Uber reported better-than-expected second quarter results and credited "algorithmic improvements" for better unit economics.

CEO Dara Khosrowshahi referred to algorithm improvements and how they were driving better economics and customer experiences. Although Uber is known for its delivery and ride services, it is really a data company that can extend into multiple markets.

- How Uber's tech stack, datasets drive AI, experience, growth

- Uber aims to press its 'data advantage' for AI, model training

Khosrowshahi said:

"We continue to fundamentally improve unit economics as we lower cost per transaction through algorithmic improvements and more efficient batching; grow advertising revenue; increase multi-product usage; improve promotion efficiency; and deliver fixed-cost leverage. Every one of these levers has a specific technical and operational roadmap behind it that remains promising, allowing us to generate profits that we can reinvest back into growth and service quality, while improving margins. This operational formula is working incredibly well and has years of runway ahead of it."

Uber reported second quarter net income of $1 billion, or 47 cents a share, including a $333 million profit due to equity investments. Revenue for the quarter was $10.7 billion, up 16% from a year ago. Wall Street was looking for second quarter earnings of 31 cents a share on revenue of $10.57 billion. It's unclear whether estimates included the equity gains for the quarter.

By the numbers for the second quarter:

- Uber's monthly active platform consumers were 156 million, up from 137 million a year ago.

- Uber completed 2,765 trips in the second quarter, up from 2,282 a year ago.

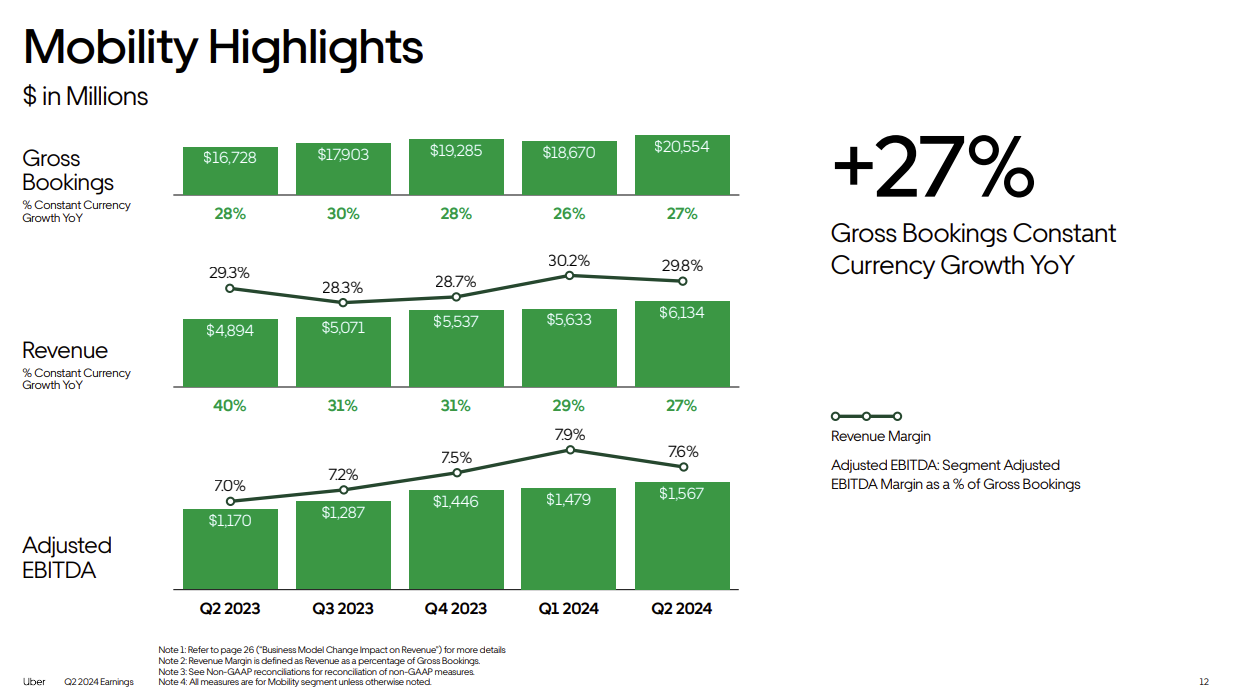

- Mobility revenue in the quarter was $6.13 billion, up 25% from a year ago.

- Delivery revenue was $3.3 billion, up 8% from a year ago, and freight revenue was flat at $1.27 billion.

- Uber advertising exited the second quarter at a revenue run rate topping $1 billion.

As for the outlook, Uber projected third quarter gross bookings of $40.25 billion to $41.75 billion, up 18% to 23% from a year ago, with adjusted EBITDA of $1.58 billion to $1.68 billion, up 45% to 54% from a year ago.

Going forward, Khosrowshahi said Uber is focused on launching new services on its platform including Uber Caregiver, scheduled UberX Share rides and Uber Shuttle.

Examples of Uber's algorithm improvements include:

- New price matching algorithms that improve reliability at airports with landing notifications, clear directions and improvements on in-app experiences.

- More efficient batching of rides and multi-product usage.

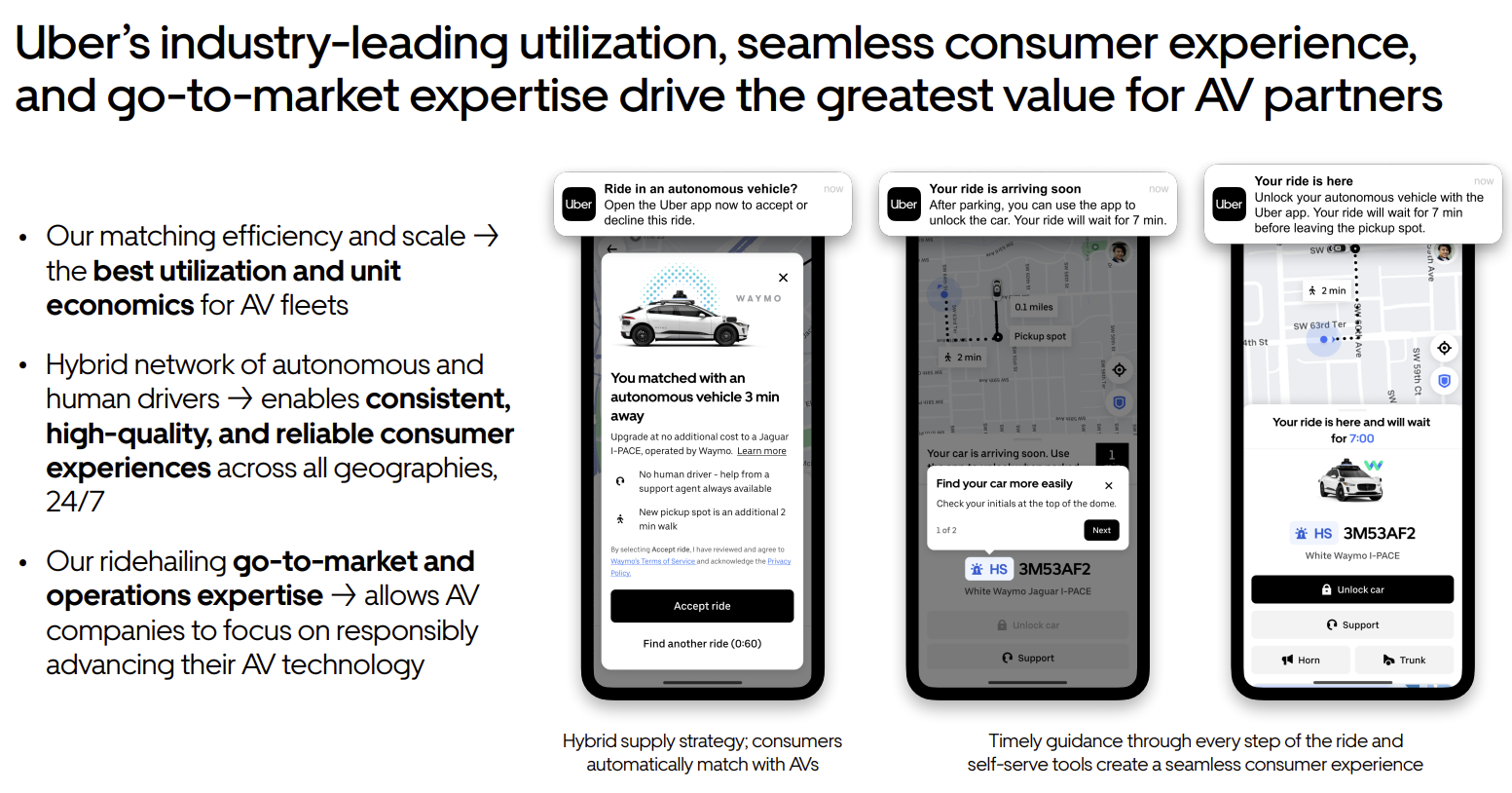

- Managing utilization of autonomous vehicles to smooth out weekly trends.