Zoom's revenue growth remains anemic, but the company is increasingly winning platform deals and displacing legacy players in the contact center.

The company reported second-quarter earnings of $219 million, or 70 cents a share, on revenue of $1.16 billion, up 2.1% from a year ago. Non-GAAP earnings of $1.39 a share handily topped estimates. For the third quarter, Zoom is expecting revenue of $1.16 billion to $1.165 billion with non-GAAP earnings of $1.29 a share to $1.31 a share. Zoom expects fiscal 2025 revenue to be between $4.63 billion and $4.64 billion with non-GAAP earnings of $5.29 a share and $5.32 a share.

With all those numbers out of the way, the primary takeaway is that concerns about Zoom growth remain, but the company is building a platform play that may add growth in the future. Zoom had 191,600 enterprise customers and 3,933 customers contributing more than $100,000 in trailing 12-month revenue.

Zoom CEO Eric Yuan said Zoom Contact Center is starting to scale with its biggest deal to date and packages that leverage AI for agents. Yuan said:

"In Q2, we landed our largest deal for a new Contact Center customer, who chose our top-tier Elite CX package coupled with Zoom Phone. We are seeing increased adoption of our advanced Contact Center packages, as customers seek to utilize our AI capabilities to enhance agent performance. Of our top 10 Contact Center wins, all represented displacements of major contact center vendors, and 40% were migrations off of first-generation cloud-based solutions."

- Constellation ShortList™ Virtual Events: Webcasts and Meetings

- Your next Zoom meeting may be at an AMC Theatre

- Will Meta's Workplace shutdown be a boon for Zoom's Workvivo?

- Constellation ShortList™ Unified Communications as a Service (UCaaS)

- Constellation ShortList™ Contact Center Workforce Engagement Management (WEM)

TIAA was a big Zoom Contact Center win as was Lyra Health. Rival contact center players have noted economic headwinds and longer sales cycles from customers. Yuan said Zoom Contact Center's integration as well as feature set is winning customers. Zoom has also added new pricing tiers but remains competitive in the field.

In addition, Yuan said Zoom's Contact Center roadmap and architecture is winning as proof-of-concept projects win out against rivals.

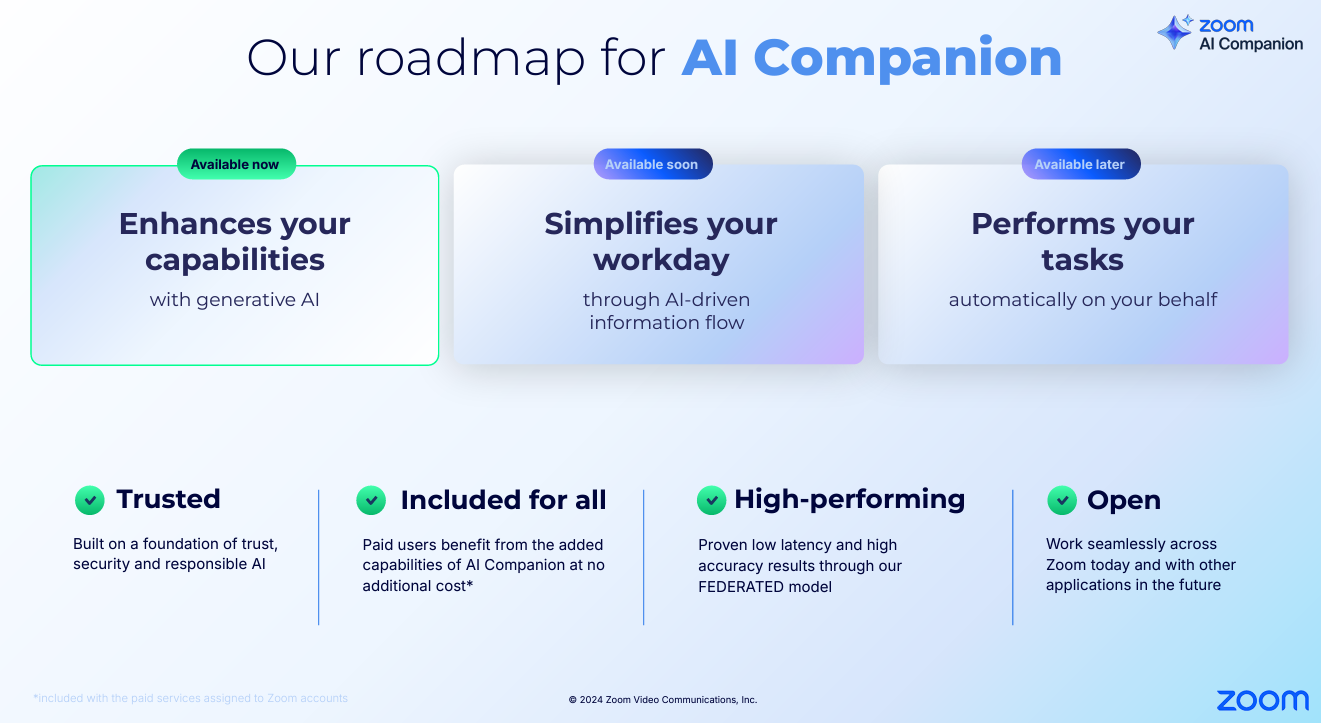

Yuan added that Zoom Contact Center is being paired with Zoom Workplace as enterprises aim to meld customer experience and employee experience. Zoom AI Companion is also being used by more than 1.2 million accounts and sits across multiple Zoom products.

Zoom will advance its AI strategy at Zoomtopia in October with multiple enhancements to AI Companion.

Outgoing Zoom CFO Kelly Steckelberg said Zoom is seeing strong enterprise demand. "We've had a lot of stability in terms of our retention rates and this is going to show up eventually in our net dollar expansion that we expect to start to reaccelerate as we come to like the middle of next year," said Steckelberg, who said SMB is still seeing macro headwinds.

Constellation Research's take

Constellation Research analyst Liz Miller said:

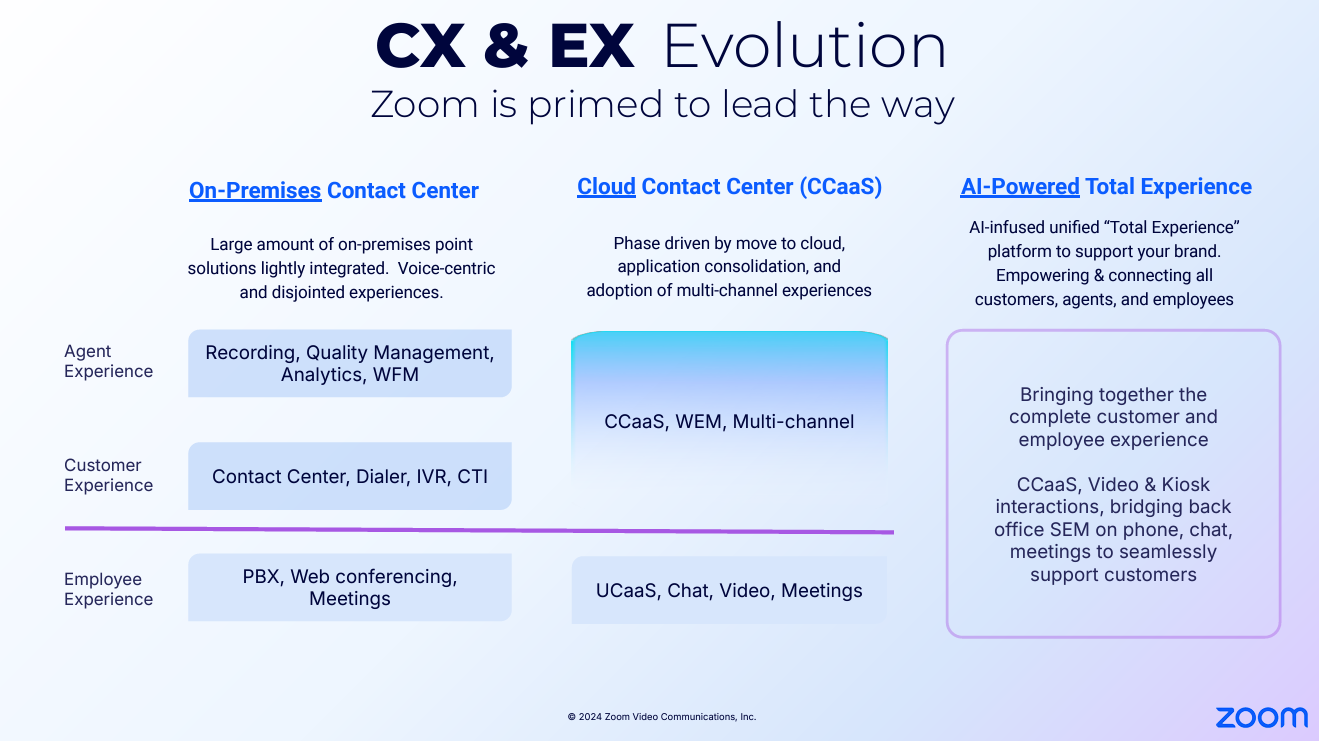

"Perhaps the most interesting snippet of Yuan’s remarks is that Zoom Contact Center is displacing "first-generation cloud-based solutions." This should be a bit of a wake up call for the market, but also one that Yuan should keep in mind as what he himself is positioning as a "second-generation cloud-based solution" – nothing in cloud is forever. The market is experiencing a bit of a malaise as customers who shifted quickly from on-prem solutions to CCaaS have now completed that honeymoon phase of speed and perhaps some initial cost savings. But there are growing grumbles about not fully realizing the operational efficiencies expected from the transition. Even more are questioning the ever-expanding function sets especially as AI gets integrated across suites and price increases take hold. In reality, the market is seeing those inaugural cloud migrations start to kick off limited experiments and explorations with other providers and vendors. Some are choosing to move forward with a more hybrid approach of on-prem telephony and over the top AI and digital business applications purpose built to leverage cloud to accelerate process and efficiencies.

So yes, Zoom and Yuan will likely be the beneficiaries of some of this exploration, but the question becomes what happens when second-generation migrations start to get hungry to explore the third generation?

It is also worth noting that Zoom has yet to fully realize what it is as a platform. Right now, Zoom is focused on articulating its integrated communications strategy, but this CCaaS + UCaaS story has become a familiar refrain for those of us following other players like RingCentral. And similar to RingCentral, Zoom has also invested in an Events business. So where does that start to come into play? Right now, both RingCentral and Zoom segment their events businesses as separated entities due to segmented buying centers. But when does that end to end capability to engage, sell and influence business through integrated omnichannel communications step into the limelight?"