Snapchat made a bet on using machine learning and AI to improve its advertising platform, increase content engagement and ultimately revenue growth. If it could optimize its infrastructure spending, Snapchat would be able to grow the bottom line.

The first quarter gave an indicator that Snapchat's bets are starting to pay off. What's unclear is whether the company can continue to optimize its cloud spending since the first quarter bottom line was helped along by credits from hyperscale cloud providers.

Google Cloud is Snapchat's primary cloud provider, but Amazon Web Services is in the mix, according to Snapchat's regulatory filings.

CFO Derek Anderson said:

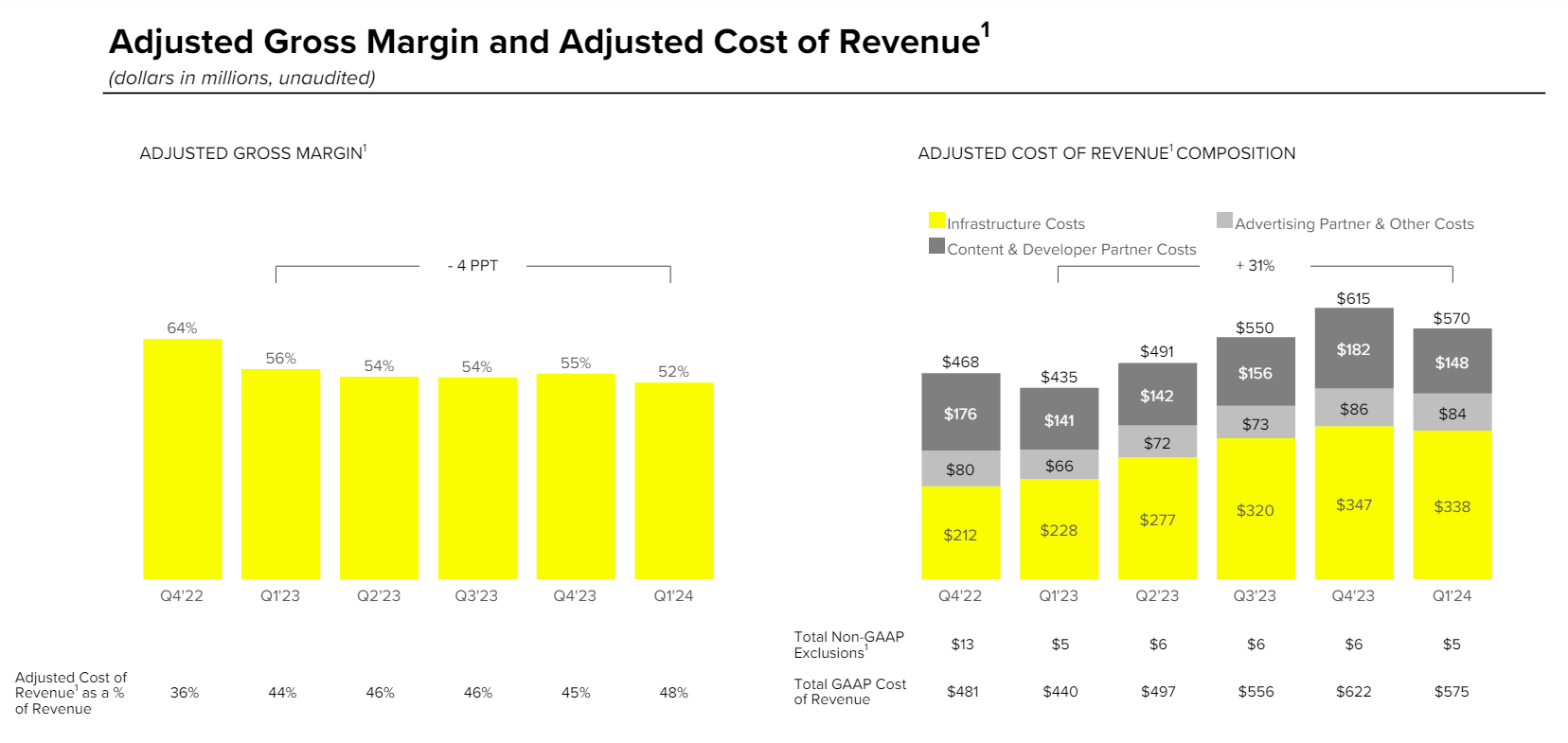

"We benefited from higher-than-average service provider credits in Q1 that helped to further reduce infrastructure costs in Q1. As a result, infrastructure cost per DAU declined from $0.84 in Q4 of 2023 to $0.80 in Q1 of 2024."

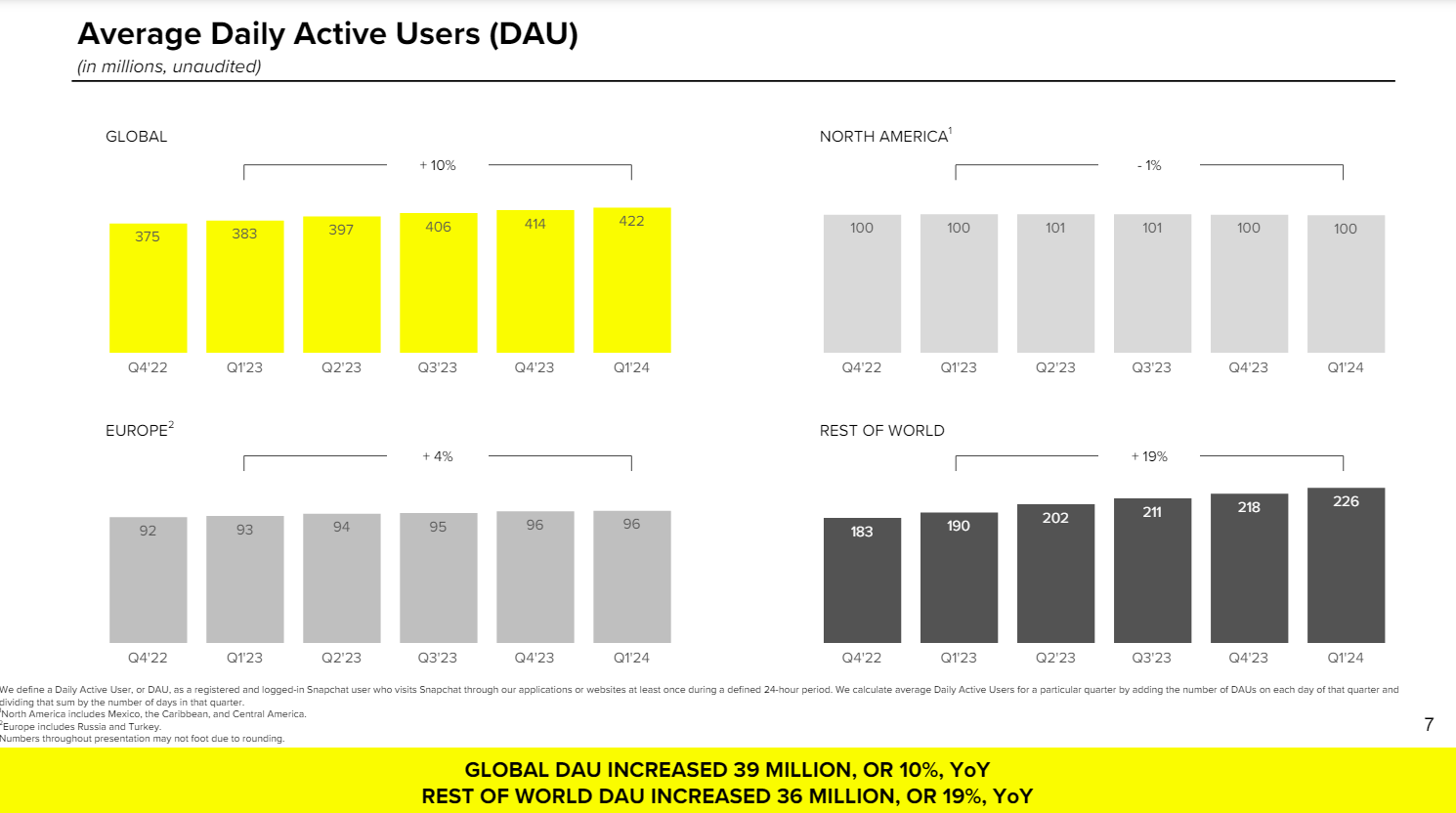

Saving 4 cents per daily active user doesn't sound like much until you scale those savings across 422 million daily active users. In Snapchat's results, cloud costs--operating expenses--turn up in cost of revenue. Snapchat executives said on the company's first quarter earnings call that the company is spending about $100 million a quarter on machine learning and AI.

"CxOs need to consider that cloud infrastructure costs are driven by usage, no matter how efficient an application's usage of the infrastructure is," said Constellation Research analyst Holger Mueller. "So for Snapchat shaving infrastructure cost is a step in the right direction – but not an insight on the efficiency of its coding."

The company reported a net loss of $305.1 million, or 19 cents a share, on revenue of $1.19 billion, up 21% from a year ago. Non-GAAP earnings were 3 cents a share, well above expectations.

Snapchat CEO Evan Spiegel said in a shareholder letter and the earnings call that the company is improving content ranking and personalization with the help of its AI investments.

"We've built larger and more advanced ranking models that are driving improvements in content engagement. In addition, we made significant progress toward unifying the ranking models between Spotlight and Stories to a single backend stack that ranks all content types," said Spiegel. "A single, unified stack will benefit Snapchatters by showing them the most relevant and entertaining content across Snapchat and helping creators find and deepen engagement with their audience."

An improving ad market also helped Snapchat, but its cloud savings flowed faster to the bottom line. Snapchat noted that it has improved its cloud infrastructure unit costs with "engineering efficiency and pricing improvements."

Indeed, Snapchat was an active participant in Google Cloud Next with sessions on moving to a microservices architecture and how it is using BigQuery and other data platforms. Snapchat has been built on Google Cloud since its inception and participated in 10 sessions at Google Cloud Next.

However, Snapchat said quarterly costs per daily active user (DAU) will be in the 83 cents to 85 cents range for the remainder of 2024. It's worth noting that Snapchat had an infrastructure cost per daily active user of 59 cents in the first quarter of 2023 and 70 cents due to its AI investment in the second quarter of 2023 before escalating to current levels of 80 cents to 85 cents per DAU.

Snapchat's infrastructure cost per DAU guidance seems to indicate that the company still has to work on its cloud optimizations and account for its AI investments. It's possible that the first quarter cost of revenue was helped in a large part because of one-off cloud credits.

Fully optimized--assuming infrastructure costs from 2022 are a benchmark--Snapchat's optimized state is infrastructure costs of 59 cents per DAU.

Spiegel said that infrastructure costs are slowing quarter over quarter as the company optimizes its spend even as it boosts revenue growth.