Rimini Street said it will exit support for Oracle PeopleSoft products including its Rimini Support, Rimini Manage and Rimini Consult services. Oracle PeopleSoft support accounts for 8% of Rimini Street sales.

The wind-down of Oracle PeopleSoft support will take more than a year. The news comes amid second quarter results from Rimini Street that missed expectations. Rimini Street reported a net loss of $1.1 million, or a penny a share, on revenue of $103.1 million, down 3% from a year ago.

On a conference call with analysts, Rimini Street CEO Seth Ravin said the company is restructuring to save $35 million. Ravin also noted that the Oracle PeopleSoft business used to be the majority of Rimini Street's revenue, but now it makes sense to focus elsewhere as it builds out new services such as VMware support.

The Oracle PeopleSoft wind-down affects a handful of contracts, said Ravin.

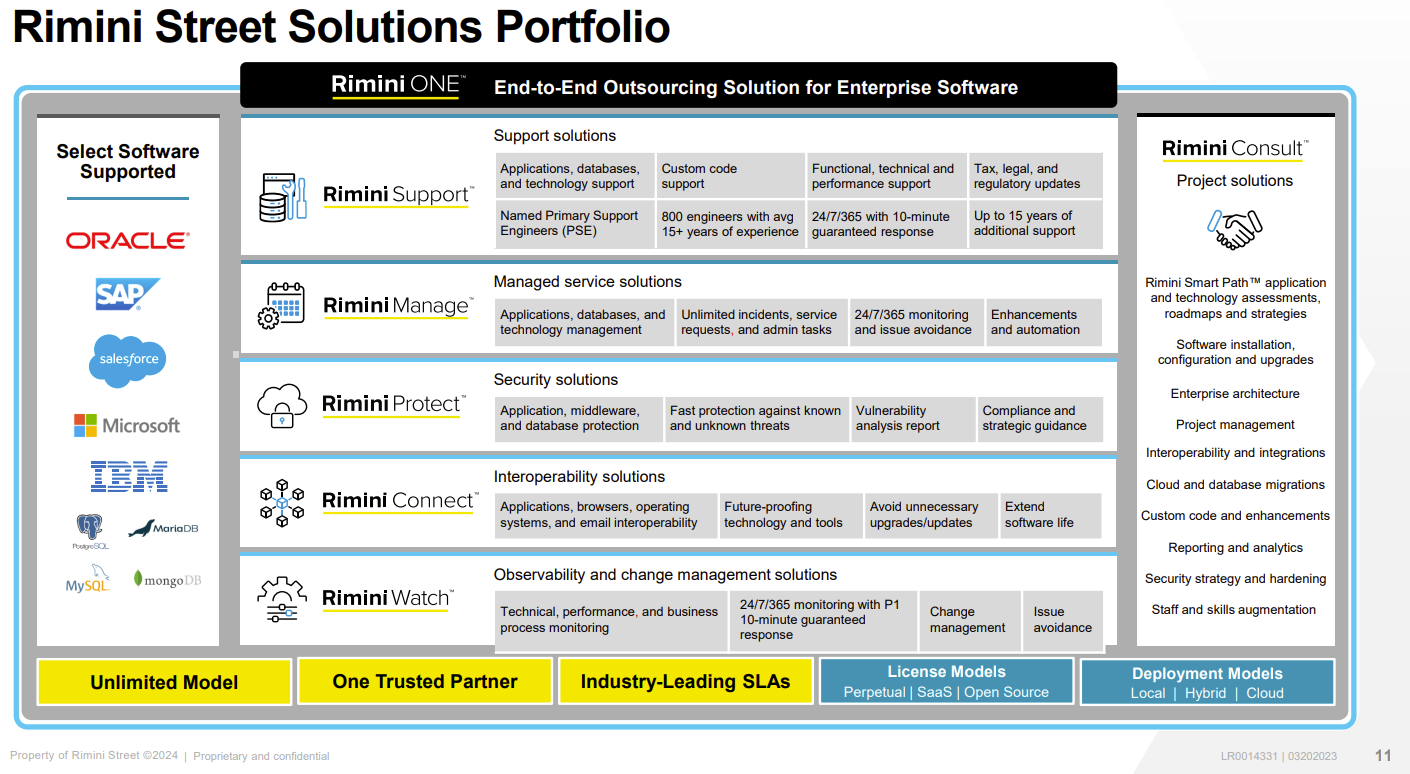

Ravin said Rimini Street is focusing on new services. "We have had several years of transformation from being a third-party support provider of replacement services just for Oracle and SAP to expanding that service dramatically in terms of the products covered even VMware in the last quarter," said Ravin. "On top of that, we added in our AMS service, an entirely large new business line, we added in expansions to the security product line to our Connect product line of interoperability tools, we added new observability capabilities, and we've built out an entire consulting business over the last few years. And we're talking on a global basis, serving customers in over 150 countries."

Ravin said that the company underestimated the time and skillsets needed to scale those new businesses up. Ravin also said that Rimini Street needs to see larger contracts.

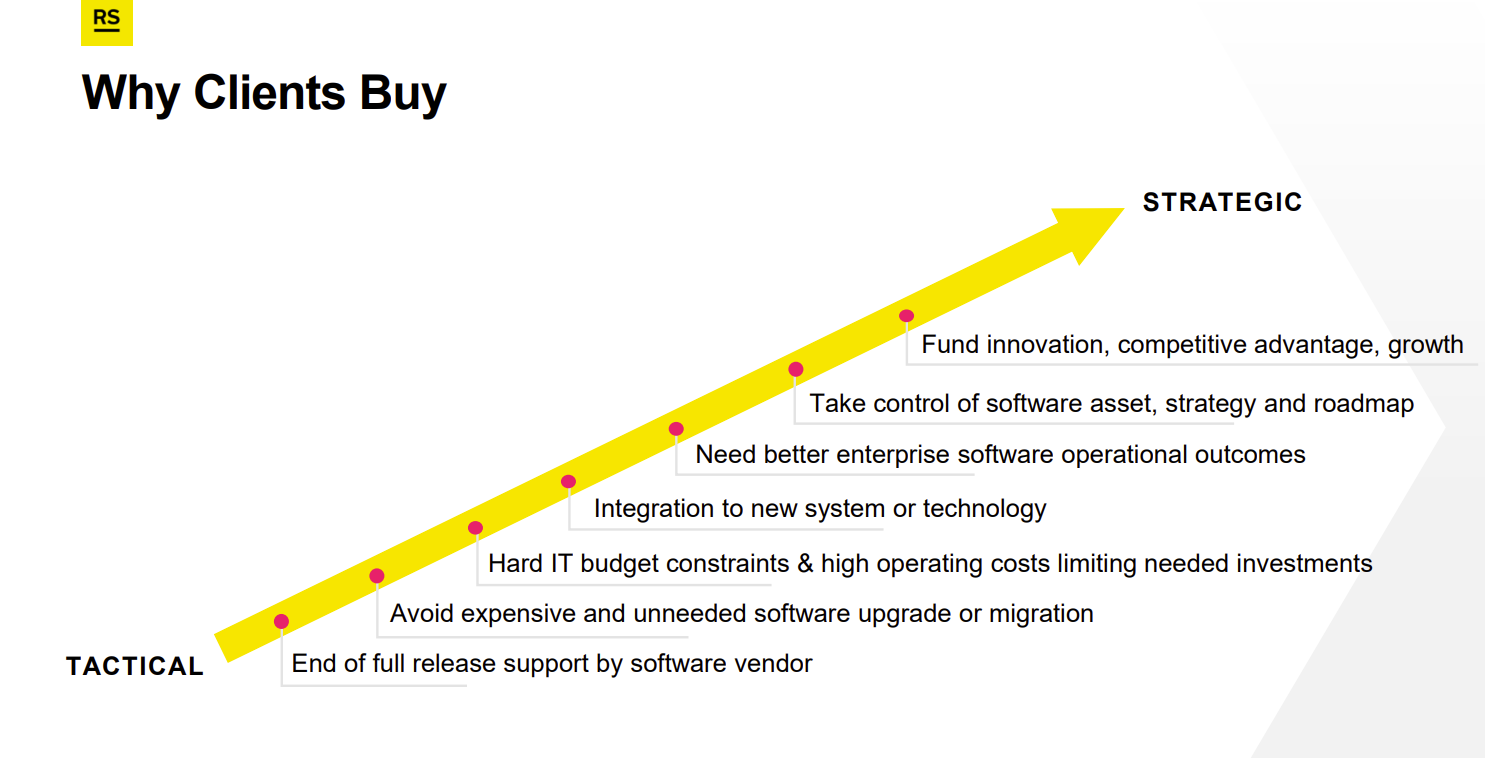

According to Ravin, Rimini Street's restructuring is designed to cut costs and make room to hire employees with new skill sets. For instance, Rimini Street is deploying regional CTOs and enterprise architects that can help with lowering maintenance costs as well as roadmaps.

"You're watching us reduce sales and marketing costs, reducing number of sellers, replacing them with CTOs, changing the mix of people on the field in order to give us a better sales capability for larger, more complex contracts," said Ravin.

In the end, Rimini Street is trying to move up the stack to be more strategic to CIOs, but that means competition with not only legacy software providers for support and maintenance, but managed service players such as Tata, Infosys and Cognizant.