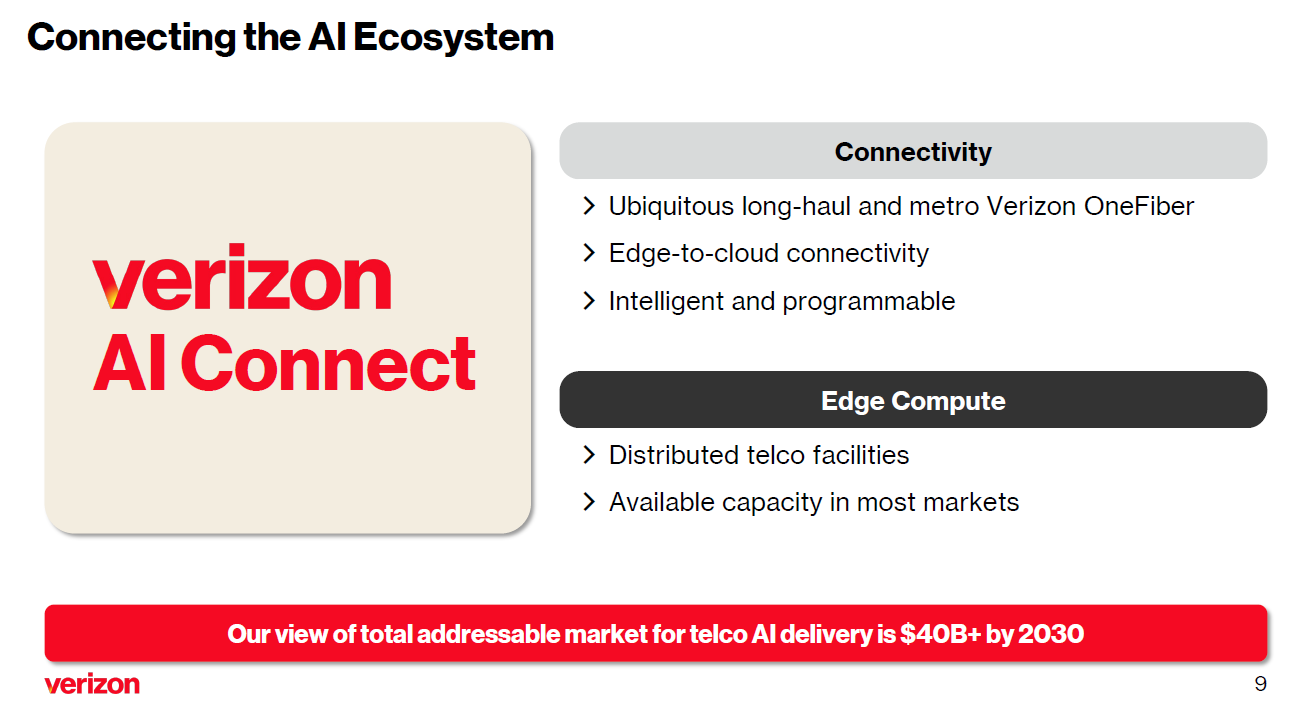

Verizon outlined Verizon AI Connect in a strategy designed to put its network, compute and edge computing infrastructure in the middle of artificial intelligence inferencing workloads.

The company announced AI Connect along with its fourth quarter earnings. Verizon said it has Google Cloud and Meta as key customers for AI Connect.

With Verizon AI Connect, the company is looking to court hyperscale cloud providers and large enterprises with an edge to cloud network. AI Connect will feature Verizon's 5G network, high-speed fiber connectivity, edge locations and power and cooling.

Verizon added that it is looking to expand its AI efforts via partnerships with Nvidia, Vultr, which is a GPU-as-a-service provider, Google Cloud and Meta.

"Our industry sits at the center of the next wave of innovation as AI transforms how consumers and businesses operate," said Verizon CEO Hans Vestberg. "Our network assets and capabilities position us uniquely in this evolving landscape."

- GenAI's 2025 disconnect: The buildout, business value, user adoption and CxOs

- Multi-cloud computing isn't 'a bunch of separate clouds'

- AI data center building boom: Four themes to know

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

Vestberg said:

"If you think about where we are on generative AI today, today, it's large language modules that are trained at large data centers, and that requires enormous capacities. Over time, that will come much closer to the edge of the network, both for applications, but transport cost, and latency in some cases. This is creating an opportunity for us and has already created an opportunity as we had revenue and EBITDA impact in the fourth quarter. We are now looking into how we can use our assets and our capability to serve this market when it comes to the next step of generative AI."

Verizon's AI Connect effort is designed to utilize the company's existing assets including its fiber buildout and long-haul network to handle AI workloads. In addition, Verizon's Converged Intelligent Edge Network will play a role.

The biggest argument for Verizon's AI Connect is that the AI infrastructure being built will need networking and connectivity to data centers and the edge.

Kyle Malady, CEO of Verizon Business Group, said:

"As we move through our network transformation work, we will continue to free up more resources that could be made available for AI Connect. In addition, we have between 100 and 200 acres of undeveloped land, some currently zoned for data center build and much of it in prime data center-friendly areas."

In addition, Verizon has $1 billion in backlog just for its existing infrastructure, said Malady.

Verizon also reported fourth quarter and 2024 earnings.

The company reported fourth quarter earnings of $5.1 billion, or $1.18 a share, on revenue of $35.7 billion, up 1.6% from a year ago. Non-GAAP earnings were $1.10 a share.

For the year, Verizon reported earnings of $4.14 a share on revenue of $134.8 billion, up 0.6% from a year ago.

By the numbers:

- Verizon reported fourth quarter wireless revenue of $20 billion, up 3.1% from a year ago.

- The company had 568,000 postpaid net phone additions in the fourth quarter.

- Broadband net additions were 408,000 in the fourth quarter.

- Verizon added a net 373,000 fixed wireless access subscribers for a total of 4.6 million fixed wireless subscribers.

As for the outlook, Verizon is expecting total wireless service revenue growth of 2% to 2.8% and adjusted earnings per share growth of 0 to 3%.