Salesforce delivered revenue growth of 11% from a year ago and joined the ranks of tech companies paying dividends.

The company reported fourth quarter earnings of $1.47 per share and non-GAAP earnings of $2.29 per share on revenue of $9.29 billion.

Wall Street was expecting Salesforce to report fourth quarter earnings of $2.27 a share on revenue of $9.22 billion.

For fiscal 2024, Salesforce delivered earnings of $4.20 a share and non-GAAP earnings of $8.22 per share. Annual revenue was $34.86 billion, up 11% from a year ago.

The company also said it will pay a quarterly dividend of 40 cents per share per share of common stock. Salesforce also added $10 billion to its share buyback program.

Salesforce’s earnings land a day after the company said its Einstein Copilot was in public beta to kick off what the company hopes is a subscription upgrade cycle. Einstein Copilot is native across Salesforce applications to answer questions, generate content and automate. Salesforce customers can access Einstein Copilot with an upgrade to Einstein 1 Editions. Einstein Copilot is available in beta for Sales Cloud and Service Cloud with Commerce Cloud and Marketing Cloud available later in 2024. Einstein Copilot for Tableau will launch in the second half of 2024.

- AWS, Salesforce expand partnership with Amazon Bedrock, Salesforce Data Cloud, AWS Marketplace integrations

- Salesforce launches Einstein 1 Platform, enables metadata across platform, Data Cloud

- Salesforce launches Data Cloud Vector Database, Einstein Copilot Search

- CXOs placing bets on AI, analytics, automation going into 2024

CEO Marc Benioff touted Einstein 1, operating margin improvements and said the company is "well positioned to build on our success and capitalize on the massive surge in tech spending expected over the coming years."

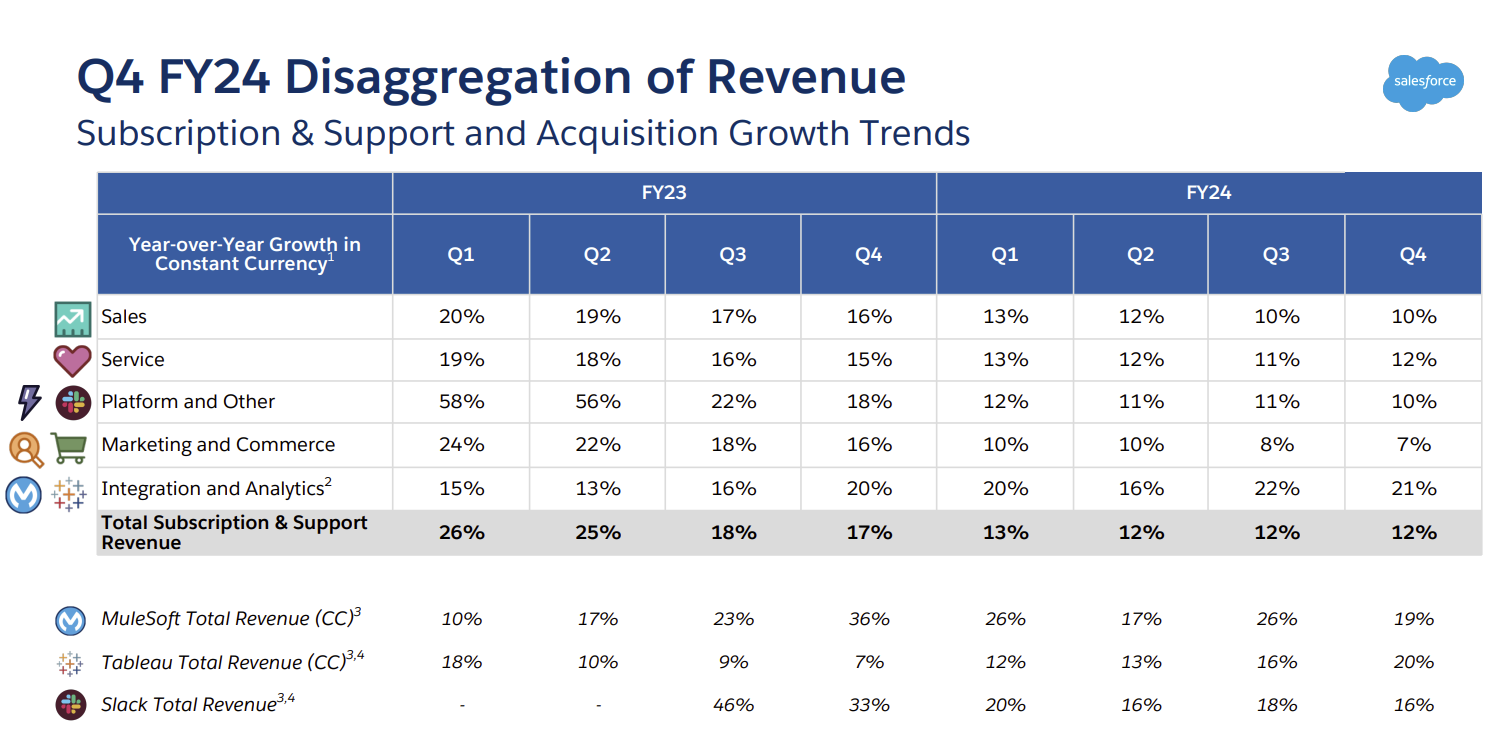

CFO Amy Weaver said the company saw a strong close to the fiscal year. In the fourth quarter, Salesforce's integration and analytics products (MuleSoft and Tableau) posted the strongest revenue growth of 21%. Marketing and Commerce Cloud had growth of 7% with Sales, Service and Platform posting revenue growth of 10% to 12%.

As for the outlook, said first quarter revenue will be $9.12 billion to $9.17 billion with non-GAAP earnings per share of $2.37 to $2.39. Fiscal 2025 revenue will be between $37.7 billion and $38 billion with non-GAAP earnings of $9.68 per share and $9.76 per share.

Weaver added that generative AI won't be a material revenue contributor yet. "In terms of the new products, in Data Cloud, we're already seeing this great traction, which is certainly factored in. Some of the GenAI, it's still early, and given that the adoption curve at really our size and scale as a $38 billion company, we're not factoring in material contribution from these new products into our FY25 revenue guidance at this time," she said.

On a conference call with analysts, Benioff said the company will highlight its next-generation AI that will go beyond copilots and delve into Data Cloud.

He said:

"There is no other time in the history of our industry that that rich data and metadata together in one place is so important, because that is what you're going to need to drive this artificial intelligence. And you're going to see that next week at Trailhead DX as we show you our copilot for our first time and prompt builder for the first time, and data cloud for the first time, and how it works together so that you can get the insights that you need."

Other items from Benioff include:

- "Our deals greater than $10 million, well, they grew nearly 80% year-over-year in fiscal year '24."

- "In Q4 25% of our deals already over $1 million have included Data Cloud. And we've recently added over 1,000 new customers to Data Cloud. We've never seen traction like this of a new product because you can just easily turn on the Data Cloud and it adds huge value to Sales Cloud, it adds huge value to Service Cloud, to Marketing Cloud, to the CDP."

- "All of us can understand the tasks that the Copilot is performing. And I bet a lot of people, even on this call, that a lot of other companies might say they can do this. But I assure you, without the deep integration of the data and the metadata across the entire platform, with the Copilot's deep integration of that data, they cannot do it. They cannot do it. I assure you they cannot because they don't have the data and the metadata, which is so critical to making an AI assistant so successful."