Tis the season for stolen and damaged packages, warranties and potentially a startup named Extend. Extend's platform, which merchandises and optimizes warranties and shipping protection, resolves claims with data, orchestration and artificial intelligence.

Extend is becoming a brand as it partners with multiple retailers to offer extended warranties and shipping protection. The company has more than 800 manufacturers and retail customers including Casper, Tonal, Oura and others. It also counts Shopify and BigCommerce as key partners. Extend said that 98% of its claims are approved in 90 seconds.

We caught up with Rohan Shah, Extend's Co-founder and Chief Revenue Officer, to talk about the extended warranty industry, processes and customer  experiences. Here are the takeaways from our conversation.

experiences. Here are the takeaways from our conversation.

The extended warranty business. Shah (right) said retailers, notably Best Buy, have developed profit centers from extended warranty sales. But other retailers did not have similar business opportunities. "Despite consumer demand and financial opportunity there was no access," said Shah. According to Shah, there was a distribution problem with extended warranties. As a result, Shah and CEO and Co-founder Woodrow Levin created Extend in 2019 to distribute warranties much like Stripe, Affirm and Klarna popularized after pay services.

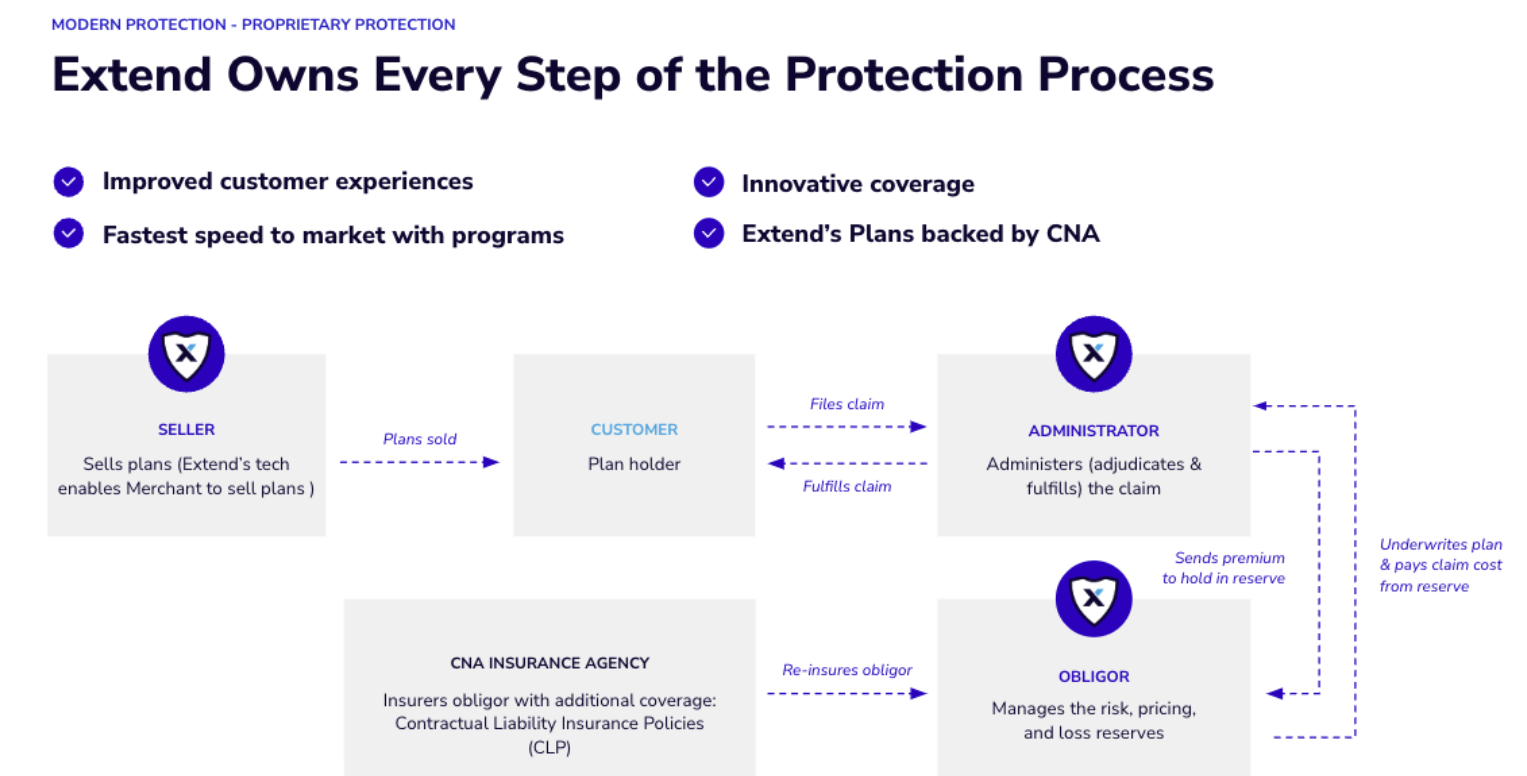

Customer experience as the differentiator. Extend offers extended warranties and package projection but aims to differentiate with customer experience. Extend's processes have "a very strong lens on the most problematic aspect of the industry which was customer experience," said Shah.

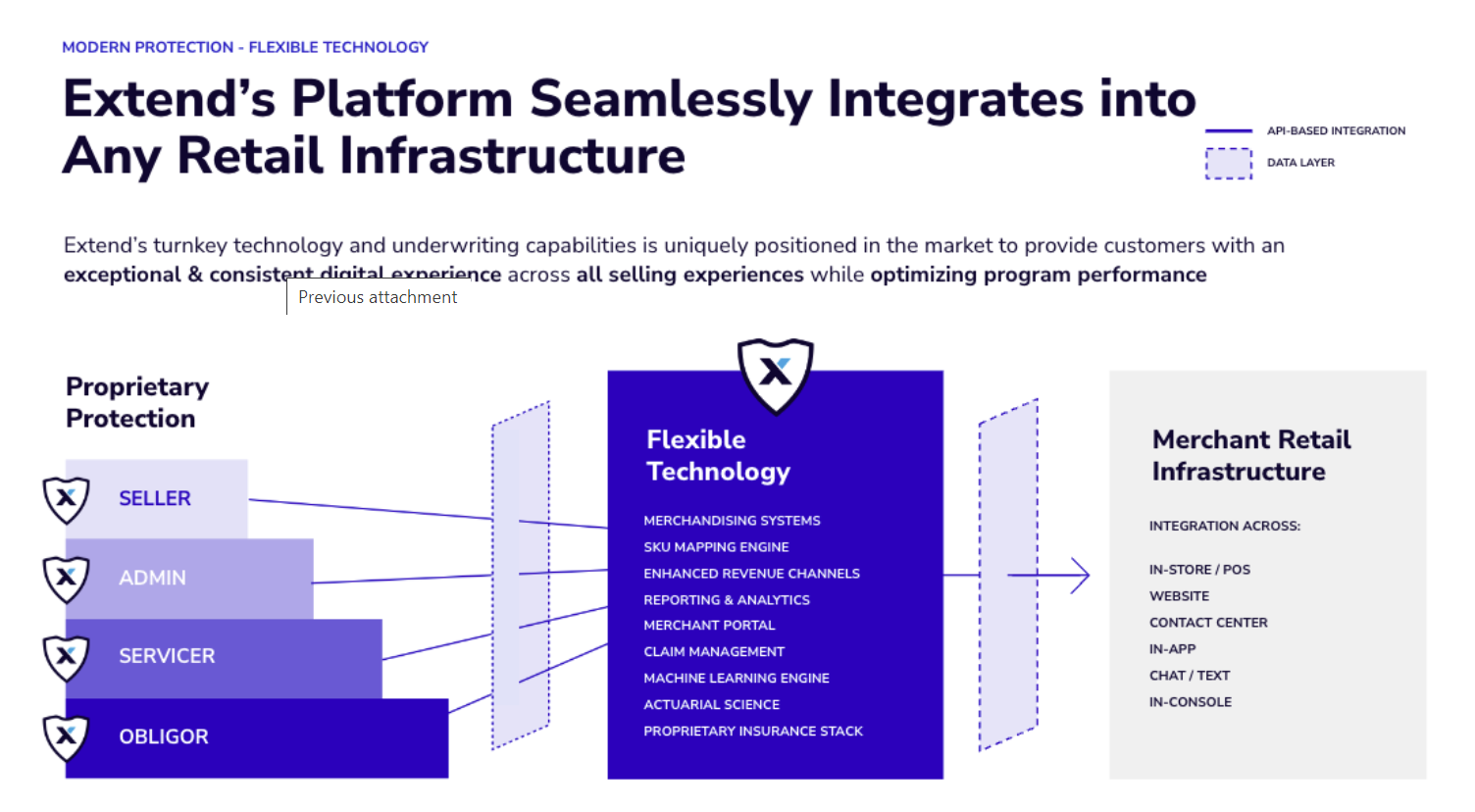

Extend created an extended warranty distribution network and API-first integrations and paired it with a customer experience where retailers could enhance customer relationships.

Building out the shipping protection business. While extended warranties were driving incremental profits for retail partners, Shah said it's important to continually ask customers what other problems they needed to solve. The answer was quick: Support operations for shipping issues. "Customers said that 30% to 50% of support team call volume was around shipping issues," said Shah. "Orders not arriving on time, packages arriving damage and theft were issues merchants saw the most. Retailers can't control those issues but can't tell the customer sorry you're out of luck. Most retailers were replacing goods at their own costs."

Now shipping protection is added to the Extend network as an add-on during the purchase process.

The business today. Extend is seeing strong cash flow for extended warranties and the business continues to grow 75% to 100% year over year. In the future, shipping and theft protection could become a bigger chunk of revenue. "We see more merchants adopting shipping protetion and it touches 100% of ecommerce volume," said Shah. However, shipping protection requires more market education relative to extended warranties. "Over the next few years theft and shipping coverage will become table stakes for retailers," said Shah.

Price points for extended warranties and shipping protection. Individuals have their own internal price points when they consider an extended warranty, said Shah. Higher priced items have higher attach rates for extended warranties. That trend kicks in for prices above $100. However, there are exceptions. Extend's first warranty went for $1.99 on a $12 pair of headphones.

Shipping protection has lower price points. "I have anxiety about deliveries so I will buy shipping protection because it's a nominal fee. It's usually like 2% of the cart," said Shah. "We see serious adoption even at a $50 price point. At $1,500 you might want shipping protection because there's no guarantee you'll get a replacement."

The use of AI. Shah said Extend leverages artificial intelligence to optimize the merchandising and messaging to pitch extended warranties and shipping protection. "I would say AI is most relevant on the claims side where we handle most cases in under 90 seconds," said Shah. "It's a dramatic difference from a 7 to 10-day claim process. We're leveraging AI from a fraud perspective to see photo validation and whether a package was delivered or not. Other products are more complicated for repairs and things that have to be sent to a depot. AI helps us do the routing in that case or schedule a technician."

Data and orchestration. Extend's biggest value to legacy retailers is focus and the ability to share data. Shah said:

"Retailers can have legacy infrastructure built on top of disparate systems that don't talk to each other today. There's not consistent middleware and we play that role where we integrate and orchestrate with our data model. Warranty is a space that has been seen from a profit perspective, but we can tell them what products are seeing complaints, where the delivery problems are and experience."

The data model also gives Extend good visibility into retail operations. Shah explained:

"We're integrated into the e-commerce system. We're integrated into the POS (point-of-sale) system, and we're integrated into any order management or ERP system they have on the back end. In many cases, these are not connected for retailers, especially large retailers with legacy systems. We also integrate with CRM systems. We're able to create a data model that touches sales, customer claims and operations and support, as well as all of our claims infrastructure. We understand down to the SKU level what products are breaking at an exorbitant rate or what products customers are having issues with. The data model is a side benefit of working with Extend."