Rivian has new models planned and a $5 billion partnership with Volkswagen Group that may enable the electric vehicle maker to emerge as a top software-defined-vehicle provider. The journey for Rivian’s integrated vehicle stack includes a hefty dose of artificial intelligence (AI), machine learning (ML), and cloud computing.

The Rivian journey highlights how cloud and data transformations are required to take that next AI step. The payoff? VW initially will invest $1 billion in Rivian and then invest another $4 billion over time. In return, Rivian will develop software for its own vehicles as well as VW’s—as well as its hardware designs, electrical systems, and integrated platform largely powered by Amazon Web Services (AWS) and Databricks.

As the combined Rivian-VW fleet grows, these vehicles will provide more data that can then be used to train models, add new features, and improve efficiency. VW CEO Oliver Blume said in a statement that the Rivian partnership will lower costs, improve vehicle experiences, and strengthen “our technology profile and our competitiveness.”

For Rivian CEO RJ Scaringe, the VW partnership is a validation of the company’s strategy. Rivian has plans to launch its R2, R3, and R3X vehicles based on a new midsize platform starting in 2026. Rivian also launched its next-generation chargers and the second generation of its flagship R1S and R1T vehicles in June 2024.

While Rivian is focused on delivering new vehicles, becoming more efficient, leveraging scale, and reinventing driver experiences, there has been a lot of technology legwork behind the scenes. Here’s a look at Rivian’s plan and the data and cloud strategy that enables it.

Rivian’s Master Plan

During the company’s 2024 Investor Day in June, Scaringe talked about the transition to electric vehicles, building “highly compelling products,” and leveraging vertical integration and scale as Rivian moves from its first-generation vehicles to its second with R2 and R3. Rivian’s strategy is Apple-ish in that it deeply integrates hardware, software, and experiences powered by data, ML, and AI.

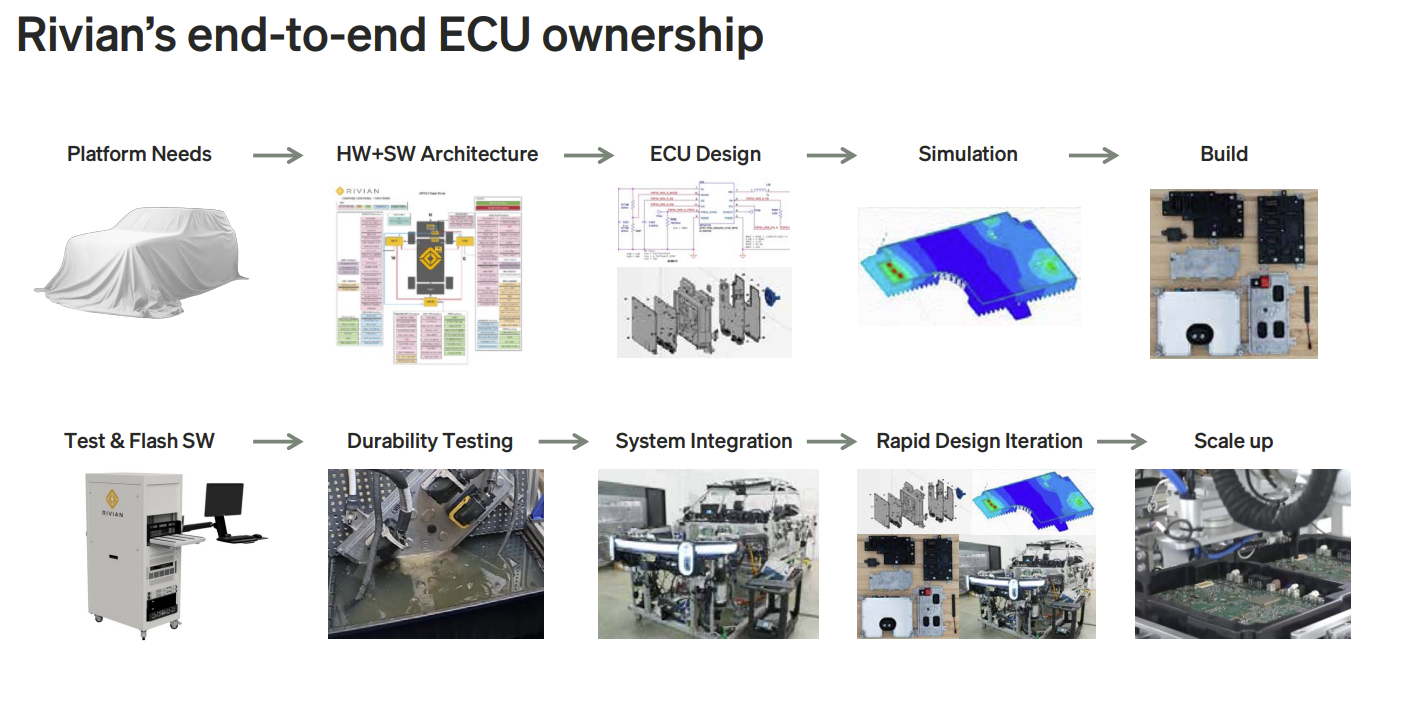

“From the very beginning, we said that we need to own the electronics in the vehicle—that allows us to own the network architecture, software stack, and hardware within the vehicle as it evolves,” Scaringe said. “It’s really important to control the full stack.”

Scaringe said the Rivian network includes its commercial vans as well as its consumer vehicles. The data provided by those vehicles influences how Rivian’s platform develops and simplifies everything from the operation of a Rivian vehicle to the customer experience. Rivian’s full-stack approach means it controls the camera hardware, radar systems, and data that ultimately trains AI models. “One of our big assets is a large fleet of vehicles—a growing fleet of vehicles that continue to get better. We train those platforms with very powerful compute and a really robust sensor set,” he said.

That data from Rivian’s fleet also enables the company to optimize everything from battery modules to electronics, drive units, and power trains. Ultimately, that optimization will lead to profitability. Rivian’s latest generation of vehicles will feature quad motors that are more efficient and save money across the company.

Rivian’s maintenance and service efforts also fuel the data flywheel. The company continues to build out its brick-and-mortar infrastructure, but most service actions are either over the air or via a mobile van.

According to Scaringe, “70% of our service actions happen with a mobile service that uses the diagnostics platform built into the vehicle and allows us to be highly predictive with what the vehicles need.”

If something is wrong in your vehicle, he continued, “we know about it. We can make sure we have the parts for it and we can then go to you, go to your house, go to your business, and take care of whatever service actions are needed. Today our service network is ramping, but over time this becomes a very powerful part of our business as well.”

Scaringe added that the mobile service effort enhances the customer experience. Rivian is also collecting data from charging networks to enhance uptime. Rivian’s software stack features a charging score to rate charging networks based on efficacy.

Rivian’s investor meeting was designed to highlight the company’s approach to AI and vertical integration, but also to outline its path to profitability by driving down the cost of bill of materials. In 2023, Rivian produced 57,232 vehicles and posted a net loss of $5.43 billion, an improvement compared to the 2022 net loss of $6,752 billion.

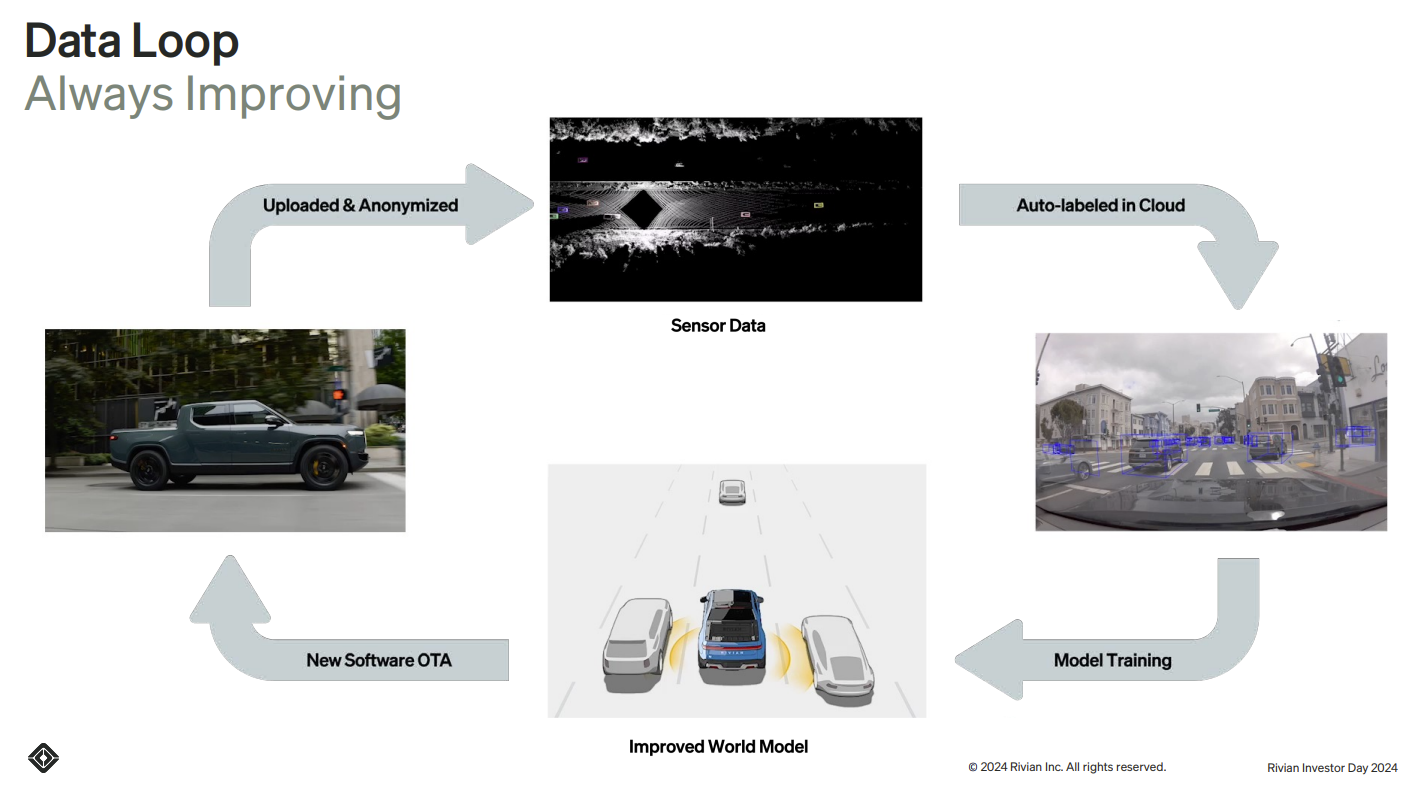

For Rivian to deliver a profit, it will have to leverage the data flywheel, AI-based driving experience, and autonomous technology it is creating (see Figure 1).

Figure 1. Rivian Continuously Updates Its Data to Train Models and Improve Customer Experiences

Source: Rivian

“When you think about these vehicles as being a series of models, you really want to be able to train these things end to end,” James Philbin, vice president of Autonomy and AI at Rivian, said. According to Philbin, supplier-based components don’t provide the data stream that Rivian-built software and hardware can. “We want the system to be simulated in on the cloud. The concept of vertical integration is even more important in autonomy. We want to be AI-first, using the rich, powerful models, using lots of data for training and leveraging our fleet,” he said.

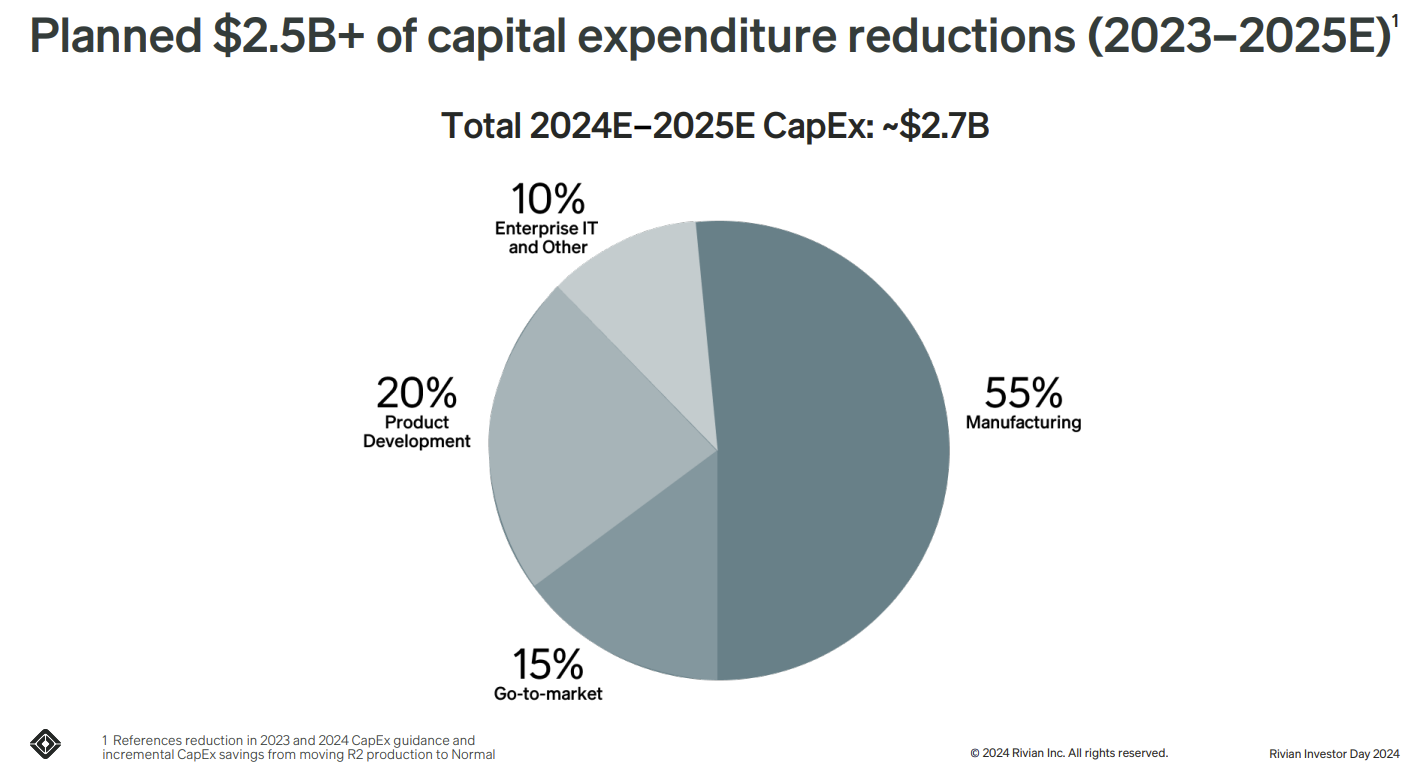

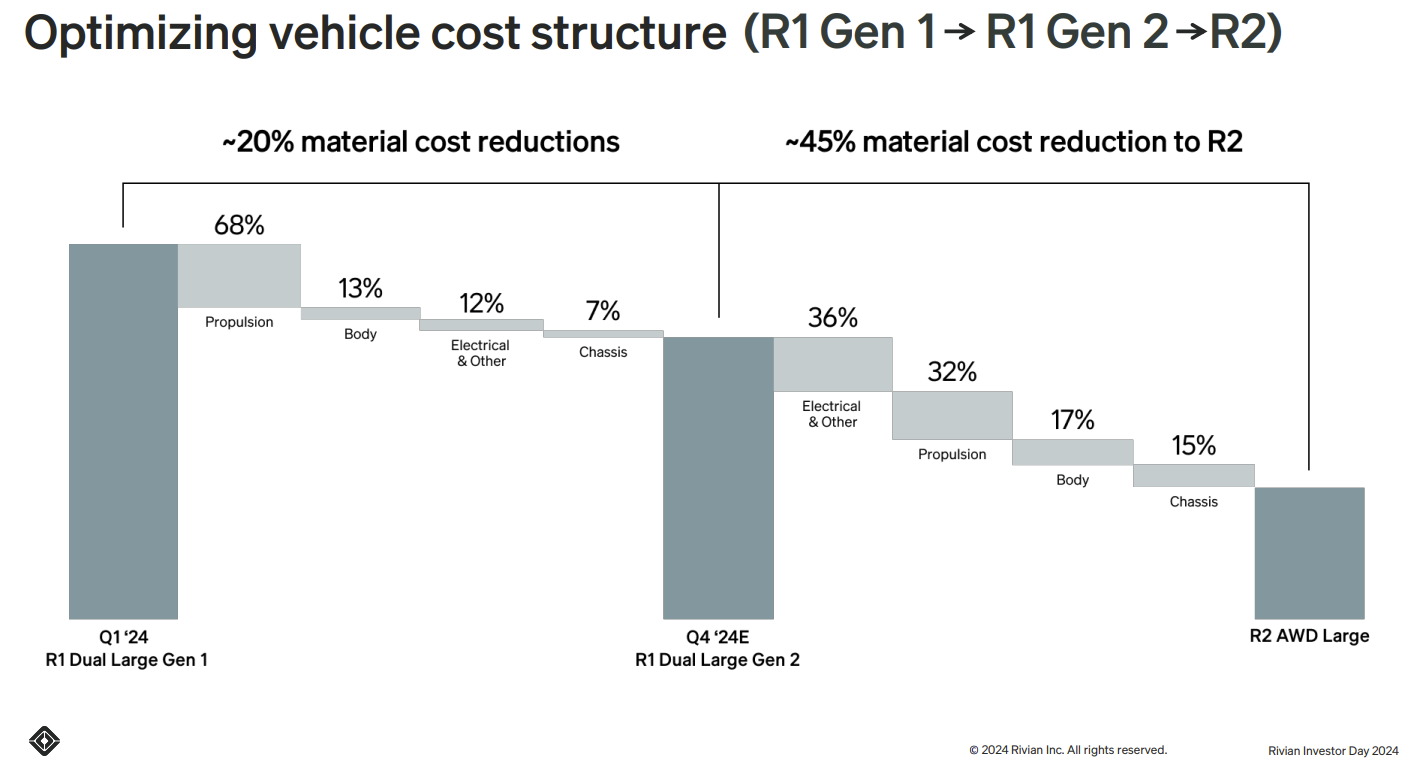

The company is expecting to produce 57,000 units in 2024 and reduce its material costs by about 20% as it transitions to its Gen2 platform. Rivian expects lower material costs will bring it to positive gross profit per vehicle in the fourth quarter of 2024. The company is targeting positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in 2027, and its partnership with Volkswagen reinforces the company’s balance sheet with a $5 billion investment (see Figures 2 and 3).

Figure 2. Rivian Is Planning to Aggressively Reduce Its Costs to Drive to Profitability

Source: Rivian

Figure 3. Rivian Is Focusing Heavily on Driving Costs Down for Manufacturing Its Vehicles

Source: Rivian

80% of Rivian’s Software Is Built In-House

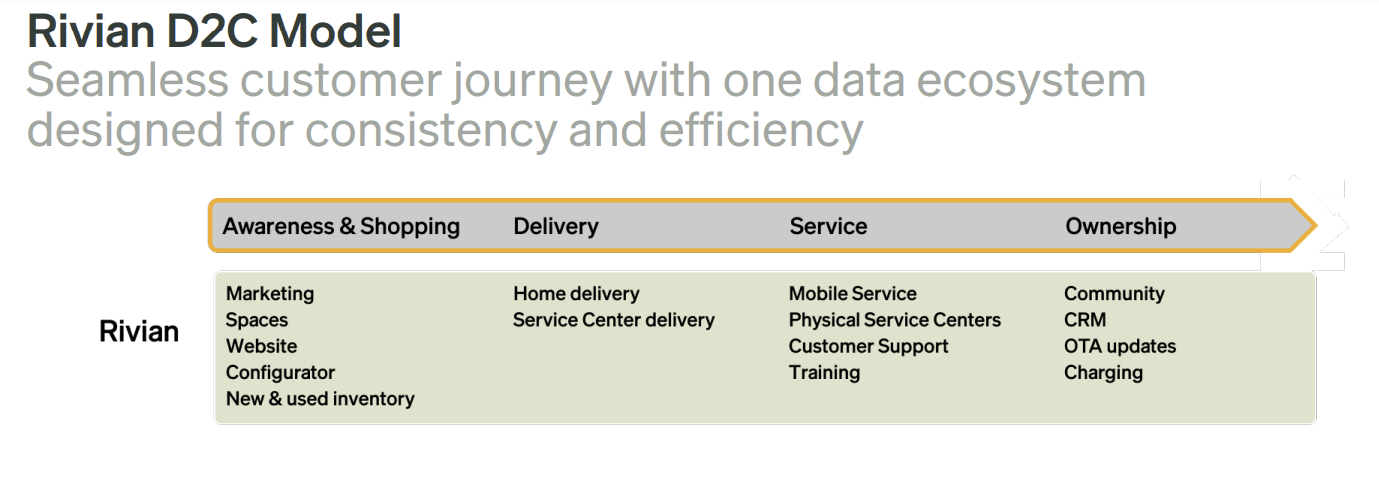

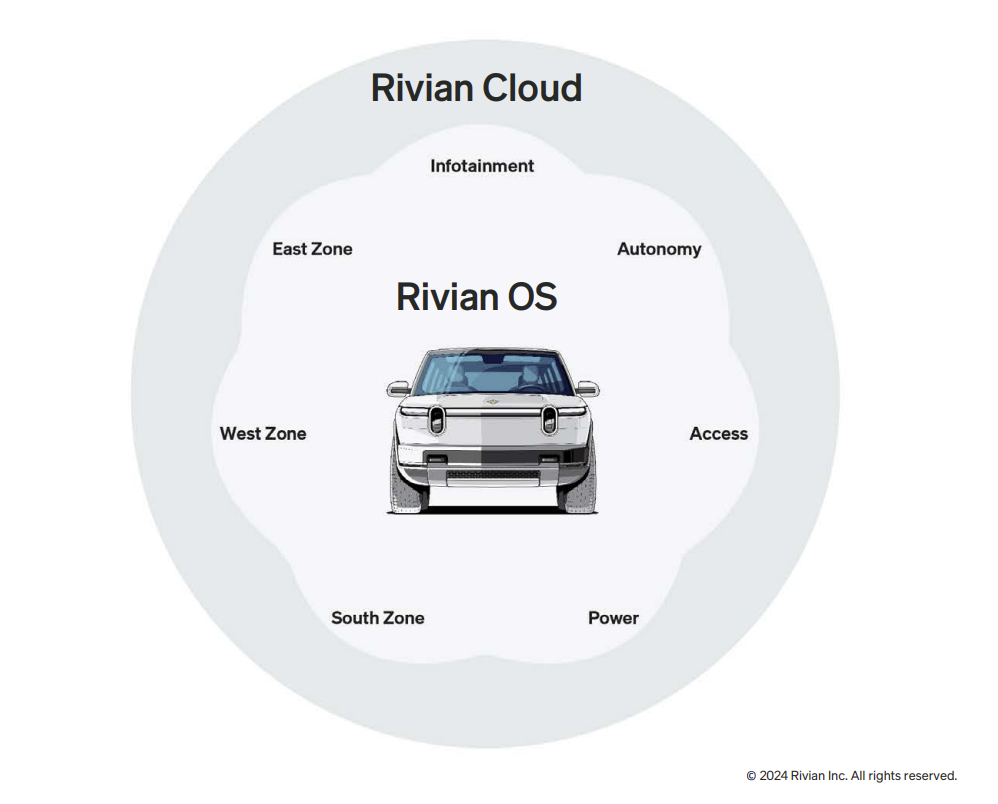

According to Wassym Bensaid, Rivian’s chief software officer, the company builds 80% of its software, and there’s a good reason for that: The Rivian experience is driven by software. To drive the point home, Bensaid opened his Investor Day presentation highlighting a customer that goes to the gym three times a week, wakes up at 7 a.m., and walks to her car to find it configured to her preferred temperature and preferred music service. All she did was pick up her smartphone.

That 30-second experience would have required more than 30 suppliers, software interfaces, and integration points, Bensaid said. To change the experience would require more coordination with all of those suppliers. “With the vertical integration we have between hardware and software, we developed a much cleaner and simpler architecture with the powerful compute we have,” he said. “We developed an end-to-end integrated and connected platform with more than 80% of the software done in-house. We orchestrate the choreography of all these features.”

Figure 4. Rivian’s Software Platform Is Designed to Work Across Its Fleet, Including Yet-to-Be-Named Vehicles

Source: Rivian

In other words, Rivian is looking to perfect the software-defined vehicle (see Figures 4 and 5).

Bensaid outlined the following:

- Rivian’s architecture is scalable and modular.

- There are multiple abstraction layers for different hardware configurations.

- The low-level architectures run on the same binary code across the Rivian fleet.

- Rivian’s core software foundation can create multiple variants. That software architecture was one of the big reasons Volkswagen partnered with Rivian.

- AI and models are pervasive across the company, including manufacturing, supply chain, commercial, and direct-to-consumer experiences.

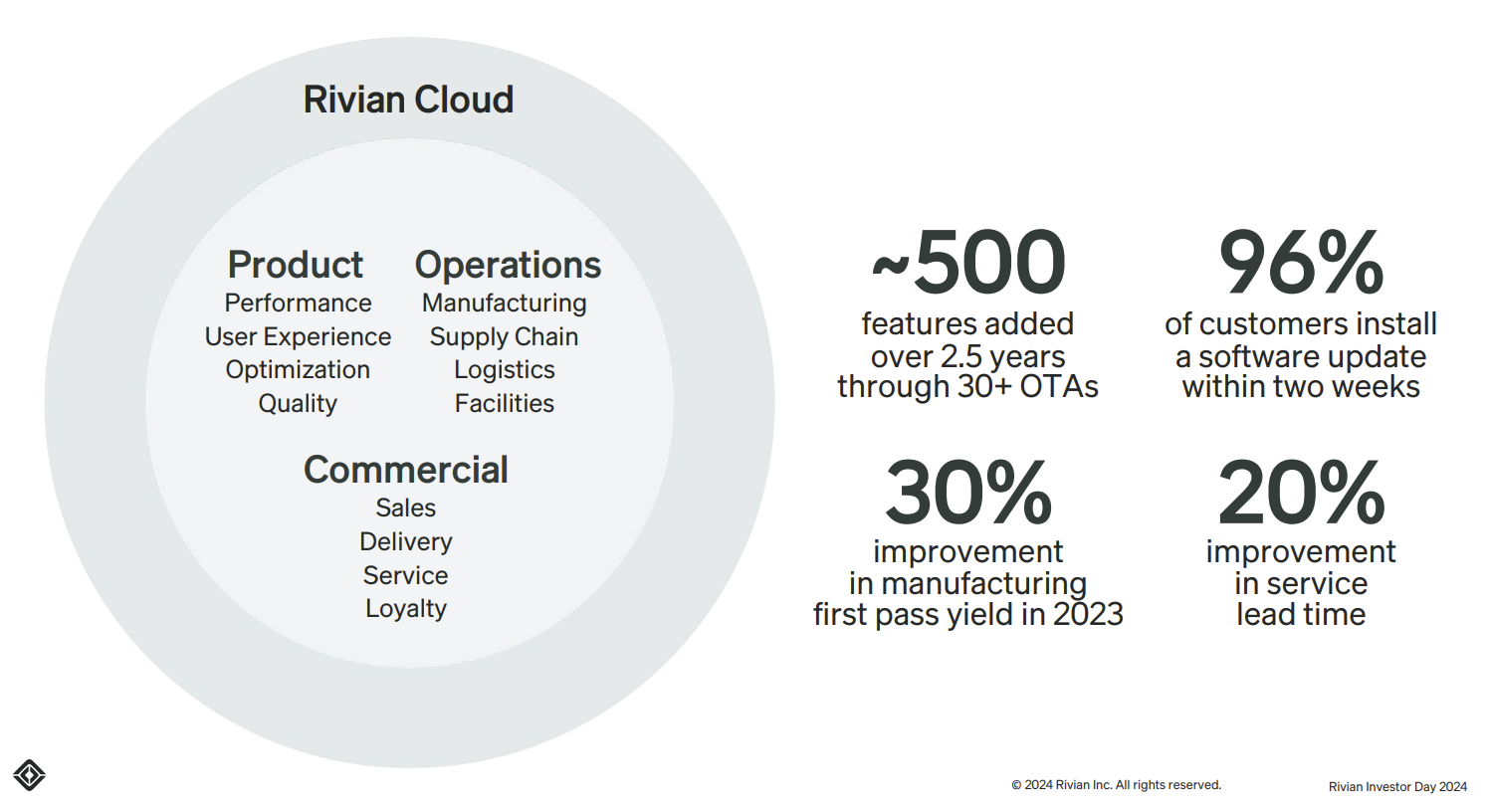

- Sensor data is fed into Rivian Cloud, with vehicle features updated over the air.

“The product today is very different than the product our customers bought two years ago,” Bensaid said, “and the product in two years will also be very different and much improved versus where we are today.”

This evolution is possible due to a connected data platform built on Databricks and AWS. “The connected data platform is at the heart of our entire software stack, and it’s as important as the embedded software,” Bensaid said. “We can run smart workloads in the cloud. In some cases, once they mature through machine learning, we can move them to the edge. We’re building this data foundation with security and privacy in mind, and with the anonymized data, we can continue to influence the product over time. With the collaboration with the Volkswagen Group, we will have much more scale, and this data platform will become even more important.”

Ultimately, Rivian has built a vehicle operating system that’s embedded when a car moves through the assembly line. Rivian creates a “clean sheet diagnostic solution” that ensures reliability and safety and enables servicing later. This system also can find issues on the line so Rivian can fix them before a vehicle leaves the factory. “Instead of having a defect escape and go to the end of the line—which would take more time and money to disassemble the vehicle—we’re able to detect that as the vehicle is moving through the line. It’s a massive efficiency unlock for us, and it’s a higher-quality bar for our vehicles,” Bensaid said.

Figure 5. Rivian’s Cloud Infrastructure Has Sped Up the Company’s Software Release Cycle

Source: Rivian

The software-defined vehicle approach also impacts the customer experience, Bensaid explained. With telemetry and remote diagnostics, service technicians don’t need to physically inspect vehicles. If over-the-air updates don’t work, Rivian can deploy a mobile service truck.

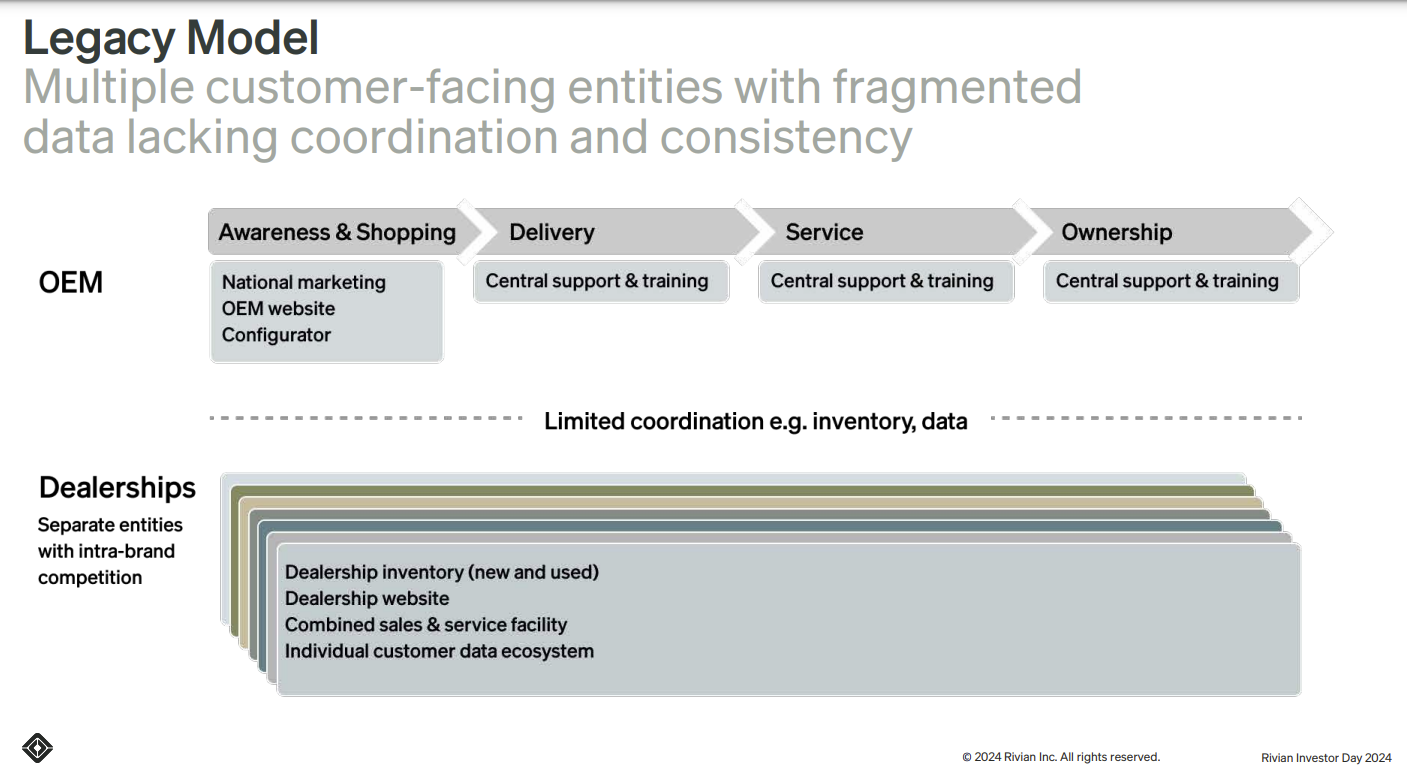

“This is a massive efficiency saving when you compare that with the legacy auto model where, for any issue that you have, you need to bring the car back to the dealership. And with the data platform that we have and integration of AI, we can now unlock many more capabilities,” Bensaid said (see Figures 6 and 7).

Figure 6. According to Rivian, the Legacy Model in Auto Manufacturing Doesn’t Scale Well for Software-Defined Vehicles

Source: Rivian

Figure 7. Rivian’s Model Is to Vertically Integrate the Entire Value Chain for Simplicity

Source: Rivian

Rivian’s ability to create a software-defined vehicle relies on integrated hardware and a bevy of sensors and vehicle compute. Vidya Rajagopalan, vice president of Engineering and Hardware at Rivian, said Rivian has decided to build its own hardware purpose-built for the company’s vehicles, with every model today and going forward built on the same scalable hardware stack. “We use the exact same hardware platform on all of them. The reason we do that is we don’t want unwanted features. We’re not buying something off the shelf that has features for a broad audience,” she said.

Rajagopalan added that Rivian is also building its own hardware stack to eliminate margin stacking from suppliers. “We were very clear that we were not going to follow that legacy philosophy of hardware for really small pieces and small tasks,” Rajagopalan said. “Not only does that approach add cost, but it also creates huge complexity in software.”

According to Rajagopalan, Rivian is using one electronic control unit (ECU) per broad function category (see Figure 8). Typically, ECUs are used for a particular function such as thermal management, body controls, wipers, door handles, and other functions. Rivian has reduced the number of ECUs from 17 to 7.

Figure 8. Rivian Has Dramatically Simplified Its Electronic Control Unit Systems

Source: Rivian

In autonomy, Rivian has merged four different ECUs with one using Nvidia Drive and upgraded multiple sensors with high-speed interfaces. “We wanted to put the best sensing out there because we know in the AI world it’s really important that you get data for training. We also don’t want to keep upgrading sensors, because then your data becomes stale,” Rajagopalan said.

Going forward, Rajagopalan said, Rivian will continue to consolidate and optimize ECUs to lower costs and gain supply chain leverage that will only be improved with the VW partnership.

AWS and Databricks

At the Databricks AI Summit in 2023, Rivian’s Bensaid outlined the company’s data strategy.

Bensaid said Rivian initially struggled with data silos and multiple systems to the point that the bottleneck became the company’s data strategy.

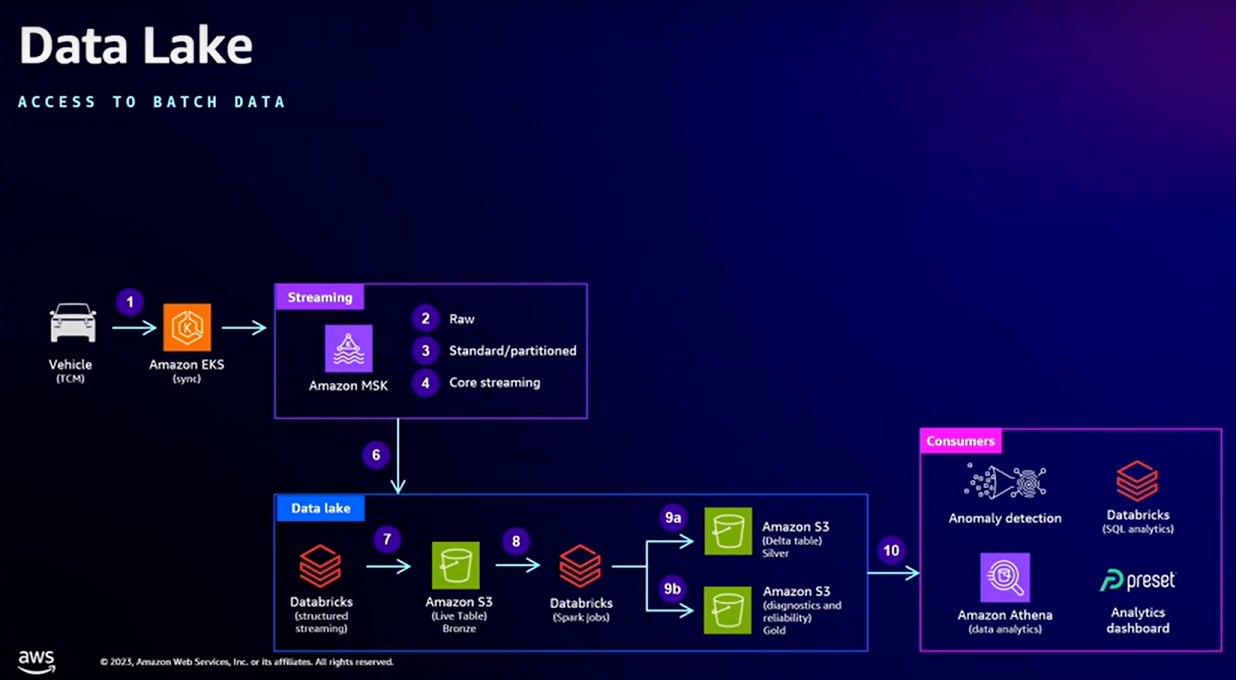

As a result, Rivian used Databricks’ Lakehouse platform to build a new architecture on top of its data lakes. Databricks’ Unity Catalog is used to create one version of the truth.

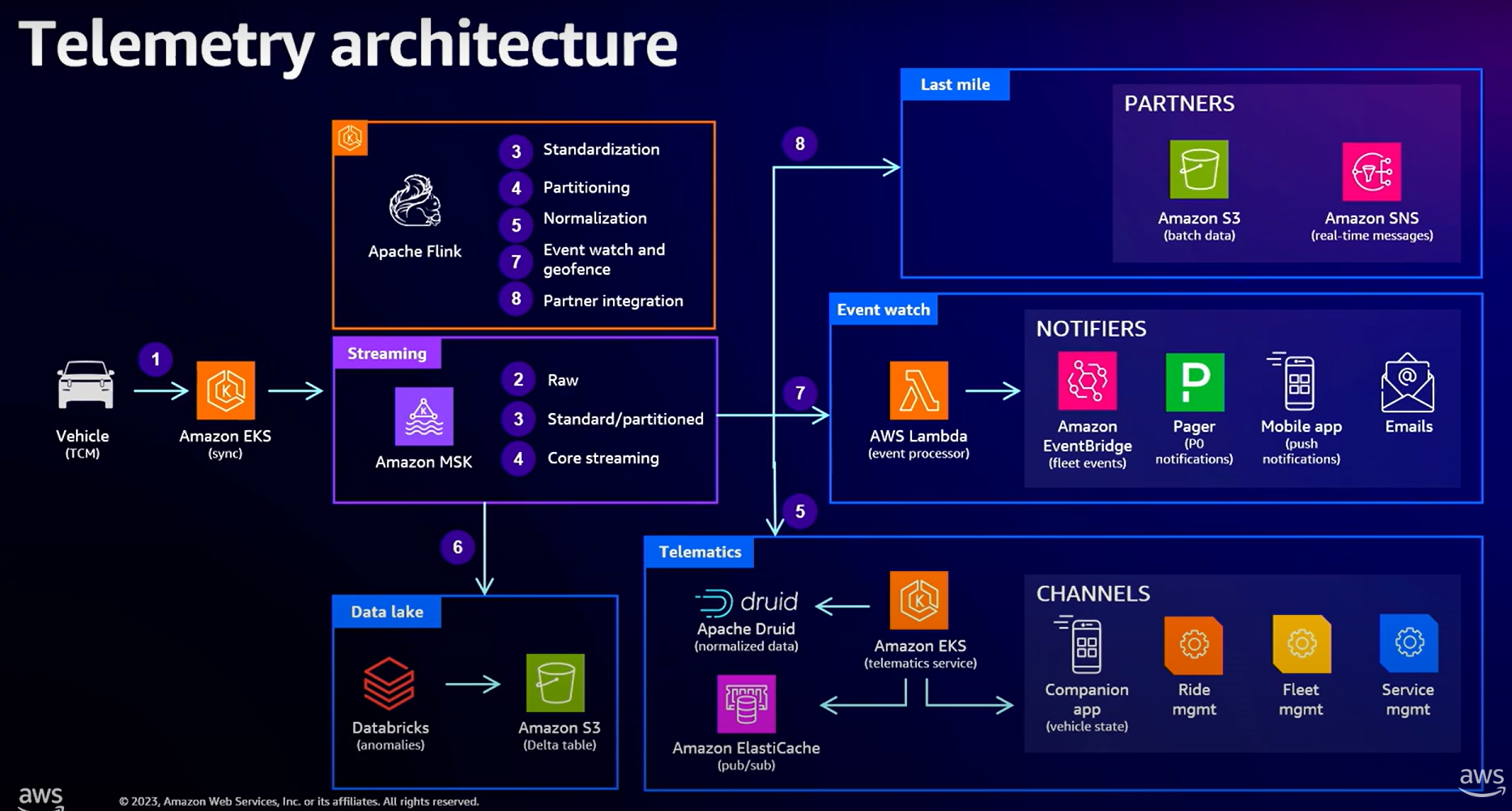

Databricks is then connected to multiple AWS services to round out Rivian’s cloud stack. At AWS re:Invent 2023, Rivian’s Anirban Kundu, principal engineer, and Rupesh More, staff engineer, walked through the AWS stack and how it connects to Databricks.

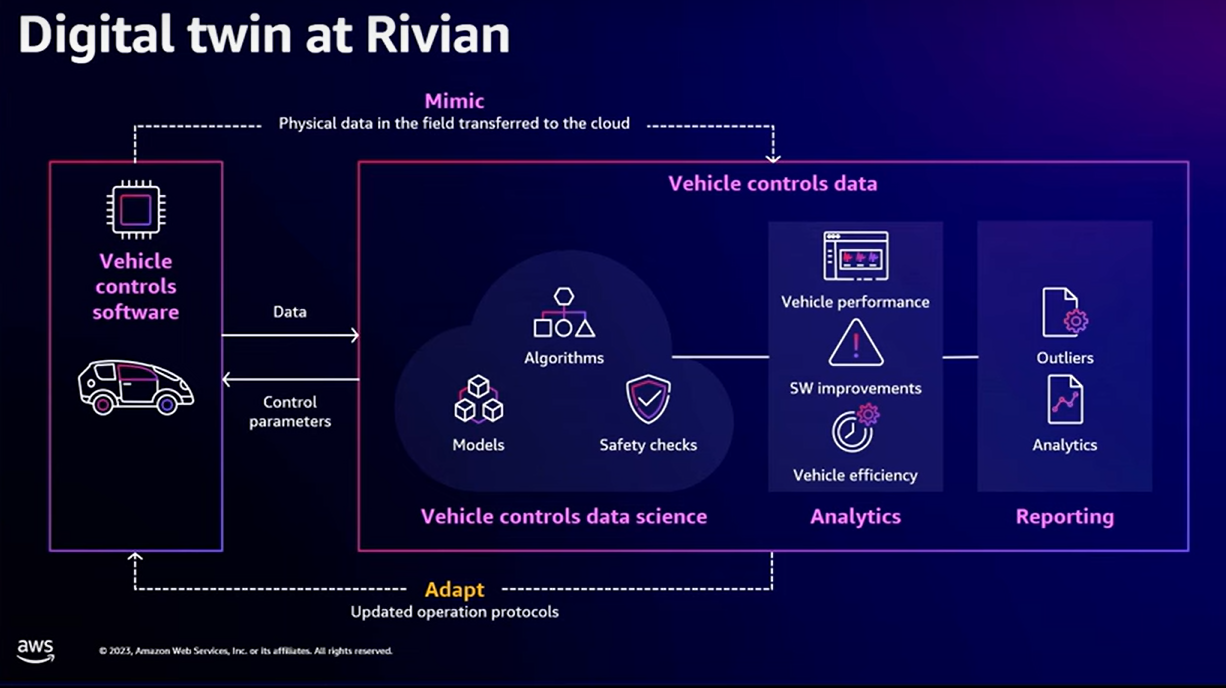

“One use case at Rivian is the digital twin. The intent is to model the vehicle’s behavior on the cloud, using its vehicle data,” Kundu said (see Figure 9). “At any point in time there are hundreds of algorithms at play in the vehicle.”

Figure 9. Rivian Creates Digital Twins of Its Vehicles

Source: Rivian

Vehicle data ultimately lands in the cloud, where it is parsed, partitioned, anonymized, sanitized, and put into standard datasets. Kundu said Rivian takes in several petabytes of vehicle data through its ingestion pipelines and analytics via AWS services (see Figure 10).

“We don’t see the vehicles as independent entities. They’re extensions of what you can do via the cloud,” Kundu said.

Figure 10. A Look at How Rivian Leverages AWS

Source: Rivian

Rivian’s More noted that the raw data from AWS is streamed into Databricks architecture to create clean datasets that are then transformed into custom tables used for analytics. There’s also an event-watch architecture, which is used to surface anomalies in cabin temperature and critical signals. These events are processed using AWS services to send notifications (see Figure 11).

Kundu said the AWS and Databricks architecture must scale going forward, given that Rivian expects to have about 1 million vehicles in the fleet in the next few years as well as more data, more applications, and more use cases.

Figure 11. Rivian Blends Its AWS and Databricks Infrastructure

Source: Rivian

Autonomy, AI, and Beyond

According to Philbin, Rivian has created a “perception stack” that’s fed data from 11 cameras with 55 megapixels of real-time imaging, five radar systems with 1,000 feet of forward-facing detection range, and overlapping sensors for redundancy.

“The perception and prediction stack is really the core of the new platform,” Philbin said, who previously worked at Waymo. “This is a large, deep machine learning model that takes all of the sensors together in combination and generates this world model output.”

Radar system and camera data is fed into a neural network that uses a transformer network to translate the information into real-world models of objects, maps, predictions, and ultimately behaviors. Rivian’s transformers operate similarly to the way large language models work.

Rivian will be able to leverage these systems to make predictions about driving behaviors, Philbin explained (see Figure 12). “The predictions are how we think agents are going to react in the near future,” he said. “We want to add to this same model so it can learn driving behaviors from real data for planning.”

The key is to learn from human driving behaviors and incorporate the rules of the road. “We don’t want our autonomy stack to learn bad behaviors,” Philbin said.

Figure 12. Rivian’s Cloud and OS Are Designed to Create a Seamless Flow of Data

Source: Rivian

Philbin also said that Rivian has added abstraction layers to account for APIs in different chips and various sensors to ensure independence from any one compute platform or provider. “We have that independence from any particular compute platform. And that extensibility allows us to cover a wide range of vehicle platforms and more in the future,” he said.

Add it up, and Rivian’s bet is that its data loop will drive autonomy features that will differentiate the company in the future. “Autonomy is a key competitive and street-strategic advantage for Rivian,” Philbin said. “We think that as the systems get better and better and better over time, customers are expecting more and more from the autonomous systems available in their vehicles.”

What You Can Learn From Rivian

- Rivian’s AI strategy and future autonomy platform builds on a cloud and data strategy that can scale. Without those investments, Rivian would look more like a legacy automaker.

- Customer experience is everything. Rivian’s integrated stack approach begins and ends with the customer experience.

- You can’t have good customer experience, improve margins, and leverage your unique advantages without a data flywheel.

- Given electric vehicles are a relatively new category, the technology is evolving, and Rivian must build its own platform. Many enterprises are realizing that they’re going to need to build applications versus buying off the shelf, where suppliers are more concerned about their margins than their customers’.

Get this story as a PDF.

Get this story as a PDF.