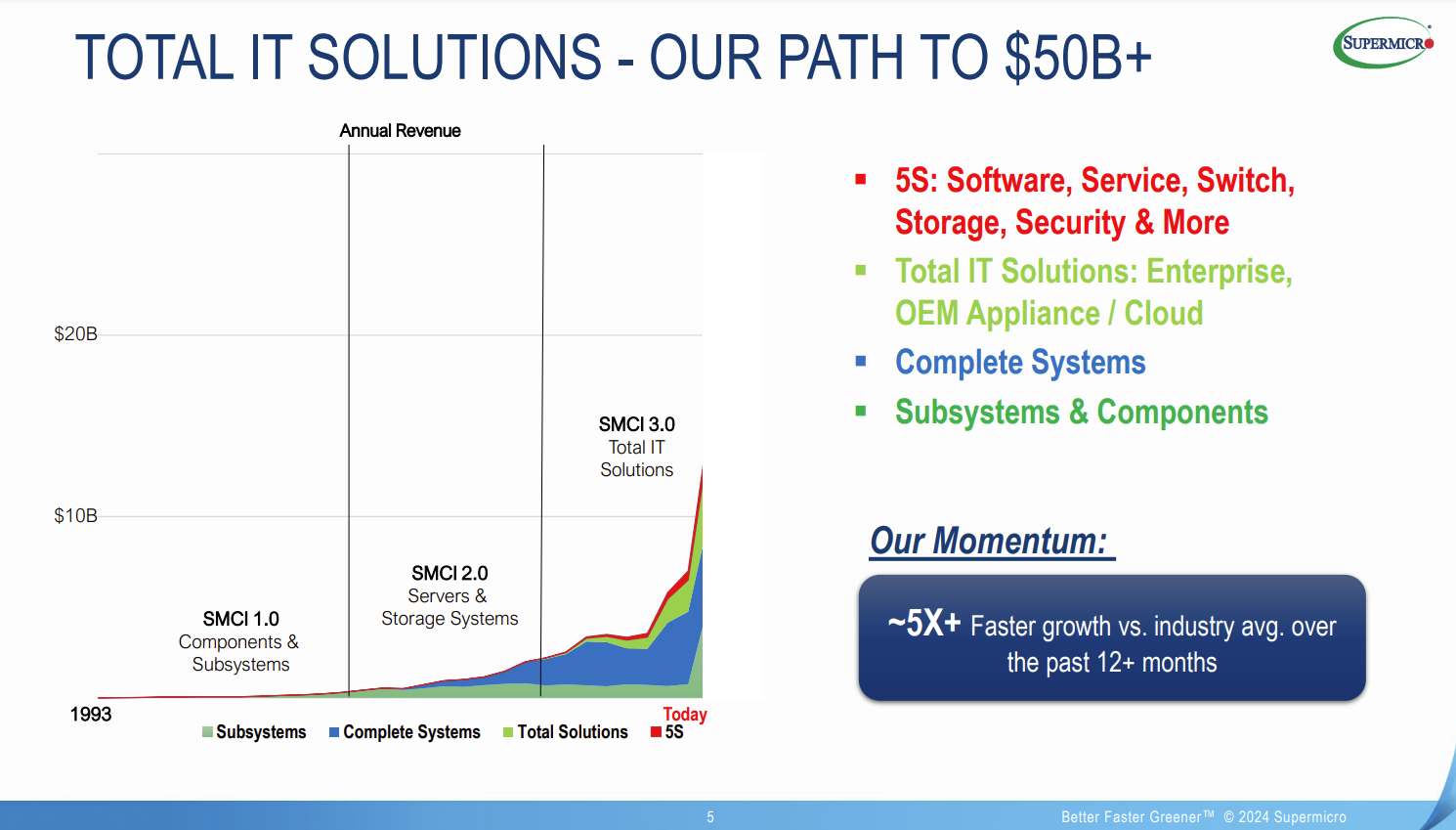

Supermicro said it expects fiscal 2025 revenue between $26 billion and $30 billion, well above expectations, as the company sees the genAI building boom continuing.

The outlook from Supermicro landed along with mixed fourth quarter results. The company reported net income of $353 million, or $5.51 a share. Adjusted fourth quarter earnings were $6.25 a share on revenue of $5.31 billion, up more than 100% from a year ago. Wall Street was looking for earnings of $8.14 a share on $5.3 billion in revenue.

Supermicro also announced a 10-for-1 stock split.

- The generative AI buildout, overcapacity and what history tells us

- Dell Technologies, Supermicro building xAI supercomputer

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

For fiscal 2024, Supermicro reported net income of $1.21 billion, or $20.09 a share, on revenue of $14.94 billion, up 110% from a year ago.

As for the outlook, Supermicro projected first quarter revenue of $6 billion to $7 billion with non-GAAP earnings per share of $6.69 to $8.27. For the fiscal year, Supermicro sees sales of $26 billion to $30 billion.

Charles Liang, CEO of Supermicro, said the company saw component shortages in the fourth quarter. That revenue will shift to the first quarter. The shortages cost Supermicro about $800 million in revenue in the fourth quarter.

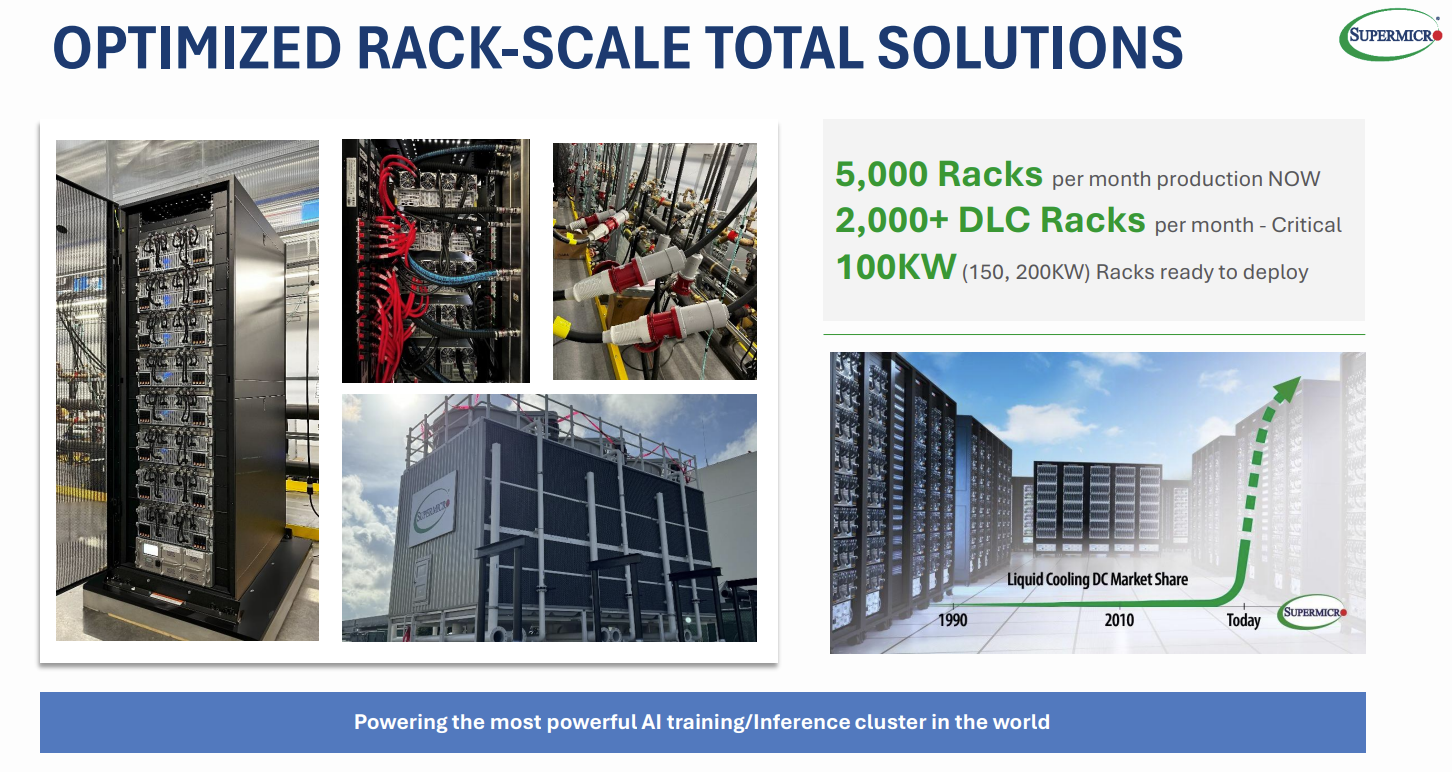

Liang said Supermicro is transitioning to become a complete data center provider to address "record demand of new AI infrastructures." He said Supermicro will grow due to rack-scale DLC liquid cooling expertise and its new Datacenter Building Block Solutions. Liang also said it is expanding its footprint in Malaysia and Silicon Valley as well as its supply chain.

Speaking on a conference call, Liang said the company saw component shortages in parts needed for hyperscale data center buildouts.

"Supermicro is powering the largest AI factories around the world today," said Liang, who said the company is targeting 25% to 30% of new global center deployments with liquid cooling.

Supermicro has 5,000 racks in production per month now and more than 2,000 direct liquid cooled racks.

Liang said the company is "seeing a lot of customer engagement" increasingly from enterprises. Supermicro also will have capacity starting in Malaysia and is improving its manufacturing efficiency.

"We will continue to grow with large customers. At the same time, we also continue to enhance our enterprise customer base," said Liang. He noted that Supermicro can gain share in liquid cooling systems and that component shortages were the norm when new technologies are introduced.

Key items of note from the Supermicro fourth quarter:

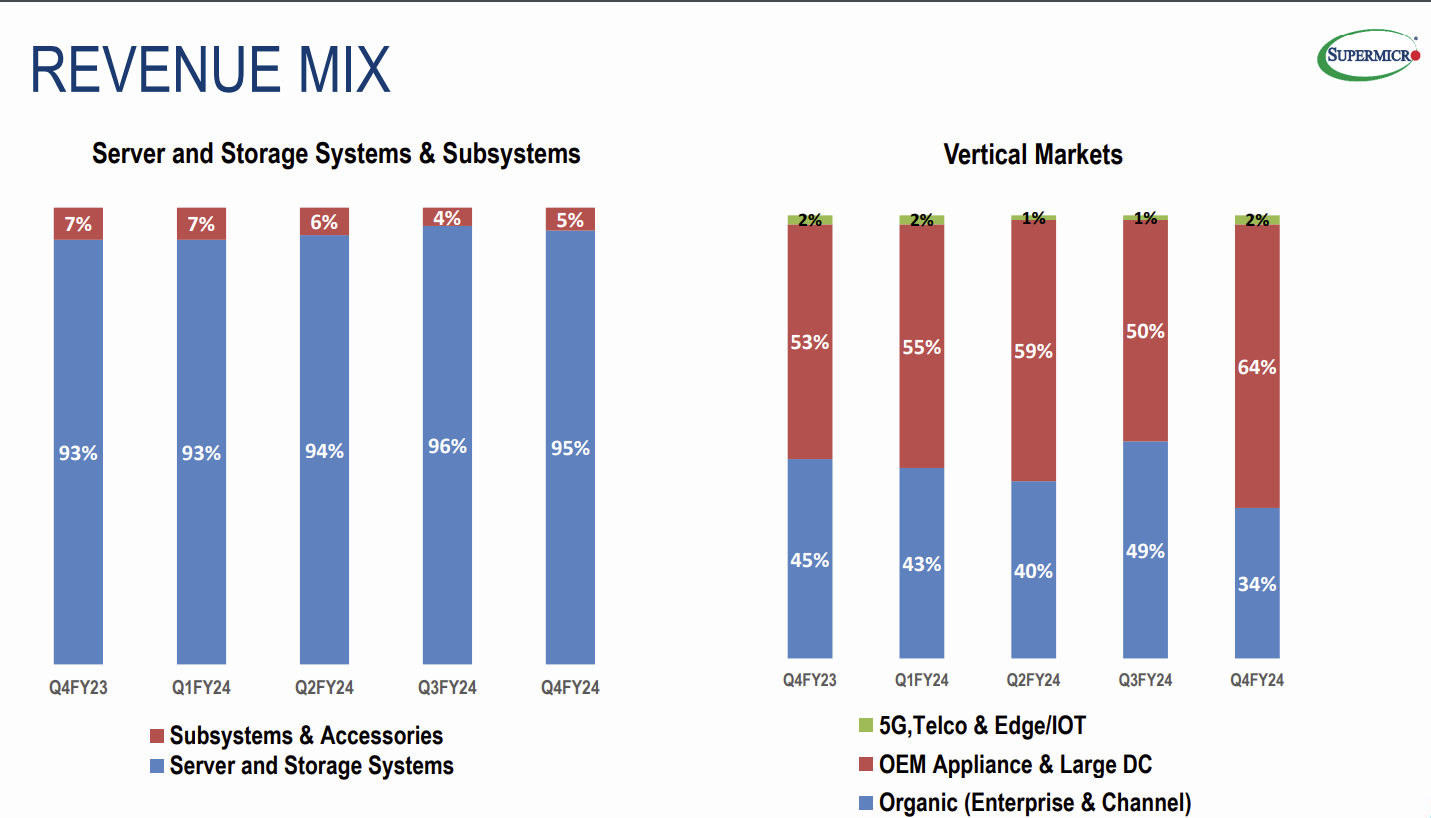

- 70% of revenue across enterprise and cloud service providers were next-gen air cooled and direct liquid cooled systems for AI infrastructure.

- Shipments may continue to be constrained in the short term by supply chain bottlenecks for key new components.

- Supermicro is scaling up production in Malaysia and Taiwan and expanding in Americas and Europe.

- 61% of revenue in the quarter was attributed to the US.