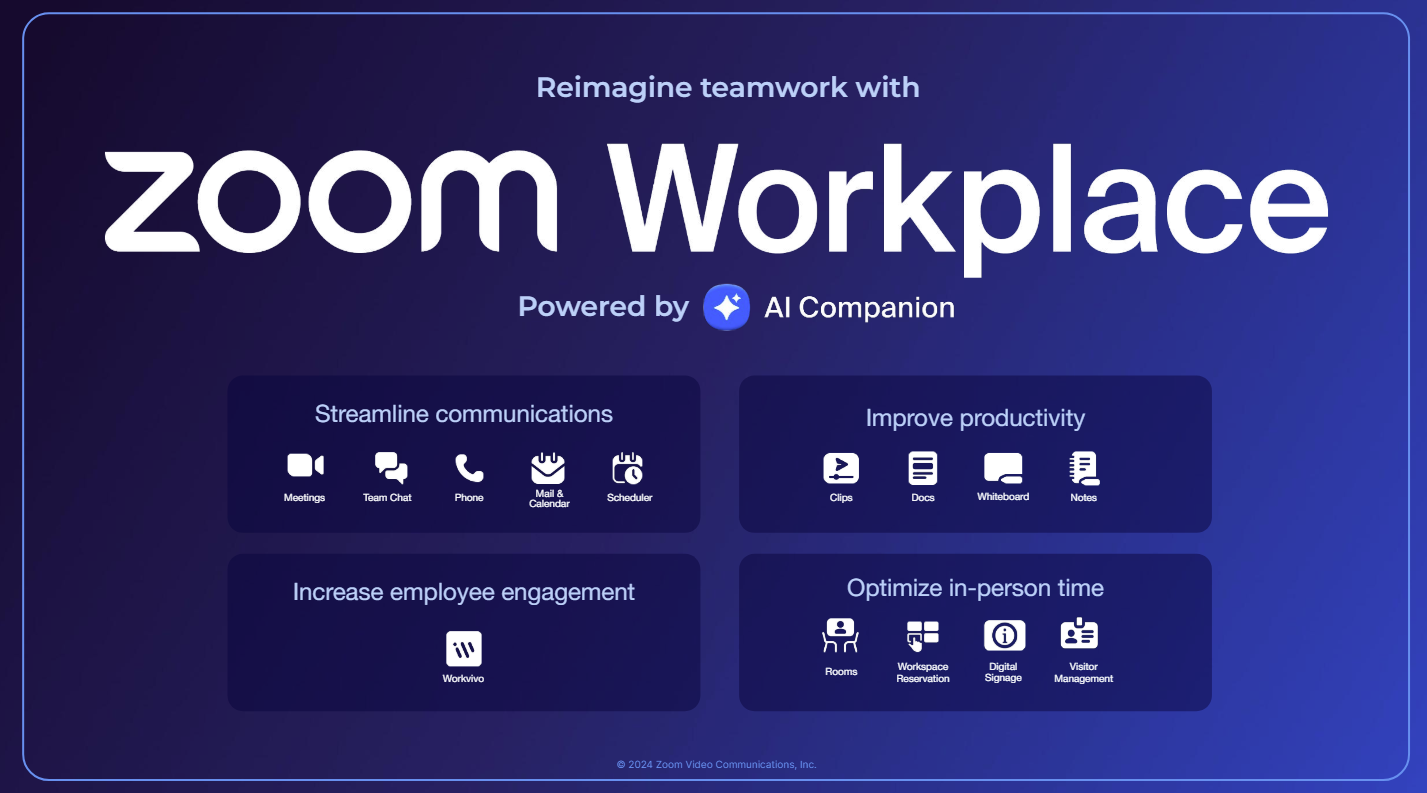

Zoom said its Zoom AI Companion is gaining traction and the company is betting that Zoom Workplace can drive demand for its portfolio.

Zoom reported first quarter earnings of $216.3 million, or 69 cents a share, on revenue of $1.14 billion, up 3.2% from a year ago. Non-GAAP earnings in the quarter were $1.35 a share. Wall Street was expecting Zoom to report first quarter non-GAAP earnings of $1.19 a share on revenue of $1.13 billion.

Last week, Zoom said its Workvivo employee engagement tool will be the sole migration partner for Meta's Workplace offering, which is being shut down.

By the numbers:

- Zoom had 3,883 customers contributing more than $100,000 in trailing 12 months revenue.

- The company had 191,000 enterprise customers, but Zoom noted that it moved 26,800 enterprise customers to an online sales channel.

- Churn in the quarter was 3.2%.

- Zoom Phone has 5 customers with 100,000 seats.

- Zoom AI Companion has more than 700,000 customer accounts enabled.

- 90 Contact Center accounts had more than $100,000 ARR.

- The company ended the quarter with $7.4 billion in cash, cash equivalents and marketable securities.

Speaking on an earnings call, Zoom CEO Eric Yuan said AI enhancements were boosting demand of Zoom Workplace, Zoom Phone, Team Chat, Events and Whiteboard. Yuan added that Workplace integration with Workvivo will also enhance employee engagement. Yuan said the deal with Meta to migrate Workspace customers to Workvivo will also be positive.

"Our success in employee experience represents an important beachhead for us in upselling customers on the full suite," said Yuan.

As for the outlook, Zoom projected second-quarter revenue of $1.145 billion to $1.15 billion with non-GAAP earnings of $1.20 a share and $1.21 a share. Sales were in line with estimates, but missed Wall Street earnings targets of $1.24 a share. For fiscal 2025, Zoom projected revenue of $4.61 billion and $4.62 billion with non-GAAP earnings of $4.99 a share to $5.02 a share. Both projections were ahead of expectations.

"We still believe that Q2 will be the low point from a year-over-year growth perspective and to improve from there," said Yuan.