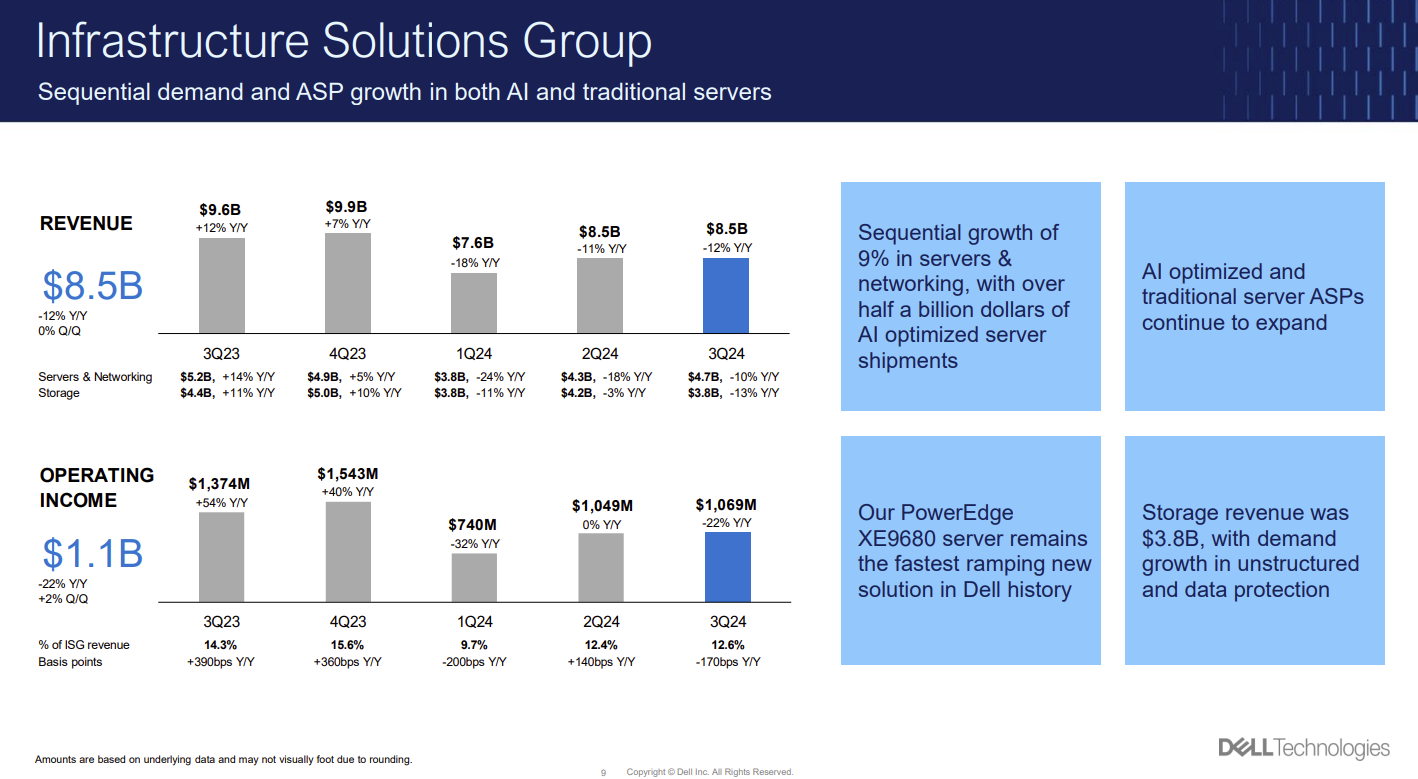

Dell Technologies' infrastructure unit saw strength in AI-optimized servers, but revenue in the third quarter for the data center group was down 12% from a year ago.

The results highlight the moving parts for data center vendors. AI-optimized gear is selling well as traditional storage and server systems lag. HPE saw similar issues in its quarter.

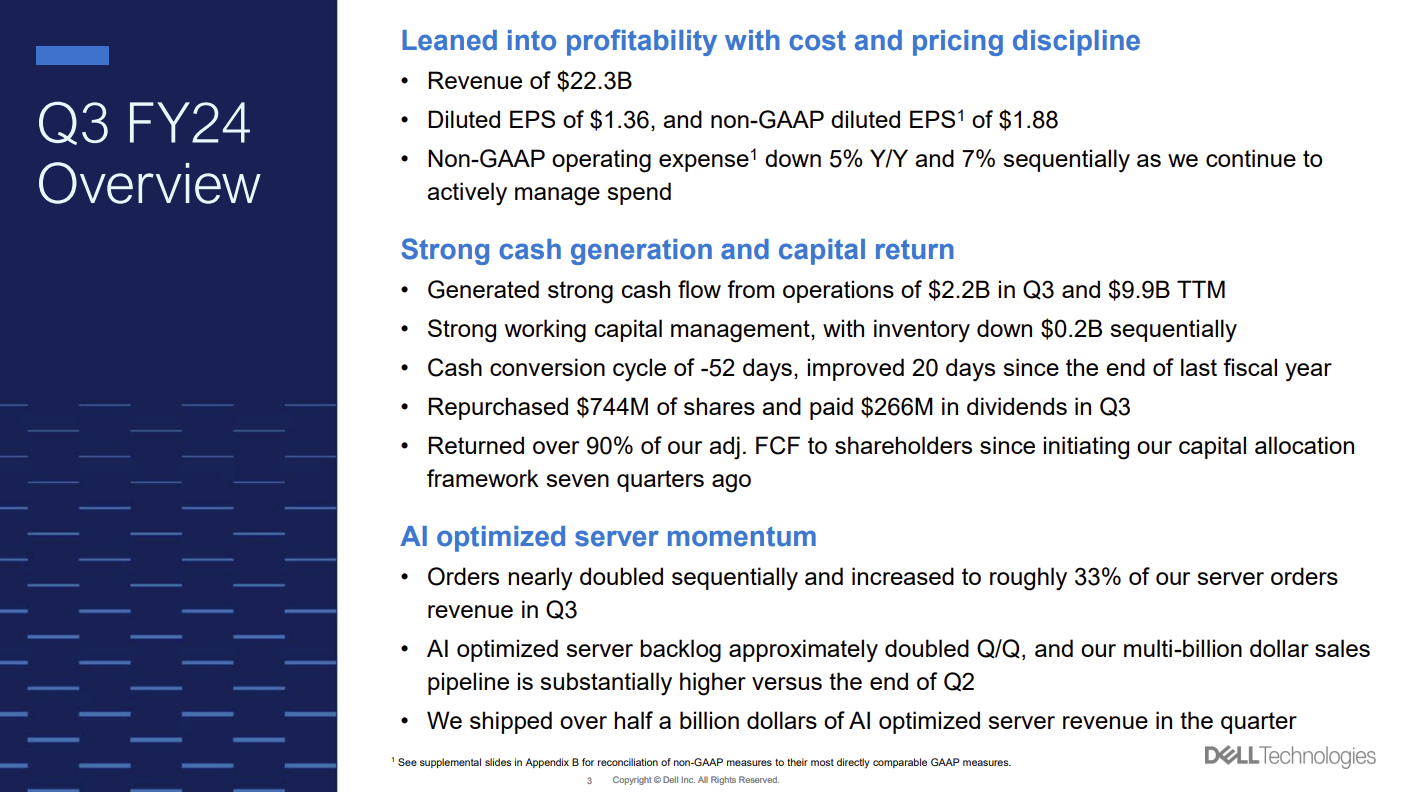

Overall, Dell Technologies reported third quarter earnings of $1 billion, or $1.36 a share, on revenue of $22.3 billion, down 10% from a year ago. Non-GAAP earnings were $1.88 a share.

Wall Street was expecting Dell Technologies to report third quarter earnings of $1.45 a share on revenue of $22.9 billion.

In a sign of its revenue model transformation, Dell said it had remaining performance obligations of $39 billion. Recurring revenue in the quarter was up 4% from a year ago and deferred revenue was up 7%.

Infrastructure group revenue in the third quarter was $8.5 billion, down 12% from a year ago. Server and networking revenue was $4.7 billion and storage revenue were $3.8 billion.

According to the company, AI optimized servers accounted for 33% of total server orders revenue. Demand was driven by AI focused cloud providers and companies in key verticals. AI optimized server backlog nearly doubled in the third quarter from the second quarter.

Dell's PC business had third quarter revenue of $12.3 billion, down 11% from a year ago. The company said an aging installed PC base and AI-enabled systems from Intel, AMD and Windows on ARM should drive a refresh cycle.

Jeff Clarke, chief operating officer of Dell Technologies, said the company expects fiscal 2025 to show revenue growth as systems are upgraded for generative AI use cases.

Clarke said in prepared remarks:

"The demand environment for traditional servers improved over the course of the quarter, and demand for AI servers continues to be strong across a wider range of customers. Demand for storage was down, as expected."

He added that Dell Technologies was seeing sequential growth in AI optimized services. Clarke said the company "began to convert more PowerEdge XE9680 backlog into revenue."

"For the quarter, we shipped over half a billion dollars of AI optimized servers, including our XE9680, XE9640, XE8640 and R750 & 760xa servers," said Clarke, who added that "demand remains well ahead of supply."

Clarke was optimistic about AI driving demand for Dell systems.

"AI continues to dominate the technology and business conversation. Customers across the globe are turning their operations upside down to see how they can use generative AI to advance their businesses in meaningful ways. These AI initiatives are being driven at the CEO and board levels. And as a result, we are at the front of a significant TAM expansion."