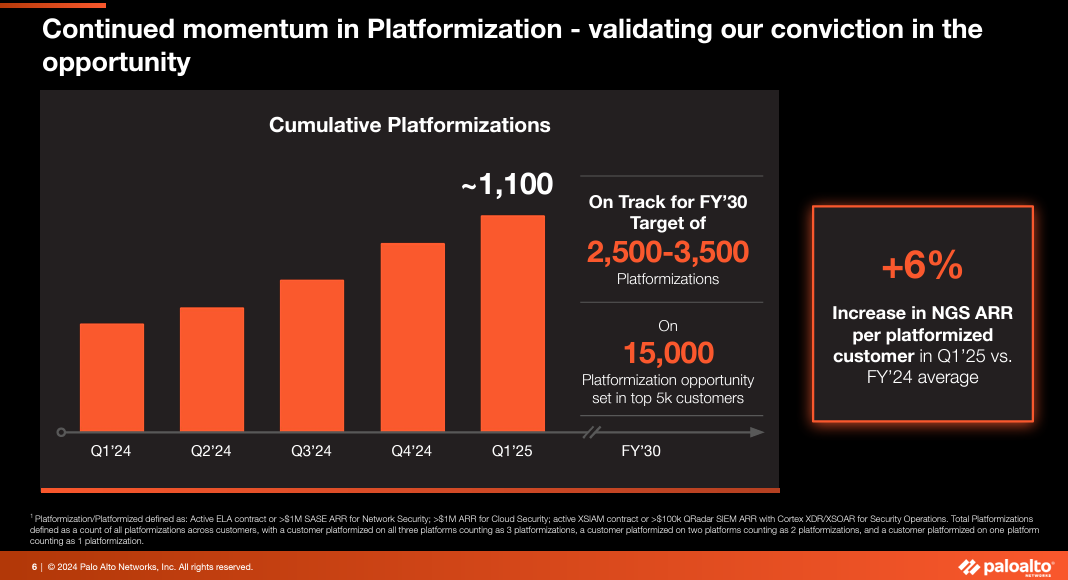

Palo Alto Networks reported better-than-expected first quarter results and said that it is benefiting from enterprises looking to consolidate cybersecurity vendors. Palo Alto Networks focused on a "platformization" strategy designed to land more wallet share on its platform.

The company reported earnings of $350.7 million, or 99 cents a share, on revenue of $2.1 billion, up 14% from a year ago. Non-GAAP earnings were $1.56 a share.

Wall Street was expecting Palo Alto Networks to report earnings of $1.47 a share in the October quarter on revenue of $2.12 billion.

Palo Alto Networks also announced a 2-for-1 stock split effective Dec. 12.

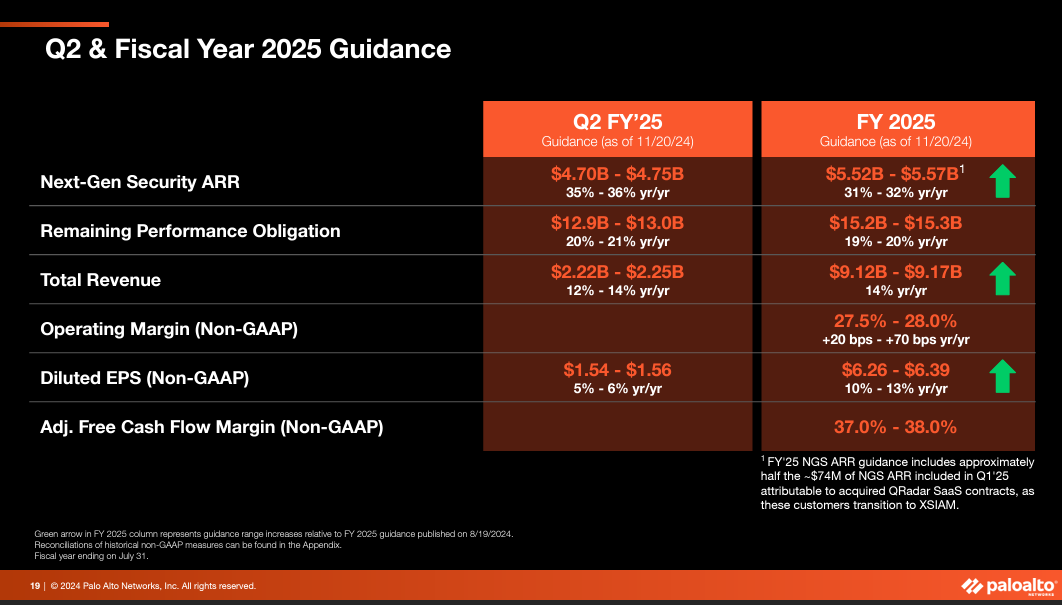

As for the outlook, Palo Alto Networks said its second quarter revenue will be between $2.22 billion to $2.25 billion, up 12% to 14% from a year ago. Non-GAAP earnings will bet $1.54 a share to $1.56 a share.

For fiscal 2025, Palo Alto Networks projected revenue of $9.12 billion to $9.17 billion, up 14% from the previous year. Non-GAAP earnings will be between $6.26 a share to $6.39 a share.

- Palo Alto Networks reports strong Q4, raises outlook on platformization play

- CrowdStrike outage likely to hit cybersecurity's platformization pitch

- Cybersecurity platformization: What you need to know

Speaking on a conference call, CEO Nikesh Arora made the following points:

- "The market for cybersecurity continues to be robust and continues to grow faster than the overall technology market. We saw particular strength in our next generation security offerings."

- "Our industry peers have been evangelizing platformization. Imitation is the highest form of flattery."

- "Our approach is to ingest all relevant security data, analyze this with precision AI technology and natively automate end-to-end workflows. It's a tall order to take data from many different security vendors, analyze it on the fly and make a decision to stop an attack faster, but we're encouraged with the early success of our cloud platform."

- "We feel the cybersecurity industry is embarking into its next phase, but the market will continue to converge towards a fewer set of platformization players over the next five to 10 years. Point solutions will continue to get subsumed in these platform plays."

Constellation Research's take

Constellation Research analyst Chirag Mehta said:

"Palo Alto Networks' Q1 FY25 results reflect their conviction and commitment to platformization, driving 40% YoY growth in NGS ARR. The inclusion of QRadar SaaS contracts, acquired from IBM, contributed to this ARR growth, though the company anticipates transitioning these customers to XSIAM solutions in the coming quarters.

This strategy signifies a broader market trend where enterprises are gravitating towards integrated platforms to streamline network security and security operations while reducing total cost of ownership. However, as evident from ongoing hesitations around vendor lock-in, this transition presents challenges for customers. Converting QRadar customers to XSIAM (~10% so far) underscores Palo Alto's potential to redefine security operations through telemetry-driven insights.

For customers, the focus on XSIAM as a replacement for traditional SIEM systems represents an opportunity to modernize their SecOps. As CISOs aim to balance risk reduction with operational efficiency, this quarter's results highlight Palo Alto Networks' ability to lead in a consolidating market while signaling the need for clarity and choice in platform commitments."