Zoom Communications reported better-than-expected third quarter results and raised its fourth quarter outlook as the company grew its contact center customer base.

The company reported third quarter net income of $207.1 million, or 66 cents a share, on revenue of $1.177 billion, up 3.6% from a year ago. Non-GAAP earnings were $1.38 a share.

Wall Street was expecting Zoom to report third quarter earnings of $1.31 a share on revenue of $1.16 billion.

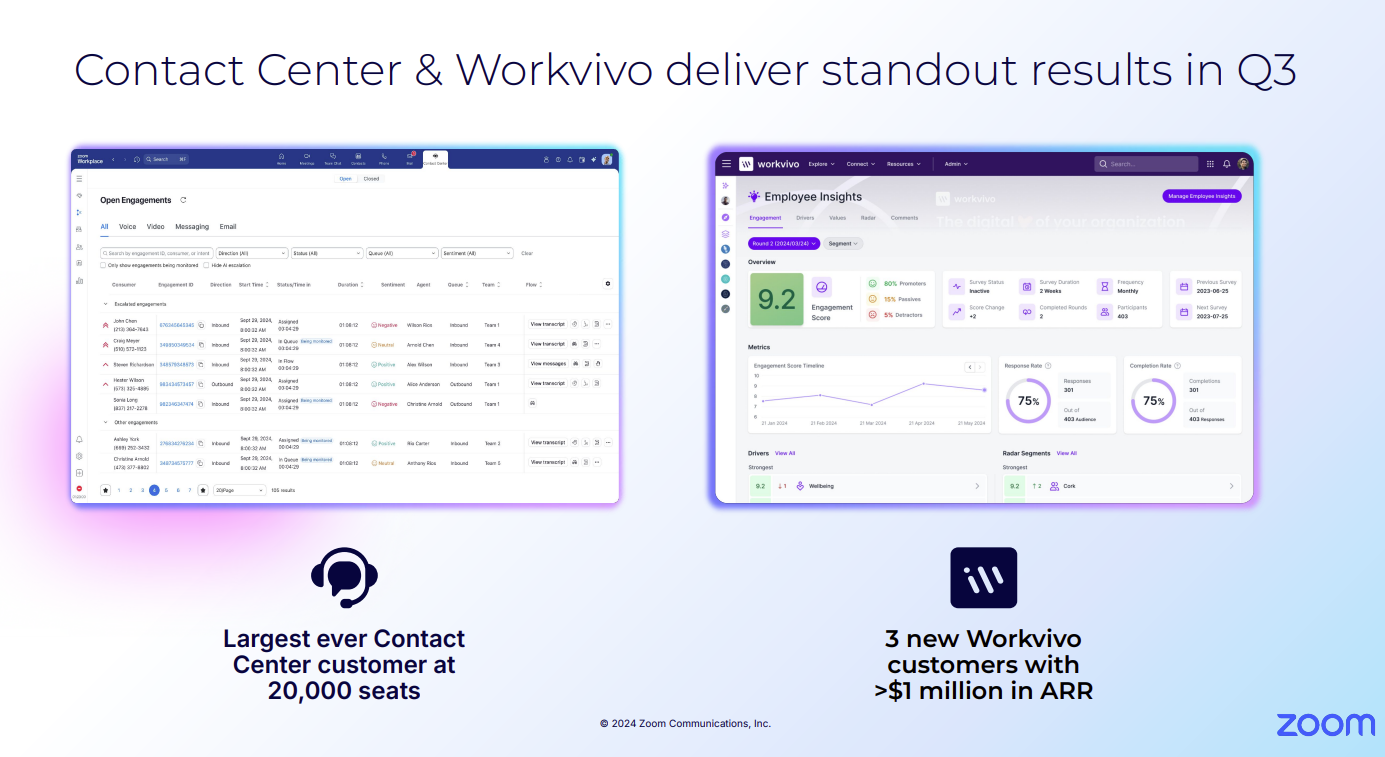

Speaking on an earnings conference call, Zoom CEO Eric Yuan said Zoom AI Companion monthly active users grew 59% sequentially. Zoom's Workvivo, which is benefiting from a Meta partnership, saw its customer base jump by 72%.

- Will Meta's Workplace shutdown be a boon for Zoom's Workvivo?

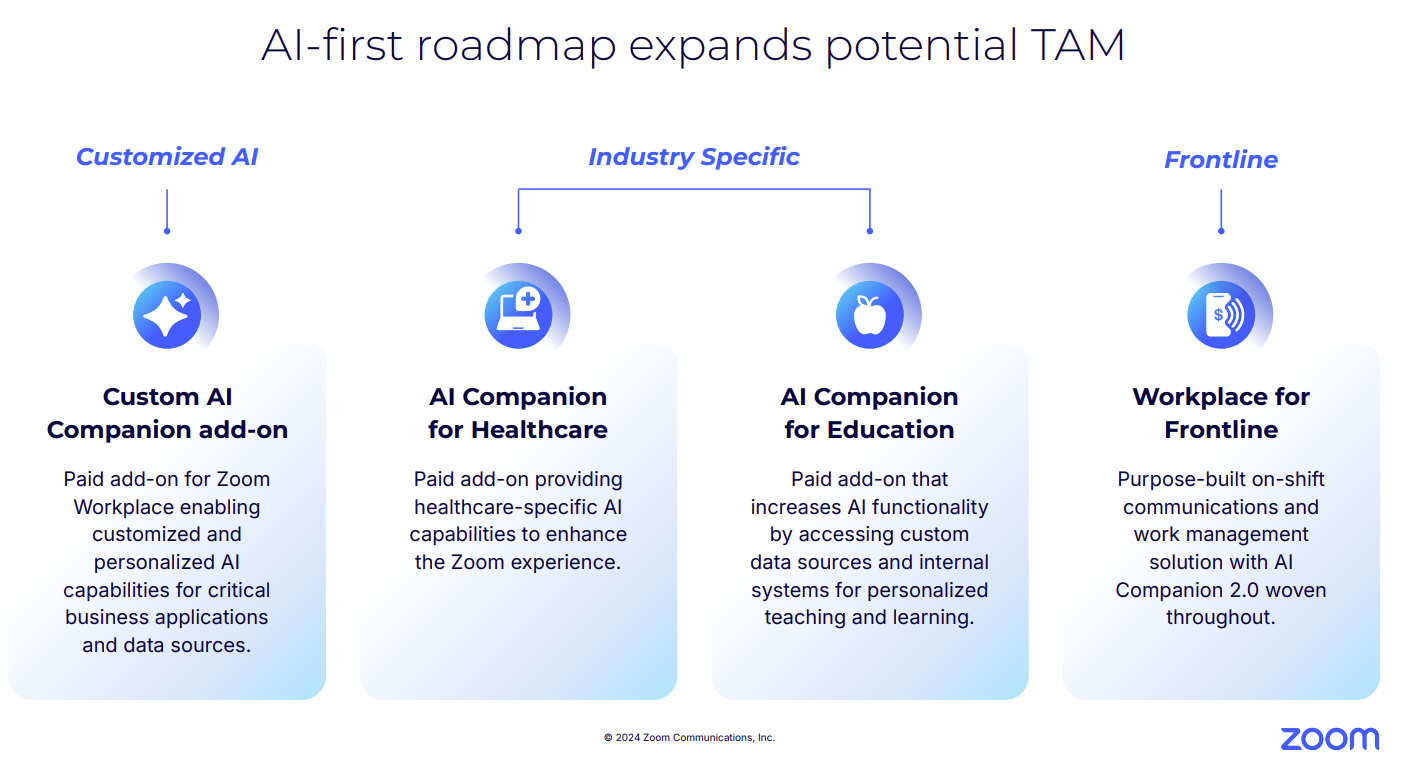

- Zoom launches AI Companion 2.0, eyes enterprise, industry expansion

"Zoom Contact Center set a record with an over 20,000-seat deal in EMEA, and Workvivo secured its largest deal ever with a Fortune 10 company, showing our success in landing and expanding with global enterprises that recognize the promise of our integrated Workplace and Business Services platform," said Yuan.

Yuan added that the number of Zoom Contact Center customers topped 1,250, up 82% from a year ago. "Our Enterprise revenue grew approximately 6% year over year, reflecting a continued shift to Enterprise which now makes up 59% of our total revenue," said Yuan.

Constellation ShortList™ Unified Communications as a Service (UCaaS) | Constellation ShortList™ Contact Center Workforce Engagement Management (WEM)

As for the outlook, Zoom said its fourth quarter revenue will be between $1.175 billion and $1.18 billion with non-GAAP earnings of $1.29 a share to $1.30 a share. For fiscal 2025, Zoom revenue will be between $4.656 billion to $4.661 billion. Non-GAAP earnings for fiscal 2025 will be between $5.41 a share to $5.43 a share.

By the numbers:

- Zoom said it had 3,995 customers contributing $100,000 in trailing 12 month revenue.

- The company reported 192,400 enterprise customers.

- Online churn in the third quarter was 2.7%.

- Non-GAAP gross margin in the third quarter was 78.9%, down from 79.7% a year ago due to investments in AI.

- The company authorized another $1.2 billion to buy back shares. Zoom said it had $2 billion to buy back shares with purchases expected to be complete by the end of fiscal 2026.

Constellation Research's take

Constellation Research analyst Holger Mueller said:

"Zoom continues its transformation from being the synchronous video platform – to an overall communications vendor. And we see why – growth is slow despite the substantial capability growth and widening the total addressable market for Zoom. The problem is the competition and commoditization of the synchronous communication. About 50% of Zoom's growth in net income is fueled more by the doubling of its ‘other income,' which grew from a quarter of operating income a year ago to now 50% of that measure. Zoom is doing the right thing, but it just needs to find ways to grow faster with its new offerings as its core business is being pressured. Next quarter will tell."