SAP in the second quarter said its cloud revenue was up 25% and CEO Christian Klein said its Business AI efforts are "enabling many deals." The company reiterated its outlook for 2024 and raised its 2025 operating profit guidance due to efficiency efforts.

The company also said its restructuring efforts will impact 9,000 to 10,000 jobs. SAP said in January it expected to cut 8,000 jobs.

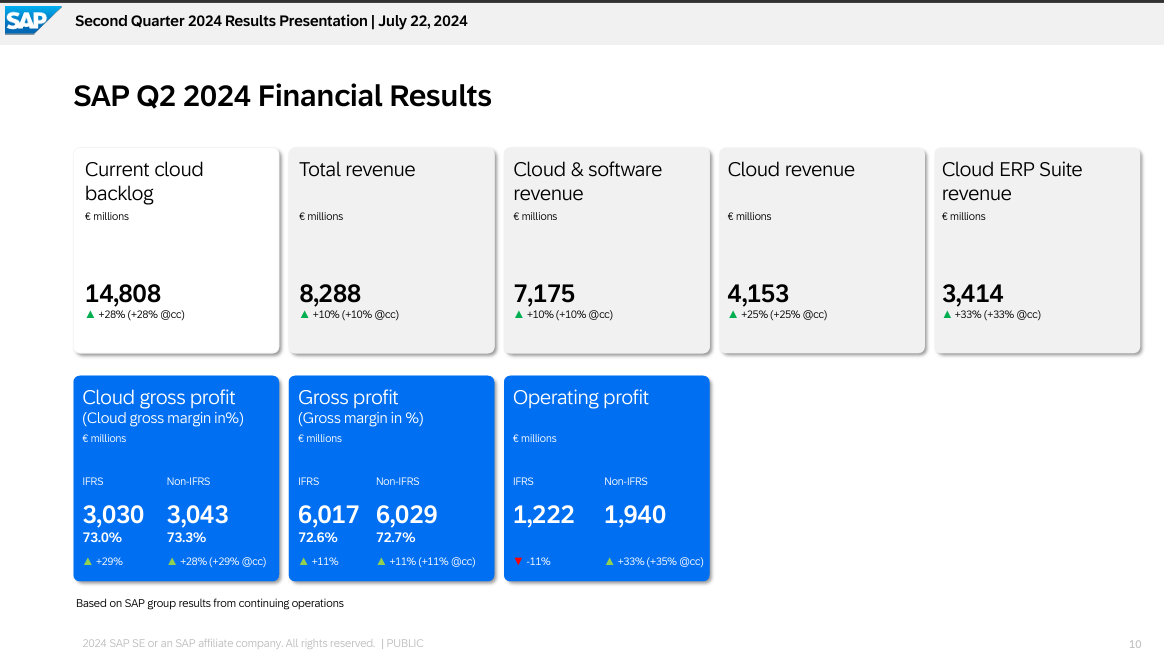

For the quarter ending June 30, SAP said its SaaS and PaaS revenue was €4.02 billion, up 28%. Cloud ERP revenue was €3.41 billion, up 33%. The Cloud ERP Suite revenue line includes services that are included in RISE with SAP. SAP S/4HANA Cloud, SAP Business Technology Platform, and applications for HR and payroll, spend management, commerce, customer data, business process transformation, and working capital management also fall under Cloud ERP.

- SAP’s Joule everywhere plan: ‘We are not developing AI just for the sake of AI”

- SAP acquires WalkMe for $1.5 billion

- SAP user group DSAG rips S/4HANA innovation plans, maintenance increases

- Amazon Bedrock integrated into SAP AI Core, SAP to use AWS chips

SAP reported second-quarter revenue of €8.29 billion, up 10% from a year ago, with €918 million in net profit. Earnings per share were €0.76. Non-IFRS earnings per share were €1.10.

In a statement, Klein said "our cloud growth momentum remained strong in Q2, with Business AI enabling many deals." He added that SAP is well positioned to see "accelerating topline growth through 2027."

CFO Dominik Asam added:

"We are staying squarely focused on delivering our outlook for this year. Our current cloud backlog growth during the second half of 2024, and especially in Q4 will be decisive to lay a solid foundation for our cloud revenue ambition for 2025. At the same time, we'll continue to execute against our transformation plan to achieve our 2025 free cash flow ambition despite a mid-triple-digit million cash out for restructuring spilling into next year."

On an earnings conference call, Klein said SAP is landing and expanding as it moves large enterprises to the cloud. "Since Sapphire, we have seen a lot of additional interest from big customers, over 90 partner use cases for co-innovation, including use cases with big systems integrator," said Klein. "Sapphire also helped to significantly boost our pipeline. It's not just a lift and shift to the cloud. It's a holistic offering to increase competitiveness through a deep business transformation to replace the legacy ERP with our modular cloud ERP."

Klein said he was confident that SAP was executing well and seeing a "land and expand" cadence at large enterprises like Exxon." He added that SAP is also investing in SMBs with partners.

By the numbers for the second quarter:

- Current cloud backlog was up 28% to €14.81 billion.

- Software license revenue fell by 28% to €0.2 billion.

- SAP had repurchased 12,895,525 shares at an average price of €145.20 as of June 30.

SAP also said that its restructuring program is expected to finish in early 2025. SAP said the restructuring will affect 9,000 to 10,000 positions, but the company expects headcount to be similar to 2023.

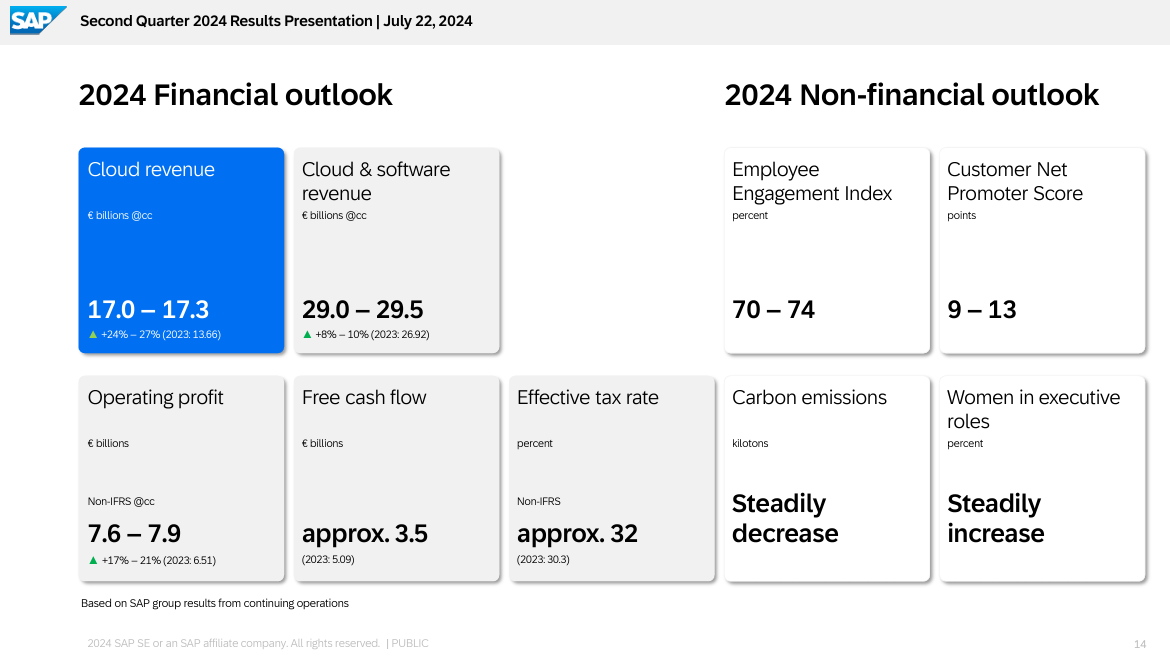

As for the outlook, SAP projected €17.0 billion to €17.3 billion cloud revenue for 2024, up 24% to 27% from 2023 with €29.0 billion to 29.5 billion in cloud and software revenue for the year.

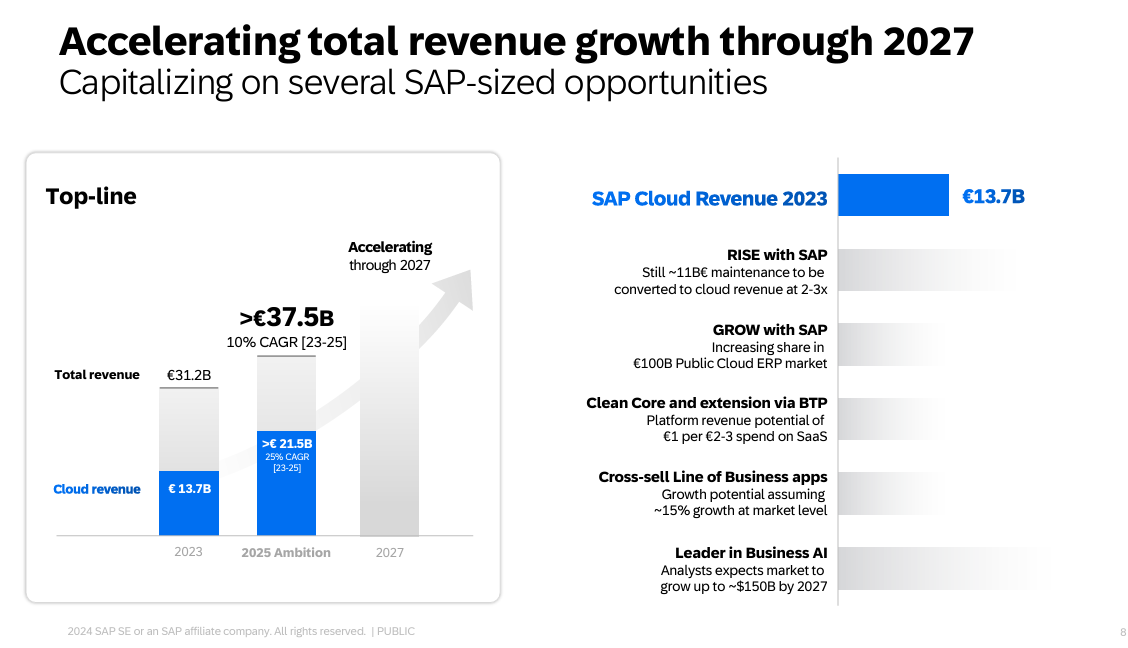

For 2025, SAP projected non-IFRS operating profit of approximately €10.2 billion, up from previous guidance of €10 billion. The rest of SAP's 2025 outlook remains the same including cloud revenue of more than €21.5 billion and total revenue of more than €37.5 billion.

- SAP, IBM Consulting pair up on process transformation, genAI

- BT150 CXO zeitgeist February edition: Low marks for SAP RISE, process automation, change management, AI risk

- SAP's Supervisory Board to nominate Ala-Pietilä as Plattner successor, Renjen to resign

- SAP's German speaking user group takes aim at cloud contracts, BTP and more

- SAP retools for generative AI, cuts 8,000 jobs, sets 2024, 2025 ambition