This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly.

PepsiCo's second quarter earnings were better than expected, but the real story is that its transformation efforts for processes, supply chain, technology and business services have gone so well it has good visibility into 2024.

The company's quarterly report featured top and bottom line results ahead of estimates, a solid third quarter outlook and this tidbit about 2024. For the year ahead, PepsiCo in prepared remarks noted that the company will be at the upper end of its long-term ranges for organic revenue growth of 4% to 6% and earnings per share growth in the high single digits.

Companies usually don't provide their annual outlooks until they report first quarter results in January and February.

Analysts quickly asked PepsiCo CEO Ramon Laguarta and CFO Hugh Johnston what gave the company confidence in a 2024 outlook given a variety of wild cards ranging from the financial health of the consumer to inflation to the effect of obesity drugs on snacking and beverage sales. The short answer is that PepsiCo has been using technology and process improvement to drive costs lower.

Johnston said:

"We've put even higher focus than we've had in the past on driving productivity and driving out unnecessary costs using the tools that we've discussed, the investments in digitalization, the investments in global business services, the investment in driving out overlaps within the organization. Because that work has been going on for a longer period of time, I think that gave us an earlier line of sight into what we would expect our cost outcome to be for next year."

Laguarta added that PepsiCo is seeing "long-term structural tailwinds of our categories" including demographics, urbanization and a lifestyle that's revolving around snacking.

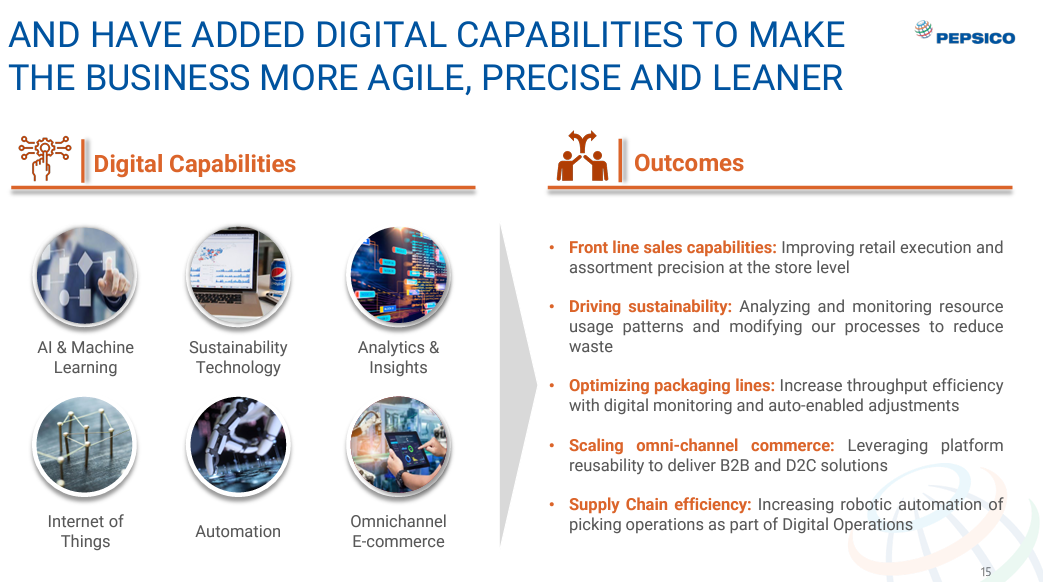

Simply put, it's easier to forecast business when you have your costs under control and continual efficiency improvement. PepsiCo has an initiative called pep+ (PepsiCo Positive) that features product innovation, new markets and a lot of cost management. In a nutshell, PepsiCo has been carrying out the following transformation efforts.

- Cost management through supply chain and distribution efficiencies.

- Identifying waste throughout its value chain.

- Leveraging global business services to cut general and administrative expenses.

- Using analytics, process mining and data to speed up decisions, optimize routes and execute in stores.

- Modernizing IT systems across businesses and countries.

That transformation is enabling PepsiCo to adapt and execute no matter what the market brings.

In February at the Consumer Analyst Group of New York (CAGNY) conference, PepsiCo outlined its transformation. Laguarta noted that PepsiCo set out in 2019 to become more agile and efficient while innovating in its categories. The company invested in e-commerce and direct-to-consumer and tools that improve how PepsiCo works.

Laguarta said PepsiCo has been delivering $1 billion in productivity savings a year for the last four years by consolidating and connecting systems, leveraging automation amid labor shortages and optimizing routes. Laguarta said:

"We've invested a lot in AI, we've invested a lot of Internet of Things, automation, et cetera, to drive the output. I would maybe go deeper into what I think is one of the most important competitive advantages of our company is the fact that we get to the point of sale ourselves. And we've been investing in technology and information for our salesmen to optimize the portfolio with precision store by store. So, we can read who lives around that store, who buys in that store, and our salesmen have that information to optimize the planogram on that particular store to maximize the throughput. And that has been a pretty powerful tool.

I think we're only scratching the surface."

As for the tech stack, PepsiCo has appeared as a reference account for Salesforce, SAP, ServiceNow and Snowflake among others.

PepsiCo is also a Celonis customer and has used process mining for multiple processes including accounts receivable, sales orders, distribution and inventory to name a few. PepsiCo is also migrating to SAP S4/HANA and was a featured customer at SAP Sapphire 2023. Johnston said in February at the CAGNY investment conference that "we're all going through the upgrade as SAP is moving to the cloud, moving to S/4HANA."

That migration isn't unique in consumer product goods since SAP is forcing the cloud move, but Johnston noted there are benefits in that you have more harmonized data for future platforms and analysis for supply chain, logistics and store optimization. "There's a ton of power once you get the data right," he said.

Here are two slides that sum up PepsiCo's core transformation technologies.

More from the buy side:

- Domino's Pizza eyes generative AI, Microsoft and Uber tech to drive growth

- JPMorgan Chase: Why we're the biggest tech spender in banking

- Walmart Chief Sustainability Officer: ESG is integrated into operations, business

- AI Meets Mental Health Assessments: How Futures Recovery Healthcare, Aiberry Co-innovated

- How Magnox is Transforming Employee Experience

- Cenlar's Chief Digital Officer Josh Reicher on automation, AI and staying ahead

- Bank of America: Why 'digital superiority' matters

- Rivian: AI, data power customer experiences

- How JetBlue is leveraging AI, LLMs to be 'most data-driven airline in the world'

- Hyundai Motor's innovation strategy: What we can learn

- How Home Depot blends art and science of customer experience (PDF)

- JPMorgan Chase: Digital Transformation, AI and Data Strategy Sets Up Generative AI

- AI is everywhere including your supermarket, homebuilder and soup

- Goldman Sachs CIO Marco Argenti on AI, data, mental models for disruption

- Enterprise tech buyers wary of generative AI hype, security

- Walmart, Target highlight intersection of supply chain, customer experience

- How 4 CEOs are approaching generative AI use cases in their companies

- Zillow, Redfin aim to use OpenAI ChatGPT-4 to find your next house

- Starbucks’ new CEO: ‘We can enhance our tech stack to lower costs and reinvest’

- Uber aims to press its 'data advantage' for AI, model training