Twilio projected first quarter revenue growth of 2% to 3% to $1.025 billion to $1.035 billion, below expectations of $1.05 billion.

The company also projected non-GAAP earnings of 56 cents a share to 60 cents a share. Wall Street was looking for 55 cents a share. The outlook came as Twilio reported its fourth quarter earnings. Twilio's results were the first with new CEO Khozema Shipchandler at the helm.

Shipchandler said Twilio is entering 2024 "from a position of strength and the team is focused on further delivering on our customer engagement vision for our customers."

Twilio names Shipchandler CEO as Co-Founder Lawson steps down

Twilio's outlook was light, but its fourth quarter results handily topped estimates. The company reported fourth-quarter non-GAAP earnings of 86 cents a share on revenue of $1.08 billion, up 5% from a year ago. Wall Street was looking for earnings for 58 cents a share on revenue of $1.04 billion.

Communications revenue in the fourth quarter was up 5% from a year ago and Segment revenue was up 4%.

For 2023, Twilio reported a net loss of $5.54 a share on revenue of $4.15 billion, up 9% from a year ago. Non-GAAP earnings for the year were $2.45 a share.

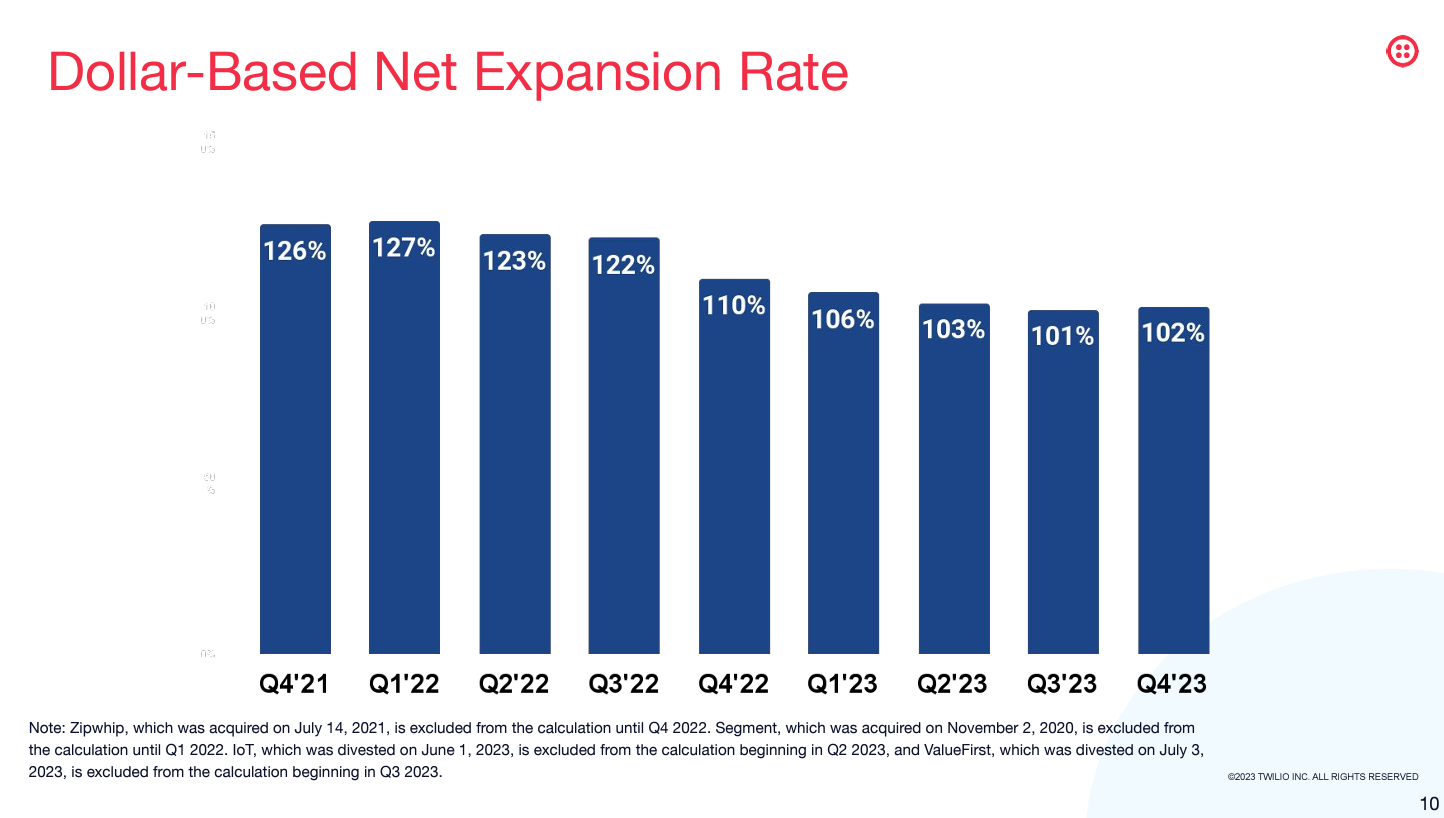

Twilio ended the quarter with 305,000 active customer accounts, up from 290,000 a year ago. Dollar-based net expansion rate was 102%, but that was down from 110% a year ago.

According to the company, the Segment unit is being evaluated to "identify the appropriate path forward for improved execution and profitable growth." Segment revenue was $295.2 million for 2023 and $75 million in the fourth quarter.

Segment was a major topic on Twilio's earnings conference call. Analysts were peppering Shipchandler with questions about whether Segment fit. A few key quotes to note from Shipchandler about Segment.

- "Twilio Segment is not performing at the level it needs to and I've already begun to take a closer look at this business to see how we can deliver improved performance."

- "Over the past five weeks, I've been working with the team to conduct an extensive operational review of Segment, and this work is ongoing. We plan to do a read-out of these results in March at which time I'll be ready to share our findings, path forward, and any changes to Twilio's financial framework as a result."

- "Some of the indicators that we're looking at is sequential bookings, and we did see improvement in Q4, but as we alluded to, it's not exactly where we'd like it to be. And I think just the overall pace of the improvements that we were anticipating and that we would expect of ourselves, they're just kind of not meeting our expectations."

- "I think that we do see a lot of opportunity there in terms of our ability to combine our data offering with our Communications offering. And we've started to launch a handful of products that do exactly that, bring together kind of all of the best capabilities of Twilio within single offerings. You see that today, for example, in our Flex Unify offering, which has been announced relatively recently."