Quantinuum raised $300 million in equity investment putting the quantum computing company's valuation at $5 billion.

Honeywell merged its quantum unit with Cambridge Quantum Computing in 2021 and launched Quantinuum as a stand-alone company. Honeywell remains Quantinuum's largest shareholder.

In a statement, Honeywell said that the funding round was led by JPMorgan Chase with participation from Mitsui & Co., Amgen and Honeywell. Mitsui said it will help expand Quantinuum's reach in Asia.

Quantinuum, which is focusing on quantum use cases such as cybersecurity, computational chemistry and simulation, has raised $625 million since inception.

- IBM launches latest Heron quantum processor, IBM Quantum System Two

- AWS launches Braket Direct with dedicated quantum computing instances, access to experts

- Will IonQ make quantum computing enterprise relevant in 2025?

- Quantum Computing Platforms

- Quantum Computing Software Platforms

- Quantum Full Stack Players

- Why your quantum computing vendors are going to look familiar

According to Honeywell, Quantinuum will use the funds to "accelerate the path towards achieving the world's first universal fault-tolerant quantum computers, while also extending Quantinuum's software offering to enhance commercial applicability." Quantinuum is also working to develop Quantum Natural Language Processing, an effort to bridge quantum computing and generative AI.

Quantinuum counts JPMorgan Chase as one of its customers using Quantinuum's H-Series quantum processors and the company's software development kit, TKET. Other Quantinuum customers include Airbus, BMW Group, Honeywell, HSBC, Mitsui and Thales.

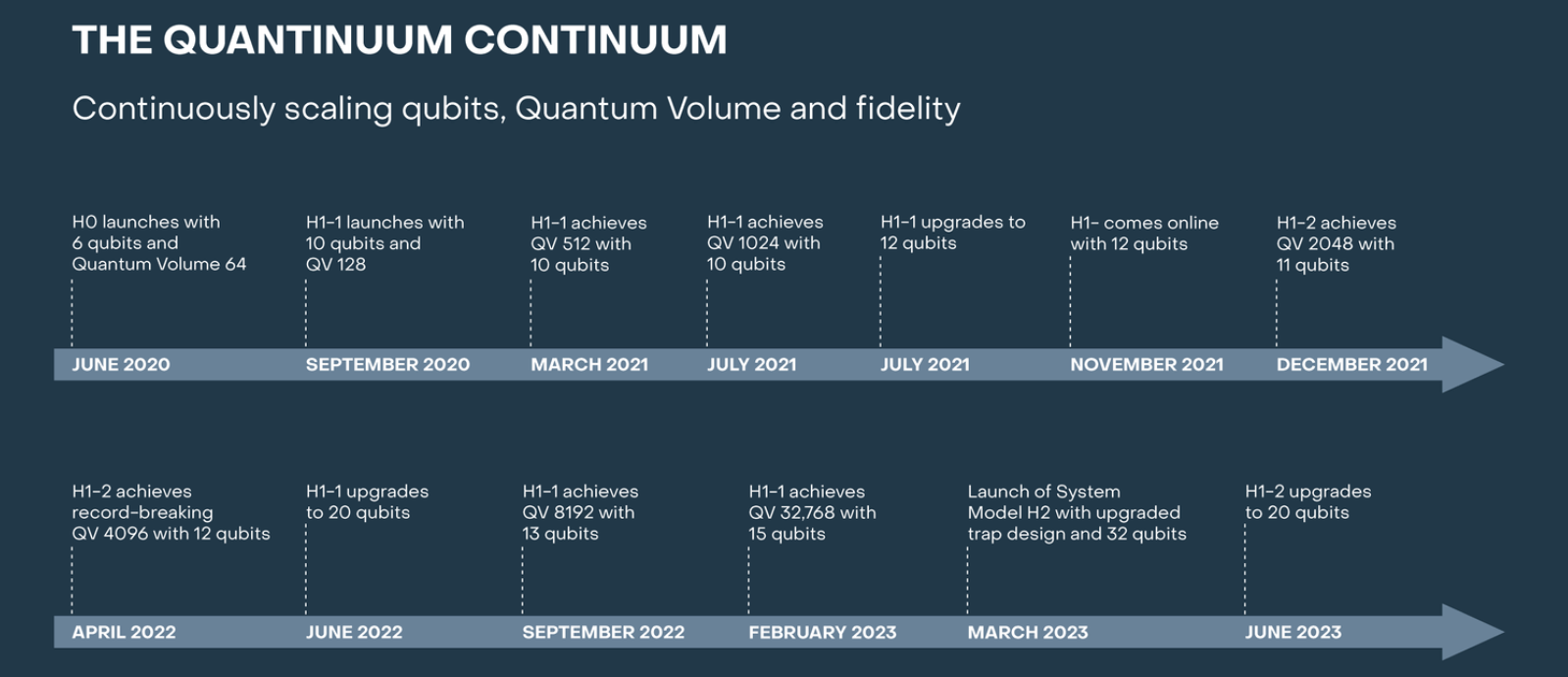

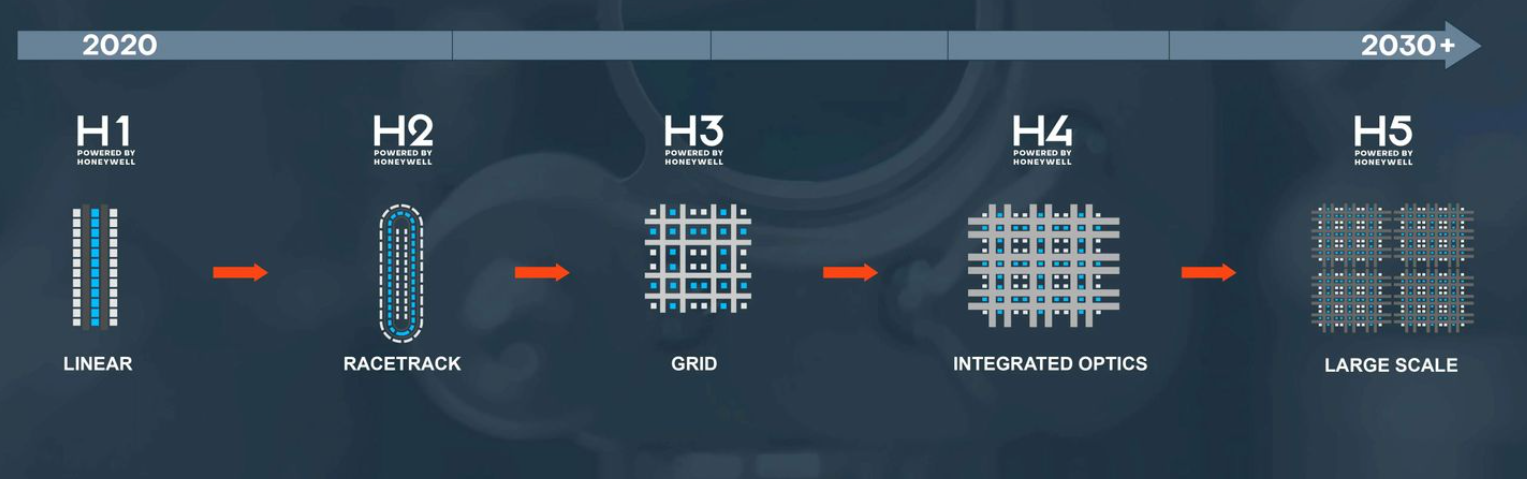

Here's a look at Quantinuum's development so far and roadmap ahead.