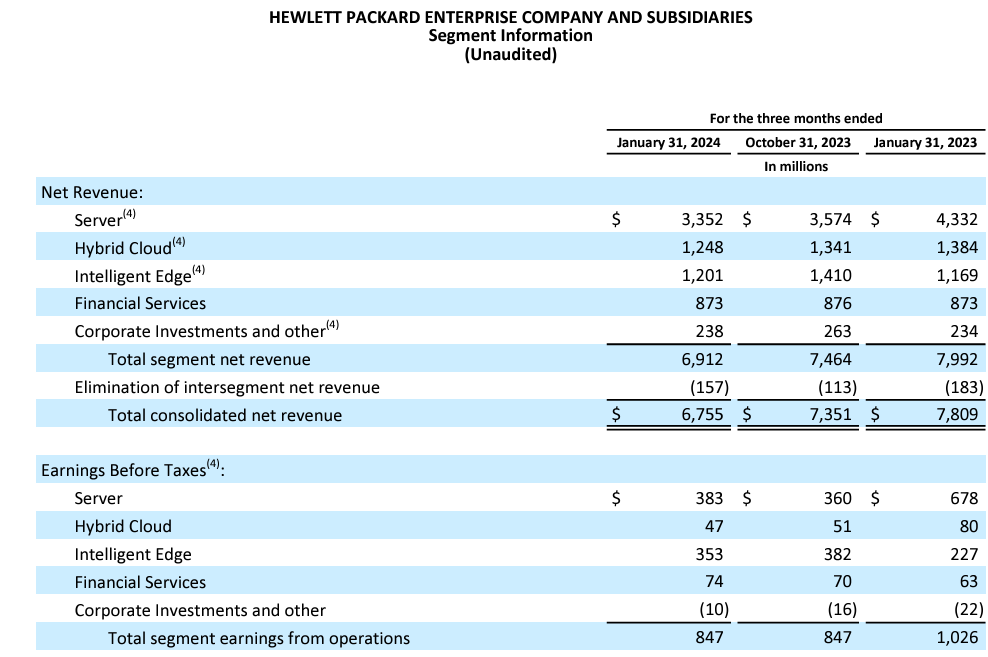

By unit, HPE said server revenue fell 23% in the first quarter to $3.4 billion. Intelligent edge revenue was $1.2 billion, up 3% from a year ago. Hybrid cloud revenue was $1.2 billion in the first quarter, down 10% from a year ago.

CEO Antonio Neri said HPE had operational discipline to manage through the quarter and remained confident in the strategy. Myers added that "we are controlling what we can control, and we are optimistic about delivering strong shareholder returns over the remainder of the fiscal year.”

As for the second quarter, HPE said revenue will be between $6.6 billion to $7 billion with non-GAAP earnings of 36 cents per share to 41 cents per share. For fiscal 2024, revenue growth will be flat to up 2% from a year ago. HPE non-GAAP earnings per share will be between $1.82 and $1.92.

- HPE to acquire Juniper Networks for $14B: What it means

- HPE Enters the Next-Generation Computing Market

- HPE sees Q4 strength in AI, edge, high performance computing

- HPE bets AI, edge, supercomputing workloads will drive growth

On a conference call with analysts Neri said HPE lacked GPU supply and customers were digesting Aruba networking orders. The networking comments have been echoed by Cisco, who said something similar in its most recent earnings call. Regarding AI-optimized servers, Neri said "several large GPU acceptances shifted" and the company "did not have the GPU side."

Here's a look at the key points from the conference call via Neri:

- "We saw campus networking weaken and the decline late in the quarter was greater than expected. There was a large headwind relative to our expectations. Customers are taking longer to digest prior orders than we had anticipated."

- "We expect weakness in the networking market to persist and impact reveneu through fiscal year 2024."

- "Server demand remains very strong evidenced by our growing cumulative order book. However, GPU availability remains tight and our delivery timing has also been affected by the increase in length of time. Customers required to set up the data center space power and cooling requirements needed to run these systems. As a result of our AI server orders conversion was below our expectations."

- "We have already a lot of GPUs that we already built that the customers will take time to assemble systems. But the reality is that we need more supply against the backlog that we announced today, which was $3 billion at the end of the q1."

- "Our pipeline is large and growing across the entire AI lifecycle from training to tune into inferencing. We are starting to see a demand pull through for other solutions, including storage. We expect our server and hybrid cloud segments to grow sequentially through the fiscal year."

- "Given the softening network in market GPU deal timing and to some extent GPU availability. We're focused on execution as we navigate the fluctuations in demand we see in certain areas of the market."

- "This quarter is a moment in time and does not at all dampen our confidence in the future ahead of us."