Alteryx is going private in a $4.4 billion deal including debt. Clearlake Capital and Insight Partners will pay $48.25 a share in cash for each Alteryx share.

The price is a 59% premium to Alteryx's closing price Sept. 5 when reports surfaced about the potential buyout.

Mark Anderson, CEO of Alteryx, said going private via the Clearlake and Insight transaction will give the company more flexibility to implement its long-term strategy. "Over the past several years, we've executed a comprehensive transformation strategy to enhance our go-to-market capabilities and establish a strong cloud and AI innovation roadmap," said Anderson.

Constellation ShortList™ Self-Service Data Science & Machine Learning

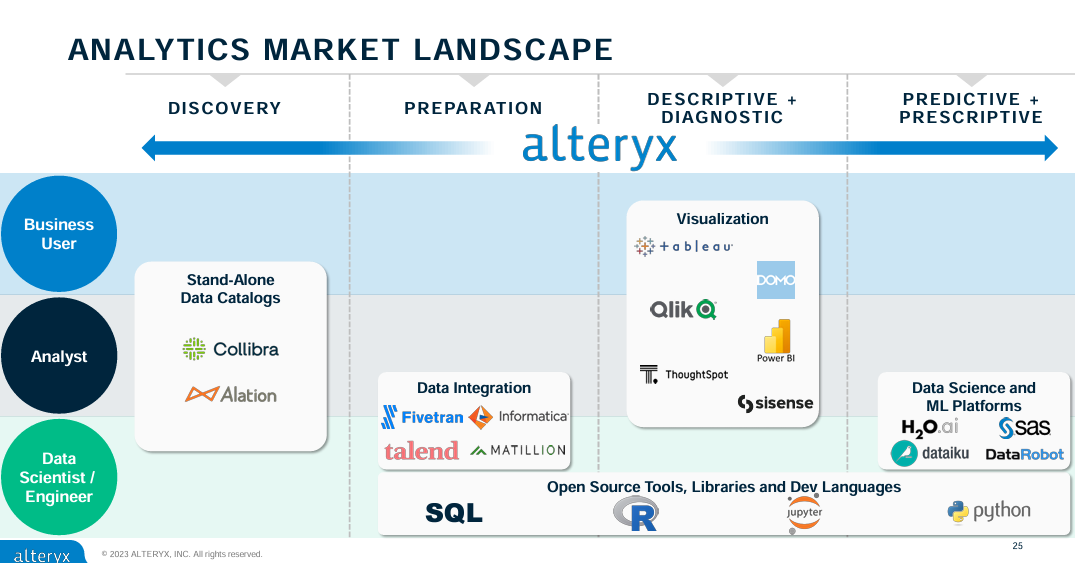

Alteryx has been trying to consolidate analytics customers on its self-service data science and machine learning platform. Alteryx is looking to be one platform for data discovery, preparation, diagnostic and predictive and prescriptive analytics and has oriented its go-to-market strategy around targeting personas.

Constellation Research analyst Doug Henschen said:

"Privatization and private equity backing will help to stabilize Alteryx. Alteryx provides a mix of data prep, analytics and AI/ML with a dose of data pipeline/analytic automation capabilities.

Competition has intensified from cloud vendors, like AWS with its SageMaker Suite and Google with Vertex AI, and from best-of-breed rivals like Dataiku and Data Robot. In addition, analytics and BI vendors, like Tableau and Microsoft with Power BI have also been pushing into data prep and advanced analytics. For its own part, Alteryx was late to the cloud, and it has also had a fair amount of executive turnover in recent years, all of which have intensified the headwinds of tougher economic conditions.

Nonetheless the company has a big installed base, and private-equity ownership should ease concerns about the company's future even if there may be short-term concerns about layoffs and continued investment in R&D. Customers should watch for signs of continued investment and commitment to product roadmaps."

As a private company, Alteryx is looking for air cover to accelerate its transformation currently underway. Here's the to-do list for Alteryx going into its buyout.

Expand the enterprise customer base. Alteryx has 49% of the global 2000 and big names including Chevron, Amazon, Procter & Gamble, DHL, Salesforce, IBM, Visa and others.

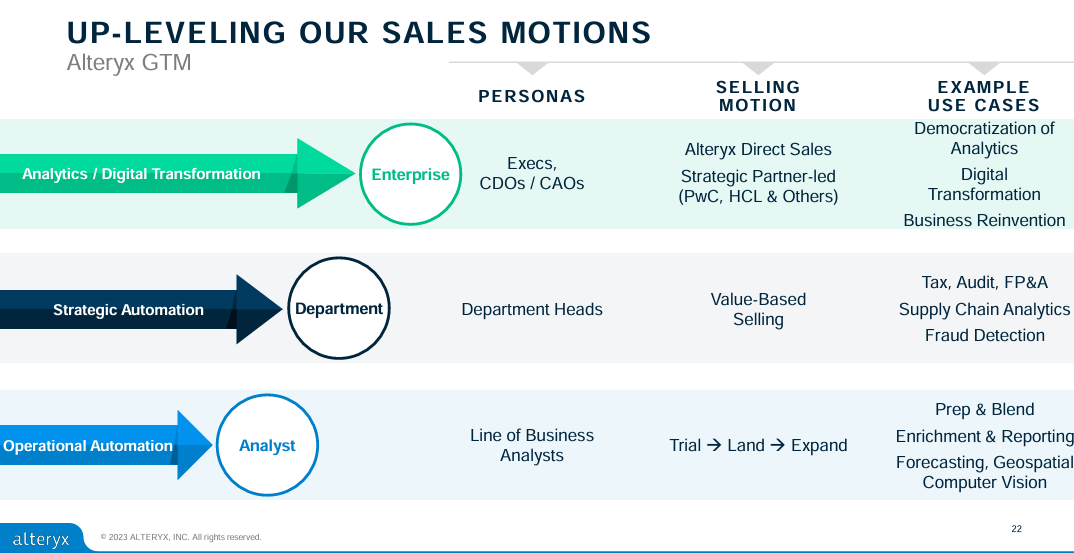

Uplevel its sales strategy to target personas including business customers, and analysts as well as chief data officers.

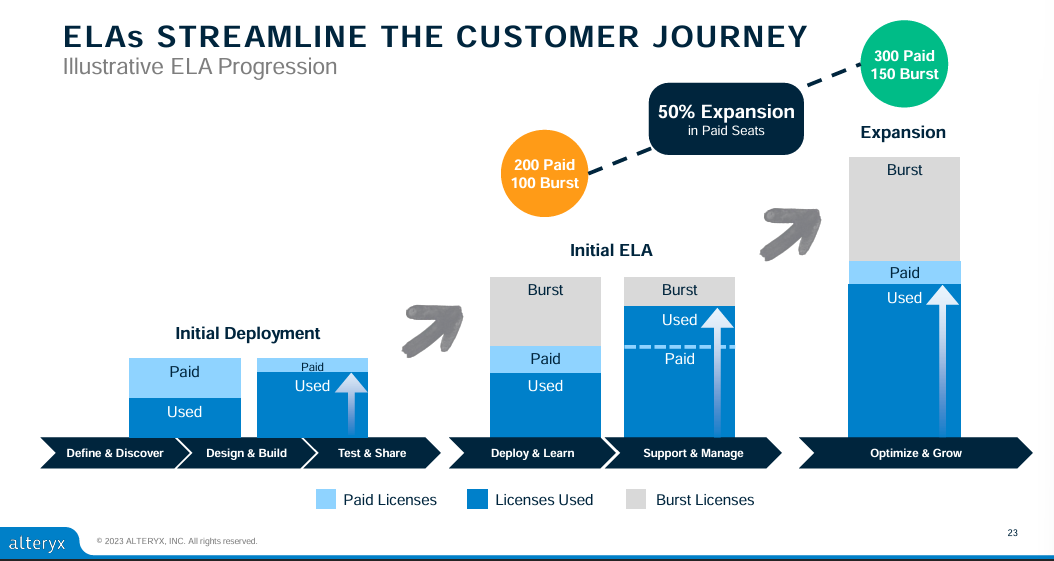

Optimize its enterprise license agreements and convince customers that it can be the analytics automation platform of choice.

Scale its revenue base. Alteryx said it will have fiscal 2023 revenue between $942 million to $948 million. In 2022, Alteryx revenue was $855.35 million, up from $536.13 billion, largely due to its Trifacta acquisition and purchases of Hyper Anna and Lore IO. In 2022, Alteryx also launched its Analytics Cloud Platform.