Zoom Video Communications reported better-than-expected third quarter as the company saw strong usage of its AI capabilities and better retention of small business customers.

The company reported third-quarter earnings of $141.2 million, or 45 cents a share, on revenue of $1.136.7 billion. Non-GAAP earnings in the quarter were $1.29 a share.

Wall Street expected Zoom to report third quarter earnings of $1.07 a share on revenue of $1.12 billion.

CEO Eric Yuan said Zoom's collaboration platform and Zoom AI Companion were showing traction. "We are also pleased with our Online business where we drove higher retention and saw usage of our new AI capabilities, enhancing the value of our platform," he said.

In prepared remarks, Yuan said that Zoom saw 220,000 accounts enabling Zoom AI Companion. Last quarter, Yuan was peppered with questions about generative AI monetization and the company's decision to not charge an add-on price for features.

- Zoom sets AI Companion roadmap across platform

- Zoom expands reach, generative AI use cases with pricing that aims for market share

- Zoom sees enterprise traction, cites Contact Center, Team Chat wins

- Zoom's customer data terms for training AI may be just the beginning

As for the outlook, Zoom is projecting fourth quarter revenue between $1.125 billion and $1.13 billion with non-GAAP earnings between $1.13 a share and $1.15 a share. For fiscal 2024, Zoom is projecting revenue between $4.506 billion and $4.511 billion with non-GAAP earnings of $4.93 a share and $4.95 a share.

Wall Street was expecting fourth quarter earnings of $1.13 a share and $1.15 a share and fiscal 2024 earnings of $4.66 a share.

By the numbers for the third quarter:

- Enterprise revenue of $660.6 million was up 7.5% from a year ago. Online revenue--the more volatile self-serve accounts--was $476.1 million, down 2.4% from a year ago.

- Zoom Phone reached about 7 million paid seats.

- The number of customers on Zoom One bundles grew 330% from a year ago.

- Zoom Contact Center hit nearly 700 customers at the end of the quarter.

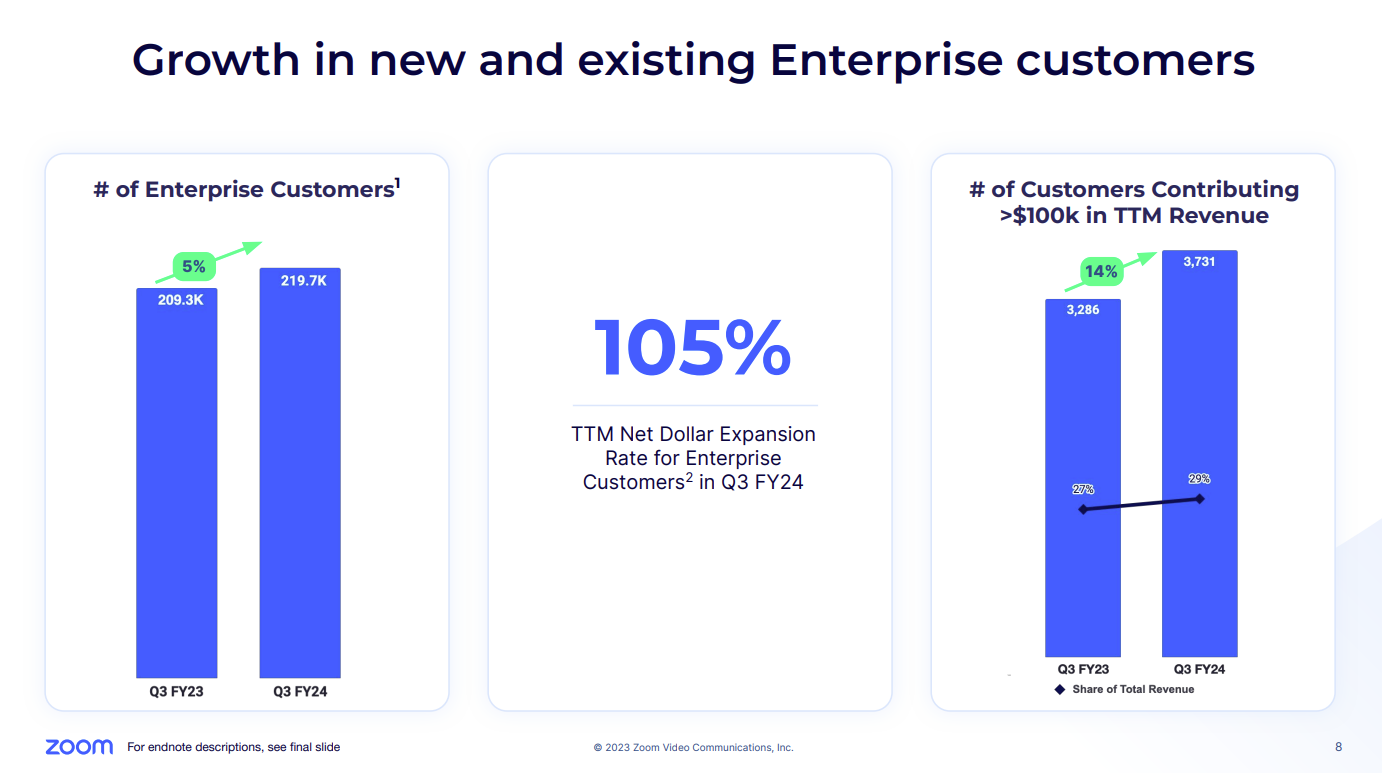

- Zoom ended the quarter with 219,700 enterprise customers, up 5% from a year ago.

- 3,731 customers contributed more than $100,000 in revenue.

- Online average monthly churn was 3% in the quarter, down 10 basis points from a year ago.