CEOs from Qualcomm and Arm say that AI inferencing will increasingly happen at the edge in multiple devices as large language models become more efficient and need less compute.

The buzz around DeepSeek's models and the ensuing discussion about how much AI infrastructure is necessary has given edge computing--where AI inference is likely to happen--more play.

Keep in mind that Qualcomm and Arm have a vested interest in this edge AI game, but the comments from the companies are notable.

The DeepSeek-inference-lower cost AI discussion has also highlighted how edge devices--PCs, smartphones, Project Digits and more--are going to be a larger part of the AI inference mix. Here's what Arm CEO Rene Haas said on the company's third quarter earnings call:

"DeepSeek is great for the industry, because it drives efficiency, it lowers the cost. It expands the demand for overall compute. When you think about the application to Arm, given the fact that AI workloads will need to run everywhere and lower-cost inference, a more efficient inference makes it easier to run these applications in areas where power is constrained. As wonderful a product as Grace Blackwell is, you'd never be able to put it in a cell phone, you'd never be able to put it into earbuds, you can't even put it into a car. But Arm is in all those places. I think when you drive down the overall cost of inference, it's great."

DeepSeek: What CxOs and enterprises need to know | GenAI prices to tank: Here’s why

Haas also added that the industry will still need some serious compute so the AI buildout will continue. "We're nowhere near the capabilities that could be transformational in terms of what AI can do," he said.

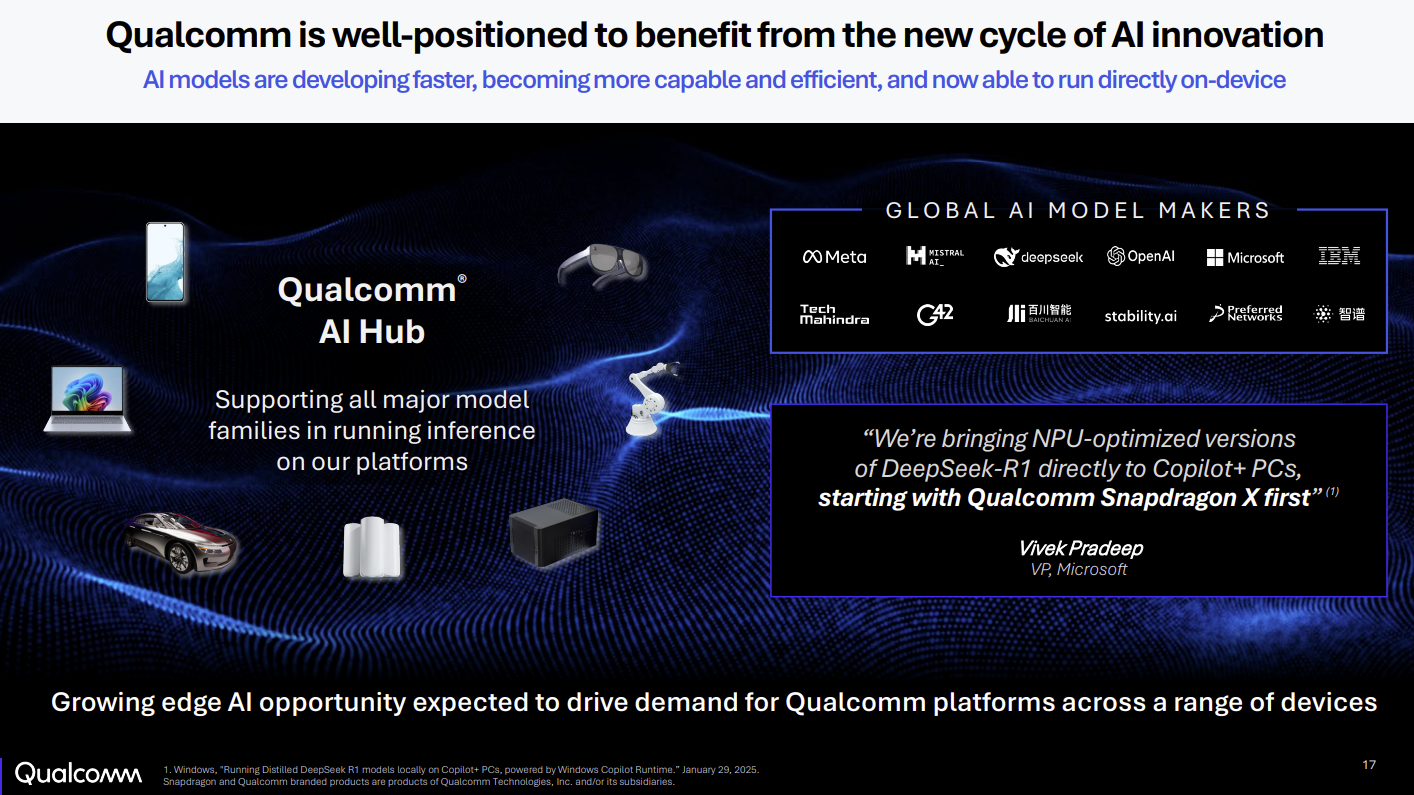

Qualcomm CEO Cristiano Amon said DeepSeek illustrates how AI will play into edge use cases. Amon said:

"We also remain very optimistic about the growing edge AI opportunity across our business, particularly as we see the next cycle of AI innovation and scale. DeepSeek-R1 and other similar models recently demonstrated the AI models are developing faster, becoming smaller, more capable and efficient, and now able to run directly on device. In fact, DeepSeek-R1 distilled models were running on Snapdragon powered smartphones and PCs within just a few days of its release.

As we entered the era of AI inference, we expect that while training will continue in the cloud, inference will run increasingly on-device, making AI more accessible, customizable, and efficient. This will encourage the development of more targeted, purpose-oriented models and applications."

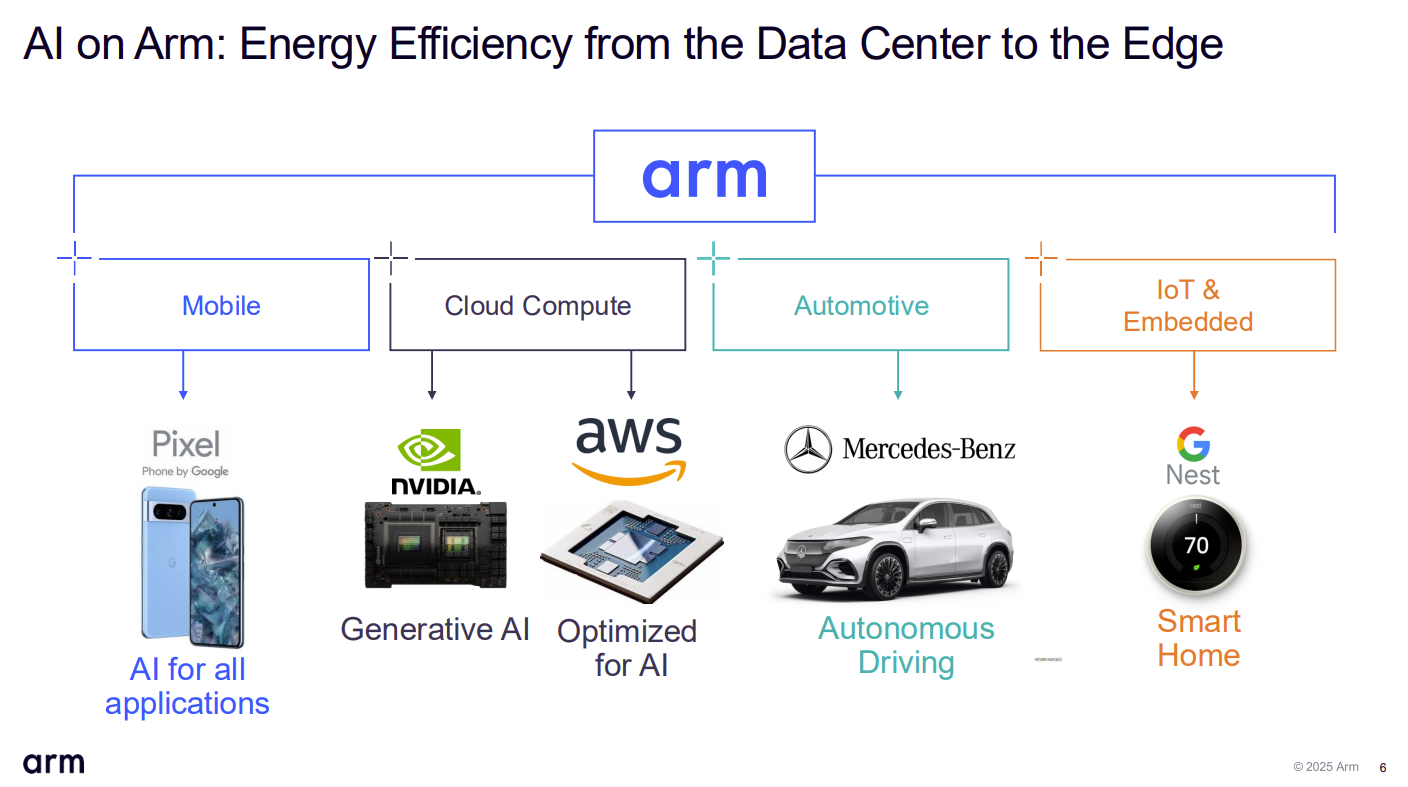

The visions of Qualcomm and Arm are very similar when it comes to AI at the edge. Both companies are in data centers, smartphones, PCs, Internet of things endpoints and multiple edge devices such as automobiles. Qualcomm designs processors and markets its dominant Snapdragon platform. Arm licenses its designs to the industry.

Qualcomm's first quarter

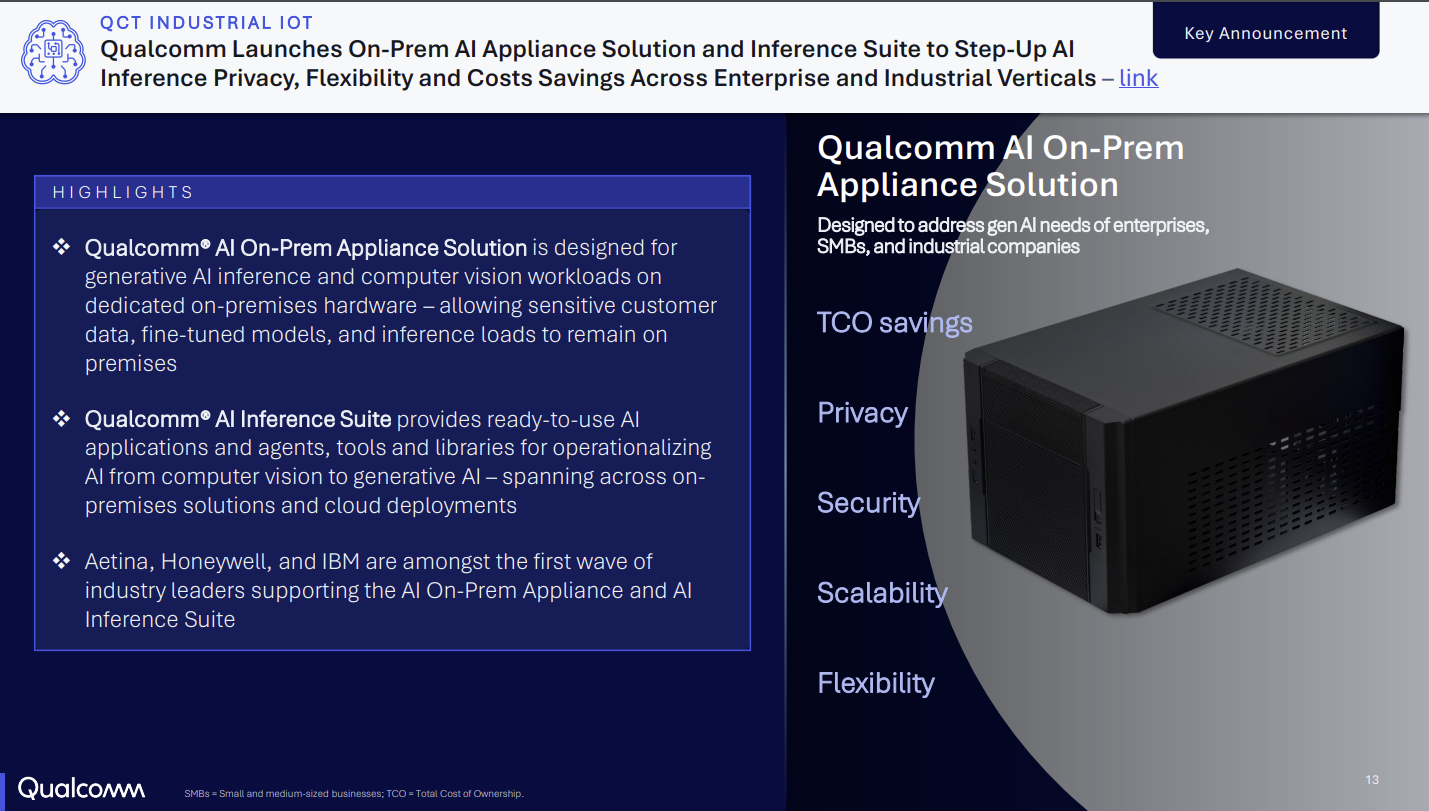

Qualcomm's IoT business, which includes PCs, tables, edge networking and extended reality devices, grew at a rapid clip in the first quarter and generated revenue of $1.55 billion, up 36% from a year ago. That business is dwarfed by Qualcomm's handset business, but headed in the right direction.

The company reported strong first quarter results with earnings of $3.18 billion, or $2.83 a share, on revenue of $11.67 billion, up 17% from a year ago. Non-GAAP earnings were $3.41 a share, well ahead of Wall Street estimates.

Amon noted the company is diversifying its business and expanding into industrial IoT, auto and PCs. Qualcomm projected second quarter revenue between $10.3 billion to $11.2 billion with non-GAAP earnings of $2.70 to $2.90 per share.

Qualcomm said it expects strong growth in PCs along with more enterprise traction, auto and industrial IoT. More: AI PCs may decentralize inferencing workloads | Physical AI, world foundation models will move to forefront

Constellation Research analyst Holger Mueller said:

"All Qualcomm segments have been growing nicely. Qualcomm will have to keep executing in the same direction for the quarter, with concerns about its licensing business showing pedestrian growth, close to inflation. Investors care about this revenue stream as it highly profitable for Qualcomm. Credit goes to CEO Amon to have transform Qualcomm into a high tech manufacturer."

Arm's third quarter

Arm reported third quarter net income of $252 million, or 24 cents a share, on revenue of $983 million, up 19% a share. Non-GAAP earnings were 39 cents a share. The results were better than expected.

The outlook from Arm was in line with expectations.

Arm projected fourth quarter revenue between $1.17 billion and $1.27 billion with non-GAAP earnings between 48 cents a share to 56 cents a share. For fiscal 2025, Arm is projecting revenue of $3.94 billion to $4.04 billion with non-GAAP earnings of $1.56 a share to $1.64 a share.

On a conference call, Haas touted Arm's role in Project Stargate and Nvidia's various efforts.

"We strongly believe that the advances in AI, both for training and inference, are going to increase the demand for compute in the AI Cloud," said Haas. "We expect Arm solutions to address the needs from the cloud to the edge to power growth in the world's most popular compute ecosystem for decades to come."

- Arm's data center takeover: A lumpy revolution

- Arm launches compute subsystems optimized for AI for edge devices

- GPUs, Arm instances account for larger portion of cloud costs, says Datadog

- Nvidia outlines roadmap including Rubin GPU platform, new Arm-based CPU Vera

Mueller said:

"All Qualcomm segments have been growing nicely. Qualcomm will have to keep executing in the same direction for the quarter, with concerns about its licensing business showing pedestrian growth, close to inflation. Investors care about this revenue stream as it highly profitable for Qualcomm. Credit goes to CEO Amon to have transform Qualcomm into a high tech manufacturer."