Oracle's infrastructure as a service business gained momentum in the fourth quarter courtesy of generative AI workloads, according to CTO Larry Ellison. The company's cloud business also showed strong sales with the addition of Cerner.

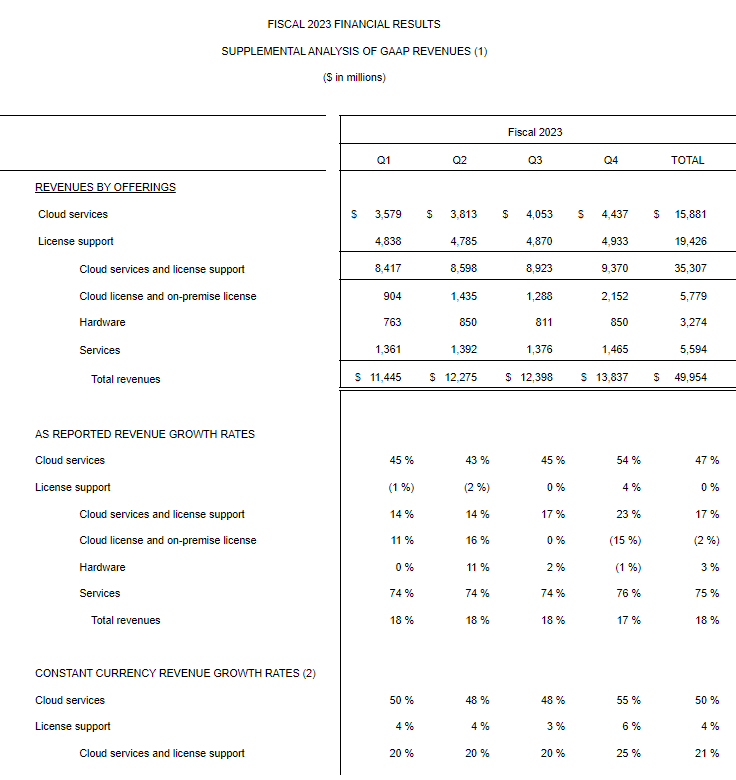

The database, cloud and ERP company reported fourth quarter earnings of $1.19 a share on revenue of $13.8 billion, up 17% from a year ago. Non-GAAP earnings for the fourth quarter were $1.67 a share. Cerner contributed $1.5 billion in revenue in the fourth quarter. Wall Street was expecting Oracle to report non-GAAP earnings of $1.58 a share on revenue of $13.73 billion.

For fiscal 2023, Oracle reported net income of $8.5 billion, or $3.07 a share, on revenue of $50 billion, up 18% from a year ago. Non-GAAP fiscal 2023 earnings were $5.12 a share.

In a statement, Ellison said Oracle's IaaS landed more than $2 billion in deals for its Oracle Gen2 Cloud. Ellison said Nvidia is using its clusters as are LLM developers such as Mosaic ML, Adept AI and Cohere. "Our GPU clusters are built using the highest-bandwidth and lowest-latency RDMA network—and scale up to 32,000 GPUs," said Ellison.

CEO Safra Catz said infrastructure growth is accelerating with fourth quarter sales up 77% from a year ago.

On a conference call, Catz said organic revenue growth is accelerating and the cloud has transformed Oracle's business and culture. "Consumption of our Gen-2 cloud is 7x larger. Our cloud infrastructure growth rate has doubled from last year," she said. "We're at the middle of the beginning."

"Our exploding AI demand leaves us with significant upside," she said. "Customers are choosing to run on Oracle infrastructure."

AWS, Microsoft Azure, Google Cloud themes: Optimization, generative AI and the long game

On applications, Catz said the combination of Fusion ERP and NetSuite means Oracle can support customers of all sizes. Catz said cloud database workloads will also fuel growth in the future as on-premise databases migrate to the cloud. Overall, she said gross margins in the cloud business will improve even as Oracle builds out its infrastructure.

Even though Oracle's IaaS business remains smaller than the big three--Amazon Web Services, Microsoft Azure and Google Cloud--its growth rates are higher in comparison. For context, Oracle's annual IaaS revenue run rate exiting the fourth quarter is $5.6 billion. Comparisons across the cloud providers are tricky since few break out only IaaS sales.

On a conference call, Ellison said Oracle Cloud Infrastructure's Gen2 architecture, hardware and software can deliver higher performance for AI workloads. "In the cloud where you pay by the minute if you run twice as fast you pay half as much," said Ellison.

He said generative AI demand will drive returns for both applications and its cloud business as well as internally. "The biggest strategic difference is that we use our infrastructure and build enterprise scale applications with it. We have a continuous feedback loop and improvements in productivity," said Ellison. "By being in applications and infrastructure we make both better."

That feedback loop between cloud, hardware and applications means Oracle's cloud unit is suited well for generative AI training, said Ellison. He touted a partnership with Nvidia to scale AI workloads. He added that Oracle is launching a generative AI service designed to protect enterprise training data while implementing large language models. Salesforce is also targeting the same use case via an abstraction layer to protect corporate data when training LLMs.

Ellison said specialized LLMs will be instrumental to industries such as healthcare. Oracle Cloud is working with Cohere to train specialized models.

By the numbers for the fourth quarter:

- IaaS cloud revenue in the fourth quarter was $1.4 billion, up 76% from year.

- Cloud revenue in the fourth quarter was $4.4 billion, up 54%. Excluding Cerner, cloud revenue for fourth quarter was up 33%.

- Cloud application revenue was $3 billion, up 45%.

- Fusion Cloud ERP revenue was $700 million, up 26%

- NetSuite Cloud ERP revenue was $700 million, up 22%. It's worth noting that Oracle's core cloud ERP suite now has the same revenue as NetSuite.

- R&D was 17% of revenue for the year ending May 31.

For fiscal 2023, Oracle reported total cloud services and licenses support revenue of $35.3 billion.

Oracle said it added Children’s National Hospital, Daiwa Securities Group, DHL Supply Chain, Emerson, GitLab, Mayo Clinic, Skecher as customers in the fourth quarter.

As for the outlook, Catz said Oracle Cloud Infrastructure will have another strong year. Cloud capital spending in fiscal 2024 will be on par with fiscal 2023. For the first quarter, Catz said total revenue will grow from 7% to 9% with added upside depending on capacity. Cloud revenue will grow 28% to 30%. Non-GAAP earnings will be between $1.12 a share to $1.16 a share.

For fiscal 2024, Catz said Oracle is seeing strong demand for AI workloads. Cloud revenue including Cerner will grow at similar rates in 2024 compared to 2023.