Your quantum computing vendors may look a lot like your cloud, data center and supercomputing providers today as Microsoft, IBM and Intel all had quantum related announcements in recent days.

The big question is whether smaller quantum vendors will be able to deliver the breakthroughs that can propel them to the big leagues. Constellation Research's Shortlists for quantum computing platforms, software and full stack providers include a mix of traditional vendors and startups.

Recent events include:

- Microsoft unveiled Azure Quantum, which included three items. First, Azure Quantum Elements aims to integrate high-performance computing, AI and quantum to accelerate research. Not surprisingly, Microsoft outlined Copilot in Azure Quantum, which takes natural language to chemistry and material science problems. And finally, Microsoft outlined a roadmap to build a quantum supercomputer that includes a new metric (rQOPS or Reliable Quantum Operations Per Second) and plans for a hardware protected qubit. "Our goal is to compress the next 250 years of chemistry and materials science progress into the next 25," said Microsoft CEO Satya Nadella, who acknowledged the effort was just the beginning.

- Intel made its new 12-qubit quantum chip called Tunnel Falls available to university and federal research labs. Intel added that it is collaborating with the Laboratory for Physical Sciences (LPS) at the University of Maryland and College Park's Qubit Collaboratory (LQC) on quantum computing research. Nvidia also has staked out quantum as a growth market because there will be quantum accelerators too.

- IBM Quantum and UC Berkeley outlined the progress being made for complex physical simulations on the 127-qubit IBM Quantum Eagle processor. The goal of the project was to reduce the noise in quantum computing and reduce errors. As noted by Constellation Research analyst Holger Mueller, IBM has a mature ecosystem surrounding its quantum efforts.

Now it's not like startups are being lapped. IonQ last week announced its IonQ Forte system was commercially available. IonQ has a partnership with Dell Technologies and is available on all three major cloud providers (AWS, Google Cloud, Azure). The company just raised its 2023 bookings growth to $45 million to $55 million. In its first quarter, IonQ had revenue of $4.3 million.

But overall, it's telling that quantum computing seems to be driven by established enterprise technology players with the biggest R&D budgets. It's really hard to sneak up on big tech these days.

Mueller said the verdict is still out on whether the big enterprise tech players will all pivot to quantum. CIOs could explore Quantinuum, formed by the combination of Honeywell Quantum and Cambridge Quantum, technically isn't an IT vendor. He said:

"Clear trend: It will be the first enterprise tech that will be practially only availalble in the cloud. With that every cloud vendor needs to play to remain relevant. But we are still in basic tech phase. Who will win? It is VHS vs Betamax."

Short version: You're not quite ready to buy into quantum computing at scale just yet.

Kirk Bresniker, Hewlett Packard Labs Chief Architect and HPE Fellow, said in a tech talk at HPE Discover that quantum computing will require decades of hard engineering work to be mainstream. However, quantum computing will have role in a hybrid supercomputing approach.

"HP Labs is here to partner and apply engineering expertise to make this process real," said Bresniker. He acknowledged that quantum computing is still early in its development--akin to vacuum tubes in old classical computers--but can accelerate. "We're looking to partner to give enterprises a better set of information so they can reason over this quantum future. You want to make reasoned investments in these technologies over time," he said.

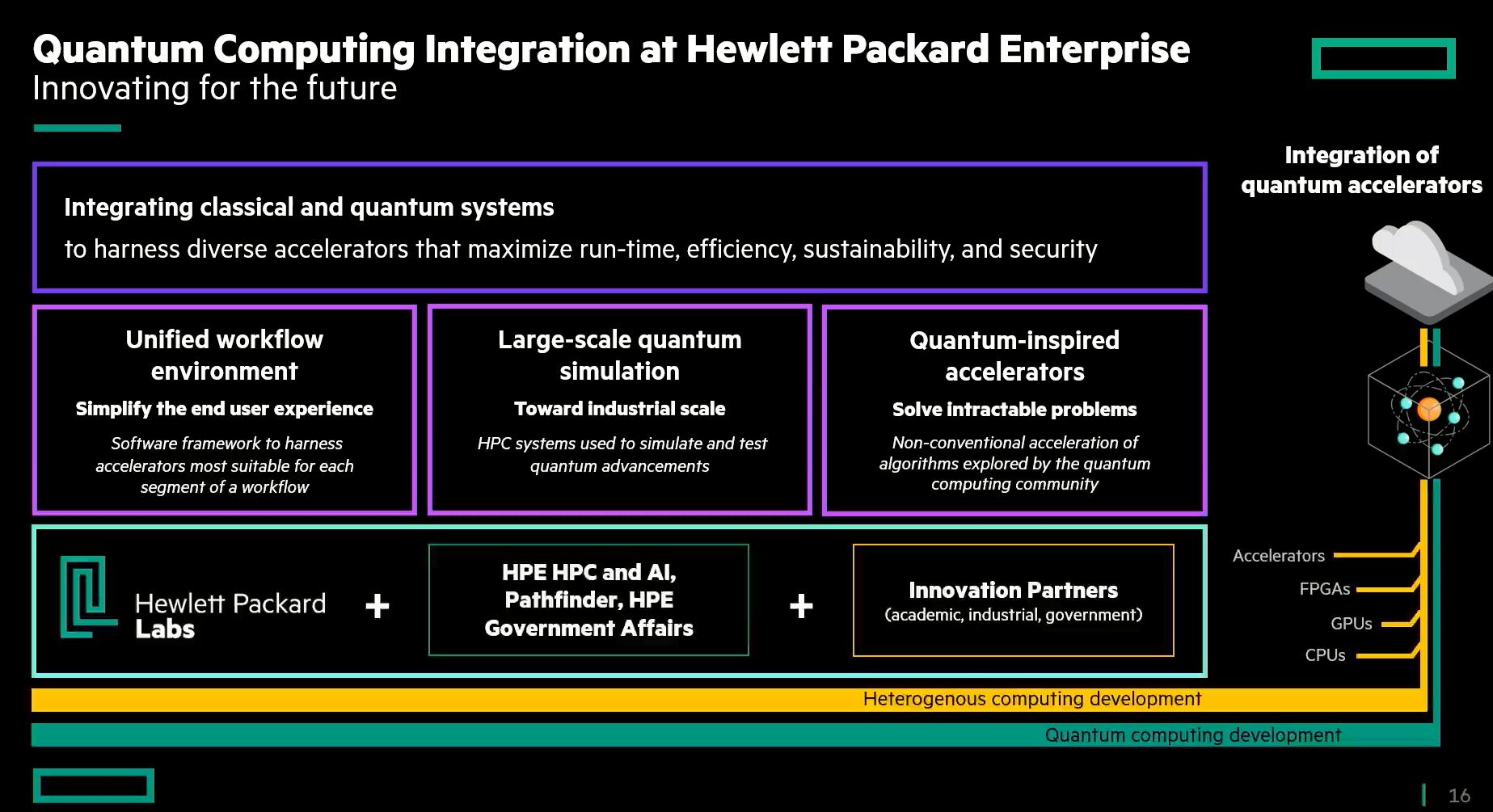

His architecture slide is worth checking out from a vision perspective.

Bresniker said HPE is betting that supercomputing will evolve with an architecture that includes CPUs, GPUs, various accelerators and quantum computing to tackle problems.

For now, quantum computing is worth experiments and use cases in select industries. TCS recently noted how it is using IBM Quantum infrastructure for financial advisor scenarios. Financial services and life sciences are obvious areas for quantum computing.

For now, quantum computing is clearly in the press release stage, but there seems to be consensus around the following:

- Quantum computing will likely be consumed through the cloud.

- Select industries should explore use cases.

- Key metrics on how to measure efficiency and performance are being debated.

- Quantum computing will be part of what's emerging as a hybrid supercomputing approach.

- Projections about how quantum computing will scale are often based on assumptions of breakthroughs. However, you can't predict breakthroughs.

In the meantime, enjoy the parade of quantum computing announcements flying by.