Uber addressed long-running concerns about its autonomous vehicle strategy with a plan that revolves around partnering and leveraging its data platform to manage workloads and rides.

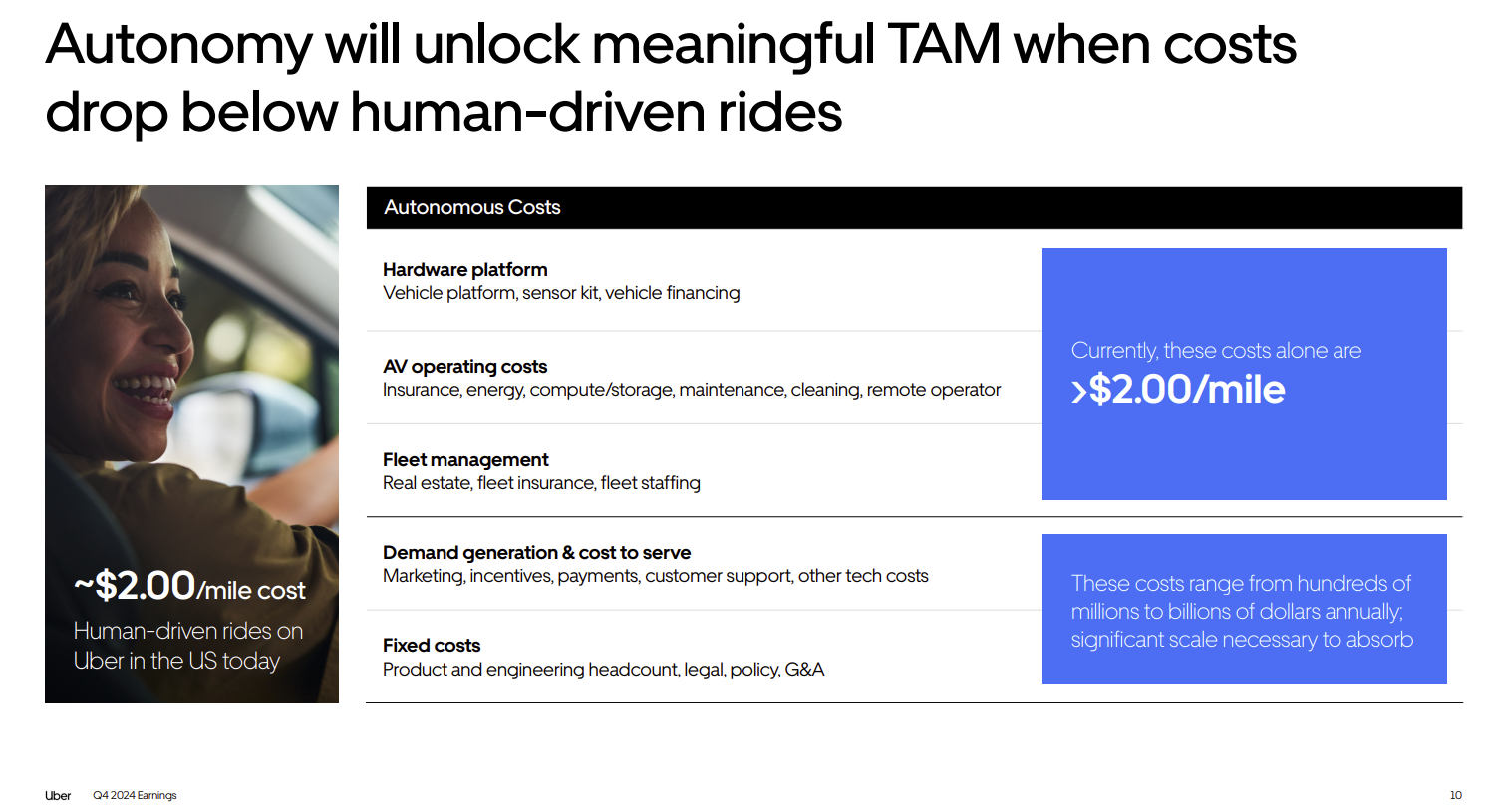

However, Uber noted that autonomous vehicles (AVs) needed a lot of things to go right to scale adequately. The biggest hurdle is costs. AV rides need to drop below what it costs a human to shuttle you place to place.

Speaking on the company's fourth quarter earnings conference call, Uber CEO Dara Khosrowshahi said AV costs including hardware such as vehicle and sensor kit, operating costs with compute, storage and maintenance and fleet management cost more than $2 million a pile. Those costs don't include demand gen, marketing, payments and cost to serve. Humans rides are about $2 a mile.

Khosrowshahi said 2024 was a turning point for AV technology as Waymo, WeRide, Pony and Baidu made self-serving rides to the public. Other players are likely to follow. The big question for Uber was whether it would get disrupted. Khosrowshahi outlined many threads worth considering:

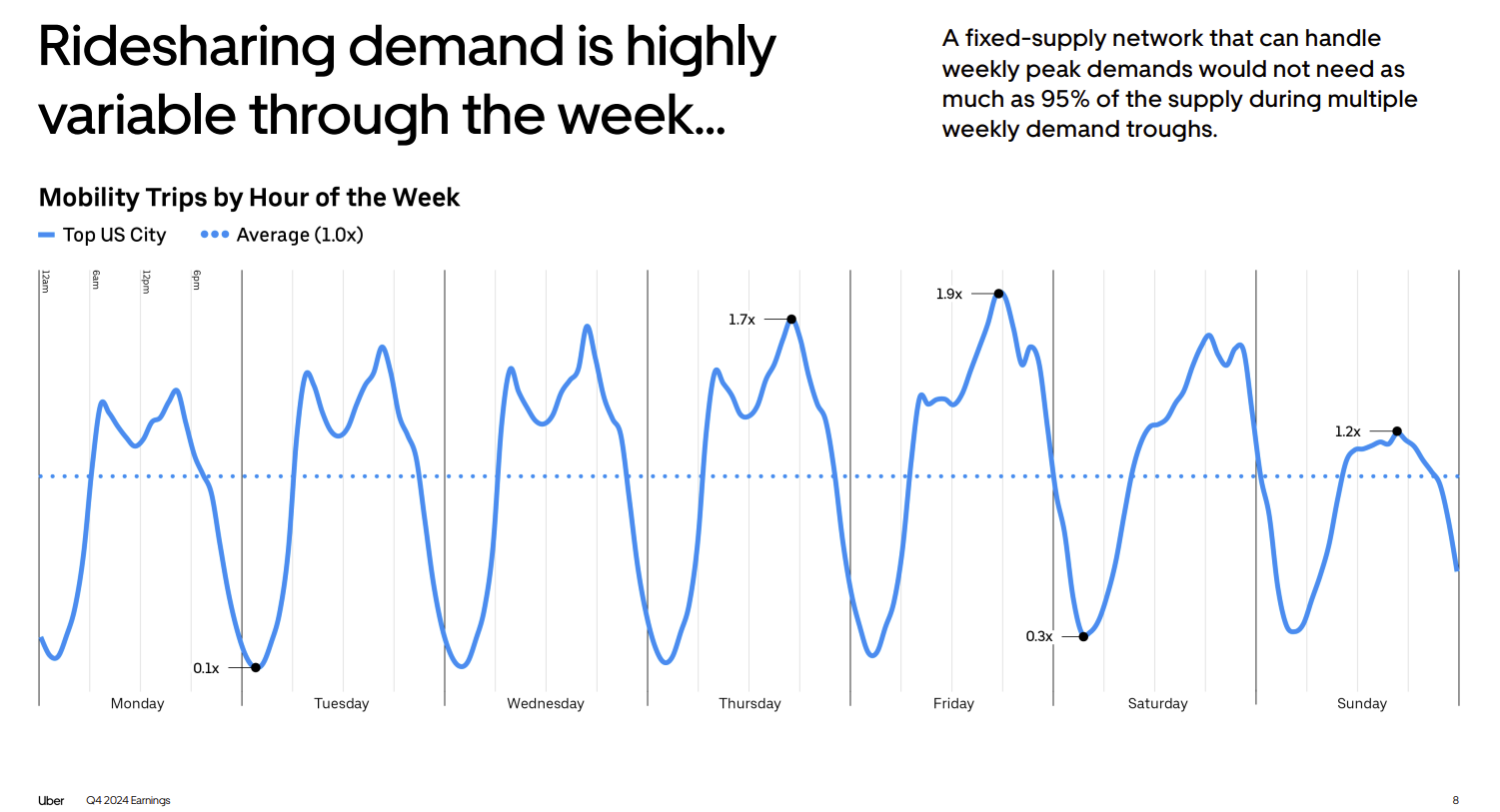

"Even as we see AV technology advancing, we expect AV commercialization will take significantly longer. Several pieces of the go-to-market puzzle still need to come together, including: a consistently super-human safety record; enabling regulations; a cost-effective, scaled hardware platform; excellent on-the-ground operations; and a high-utilization network that can manage variable demand with flexible supply.

Every one of these five pieces must work in concert, or the puzzle falls apart. For example, even the lowest-cost AV fleet will struggle to generate revenue if its vehicles are not highly utilized. And even a well-utilized but fixed fleet will struggle to meet consumer demand at peak times."

Uber obviously sees its role in at the application and data layer of that AV stack. The plan is simple and on brand: Leverage its data platform and AI to manage rides, supply and demand and continually optimize.

- How Uber's tech stack, datasets drive AI, experience, growth

- Uber aims to press its 'data advantage' for AI, model training

Khosrowshahi made the following points about the moving AV parts.

- Safety will have to surpass what humans can do for mass adoption. He said Waymo is a safety leader with its transparency, but multiple tech platforms and approaches will create more risks.

- Regulations are fragmented across states and a national framework in the US for AV testing and deployment would be welcome. International markets such as Abu Dhabi may move faster.

- The software stack from auto OEMs has been slow. Without OEMs, it will be hard to scale AVs. AV companies have retrofitted traditional vehicles with sensors that mean costs of more than $200,000 per vehicle. Costs need to come down. It is likely that all new vehicles will be sold with L4-capable software and that will increase supply.

- Fleet management and operations. Uber said an average AV can run as much as 100,000 a year. That scale means charging and service costs will increase. Uber sees a role in managing cleaning, parking and operational issues such as fare disputes, stranded vehicle rescue and insurance claim resolutions.

- Utilization. If all of the pieces of the AV puzzle fall into place, AV operators will need to manage supply and demand. Ride demand patterns fluctuate and AV vendors will struggle meeting weekly peaks and downtime.

"Given the scale of the Uber platform, and human drivers’ ability to dynamically fulfill demand spikes—and take a break during demand troughs—partnering with Uber allows AV players to move much faster than they could on their own. This fact gives us confidence that the Uber network, with a hybrid of AV and human drivers, will deliver the highest asset utilization and revenue generation opportunity for our partners," said Khosrowshahi. "We are spending an enormous, yet appropriate, amount of organizational energy to execute on our AV strategy. We will have much more to share through the year, starting with our public launch with Waymo in Austin next month and Atlanta this summer."

In other words, Uber's plan is to plug into those AV networks just like it does for human drivers and then adding support, technology and payments to the stack.

While Uber's AV chat was the most notable, the company's fourth quarter results were solid. The company reported fourth quarter earnings of $6.9 billion, including a tax valuation release and unrealized gains from investments, on revenue of $12 billion, up 20% from a year ago.

Gross bookings in the fourth quarter were up 18% to $44.2 billion. Uber delivered 3.1 billion trips in the fourth quarter, or 33 million trips per day.

For the first quarter, Uber projected gross bookings growth of 17% to 21%.