Brian Niccol, who takes over as Starbucks CEO on Sept. 9 after leading Chipotle since 2018, is landing at a company with more scale, IT platforms and digital transformation efforts. It'll be interesting to see what Niccol does at Starbucks.

We've documented Starbucks’ strategy to digital transformation and process automation before. Former Starbucks CEO Laxman Narasimhan in May 2023 outlined plans to simplify supply chain, support systems and procurement practices and leverage the coffee retailer's digital footprint. At the time, Starbucks Rewards accounts were 57% of US company operated revenue and mobile orders were 47% of sales.

Starbucks maintained its digital mojo, but ran into a consumer that was cutting back on purchases and pinched by inflation. Starbucks Rewards 90-day active members in the US were 33.8 million, up 7% from a year ago, but global same store sales fell 3% due to a decline in transactions.

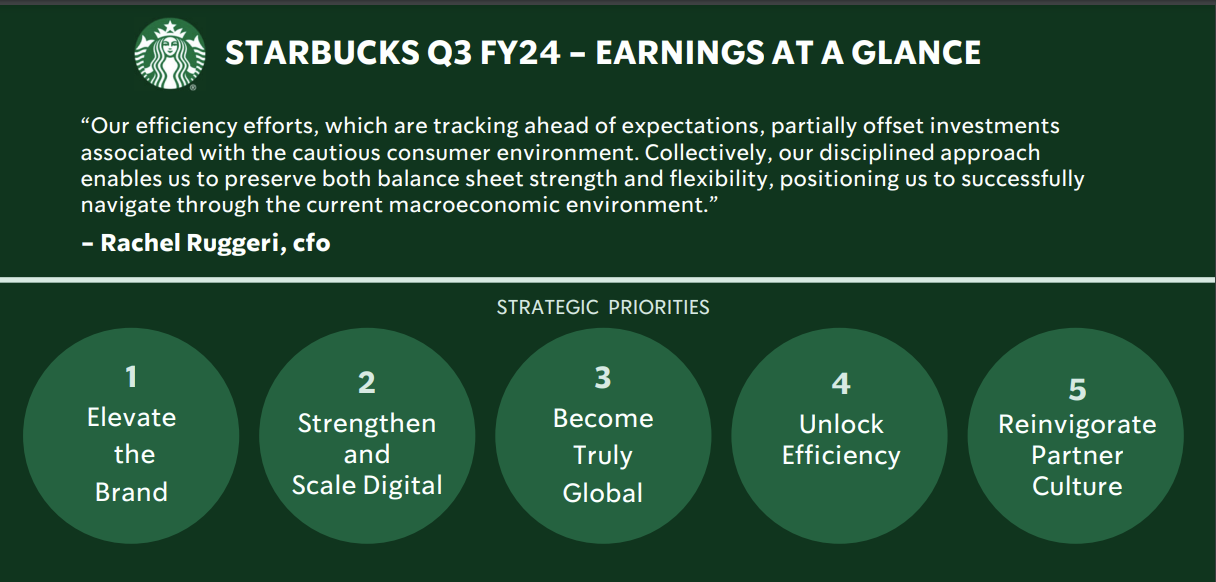

Starbucks has doubled down on efficiency efforts while leaning into digital and mobile in-store.

With that backdrop it's instructive to look at what Niccol had going on at Chipotle, a chain with more growth yet less scale relative to Starbucks.

For the second quarter ending June 30, Chipotle's digital sales accounted for 35.3% of total food and beverage revenue. Digital sales include sales from the Chipotle website, app, third-party delivery aggregators and Chipotle Rewards. 2023, Chipotle's digital business accounted for 37.4% of food and beverage revenue, down from 39.4% in 2022.

Niccol's high-level strategy at Chipotle was outlined in annual reports. Chipotle's business strategy has a heavy dose of technology throughout.

Here's a look:

- Sustaining world class people leadership by developing and retaining diverse talent at every level.

- Running successful restaurants with a people accountable culture that provides great Food with Integrity while delivering exceptional in-restaurant and digital experiences.

- Making the brand visible, relevant, and loved to improve overall guest engagement.

- Amplifying technology and innovation to drive growth and productivity at our restaurants, support centers and in our supply chain; and

- Expanding access and convenience by accelerating new restaurant openings in North America and internationally.

Under Niccol, Chipotle focused on personalization, in-store experiences, and a heavy dose of robotic innovation to improve restaurant productivity.

In late 2022, Adobe and PwC published case studies on the deployment of Adobe Experience Platform (AEP), which improved personalization as well as customer retention.

Key technology milestones for Chipotle include:

2019: The roll out of Chipotlanes, which are drive-thru for mobile orders placed on the company's mobile app.

2021: Chipotle invested in Nuro, an autonomous delivery company.

2022: Deployment of Adobe Experience Platform.

2022: Chipotle Mexican Grill launched a $50 million venture fund called Cultivate Next to support Series B stage companies that align with the restaurant's strategy.

2022: Chipotle tested an AI robot called Chippy to cook tortilla chips and the use of RFID to trace and track ingredients.

2023: Autocado, an avocado processing robotic prototype that cuts, cores and peels avocados. The prototype was developed with Vebu, a developer of restaurant automation technology, and was designed to reduce guacamole prep time by 50%. Chipotle uses about 4.5 million cases of avocados a year. Chipotle is an investor in Vebu.

What you can expect

When Niccol takes over Starbucks, an investor day outlining the technology strategy should follow relatively quickly. What will be interesting to watch will include the following:

- Technology talent turnover. Chipotle Chief Customer and Technology Officer Curt Garner will be one to watch.

- Use of in-store robotics and productivity enhancements. Starbucks had a bevy of efforts to improve in-store processes but it’s unclear what the impact has been.

- Starbucks has a thriving digital platform that Niccol could leave alone and ride for a while.

- Global platforms. Niccol was planning to take Chipotle global, but at Starbucks he'll inherit a sprawling international base including China.

- Customer experience changes.

- Vendor changes. Starbucks is a confirmed ServiceNow, AWS, SAP, Microsoft and Salesforce customer based on job listings and vendor case studies.

Insights Archive

- Disruption is coming for enterprise software

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- The generative AI buildout, overcapacity and what history tells us

- Enterprises start to harvest AI-driven exponential efficiency efforts

- GenAI may be the new UI for enterprise software

- Education tech in turmoil amid genAI: Why consolidation is next

- 14 takeaways from genAI initiatives midway through 2024

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Financial services firms see genAI use cases leading to efficiency boom