Palantir reported better-than-expected fiscal second quarter results as it posted 55% growth in its US commercial business.

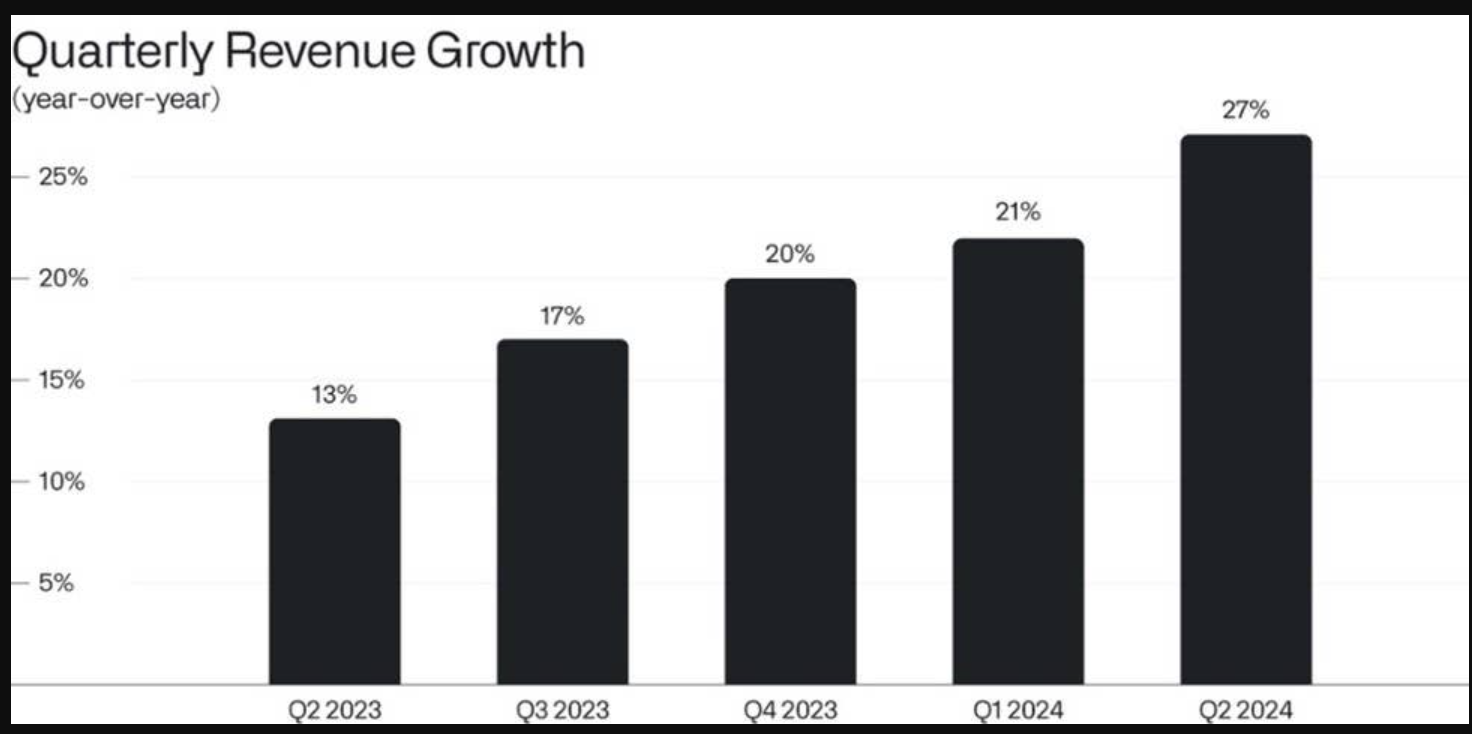

The company reported second quarter net income of $134 million, or 6 cents a share, on revenue of $678 million, up 27% from a year ago. Non-GAAP earnings were 9 cents a share.

Wall Street was expecting second quarter earnings of 8 cents a share on revenue of $652.4 million.

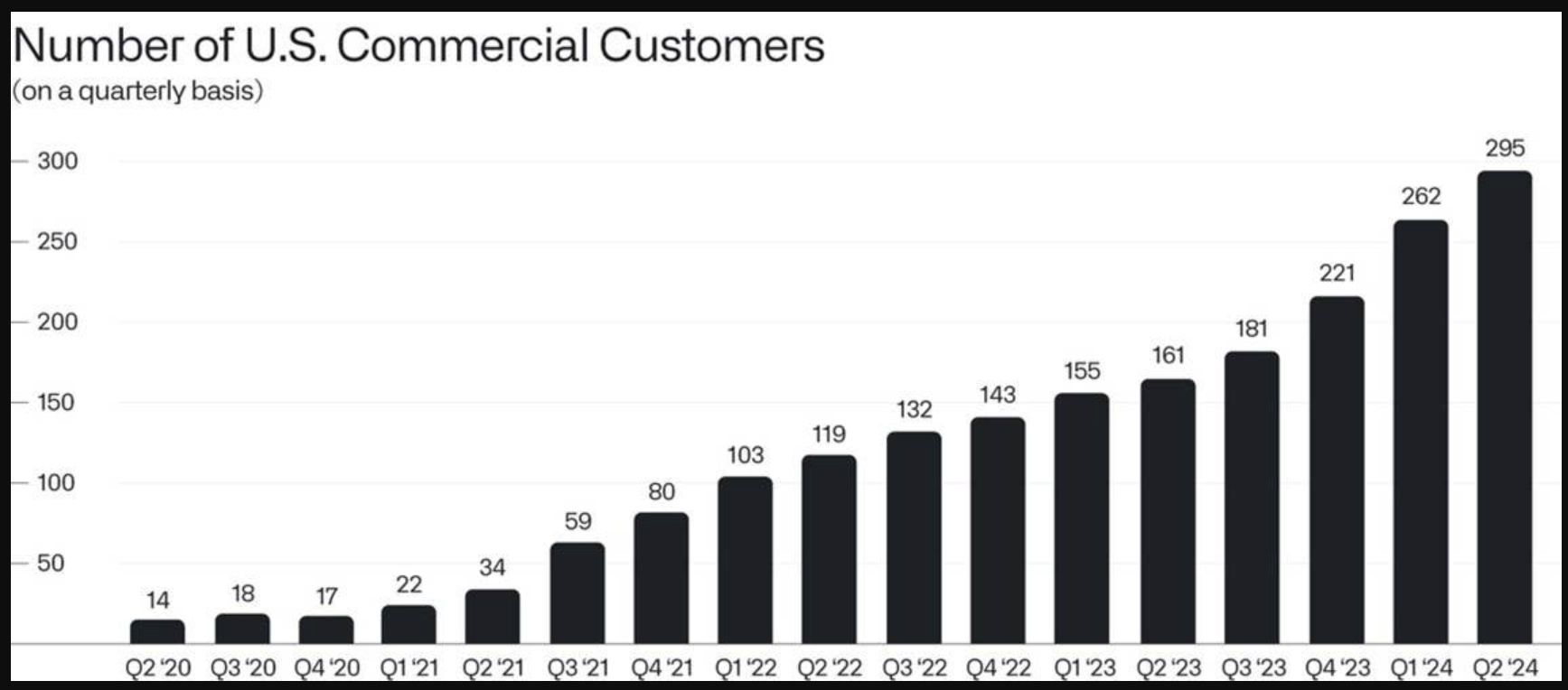

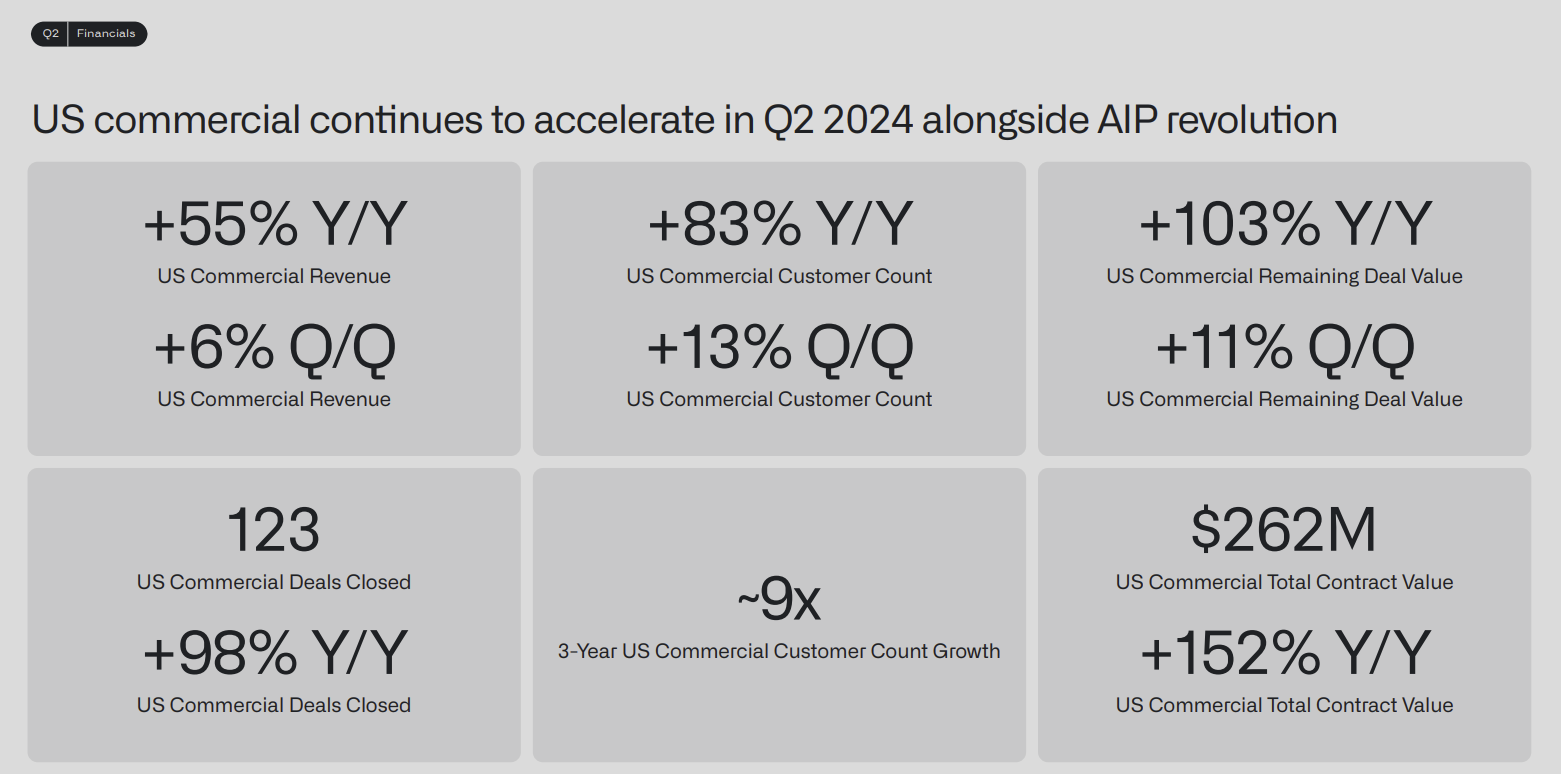

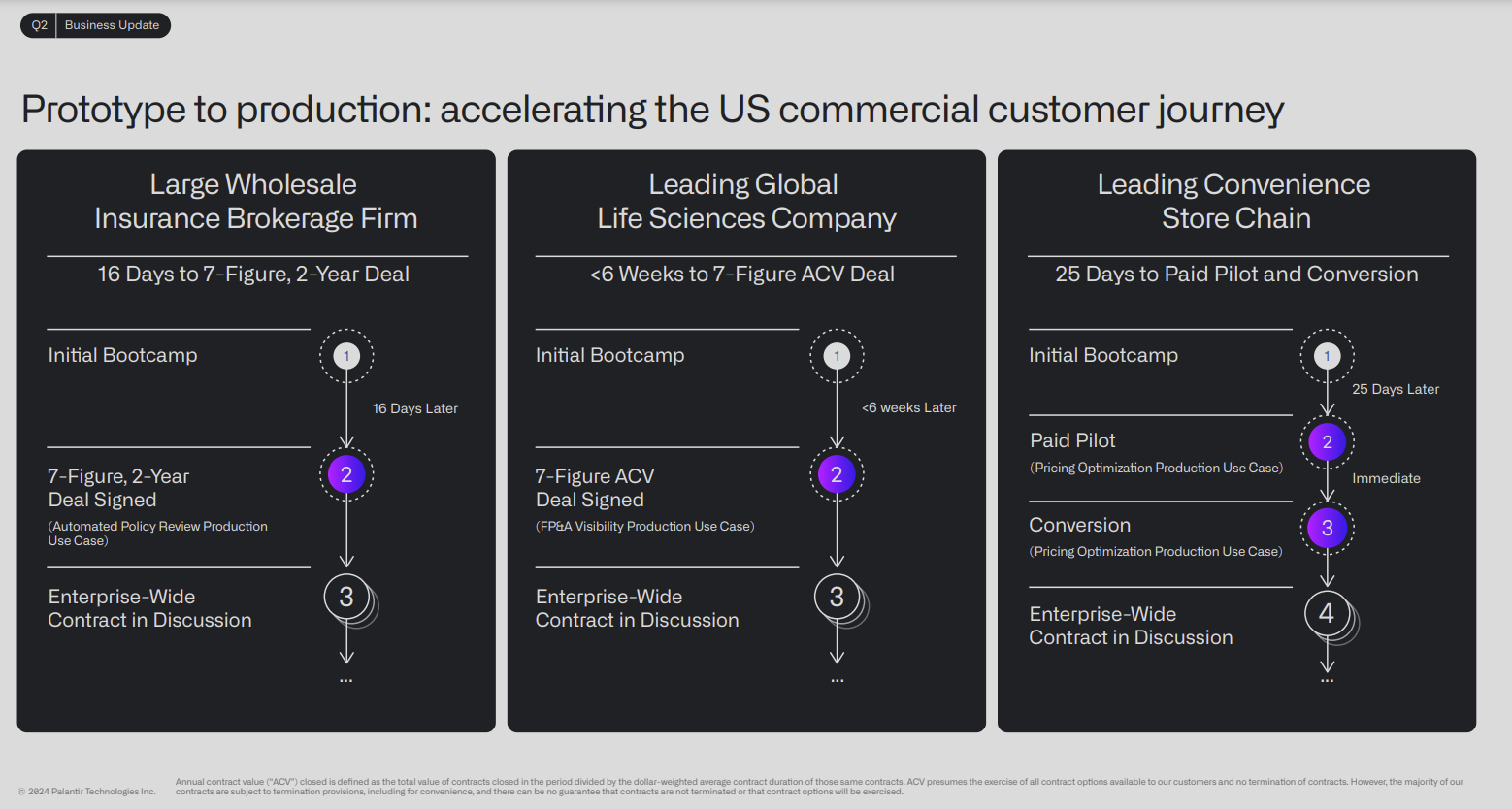

US commercial revenue in the second quarter was $159 million, up 55% from a year ago. Palantir has leveraged boot camps and pilots to land enterprises for its AI platform. Palantir now has 295 US commercial customers.

- Palantir will move workloads to Oracle Cloud as both court governments and enterprises

- Palantir's commercial business scales with help of AI boot camps

- Palantir US commercial revenue up 40% in Q1

Commercial accounts are critical for Palantir as it expands its base. Commercial revenue in the first quarter was $307 million, up 33% from a year ago. Government second quarter revenue was $371 million, up 23% from a year ago. US government revenue accounts for the bulk of Palantir's government sales.

According to Palantir, the company closed 27 deals over $10 million in the quarter.

As for the outlook, Palantir projected third quarter revenue between $697 million and $701 million with adjusted income from operations between $233 million to $237 million.

Palantir also raised its 2024 fiscal year outlook and projected revenue between $2.742 billion and $2.750 billion with US commercial revenue of $672 million, up about 47%. Palantir added that it expects adjusted operating income for the year to be between $966 million and $974 million with net income in each quarter.

In a letter to shareholders, Palantir CEO Alex Karp said the company is focused on growing its enterprise software business. Karp said:

"A premium was placed on developing software products whose principal purpose was to sell themselves. And a perception of value became more important than value itself. The rise and increasing sophistication of artificial intelligence capabilities have exposed the extent of dysfunction within enterprise software deployments. This was the era of thin technology and the abandonment of any real interest in results.

Those companies, however, are now being swept to the side. They attempted to seize the cultural and moral high ground at the expense of anything resembling a commitment to outcomes. And society, not to mention customers, have grown disinterested in their theater."

Palantir as ERP fix?

Speaking on Palantir's earnings conference call, CTO Shyam Sankar said the company will launch a new offering called Warp Speed "to power American reindustrialization."

The Warp Speed effort will be focused on manufacturing, said Sankar. He said:

"The software playbooks have also failed in manufacturing, and all the founders driving reindustrialization know it. This is why SpaceX built their own ERP. We created Warp Speed from our years of experience on the factory floors, helping customers build planes, trains, automobiles and even ships. Today we power production of jet engine satellites and weapon systems in the industrial base. Warp Speed built on AIP and our industrial AI and with ontology is the modern American manufacturing operating system that reimagines how to bend atoms better with bits.

At the dawn of World War Two we didn't have a defense industrial base. We had an American industrial base. Chrysler made missiles and General Mills wasn't just a cereal company. This is also what our future must look like. It is clear that the nation must reindustrialize and mobilize at warp speed to win."

Palantir's plans with Warp Speed are notable given the flux in the enterprise software market.

- Why enterprise, process workflows are the new battleground

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- Enterprises start to harvest AI-driven exponential efficiency efforts

- GenAI may be the new UI for enterprise software

- 14 takeaways from genAI initiatives midway through 2024

- GenAI boom eludes enterprise software...for now

Sankar explained Warp Speed and where it hopes to fit in with the ERP space. Sankar said Warp Speed will touch on ERP, but also product lifecycle management (PLM) and other components. Sankar said:

"I think the kind of congenital defect for ERP is that it was designed historically in the '70s for the CFO. Why would you do that? If you were starting over today, you would build software that was designed for the head of production that was focused principally on production and then integrate with your extant legacy systems

I think the big opportunity is to go to the big legacy manufacturers and you say 'this sounds crazy.' If you go to new manufacturers, the one that are powering the reindustrialization of the country, they all know this. They also know they can't afford the 300 engineers it would take to build this completely from scratch, or the time it would take to do that. So there's this very powerful role of taking AIP building the applications on top of it.

We live in a world today where it's $1 of license for $9 of implementation. That never seems to quite work. Who is really happy with the implementation of these systems?"

Other takeaways

Here's a look at some other takeaways from Karp's letter that were reiterated on the conference call:

- He said large language models (LLM) as they stand today lack enterprise value. "The large language models that have transfixed the world will only be capable of transforming the work of a multinational business or a defense agency’s operations if their power is unleashed within the context of an enterprise software system that has an opinionated view of the world—its idiosyncratic objects, logic, and physics," said Karp, who added that data ontology is critical.

- "The persistent and unbridled demand for our software, for an effective enterprise platform that makes artificial intelligence capabilities useful to large institutions, shows no sign of relenting," said Karp. "The right software properly wielded can and should transform an institution. And it is that ambition that has won over not only our existing partners but that of an entirely new cohort."

- Palantir had 295 US commercial customers, which now accounts for half of the total number of customers.

- Trailing 12-month revenue in Palantir's US government business topped $1 billion.