AMD's data center business held up well in the first quarter as the company topped estimates a week after Intel reported its results.

The company reported a first quarter net loss of $139 million, or 9 cents a share, on revenue of $5.4 billion, down 9% from a year ago. Non-GAAP earnings for the first quarter were 60 cents a share.

Wall Street was expecting AMD to report a first quarter non-GAAP profit of 56 cents a share on revenue of $5.31 billion.

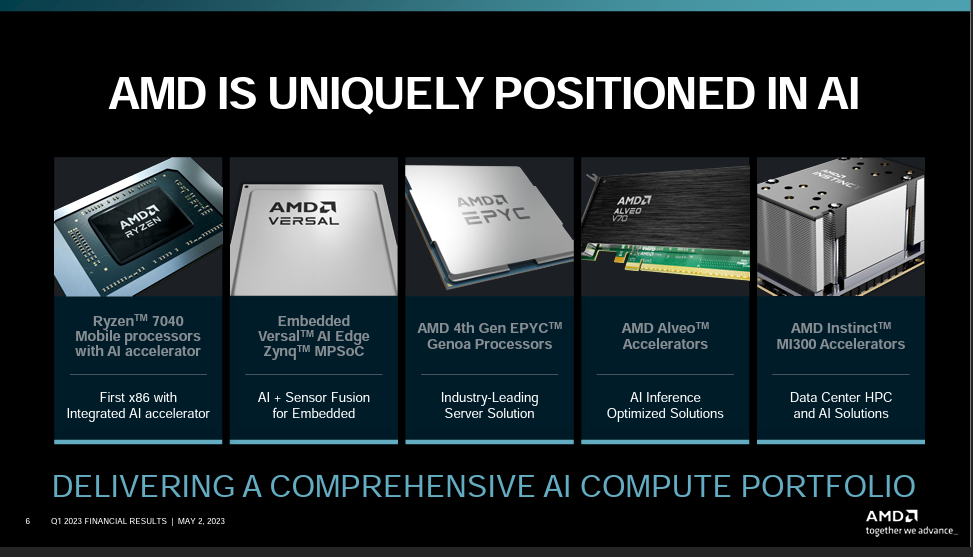

AMD CEO Lisa Su said AMD rounded out its AI roadmap and sees "significant growth opportunities as we successfully deliver our roadmaps, execute our strategic data center and embedded priorities and accelerate adoption of our AI portfolio."

Like most chip makers, AMD sees opportunities in providing infrastructure to power the compute needed to train AI models. It’s a race that includes Intel and Nvidia as well as others.

AMD is gaining cloud service provider traction with its AMD EPYC processors.

Oracle’s Data Platform Gets an EPYC™ Boost

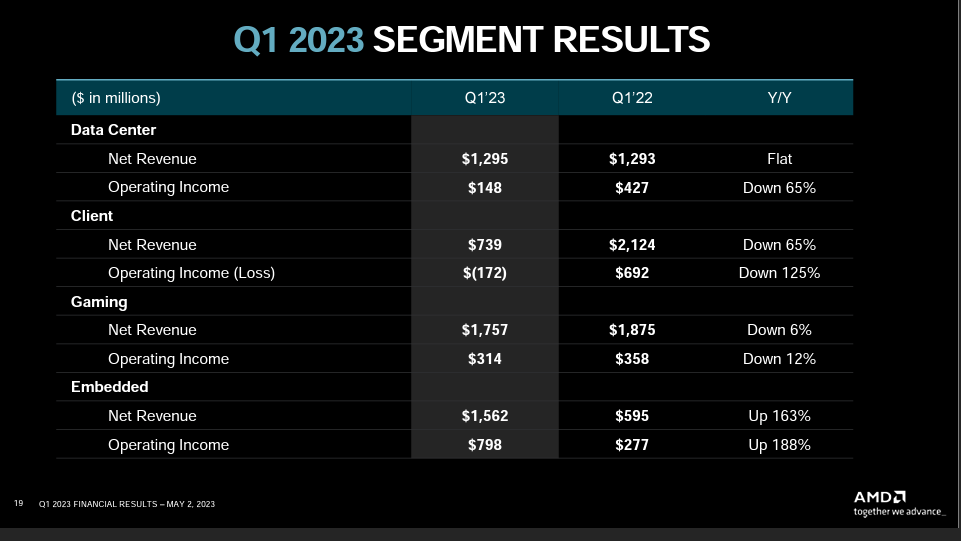

It's also notable that AMD's Data Center and Embedded units represented more than half of the company’s revenue. AMD expects sequential growth for those units in the second quarter.

However, AMD's PC business was thumped in the first quarter with sales falling 65%. Here's the breakdown:

AMD said it is expecting second quarter revenue of $5.3 billion, give or take $300 million. Wall Street was expecting second quarter sales of $5.5 billion.

Su said on an earnings conference call:

"We have significant growth opportunities ahead based on successfully delivering our road maps and executing our strategic data center and embedded priorities, led by accelerating adoption of our AI products. We are in the very early stages of the AI computing era, and the rate of adoption and growth is faster than any other technology in recent history.

And as the recent interest in generative AI highlights, bringing the benefits of large language models and other AI capabilities to cloud, edge and endpoints require significant increases in compute performance. AMD is very well positioned to capitalize on this increased demand for compute."

A week ago, Intel reported a first quarter loss of 66 cents a share on revenue of $11.7 billion, down 36% from a year ago. The chip giant reported a non-GAAP first quarter loss of 4 cents a share.

Intel also forecasted second quarter revenue of $11.5 billion to $12.5 billion with a loss of 62 cents a share, or a loss of 4 cents a share on a non-GAAP basis.

In the first quarter, Intel's Data Center & AI unit had revenue of $3.7 billion, down 39% from a year ago. Client Computing Group was down 38% in the first quarter compared to a year ago.

CEO Pat Gelsinger said on Intel's first quarter earnings call:

“As the industry continues to navigate through multiple global challenges and headwinds, we remain cautious on the macro outlook even as we expect some modest recovery in the second half. We are seeing increasing stability in the PC market with inventory corrections largely proceeding as we had expected. However, the server and networking markets have yet to reach their bottoms, as cloud and enterprise remain weak. As a result, our Q2 revenue guide embeds continued inventory corrections in our core markets, and a range of normal seasonal to better-than-seasonal growth off depressed Q1 revenue levels.”