Snowflake reported a mixed first quarter and said it will acquire technology assets and employees from TruEra, an AI observability platform that can manage evaluate large language models (LLMs).

The company reported a net loss of $317 million, or 95 cents a share, on revenue of $828.7 billion. Non-GAAP earnings for the first quarter were 14 cents a share.

Wall Street was expecting Snowflake to report first quarter non-GAAP earnings of 17 cents a share on revenue of $785.9 million.

Snowflake’s big move this quarter was the launch of its Arctic large language model (LLM).

- Snowflake CEO Ramaswamy on product cycles, AI, scaling

- Snowflake CFO Scarpelli: Don't pigeonhole new CEO Ramaswamy as technologist

- Snowflake's Slootman steps down as CEO, technologist Ramaswamy takes over

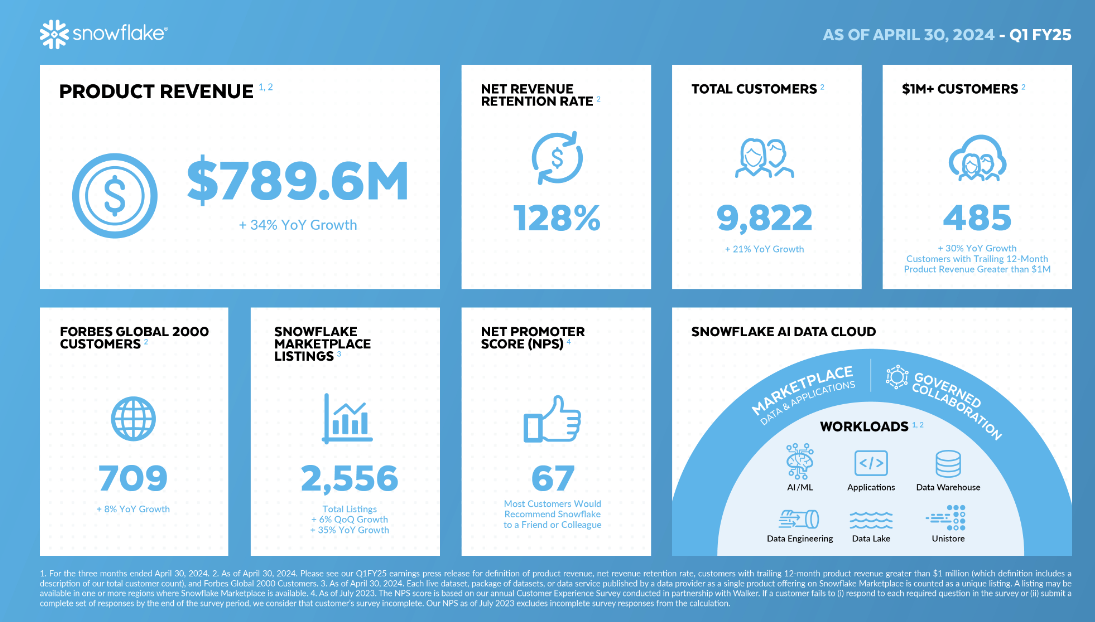

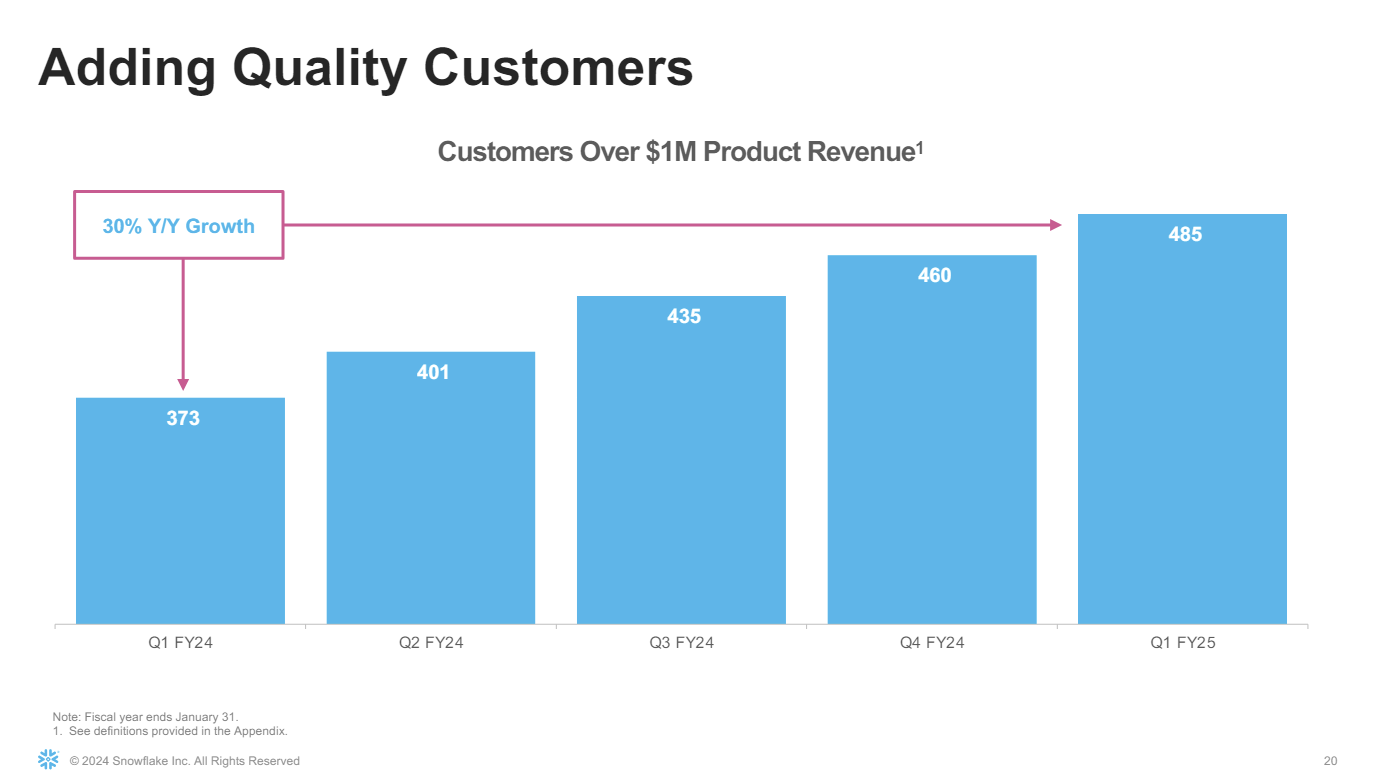

Ramaswamy said the company saw "strong customer interest" for its AI products. Product revenue was up 34% from a year ago and Ramaswamy said its core business was strong.

As for the outlook, Snowflake projected second quarter product revenue of $805 million to $810 million, up 26% to 27% from a year ago. Product revenue in the first quarter was $780.6 million, up 34% from a year ago.

Constellation Research's take and conference call takeaways

Constellation Research analyst Holger Mueller said:

"Snowflake had another very strong quarter. But growth came at a price and Snowflake went backwards when it comes to costs, deepening its loss. It became more expensive to run its offerings, as cost of revenue rose linear to overall revenue growth. Snowflake keeps managing on the best practice of startups before interest rate hikes, with its cost structure of last fiscal year leading to a nice profit with the revenue of this fiscal year. We will see if Snowflake can keep it up. Its competitor Databricks is the all encompassing lakehouse of the cloud vendors, the foundation of analytics, and the foundation for all forms of AI. Investors will have to watch how much Snowflake can become the AI data platform of enterprises in the coming GenAI years – and the verdict is still out."

Key items from the Snowflake conference call include:

- Ramaswamy acknowledged that Snowflake needs to become a data platform. He said: "We're still in the early innings of our plan to bring our world class data platform to customers around the globe. And in the first quarter alone, we saw some of our largest customers meaningfully increase their usage of our core offering. The combination of our incredibly strong data cloud, now powerfully boosted by AI, is the strength and story of Snowflake."

- Snowflake said data sharing and collaboration with customers can drive growth. Ramaswamy said: "Nearly a third of our customers are sharing data products as of Q1 2025, up from 24% one year ago. Collaboration already serves as a vehicle for new customer acquisition. Through a strategic collaboration with Fiserv, Snowflake was chosen by more than 20 Fiserv financial institutions and merchant clients to enable secure direct access to their financial data and insights. We announced support for unstructured data over two years ago. Now about 40% of our customers are processing unstructured data on Snowflake. And we've added more than 1,000 customers in this category over the last six months."

- Arctic model training was quick and cost effective. Ramaswamy said: "I'm comfortable with the amount of investments that we are making. Part of what we gain as Snowflake is the ability to fast follow on a number of fronts, is the ability to optimize against metrics that we care about, not producing like the latest, greatest, biggest model, let's say, for image generation. And so having that kind of focus lets us operate on a relatively modest budget pretty efficiently."