Oracle continued to put up strong cloud and infrastructure as a service revenue growth, but its third quarter results fell short of expectations. However, Oracle said its cloud backlog is pointing to revenue growth of about 15% in the new fiscal year that starts in June.

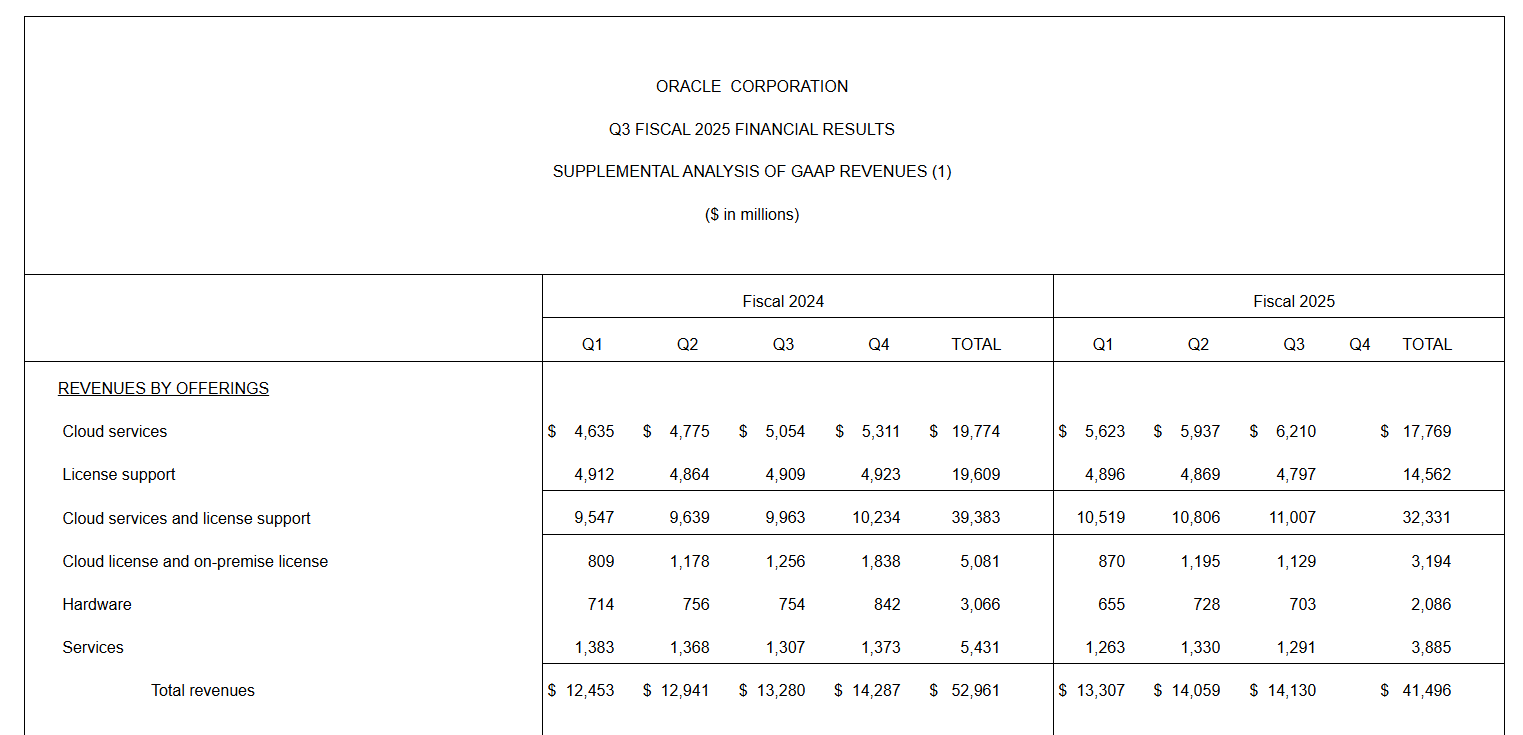

The company reported third quarter earnings of $1.02 a share on revenue of $14.1 billion, up 6% from a year ago. Non-GAAP earnings for the quarter were $1.47 a share. Oracle has been wrestling with currency exchange rates vs. the US dollar like other global firms.

Wall Street was expecting Oracle to report earnings of $1.49 a share on revenue of $14.39 billion.

Nevertheless, Oracle's cloud growth has been impressive. By the numbers:

- Oracle cloud revenue in the third quarter was $6.2 billion, up 23% from a year ago.

- IaaS revenue was $2.7 billion, up 49% from a year ago.

- SaaS revenue was $3.6 billion, up 9% from a year ago.

- Catz, Oracle CEO, said the company signed sales contracts worth more than $48 billion in the third quarter. "We have now signed cloud agreements with several world leading technology companies including: OpenAI, xAI, Meta, NVIDIA and AMD. We expect that our huge $130 billion sales backlog will help drive a 15% increase in Oracle's overall revenue in our next fiscal year beginning this June," she said.

CTO Larry Ellison said the company is "on schedule to double our data center capacity this calendar year." He added that Oracle's database revenue from Microsoft, Google and Amazon is up 92% in the last three months. GPU consumption for AI training was up 244% over the last year.

- Oracle scales Oracle Database@Google Cloud

- Oracle's cloud, AI plans are a master class in co-opetition

- OpenAI's Stargate Project diversifies its cloud infrastructure

In addition, Oracle said it is signing its first Stargate contract. Stargate is an effort by the US government, OpenAI, Oracle, Softbank and others to invest $500 million in domestic AI infrastructure.

Ellison added that Oracle is seeing "enormous" demand for AI inferencing on customer private data. Oracle is launching Oracle AI Data Platform that connects "OpenAI ChatGPT, xAI Grok and Meta Llama directly to Version 23ai of the Oracle Database with advanced vector capabilities," said Ellison.

Speaking on a conference call, Catz said "the growth of our power capacity under contract is even higher than the growth in the number of data centers, and we expect that our available power capacity will double this calendar year and triple by the end of next fiscal year."

That capacity will double this fiscal year and triple by the end of next fiscal year. "What we are seeing in the market is that we are the destination of choice for both AI training and inferencing. This is due to the fact that our gen two cloud is faster and therefore cheaper than our competitors, and also due to our ultra high speed networking engineering that we started decades ago and that is now highly relevant for AI," she said.

Other key items from Catz:

- Component delays have slowed expansion this year, but should ease in the first fiscal quarter.

- Cloud infrastructure revenue growth should top 50%.

- Oracle revenue growth will be 15% in fiscal 2026 and accelerate to 20% in fiscal 2027.

- Fourth quarter will continue to see currency headwinds. In constant currency, Oracle will see revenue growth of 9% to 11% in constant currency and 8% to 10% in US dollars.

- Total cloud revenue will grow 25% to 27% in the fourth quarter in US dollars.

- Fourth quarter non-GAAP earnings will be between $1.61 a share to $1.65 a share.

- Stargate is not included in Oracle's remaining performance obligations.

Holger Mueller, analyst at Constellation Research, said Oracle is clearly doubling down on cloud even though the third quarter was mixed.

"Oracle had a tough quarter, slipping into the single zone 'pedestrian' growth, and barely beating inflation. It is clear that Oracle needed the Cloud @ business to maintain its level of revenue. What stands out is that Oracle doubles down on cloud with record capex close to $15 billion. Safra Catz usually invested 50% of cash flow into datacenters. Now it's 75%. 2025 will show if Oracle's doubling of OCI capacity can be monetized. AI workloads seem to be a key growth engine. But customers can also be fickle."