Smartsheet is planning to roll out a new pricing and packaging model on June 24 to replace the four pricing tiers it has now.

Today, Smartsheet has a free tier for 1 user and up to 2 editors, a Pro version with a maximum of 10 users and unlimited viewers for $7 per user/ month, a Business plan for $25 per user/month with a minimum of 3 users and unlimited editors and Enterprise accounts.

The new model will have broader access to Smartsheet features including AI and include more users in a plan. Speaking on Smartsheet's first quarter earnings call, CEO Mark Mader said the new model "pairs a greater number of licensed users with a lower price per user on business and enterprise plans."

New customers will have the new pricing model June 24 with existing annual customers transitioning 2025. Smartsheet members will be licensed instead of today's model of paid editors and free collaborators. Going forward, Smartsheet will have provisional member access, which enables people in an enterprise to create and contributed to a workflow before being added to a subscription.

Smartsheet's model change comes as Asana and Monday.com are rolling out AI features for workforce management. For instance, Asana launched AI teammates built on its Asana Work Graph and recently reported strong first quarter results. Asana delivered revenue growth of 13% in the first quarter to $172.4 million. Monday in May delivered fourth quarter revenue of $202.6 million, up 35% from a year ago.

- Smartsheet vs. Asana vs. Monday: What you need to know

- Constellation ShortList™ Work Coordination Platforms

The previous model revolved around creators who made edits and contributed to processes. The new models are based on contributions so the number of platform users will grow. Every customer will also have access to AI on Smartsheets.

Mader said:

"This will drive increased virality by enabling organizations to make available to employees the full breadth of the platform in a low-friction manner while allowing system admins to manage their users more effectively. While existing customers will transition to the new subscription model with their renewal dates in 2025, we anticipate demand from some organizations wanting to benefit from the new subscription model sooner and we will accommodate them as appropriate."

Mader said Smartsheet is seeing strong adoption of its AI tools and nearly half of enterprise customer plans have used Smartsheet AI for business logic and content via prompts.

The bet for Smartsheet is that the new pricing model will create a flywheel where it has more users of its genAI tools and data for insights.

Details of the pricing model will be revealed later this month.

Smartsheet said that it has piloted new pricing plans with customers. The reaction from both large enterprises and SMBs has been positive. Mader said:

"When I think about how someone responds when you say, Mark, what does it cost to license Smartsheet? The first two things out of my mouth can't be it depends, so the clarity in this new model is super, super high."

Other key items:

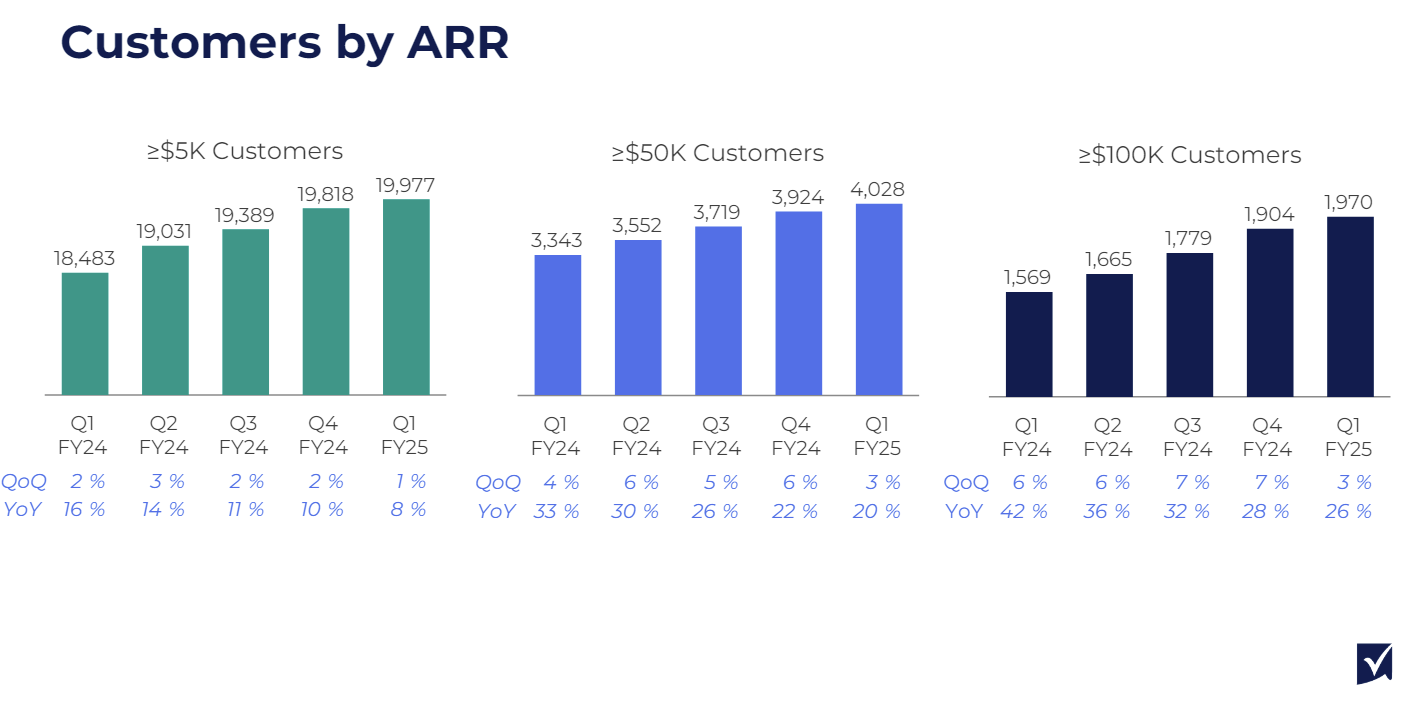

- Smartsheet delivered better-than-expected fiscal first quarter results. The company reported a first quarter net loss of $8.9 million, or 6 cents a share, on revenue of $263 million, up 20% from a year ago. Non-GAAP earnings were 32 cents a share.

- For the second quarter, Smartsheet projected revenue of $273 million to $275 million with non-GAAP earnings of 28 cents a share to 29 cents a share. For fiscal 2025, Smartsheet sees revenue of $1.116 billion to $1.12 billion and non-GAAP earnings of $1.22 a share to $1.29 a share.

- Scale is an issue for CIOs just as much as features. CIOs are looking for work management platforms to scale across diverse business units and needs with governance. "There's not a single customer that I've seen who is just willy-nilly approaching it on a feature set dimension," said Mader. "I think CIOs are recognizing that it is a diverse environment. There will be multiple tools, but where they're placing their bigger bets, they are doing that in fewer places."

- Smartsheets saw a slow start to the first quarter in February as the enterprise pipeline grew and finished strong in April.