The manufacturing industry and its supply chains are being rewired and could ultimately evolve into data-driven signal chains.

Those are some of the takeaways from Raj Badarinath, Chief Marketing & Product Officer at Rootstock.

DisrupTV caught up Badarinath to talk shop. Badarinath has held multiple positions at cloud companies and large enterprise vendors such as PeopleSoft/Oracle, Capgemini and Infosys. Here are the highlights of the conversation.

Disrupting the ERP market. "This is a space--a $57 billion industry--that's begging for disruption," said Badarinath. "There's a market demand because the typical manufacturer put their ERP system in when (CIOs) had their first-born child and now the kid is graduating and they're still on the same ERP. There's a generational shift here with moving to the cloud."

Badarinath said it makes sense for enterprises to have Rootstock sitting natively on top of the Salesforce platform, which powers manufacturing.

Globalization and the supply chain. Badarinath said globalization had been the theme for 50 years and that's ending now. "Re-globalization is what we're looking at now," said Badarinath. "From a US standpoint, there was a pandemic and the supply chain got stuck. There's distrust in a model where China is the single manufacturing hub for the world. There's a China plus one strategy that's going on and that's rewiring and re-globalizing supply chains."

Badarinath added that every state entity is doubling down on investment in the manufacturing sector because it's the bellwether for GDP growth. "This investment is not in your grandfather's manufacturing. We're talking EV technology, renewables, battery technology," said Badarinath. "In the next five years Western countries will be very different from where we were 5 years ago. Manufacturing is not going back to how the world was 20 or 30 years ago."

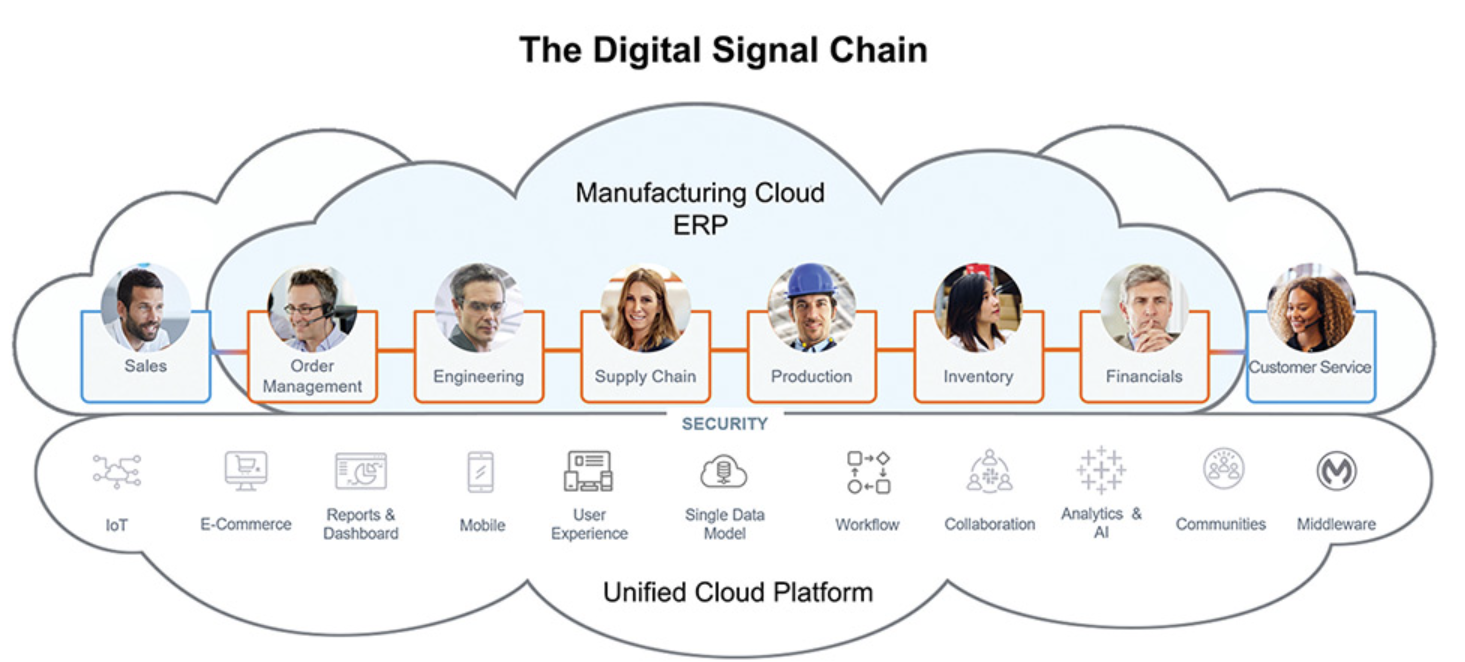

Manufacturing moving from transactions, automation and transportation to insights and signal intelligence. Badarinath said the data value chain in supply chains and manufacturing is critical.

"There is an interesting split in manufacturing right now. The front end of manufacturing has been digitized. The digitization of the demand side has received investment," said Badarinath. "The supply side is still very people oriented, logistics and moving physical atoms. The bits on the demand side are moving faster. What we try to do is build a decision layer on top of the data, collect the data and create signal intelligence."

Badarinath said when the data is in one place, machine learning, generative AI and AI can be used. "When it comes to structured and predictive analytics manufacturers are looking for real ROI use case. We believe that bringing the signals together and creating a decision platform is the future," he said. "The whole process of bringing demand capacity and supply to one platform is what we're calling the signal chain."

AI in manufacturing. Badarinath, who noted that Rootstock's annual conference will spend a lot of time on AI, said the manufacturing industry is methodical and deliberate and AI will be no different. "Manufacturers want to make sure they are looking at all the dimensions before making choices," he said.

Manufacturing's next generation. AI will assume a bigger role in manufacturing because there won't be a choice. Many people with institutional knowledge will be retiring and AI can help bring some of that experience into systems.

Manufacturing will also change because it requires less people due to automation.

"I think manufacturers will have to shift whether they like it or not because markets are changing. ERP will have to be reimagined in the AI era," said Badarinath, who noted that experiential knowledge, historical data and real time signals will all be built in. "We're working with our customers and saying let's build an AI that matters to you. The hype of AI will not work in manufacturing. It has to be real."

Battling giants. Badarinath said Rootstock is battling incumbents and it couldn't be in conversations without being on Salesforce's platform. "People are making decisions on platforms and what platform they trust," he said. "As Salesforce becomes much more well known in the market, the next generation wants something cooler. the idea that we can seamlessly extend the CRM investment into ERP resonates."

Rootstock is starting in the midmarket with plans to go for larger enterprises in the next few years.