Workday said it is aiming to deliver annual subscription revenue growth of 17% to 19% over the next three years with a plan that revolves around expanding its enterprise wallet share, winning midmarket companies and international expansion.

That outlook comes after a bevy of announcements around generative AI and platform updates at Workday Rising in San Francisco. The outlook for fiscal 2027 disappointed Wall Street analysts.

Nevertheless, Workday's Financial Analyst Day offered a bevy of takeaways. Here's a look at the key points.

Workday is betting that the data across its platform will differentiate its approach to generative AI and large language models (LLMs). Workday's data set is based on more than 65 million users under contract, 50 million daily machine learning inference requests, more than 600 billion annual transactions and, more importantly, 3,000 customers who opted in to sharing data for machine learning models. Those customers sharing data enable Workday to launch new SKUs in the future.

Generative AI is product focused and geared internally toward efficiency. Workday said it is focused on delivering AI and generative AI within its products, expanding the ecosystem and using AI internally to lower costs.

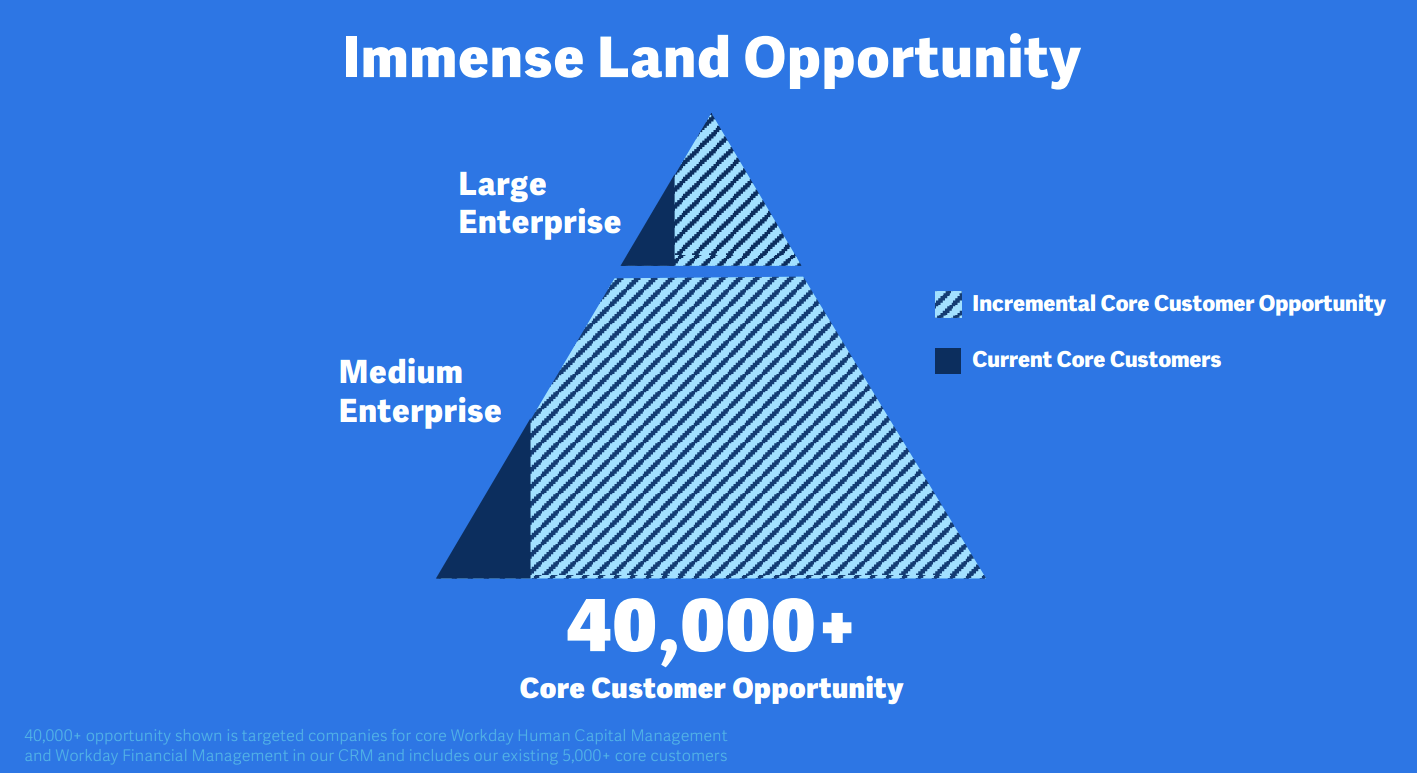

Workday has been landing large enterprises, but the medium sized enterprise is just as important. Workday said it will expand internationally by targeting midmarket companies. Today, 25% of Workday's revenue is internationally. The plan is to leverage partners and run Workday's enterprise playbook abroad.

Industry-focused opportunities are underappreciated. Workday executives made the case that the company can expand with vertical efforts. Financial services and retail and hospitality have more than $1 billion in ARR, but Workday is also looking to expand in technology and media, healthcare, professional services, education and public sector.

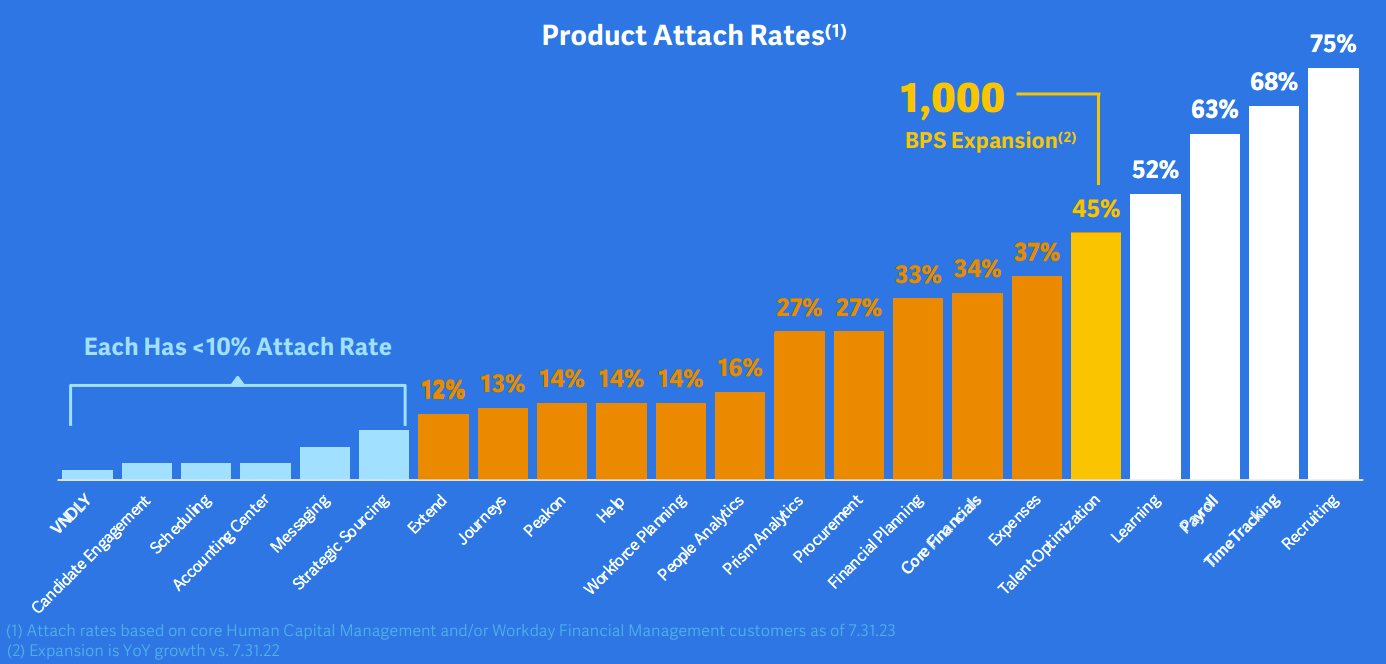

Workday is looking to attach new applications on its platform as it upsells the customer base. The results are mixed. For instance, Workday Recruiting has a 75% attach rate, Talent Optimization is at 45% but applications like People Analytics are at 16%. Workday estimates that it has a more than $2 billion incremental ARR opportunity within its top 100 accounts.

Here's a look at the attach rates to Workday HCM and/or Workday Financial Management.

Workday Financial Management is key to Workday's growth plans. Workday said that more than 35% of new customers landed with Workday Financial Management either as a standalone subscription or part of a joint rollout with HCM. Workday said it will roll out more financial applications for industries and convert Workday Adaptive Planning to core Workday Financial Management. The company has also allocated more than half its sales capacity in fiscal 2024 to Workday Financial Management.

According to Workday, 75% to 80% of overall financials market is on-premise and can be moved to a cloud platform like Workday Financial Management.

Workday's fiscal 2027 financial goals are balancing growth and margins. Aside from its subscription revenue growth guidance, Workday CFO Zane Rowe noted that the company is looking to deliver non-GAAP operating margins of more than 25%. How? Focus R&D investments on AI and machine learning and using automation across the business. Operating cash flow targets of more than 30% will come from strong customer retention, industry expansion and Workday's platform approach.